Imagine that you’re in a financial bind: would you be able to resist those ubiquitous ads around the web that entice you to “get a fast cash loan”? You may be one of those wondering how to get a personal loan in these tough economic times. These days, many people with little to no money are turning to high interest payday loans to assist them when financial emergencies arise or even to pay monthly bills. However, many do not realize the danger of cash advance payday loans until they are deep in debt with no way out.

What exactly is a payday loan?

To put it simply, a payday loan is a short-term loan. An individual goes to a payday lender, writes a check for the amount they want to borrow plus a fee. The payday lender then holds the check for a short period, typically two weeks, and cashes it at the end of that period. The borrower may also have the option of extending the loan at the end of a two-week period if they don’t have the sufficient funds to pay. Now this is where people get into a lot of trouble because when loans are extended, these loans accumulate more fees. This is precisely why payday loans are dangerous — they’re extremely expensive because they charge an enormous amount of interest and fees, typically with an over 100% annual percentage rate. They are in no way, shape or form, a good way to manage money or borrow money.

Whom do payday lenders target?

It’s always the most financially vulnerable who fall prey to these arrangements. These loans are targeted at lower income individuals who have no other means of borrowing money when an emergency arises. You will notice that you will never see a payday lender in an upper class neighborhood, but you’ll often find these establishments well ensconced in geographically low-income areas. Customers of these establishments are individuals who need quick cash and are looking for an easy way to get it. And indeed, it can be a tempting “way out” for many poorer clients, since by simply writing a check (whether or not you have funds at the moment), you can get a cash advance payday loan and worry about the consequences later. It’s fast and easy, with no credit check required!

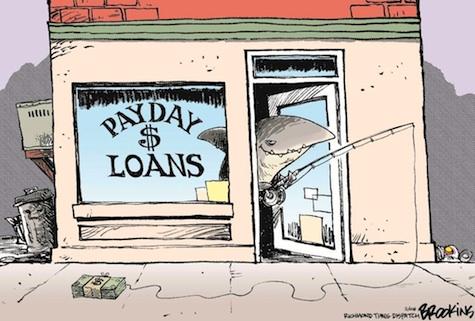

Image from StopPaydayPredators.org

What are the consequences?

Financial counselors and experts will tell you that clients who begin using payday loans typically have a very difficult time paying them off. What typically occurs is an endless cycle of borrowing and paying until the individual reaches a point when they can no longer afford the fees and interest charges that have compounded from extending payday loans every two weeks. At this point, the borrower will call a credit counseling agency for help with paying things off. Unfortunately, it’s also at this point when their credit gets shot as they’ve become delinquent on their loans and see no way out, given the amount of income they are bringing in.

Have A Cash Advance Payday Loan? 3 Tips For Paying It Off

Unfortunately, most credit counseling agencies are unable to place payday loans on a debt management plan. Payday lenders rarely offer benefits or lower personal loan interest rates through credit counseling programs. Still, there could be constructive ways to help a payday loan borrower in a bind. If you find yourself in this position, then here are some options to consider:

1. Talk to the payday lender.

The first option is to try to negotiate. Call the payday lender and see if it is possible to speak with the manager of the establishment. You can then ask this person if they can place you on some type of hardship program where you can afford the payments and possibly have a lower interest rate. The same ideas apply here as you would if you wanted to lower your credit card interest rates. While payday lenders are in the business of making the most out of each loan they approve, they’re also eager to salvage agreements with those borrowers who are sincere about working out their payment problems.

2. Wait for your payday loan to go into collections.

Another option is to wait until your loan goes into collections. If you have borrowed money and the accounts are past due, you can expect your payday lender to go to great lengths to coerce and threaten you to pay. If you continue to be uncooperative, then eventually, your loan will be turned over to a collection agency. Once this happens, you may be able to roll over your accounts in collection onto a debt management program. This will provide you with a more manageable payment and an estimated payoff time.

3. Settle your debt.

Finally, you can try to contact a debt settlement company and proceed with a settlement, or file for bankruptcy. With this approach, you’ll need to deal with a bankruptcy attorney or debt professional.

Final Thoughts

You should avoid getting a payday loan as much as possible. Still, there are people who insist on securing such loans regardless of the consequences. If you are one such borrower, then make sure it’s truly your last resort to go down this path. Weigh the risks and the benefits of a quick cash advance or short term loan. The risks here are great, so your benefits (per your particular situation) better be worth the money you end up forking out, if you do decide to opt for a loan like this.

Always do your best to find other alternatives to borrowing. Perhaps you can find out how to apply for a loan through other avenues and sources. As an alternative, do your very best to save up for an emergency fund in a high interest savings account, so that you do not have to depend on a credit card, bank, or payday lender to get yourself out of an emergency. This is the best way to avoid falling prey to payday lenders.

Copyright © 2010 The Digerati Life. All Rights Reserved.

{ 16 comments… read them below or add one }

I have had a payday loan for over a year. Its all I can do to make the payment every other week so I have to keep writing it each time I pay it off. Otherwise, I won’t have the money to get gas, groceries etc. I have 2 of these! I desperately want to get them paid off but have bad credit due to medical bills 4 years ago. I paid those bills off over a year ago but they haven’t been taken off my credit report yet. If I could get a personal loan I think it would be easier, not to mention cheaper to pay. Any ideas on what type of company or a particular one that I could use? It’s getting so difficult just to manage. If I could get rid of those payday loans I could pay my other bills. Please, any advice would help.

Please feel free to email me with ANY advice! Please!

Qualifying for a payday loan is easier than being approved for a traditional loan from a bank. The minimum requirements needed are that you are employed, make at least $1000 per month, are over 18 and a US citizen, and have a valid and current bank account. But I suppose this is why it’s such a risky loan — it’s too easy to get!

Cash advance/Payday loans due to the fees and interest rates will cause anyone to fall into a death spiral. Very few escape financial death! Beware.

That image is a good one. Generally speaking, payday loans prey on those who have no other options but to get a payday loan. It might sound like a good option at first but wait until you miss your payment. Like what the article said, you can be in more troubles than you started with. Besides, a “collector” threatening to “break your knees” is a bad thought. Haha!

They have payday loan consolidation companies now – which I guess screw you slightly less? Ugh.

Elizabeth – I hope you’re able to get traction toward your debt repayment soon.

If those med bills are paid, but not reflected as such, dispute this on your credit report with all 3 credit bureaus.

Be careful trying these tips. I have a friend who was in that business. They will cash the check with your bank and then it will more than likely bounce your account.

Payday loans definitely rate as toxic cesspits that is not good for getting one’s feet wet in….there should really be laws against loansharking like this. The thing is they get the really desperate people that can not get help from somewhere else. Kicking a person on the ground is just not on!

Even with two earner families, many people in today’s economy live paycheck to paycheck. As hard as that is, cash advance payday loans are a slippery slope and that are hard and sometimes impossible to get out from under.

When cash advance payday loans are a necessity for food or shelter, or even getting to and from work, then they’re a necessary evil. For any other purpose, they’re just plain evil.

It is a painful fact that these payday lenders target people who are financially vulnerable and due to our economy today, a lot more people are starting to actually consider payday loans as an option. The fact that it is so easy to get also contributes to why a lot of people actually get tempted, which is really bad considering the consequences. I think that getting people informed or educated about the catch in loans (all kinds of loan) is a good way to get people to reconsider.

Elizabeth, I think you can try to speak to your bank to clear you from the bills that you have settled last year since it has been settled, this way it won’t show up in your credit report anymore. You have to try to make your credit report as accurate and as good looking as possible, this may help you if you plan to get loans from banks or from big lending companies etc.

I guess I’ll be the lone voice defending payday loans. I have gotten payday loans numerous times, and I’ve not gotten into trouble.

First of all, no bank is going to make a personal loan for anything under 5,000. And you have to have perfect credit. But what if you just need a couple hundred to tide you over until payday? That’s where payday loans come in.

Unlike regular loans, you don’t make payments on a payday loan. You pay the whole thing off (by the loan company cashing your check). That’s the one negative I can see with a payday loan. Which is also why you shouldn’t borrow money that you can’t afford to pay back.

If you have very little money left over after each pay, then you shouldn’t take out a payday loan. Period. But if you potentially have a decent amount of discretionary income left after paying bills, then a payday loan will be fine. Sometimes things happen and you have an unexpected expense come up, and you think, “Gee, if I could wait until payday to get this taken care of, that’d be great, b/c I’ll have enough when I get paid,” that’s what payday loans are for.

In my state, they passed some laws changing how the payday loan places do business. But you know who lobbied for those laws? Banks. The lady at the payday loan place said that it’s quite common for people to take out a small payday loan in order to put money in the bank to avoid an NSF fee. Banks notoriously rob people blind with those damn fees. My most recent payday loan for 200 dollars involved me writing a check for 226 dollars. I imagine a 100 dollar loan would have 13 dollars of interest. One NSF fee can be as much as 35 dollars. Assuming you will have the money on payday to pay back the loan, the payday loan is cheaper than getting an NSF fee.

I think if the government is going to get involved in payday loan regulation, they should stick to limiting the amount of interest they can charge and forcing them to accept payments (even just two payments of half the loan amount each would be helpful).

But payday loans do serve a purpose, and they aren’t taking advantage of anyone anymore so than banks, insurance companies, and credit card companies.

I feel that payday loans have a niche if used for the right situation and individual. I agree with Jane that a payday loan can be a lot cheaper than an NSF fee and also feel that the banks do tend to go overkill on fees with their “loyal” customers. I don’t necessarily feel that the payday lenders are intentionally targeting the financially unfortunate. I believe the financially unfortunate are uninformed of what they are getting into and are not taking the steps to being financially savvy. On that note, this type of article is exactly what people need to read to know what they are getting into.

In California, they are working to pass legislation to cap payday loan rates. This would be a welcome boon to cash poor consumers. Of course, the payday loan companies are up in arms claiming that this will curtail options for consumers as it becomes less lucrative for such loan companies to make easy money…. Well, that’s just tough. I’m all for usury laws to protect us (not just from sharks but from ourselves too).

Capping the loan rate will reduce the amount of interest with existing balances, but it won’t change the fact that people are still seeking these loans out. Unfortunately with the state of the economy in America, unemployed individuals are taking out loans that they should not be taking.

I’ve found that the main way to avoid getting into trouble with these loans is to use them for true emergencies only. I’ve got a friend who supplements her income with such loans. This is a very bad idea and just digs the hole deeper and deeper. Changes in laws help but more needs to be done to protect consumers, especially in south Carolina.

Payday lenders are looking over their shoulder right now given that Obama’s consumer watchdog agency is scrutinizing the industry very carefully.