If you haven’t yet started on your taxes, then you’ll need to get going! To help you out, I’m publishing the 2008 and 2007 Tax Bracket Tables (or Tax Rate Schedules) below — as seen in this AOL page — to use as a quick review for figuring out your taxes. But take note that the top set of tax rate schedules are for Tax Year 2008 while those further down are for 2007, which you should be using to file your current tax return (the one due this April).

Though most of us rely on tax software, spreadsheets, a CPA or Enrolled Agent to get our taxes done, the following is a simple illustration of how we use the figures in the tax rate tables to calculate our federal tax bill.

Say you’re Married Filing Jointly (like me) and made $126,500 in taxable income in 2007. Then you’d be using Table F, which shows that you’re in the 25% tax bracket. For the 25% row, your federal income taxes are calculated as such:

- $8,772.50 + (25% of income you made over the specified cut off [for that row], which is $63,700)

- $8,772.50 + (25% x ($126,500 – $63,700))

- $8,772.50 + (25% x $62,800)

- $8,772.50 + $15,700 = $24,472.50

So in this case, you’d owe the government $24,472.50 in federal income taxes this current tax year (2007).

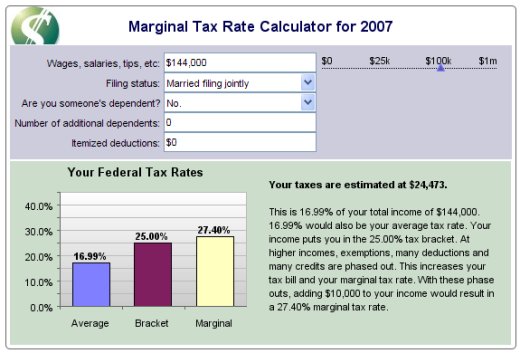

But here’s a quicker way to figure it out — these tax calculators can do it for you! You can plug in your values using this tax estimator or this marginal tax calculator. For instance, try plugging in a gross income of $144,000. Given the assumption that you take 2 exemptions — one for you and one for your spouse, this example yields a taxable income of $126,500 with a tax bill total of $24,473. The average tax rate in this case is 16.99%.

2008 Tax Brackets

Table A: Single tax return:

| If taxable income is: |

Amount of tax that you owe is: |

||

| More than: | However, not over: | This amount (or %) plus % of: |

Amount over: |

| $0 | $7,550 | 10% | — |

| $8,025 | $32,550 | $803 + 15% | $8,025 |

| $32,550 | $78,850 | $4,481 + 25% | $32,550 |

| $78,850 | $164,550 | $16,056 + 28% | $78,850 |

| $164,550 | $357,700 | $40,052 + 33% | $164,550 |

| $357,700 | — | $103,792 + 35% | $357,700 |

Table B: Married Filing Jointly (MFJ) or Qualifying Widow(er):

| If taxable income is: |

Amount of tax that you owe is: |

||

| More than: | However, not over: | This amount (or %) plus % of: |

Amount over: |

| $0 | $16,050 | 10% | — |

| $16,050 | $65,100 | $1,605 + 15% | $16,050 |

| $65,100 | $131,450 | $8,963 + 25% | $65,100 |

| $131,450 | $200,300 | $25,550 + 28% | $131,450 |

| $200,300 | $357,700 | $44,828 + 33% | $200,300 |

| $357,700 | — | $86,770 + 35% | $357,700 |

Table C: Head of Household tax return:

| If taxable income is: |

Amount of tax that you owe is: |

||

| More than: | However, not over: | This amount (or %) plus % of: |

Amount over: |

| $0 | $11,450 | 10% | — |

| $11,450 | $43,650 | $1,145 + 15% | $11,450 |

| $43,650 | $112,650 | $5,975 + 25% | $43,650 |

| $112,650 | $182,400 | $23,225 + 28% | $112,650 |

| $182,400 | $357,700 | $42,755 + 33% | $182,400 |

| $357,700 | — | $96,770 + 35% | $357,700 |

Table D: Married Filing Separate (MFS) return:

| If taxable income is: |

Amount of tax that you owe is: |

||

| More than: | However, not over: | This amount (or %) plus % of: |

Amount over: |

| $0 | $8,025 | 10% | — |

| $8,025 | $32,550 | $803 + 15% | $8,025 |

| $32,550 | $65,725 | $4,481 + 25% | $32,550 |

| $65,725 | $100,150 | $12,775 + 28% | $65,725 |

| $100,150 | $178,850 | $22,414 + 33% | $100,150 |

| $178,850 | — | $48,385 + 35% | $178,850 |

~ooOoo~

2007 Tax Brackets

Table E: Single tax return:

| If taxable income is: |

Amount of tax that you owe is: |

||

| More than: | However, not over: | This amount (or %) plus % of: |

Amount over: |

| $0 | $7,825 | 10% | — |

| $7,825 | $31,850 | $782.50 + 15% | $7,825 |

| $31,850 | $77,100 | $4,386.25 + 25% | $31,850 |

| $77,100 | $160,850 | $15,698.75 + 28% | $77,100 |

| $160,850 | $349,700 | $39,148.75 + 33% | $160,850 |

| $349,700 | — | $101,469.25 + 35% | $349,700 |

Table F: Married Filing Jointly (MFJ) or Qualifying Widow(er):

| If taxable income is: |

Amount of tax that you owe is: |

||

| More than: | However, not over: | This amount (or %) plus % of: |

Amount over: |

| $0 | $16,050 | 10% | — |

| $15,650 | $63,700 | $1,565.00 + 15% | $15,650 |

| $63,700 | $128,500 | $8,772.50 + 25% | $63,700 |

| $128,500 | $195,850 | $24,972.50 + 28% | $128,500 |

| $195,850 | $349,700 | $43,830.50 + 33% | $195,850 |

| $349,700 | — | $94,601.00 + 35% | $349,700 |

Table G: Head of Household tax return:

| If taxable income is: |

Amount of tax that you owe is: |

||

| More than: | However, not over: | This amount (or %) plus % of: |

Amount over: |

| $0 | $11,200 | 10% | — |

| $11,200 | $42,650 | $1,120.00 + 15% | $11,200 |

| $42,650 | $110,100 | $5,837.50 + 25% | $42,650 |

| $110,100 | $178,350 | $22,700.00 + 28% | $110,100 |

| $178,350 | $349,700 | $41,810.00 + 33% | $178,350 |

| $349,700 | — | $98,355.50 + 35% | $349,700 |

Table H: Married Filing Separate (MFS) return:

| If taxable income is: |

Amount of tax that you owe is: |

||

| More than: | However, not over: | This amount (or %) plus % of: |

Amount over: |

| $0 | $7,825 | 10% | — |

| $7,825 | $31,850 | $782.50 + 15% | $7,825 |

| $31,850 | $64,250 | $4,386.25 + 25% | $31,850 |

| $64,250 | $97,925 | $12,486.25 + 28% | $64,250 |

| $97,925 | $174,850 | $21,915.25 + 33% | $97,925 |

| $174,850 | — | 47,300.50 + 35% | $174,850 |

Copyright © 2008 The Digerati Life. All Rights Reserved.

{ 1 comment… read it below or add one }

Ah, you’re awesome! I’m stupid when it comes to taxes and this source was fantastic. Just wanted to say thanks 🙂