Don’t get harassed by bill collectors. Here’s how to deal with debt collection agencies.

While I don’t have bad debt collectors breathing down my neck on a regular basis, I do continue to receive my share of telemarketing and annoying political campaign calls, so I can just imagine how much worse it can be if you happen to owe people money. However, I’m not the most organized person in the world, so sometimes, I fall short and end up with a couple of missed bills and a debt collection warning. But so far, I’ve managed to weasel my way out of any penalties or negative effects on my credit. I suppose some sweet-talking doesn’t hurt, but in all seriousness, when I do get a debt collection notice, here’s what I do:

Quick Ways To Get A Bill Collector Off Your Back

#1 I don’t call the debt collection agency.

I call the creditors directly and make my inquiries to them.

#2 I admit my mistake.

To the company whom I owe money to, I let them know my bill is in collections, then I give a reasonable excuse for the oversight. They’re usually pretty forgiving (even with the “dog ate my payment” excuse) because they really just want to resolve the situation and get paid pronto! It’s the same approach I give a cop who is about to hand me a traffic ticket — I try to be as contrite as possible because honestly? I get better results when I’m non-confrontational.

#3 I offer to pay up immediately (over the phone, via credit card).

Then I ask them to retract my bill from collections. No questions asked. I pay the credit card bill in full afterward.

And I’m happy to say that this has worked out well for me on those few occasions I’ve had to do this. But what if you are perennially late with your bill payments or regularly miss or avoid paying your bills altogether? You may then have to face the wrath of a bill collector.

The FTC tells us that debt collectors are the number one complaint they receive from consumers. With consumer credit delinquencies on the rise, and actually matching the high levels of 1992, collection agencies are doing brisk business. Not exactly the kind of thing that would give you a cozy feeling.

How To Work With Debt Collection Agencies

So what should you do if you ever do find yourself unlucky enough to be harangued by collection notices and phone calls? As consumers, we are covered by the Fair Debt Collection Practices Act, which gives us some protection from distasteful encounters with debt hounds. Here are some pointers:

#1 Don’t ignore a debt collector. Take heed of their notices.

Ignoring calls or letters from an agency will not solve the problem, but in fact, aggravate it. If there’s been an error somewhere and you know that there’s nothing you owe, then an honest discussion with the collector should help clear the situation. If you do have a balance you need to pay, then try to work out a reasonable payment plan with the collection agency and get this issue out of the way. You’ll sleep better by doing so.

#2 Get proof of your debt.

Once you get a call from a representative, make sure that the inquiring agency is legitimate. Check which creditor they are representing and find out how and why your bill has turned up in collections. You also have the right to dispute the debt, request validation and proof of debt. I’ve no doubt that there are individuals who may use this as some sort of tactic to delay payment.

#3 Keep communication lines open.

Communication via written means will probably carry more weight than just phone conversations since you’re creating a paper trail this way. You can always assert your right to privacy by requesting the debt collector to contact you only in writing.

#4 Keep records of payments you’ve already made.

It’s always a good idea to have proof of payment on record with you. If you don’t have the documents (receipts, canceled checks, statements) to show you’ve paid, you can always contact the original creditor and check with their billing department. Sometimes, there may be mix ups with a creditor’s payment tracking process that you may need to straighten out.

#5 Keep track of correspondence with the debt collector.

Like with any other matter of conflict, it is always wise to keep track of your dealings with a collection agency. Things you should take note of: dates and times of any form of correspondence, the name of the representative you are in touch with, and notes of your dialogue.

#6 Know your rights as a consumer.

Be aware of your rights. Try to cooperate as best as you can, but don’t let the collectors step all over you either. There are in fact, limits to what a collector can do when trying to pursue a debt payment. There are both approved and prohibited conduct by collectors that are actually outlined in the Fair Debt Collection Practices Act. Among other things:

- Collectors cannot threaten nor harass you.

- They cannot make your personal information known, except to credit bureaus.

- They can only contact you by phone during certain hours: 8 AM to 9 PM local time.

- They cannot bother you at work if you’ve told them so in writing.

- They cannot contact you directly if you are represented by a lawyer.

If despite your best efforts you do find yourself getting unwanted or belligerent calls, then you have the prerogative to send the debt collector (and not the creditor) a written notice to stop communication about the debt. You can also write that you don’t intend to pay the debt but this does not absolve you of your financial responsibility — if you still owe them money, you may be sued. So you will need to work out an amicable arrangement with them to resolve your payment issues. In short, if you’re looking for relief from constant nagging from these people to get your thoughts together and devise a working plan to address your money problem, then make the written request: don’t expect verbal requests to be heeded.

#7 Watch out for debt repair “specialists”.

Whenever you’re facing some kind of trouble, there’s always some segment of the population who will want to capitalize on helping “solve” your problem. Be careful with whom you’re dealing with, because not all of these helpful entities are on the up and up. There are those who may promise you a quick solution to your debt issues but may actually be preying on your vulnerability. How much are these people charging for their “services”?

#8 Fight back if you are being harassed.

Don’t get intimidated: you can always refer to a consumer attorney for assistance, if need be. The web site for the National Association of Consumer Advocates or naca.net may be able to refer you to someone who can help. For more difficult cases, you can submit complaints to the Federal Trade Commission. Other places you can contact: the National Foundation for Consumer Credit, or the Consumer Credit Counseling Service, which are national organizations that may be able to put you in touch with a counselor from your community.

#9 Seek legal assistance if necessary.

If your case requires it, you may want to contact a consumer lawyer for further advice. For further details on this subject, check out this page on Debt Collection Practices.

Best advice on this matter though is to avoid collections in the first place by paying your bills on time and being more organized — nuggets of financial wisdom I should definitely take more to heart.

Facing Aggressive Debt Collectors: Harassment IS On The Rise!

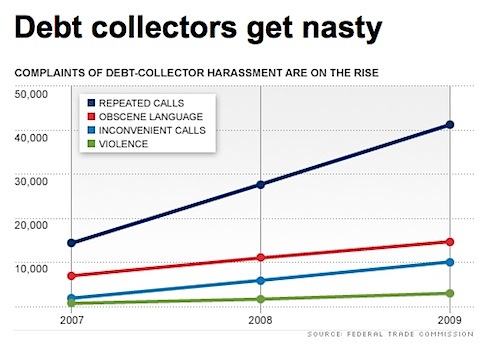

If you’ve got debt, you may have started noticing that debt collectors are getting even more aggressive and tenacious! They want their money. According to CNN Money, the bad behavior is on the rise, with repeated calls up by over 150%. Unfortunately, the use of foul or obscene language and violence is creeping up as well. No surprise that this is happening as people just get mired deeper and deeper into debt. This pain is going to take a while to get through.

This chart shows just how nasty some of these collection agencies have been lately.

Image from CNN Money

So as it gets harder for people to pay down their debt, the collectors are turning meaner and more aggressive. They know it’s “the squeaky wheel that gets the grease.” So it seems to make sense that a debtor would want to get rid of the most aggressive people on their tail. The thing is, if you’re a debt collector, you could possibly push too hard and get into trouble for your actions: remember that consumers DO have rights!

Created May 6, 2008. Updated October 25, 2011. Copyright © 2011 The Digerati Life. All Rights Reserved.

{ 23 comments… read them below or add one }

It may also help to know what could happen after you default on your credit card debt. Here’s how card companies collect from customers:

How Debt Collection Works

I hate that horrible feeling you get when you open a piece of mail and get a PAST DUE notice or worse. Your heart just drops into your stomach. Even if you think you paid the bill you know you are probably now in for a round of phone calls, faxes and letters.

I have also had good success by calling the parties involved immediately. My problems haven’t been from not having the money to pay the bill but from being disorganized, so I can offer to pay immediately.

This is a great post. I think there are a lot of people out there that don’t know their rights and that the collectors cannot threaten nor harass you. I watched the documentary “Maxed Out” not long ago, and I wish those young credit victims had known their rights. I was in deep debt when I graduated from college. I thought about filing for bankruptcy, but I ended up getting this book from Nolo called Solve Your Money Troubles, Get Debt Collectors Off Your Back & Regain Financial Freedom

by Robin Leonard, J.D.

I was able to get my act together and managed to pay off all of my debts in four years. Now I even have money saved up! Thank gawd!

My very first experience with credit was with a debt agency. I had applied for an Old Navy store card back in senior year in college – yes, I know, not a smart thing to do, but I knew nothing about credit back then – and while I filled out the application correctly in the store, they somehow botched the processing and messed up my mailing address.

So I never received my card and assumed that I didn’t get approved for it. And being really clueless, I assumed they just charged my purchase to my debit card – yeah, I really had no idea how things worked, and it got turned over to a debt agency.

I didn’t know what collections was so I assumed all the voicemail messages I was getting from this weird caller was a telemarketer or wrong number because they never left a message except for “Please call [name] at [unfamiliar company name] immediately,” until finally I got so tired of their messages that I called back one day.

It took several minutes to figure out what it was all about – they told me I owed a bill that hadn’t been paid, and when I couldn’t think of what it was, they asked me if I had applied for an Old Navy or Gap card.

I explained that I had applied for an Old Navy card but never received it, so I assumed I wasn’t approved. We figured out that it was a problem with the mailing address and they sent me a bill without the interest because it wasn’t my fault and it was all straightened out.

I could’ve really been screwed, being so uninformed, but I thought it was really nice of them to work it out for me.

I had serious credit problems when I left college, too. It’s really horrible how they rope college kids and teenagers into getting a line of credit when they’re totally unprepared for it!

I spent years trying to get out from under the burden of my debt. Fortunately, mine wasn’t too bad in the grand scheme of things– I had friends who went bankrupt! The thing that really got me through was talking to friends and reading about credit repair. I don’t think that I could have done it without support and the education about money and credit that I never got early on. What helped the most was a book called “Credit Repair.” I followed exactly what it said and sent forms to all my creditors, and about half of my debts were dropped and others were reduced. It’s amazing how much difference a little effort can make!

I agree with your assessment but i think that it’s against most collection agency contracts for the creditor to deal with you once the account has been turned over.

Also, never call the collection company with a phone number that you don’t want them to have. They are legally allowed to id your number and begin calling you on that, even if its not on record of the account.

Yikes — I’ve never paid a bill late for the very reason that I just don’t want to ever have to deal with bill collectors. I don’t know how anyone who has the money to pay their bills would not make the concerted effort to pay every bill on time and avoid this. Even if you forget one will, your credit can adversely be affected for a long time. I’ve heard some pretty awful stories of friends dealing with collectors.

Anyway, another thing to be aware of is the statute of limitations of debt. It is incredibly difficult to find (as I wrote about in this blog entry), but if your debt has expired, you may be able to weasel your way out of it. Not that I encourage dodging debt collectors for years…

Glad you mentioned the ‘Fair Debt Collection Practices Act’ & the importance of knowing your rights. Too many people are overly worried about being visited by debt collectors and/or bailiffs because they do not know what they can and can’t do. These, like any other industry have strict guidelines to follow.

You have already mentioned several fine points, but in addition, this article on our blog discusses the differences between debt collectors & bailiffs and what your rights are when dealing with each one. You may also find it interesting.

Thanks for your helpful tips.

Great post! Up until just recently I had no idea that I had so many rights as a consumer and even worse, that they were being violated on a daily basis. After hours and hours of research on the issue, I found a great site (CollectionAccount.net) loaded with information on different collection agencies from Absolute Collection Service Inc. to Zwicker & Associates PC. If you’re having a problem dealing with a collection agency, you should definitely check it out.

Most debt collectors are lowlife scumbags. They work by intimidation and they cannot do a damn thing but keep harassing you to pay up. 9 out of 10 times if you call their bluff they will back off and leave you alone.

Debt collection agencies can be scary and aggressive, they use penalty charges to drive up the debt and force you into paying the bill. But you must act quickly in dealing with debt collectors, this is to avoid penalty charges.

As a creditor, it is extremely important to have a good communication with the agency that’s collecting your payments for your overdue debts. But in order to come up with good results it is essential that you take some steps in how are you going to deal with debt collection agencies. Thanks for the tips! These are really helpful.

I had my own little debt collection drama last month. For a bill I had paid in full and on time over TWO years ago! So annoying. I didn’t get harassed or anything, but I hate the fact that someone can say I owe money and damage my credit rating without it actually being TRUE.

If you contract an attorney (rather than a debt settlement company) to handle your creditors, then these calls will cease. An attorney is your legal representative and they MUST deal with them. Also, a law firm may succesfully negotiate your debt by HALF (including their fee). See my blog at virtual-debt-relief.blogspot.com for more info.

I don’t get mad at debt collectors since they’re doing their jobs. I get mad at the vultures who try to collect debts illegally, but that’s another story.

Bogus debt collection schemes are really bad right now. There are hundreds of numbers coming out of India pretending to be debt collectors calling people who have even taken out payday loans. They’re not real debt collectors and everybody needs to be aware of them.

Thanks for the helpful article and telling people about the National Association of Consumer Advocates (“NACA”). NACA maintains a directory of consumer rights attorneys, including debt harassment and credit reporting lawyers, throughout the U.S.

To clarify some of your advice to consumers. Consumers consumers have only 30 days from the day they receive the initial letter from the collection agency in which to send a written request that the debt collector validate the debt. (This is almost always a good idea.) However, consumers can dispute the debt at any time.

Consumers should avoid the debt settlement companies like the predators that they are. Fortunately, the FTC amended the telemarketing rules to shut many of them down. Unfortunately, many of the debt settlers still use the same old tricks but using the internet.

The most important thing to remember is that a debt won’t just go away. It is your responsibility as a debtor to clear your outstanding debt. If you are suffering financial difficulty make the debt collection agency aware of this as many can, and will, take this into consideration and help to come up with a mutually beneficial payment arrangement.

If you make a payment of at least 10.00 a month, they can they do anything. I have a debt collector — this same woman calls from a law firm. She calls everyday and I just sent them a payment 2 weeks ago. It must not have been good enough because they call everyday harassing me. Is it true that they can accept a payment, and you send something every month that they can still call? ty

The debt collection industry is an aggressive one and is ranked highly as a source of complaints from consumers. Lately, JP Morgan Chase has been in the limelight as having made shortcuts when attempting to collect from delinquent card customers. But Chase has recently backed off due to the pressure of the investigations on these matters.

It’s best to know your legal rights. It’s one way to be able to fight the potential harassment that can occur when you fall behind on your payments.

I just received a letter from a bailiff wanting 4 thousand from a council tax steers from about 6 years ago. I can’t afford to pay this. He wants $600 payment up front and it’s tearing my heart out!

My son joined a boxing club at £30 a month,after a while he decided to take a break

so i stopped the direct debit.

Then a debit finance company got in touch to say that i cant stop payments as my son was on a contract, now i did not agree to any contract, and i have spoken to the boxing club who say its out of their hands. I have emailed DFC on many occasions and got nowhere, they also said they sent me an email of terms and conditions, which i never received. They are now threatening me with a debt collection agency.

I never agreed or signed any contract, what can i do?

@Colin,

Ask the boxing club to show you the contract which you signed. They should furnish you a copy upon your request, right? Also, the card issuers I work with honor dispute claims that I make without issue. Did you file a dispute claim with your card company? If none of these solutions work, then you may want to get legal advice.