How the interest rate environment affects peer to peer lending networks like Lending Club.

Have you looked into peer to peer lending as a way to borrow money? I wrote about it in my article on how to get a personal loan as one alternative way of giving yourself that extra liquidity. It’s better than payday loans and in many cases, can be superior to traditional bank loans when you compare terms. Well, there’s some news on the interest rate front as it affects peer to peer lenders.

As low rates have plagued savings account rates, so have these rates impacted the personal loan industry. In recent weeks, there’s been an uptick on the rates charged by some credit card companies and financial institutions, and sure enough, the changes have rippled through the peer to peer lending community just as expected.

How Will Interest Rates Affect Your Loans and Notes?

So if you’re a borrower or lender at a place like Lending Club, for instance, how will rate adjustments affect you? Let’s take a look at Lending Club as a case study.

Lending Club Borrowers

Lending Club borrowers have seen their average interest rates increase by 50 basis points or 0.5% over the last few days. What’s interesting is that while this average has gone up, the rates for higher quality, Grade A loans have instead gone down by 46 basis points or 0.46%. And as Lending Club has put it — they don’t see these changes affecting the quality of their borrower pool in a negative fashion. Goes to show you that prime borrowers who have outstanding credit will be rewarded with much cheaper loans. To become a borrower at Lending Club, you’ll need a FICO score of at least 660 (the average credit score for LC borrowers is 713) and a debt to income ratio (minus your mortgage) of under 25%. Here is the current rate sheet for graded loans at Lending Club (as of this writing).

Lending Club Investors

Lending Club investors have an even more compelling perspective. If you’re loaning money out, you can now expect a slightly higher return on this money — with interest rate adjustments, the average net annualized return is expected to jump from 9.1% to 9.6% (across all Lending Club investors). I don’t know about you, but if I had extra savings collecting cobwebs in so-called high interest accounts as we all await a more confident stock investing climate, I’d be tempted to consider investments such as Lending Club notes or even foreign currency CDs (okay this is a topic for another article!) as alternative places to park my savings.

I’ve actually covered the topic of Lending Club investment returns in some detail in the past, which I’d encourage you to look into if you are interested in becoming a lender (or LC investor).

Should You Invest With Lending Club?

From what I know about peer to peer lending, I have always wondered why more people haven’t joined this bandwagon yet. Perhaps it’s because social lending is still a new-ish concept, plus there have also been a few snags along the way (as with the SEC stepping in to evaluate some of the more recognizable names in this fledgling industry). But I do think that with time, the concept will be as mainstream as other forms of financing we’re seeing today.

I had a chance to speak with Patrick Gannon of Lending Club, who shared some interesting information about investing in their three year notes (that portion of a loan that you control as an investor). Recently, they’ve actually been seeing a default rate of ZERO among their best (high grade) borrowers. So this got me thinking about a hypothetical scenario:

Because I’m risk averse, why not just invest solely on a purely high quality loan portfolio? If I choose to fund only conservative Grade A loans, which have interest rates ranging from 7.05% to 8.94%, that would be around an 8% return on average. And after paying the standard lender service charge of 1% (returns are impacted by less than this amount since this isn’t an annual charge), I would be left with around 7.3% in returns. According to Patrick, typical default rates and unforeseen fees usually amount to 0.50%, so you’d expect these to take away from your net return, resulting in an expected 6.8% on your investment. But with no defaults being reported at this time, you may potentially be netting the full 7.3% instead. Not bad at all!

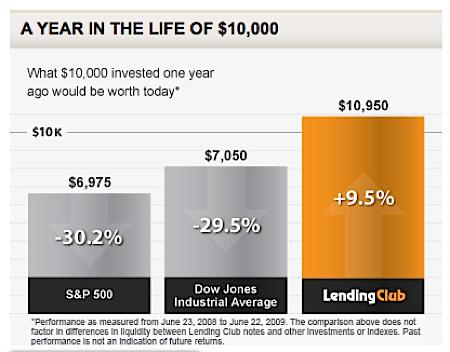

I think that with these target numbers, a loan portfolio can act as a great diversifier for your investments. I’d file these notes under “alternative investments” — something beyond my core investment portfolio — that I’ll use to diversify my holdings. With even a 6.8% to 7.3% target return, this seems like a decent rate, given the options we’re facing with a volatile stock market, slow real estate market and lethargic bank savings. Would you take a 7% annualized return on a 3 year note? You may actually want to compare your notes to current bond terms, yields and returns to see where your investment stands. At any rate, here’s a graphic comparing Lending Club average one year returns to those of U.S. stock indexes:

With higher rates for you as an investor, and lower rates for high grade borrowers, I think it’s a great time to learn about investing in something different. If you’ve got a loan portfolio with Lending Club, we’d love to hear how it’s going for you!

Copyright © 2009 The Digerati Life. All Rights Reserved.

{ 15 comments… read them below or add one }

It looks like it could be a feasible alternative to the banks and lets face it, they haven’t exactly excelled of late. Maybe the spread of risk will be more healthier for the normal person.

The $50 is great, I only got $25 when I signed up, but I was wondering if there is any promotion out there for Lending Club that if you refer a friend you get $25 and they get $25?

Thanks

Corey,

There used to be a promotion like that but I don’t believe that it is any longer in place. It could come back in the future though!

Do you personally have any loans with Lending Club? If not, do you plan on using them?

I’ve been using Lending Club for more than a year now and I can tell you it is a fantastic investment. I made my mistakes at the beginning and chose some unique loans that ended up defaulting, but even after that, I’m still making a hefty 9% after fees and bad loans. I have become a bit more risk averse and look at the loans more closely too, but overall, it’s really a gem. Highly recommended.

An 8% risk-adjusted rate of return is pretty darn good. I wonder what the tax consequences of doing these are…

Update: If anyone has signed up to get the bonus and has not yet received it, I am currently working out the kinks with the Lending Club folks on this matter. So if you have had any sign up issues, please contact me (see my contact page) about it and I’ll send your info along to be evaluated. Thanks!

If lending club were to go under would the loans outlast lending club?

Escape Somewhere,

Good question. I believe the answer is “Yes” (as far as existing loans are concerned). If a peer to peer lender were to go under, they expect to transfer their loans over to a third party servicing loan agent. This agent would then be responsible for managing existing loans and for performing ongoing lending operations accordingly. New loans will no longer be accepted into the network and existing loans will be administered and managed by a separate agent until their terms complete.

I noticed you did not answer the question posed above. Do you personally have money

invested with Lending Club. If not, could you briefly say why?

Sorry, I missed the first question — yes I have money invested in Lending Club. I have money also invested in Prosper. I am planning to discuss my investments in detail at some point, but am currently working on the material for it. There’s a lot of coverage! So stay tuned….

You should consider getting your credit improved first, since that will probably save you hundreds of dollars on your new loan… You can search for an affordable and experienced attorney owned firm that can provide you credit restoration services.

What about payday loans? Some people use this for cash. Payday loans are short-term loans that must be repaid by the next payday. Even if you have bad credit and meet the criteria you are still eligible for payments up to $1000. All you have to do is fill out an application online and a representative will get back to you with details on how to proceed. The repayment duration of a payday loan is from two to four weeks.

But be very careful when you apply for such a loan. These are far from cheap loans. I’d still recommend Lending Club over such loans especially if you have decent credit.

I’d recommend Lending Club over more expensive loans especially if you have decent credit.

Get your credit improved first. I always do that if it’s possible to do it!