Not all high interest savings accounts or money market accounts are alike. If you look at it from the standpoint of savers who decide to open such high yield savings accounts, you’ll find that we’re all prompted to select such accounts according to various reasons and criteria. Let’s take a look at some of the more popular savings products around:

Best High Yield Savings & Checking Accounts

|

Based on where we are in our lives, we tend to choose accounts according to specific requirements. Younger people in their 20’s may be particularly interested in what kind of returns to expect from their savings, and whether an account has an associated debit card or ATM bank card. Older people with some money tucked away will be more interested in the ability to easily move their money around and between accounts — perhaps from cash accounts to investment accounts and vice versa. In this case, they’d be more interested in online bank account features such as ACH, wiring and account linking.

Given these concerns, I thought it would be good to present this comparison table that shows how various high yield savings accounts rank and score on a variety of characteristics and features. I sourced this data from a couple of reports (from WTDirect and EverBank, in particular).

| Bank Features |

EverBank |

Ally Bank |

FNBO Direct |

ING Direct |

WTDirect |

| Top Savings Account | EverBank | Ally Bank | FNBO Direct | ING Direct | WTDirect |

| Rates / Balances | |||||

| APY (as of 1/09/12) | .91% | .89% | 0.70% | .90% | 1.11% |

| Maximum Balance | 10MM | Unlimited | Unlimited | 1MM | Unlimited |

| Minimum Balance | $1,500 | $0 | $0 | $1 | $0 |

| Service | |||||

| Live Person Answering Phone | Yes | Yes | Yes | Yes | Yes |

| Mobile Banking Availability | Yes | No | No | Yes | Yes |

| Account Types / Transfers | |||||

| Totten Trust Accounts Offered | Yes | Yes | Yes | No | Yes |

| # of External Bank Links | Unlimited | Unlimited | 3 | 3 | Unlimited |

| ATM Card | Yes | Yes | Yes | No | No |

| Next Day ACH Transfer | No | No | No | Yes | |

| Can Initiate Transfers From Another Bank | Yes | Yes | Yes | No | Yes |

Personal Savings Rates: Some Observations

These days, many of us question the interest rates that are earned in these popular high yield savings accounts — could you even consider these to be “high yield” returns? I’ve often mentioned that the term “high yield” is used relatively, because you’ll find most rates at banks and financial institutions to be set at even lower levels, resulting in an average APY of 1.001% for money market and savings accounts.

Granted, our current interest rate climate is not the most exciting at this time, but the expectation here is that our savings account rates won’t be staying down for too long.

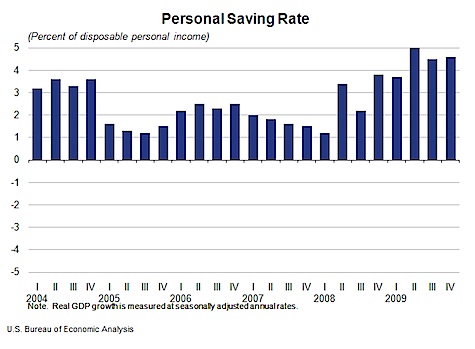

Also, the good news is that these low returns have not fazed us, as a nation. The U.S. personal saving rate (or how much money we sock away each year) has doubled over the past few years compared to how it used to be. Here’s a chart that shows this information.

Image from the Bureau of Economic Analysis

Image from the Bureau of Economic Analysis

Clearly, the state of the economy and the credit industry has had quite an impact on how we save as a nation. Question is, will this positive savings trend continue once our economy fully recovers or will we return to our spending ways as soon as we see an upswing?

Copyright © 2010 The Digerati Life. All Rights Reserved.

{ 7 comments… read them below or add one }

I have an ING account and I have been very pleased with it. I link it to my Sharebuilder account and both websites seem to be very user friendly.

At the end of the day, most internet banks are similiar. They can offer better rates because they do not have the brick and mortar costs. I had not heard of some of the other banks on this list, but I might check them out.

I have an ATM card with ING, I speak to live persons all the time and initiate weekly bank transfers. I do not live in the state ING resides.

I’ve called ING before and live person did pick up…..has it changed?

Thanks for the great summary! Are you aware of a similar summary for business checking and savings accounts?

Wow…2.51%! That’s great. I’m going to have to consider transferring my money to another bank because the bank I am currently with offers such low interest rates that it’s really not worth it when I can find better offers elsewhere…

The internet has changed business models so drastically in so many industries that it’s startling. Who would have thought even as far back as 15 years ago that there would be banks with absolutely no retail locations. Everbank is proving that banks with high interest savings accounts can work purely online just as well as retailers with no brick and mortar locations can. The costs saved can be applied to higher interests for customers.

I’m sick of the low interest rates in my savings accounts lately, and I’ve been wondering if I should get into cds or something else. I never really thought about online savings accounts though. Maybe I should look into that.