We take a close look at high yield savings rates.

Are you a saver looking for the best returns in online bank accounts right now? Let’s take a look at the rates at these banks during this time.

Get High Returns From Online Banks

According to a recent Bankrate survey, the average certificate of deposit returns at regional banks aren’t too attractive. Same goes for savings interest rates. Just take a look at this list of APYs from our favorite online banks and high interest accounts:

|

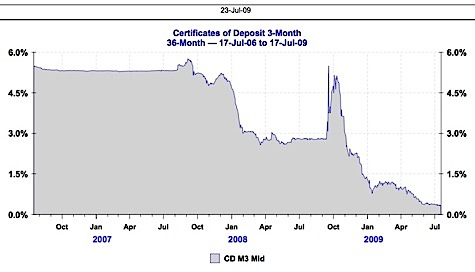

This is what constitutes as high yield returns at this time. It’s interesting to compare this to the time when HSBC Advance was offering 6% returns on its savings accounts and when WaMu accounts were offering 4% APY. That was quite some time ago and is no longer the case now. This is of course, in line with how interest rates have been behaving of late. Here is a historical view of interest rates showing recent yields. It’s interesting to take a look at the big picture:

Image from theFinancials.com

Image from theFinancials.com

Savings Account Rates: When Do Rates Decrease?

Allow me to provide a short analysis of savings account rates. Experiencing low rates is just one other phenomenon that occurs as a result of a recession. In order to resuscitate the economy, the Federal Reserve is compelled to lower interest rates; I’ve seen this happen time and again in every recession I’ve seen (our most recent recession is the third one for me).

Let’s go through some reasons and explanations for this:

1. The Fed wants to stimulate the economy.

When the Fed decides to encourage more lending and more people to jump into the markets, they’ll lower rates. They’ll do this to to get the economic juices flowing in order to have money change hands. This strategy will coax people into jumping into investments where returns could be better. When people are nervous about putting their money at risk, investors will remain paralyzed about taking more risk with their money, and will therefore keep their funds ensconced in shorter term funds. Which leads us to the next point: the effects of the flight to safety.

2. Demand for safe accounts is high.

When there’s volatility going on in riskier investments such as the stock market, many investors are often spooked out of their stock portfolios; thus, they rush to safer online savings accounts and low risk bank products. During times like these, investors would rather get small returns rather than lose big with stocks (as their thinking goes). Hence, during such instances, banks won’t feel the need to attract new customers by offering attractive rates.

3. Savings accounts are considered safer.

The FDIC has increased guaranteed coverage limits to $250,000 per account. With this guarantee in place, more people feel secure about handing their money over to their banks and credit unions. Again — easy deposits won’t require higher yields because of the greater demand.

4. Credit is tight.

When banks are not so interested in approving loans, they are also not that eager to attract deposits to support their business. As banks act more conservatively, they’ll also be able to charge higher rates for loans. The equilibrium here will shift in favor of banks, which will be able to improve their loan business without really having to be too competitive.

Savings Account Rates And The Economy

So does this mean that we’re going to have to live with paltry savings rates every time the economy slumps? For the most part, the answer is yes. However, when we notice interest rates go up, note that it may not necessarily be a good thing. If higher rates are in the horizon, it may not be for reasons that are positive. It may be because of potential inflation ahead (thanks to our large government deficits), which can signal much higher rates in the future. Now we don’t want things to tip toward the other direction either — hyperinflation is not something we’d like to face!

Just remember that whenever an economy recovers, we can expect to see rates swing to the upside. Savers may rejoice the higher APYs, but we should only celebrate when the higher APYs coincide with a healthy economy.

Copyright © 2009 The Digerati Life. All Rights Reserved.

{ 5 comments… read them below or add one }

I have actually not switched from my money market account to an online savings account for this reason. The rates are basically identical and the money market account is more liquid and easier to move funds.

I just switched to Kasasa checking at County Bank for their 4.75% APY. If it holds above 2% for the year, I’ll still make more money than my previous savings account, my current CDs, or anything else I could find.

Bank of Internet’s Advantage Savings is actually 2.25% APY

One strategy that I plan on taking is investing a lot of my money that would be in savings into a fund that buys inflation-protected treasuries. It’s really secure, and will provide you an amazing interest rate if the inflation bomb does drop.

To get higher rates of return one should consider an alternative to traditional investing or savings. Why not take more control of your financial future and try to diverse your investment strategy.

There is a wise saying that says “no one will pay you what your worth but your self.” Why not consider thinking outside the box and create your own investments.

For example tax liens have been proven time and time again to show returns of over 10% or higher on a regular basis (note: this is not to be took as financial or investment advice). Sure you have to do some research, but the same holds true for any investment.

Just my thoughts.