So who still balances their checkbook? Let’s see a show of hands. Here are some fun facts: 40% of Americans don’t regularly balance their checkbook. 20% don’t even track their balance. I’ll admit that I used to be much more on the ball about this, but ended up abandoning the practice for a while. Recently though, I’ve been trying to be a little more organized (it’s not my strongest point) by hiring a bookkeeper and by tracking transactions, but I’ll say that I don’t do this as religiously as some people do. I am one of those people who prefers to get the big picture when it comes to financial numbers, quite unlike a few of my friends who love to fuss over each and every monetary transaction.

There are, of course, benefits to balancing your checkbook. The main ones involve:

- Making sure you spot errors in your bank statements.

- Keeping track of your expenses so you don’t get an overdraft.

- Helping you to make a budget and to stick to it.

- Knowing your cash flow picture and your spending and saving habits.

- Bragging to everyone that you can do some basic financial accounting.

Okay, that last one was my lame way of trying to elicit a chuckle out of an otherwise dull subject. 😉 Accounting of any sort for me is rather a tedious process, but most people I know who get into this habit assure me that it becomes rather easy over time, since it becomes an automatic process — like driving. After a while, you can do it subconsciously, say with your eyes closed (and I don’t mean driving).

It seems that with the advent of online banking, electronic payments, and high tech gadgetry, we are now inundated with tools all designed to help us manage our money, so balancing a checkbook may not seem relevant any more. But if watching your expenses is a big deal for you, then this is one practice you want to get into the habit of doing. Expense watchers consider their checkbook register as their best friend and one of the most powerful tools they can use to make sure that they keep tabs on their spending.

Regardless of how closely you monitor your expenses, I think it’s always a good idea to keep up with some basics, as you’ll never know when you decide to get into the checkbook balancing habit. For those of you who haven’t even seen a checkbook register since 1994, here’s a quick rundown of how to use it. This may seem pretty straightforward, so take it as a refresher!

How To Balance A Checkbook

The main goal is this: every time you spend or make a deposit, you should record it on your checkbook register. It’s a way of keeping track of your transactions formally through the register. Chances are though, that you’ll miss a few transactions, so you’ll want to cross check your entries against your bank statement at some point (more on this later). Again, note both withdrawals and deposits on your registry as they happen.

Take note that there are several ways to approach this and some people develop their own process (or order the steps differently). This happens to be the way I actually prefer to do it.

1. You’ll need your knowledge of basic math. It’s all about organizing the data and tallying numbers. It’s a matter of taking down and listing the transactions that enter and leave your account.

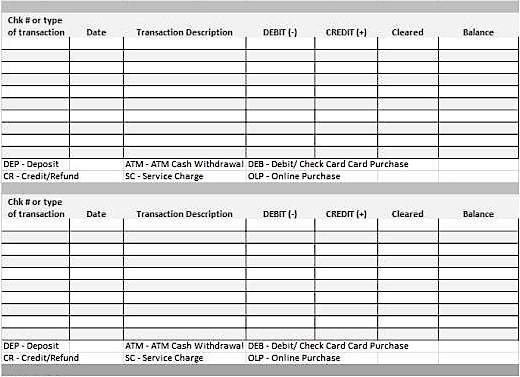

2. Get a hold of a checkbook register, which is that little booklet that comes with your box of checks. If this is not available, you can easily set one up by finding free printable registers — here’s one you can get right off the web:

3. Organize all the paperwork you’ll need for this. Find your bank statement; if you don’t have a physical statement on hand, then download one from your bank’s site. Sort out your checks, paychecks, deposit slips, withdrawal slips, receipts and so forth — any proof of a transaction you’ve made.

4. Start off with the starting balance of the account you want to track. This is obtained from your account statement. Write it down on your register.

5. Write down all your financial transactions. Gather all your checks, review them and record them in your register. Take note of cancelled and cleared checks. Record the outgo, which include payments, withdrawals, purchases, receipts, debit card and credit card charges, bank fees, online bill pay, etc. Review your deposits — both manual and electronic. Write them down in your register as well. Confirm your entries against the checking account of interest. If you have several accounts, then use this process for each one separately.

6. Start calculating and maintaining your balance. Some people like to keep a running balance for each transaction they enter. Others do it in one sitting after entering a whole bunch of transactions. Do it your way. The recommendation though, is to keep a running total if you want better control of your available balance. That running total is the new balance you enter in your register on each line.

7. Reconcile your entries against what’s shown in your bank statement. And because almost every bank nowadays allows its users to access their checking accounts via online banking, it should be a lot easier to keep your checkbook register in line. Your online bank account will allow you to see your balance, and will also help you to access your transaction history; therefore, you can use it to track the expenditures that have cleared your account and those that are still pending. I usually review my account online every week. That said, use your statement as a guide and review the transactions here; transfer any items to your register that you haven’t accounted for yet. Make sure you also figure in the account interest and fees as part of your records.

8. Confirm your transactions. I highlight the cleared transactions in my register in green. Identify which transactions are still pending, outstanding or missing.

9. Reduce your available balance by your outstanding transactions. Input the amount of money you have showing as available in your online account and reduce it by the amount you have in pending transactions. If the amount you get on your calculator matches the amount you have showing on the last line of your checkbook register, congratulations! Your checkbook is balanced. If the amount is different, you will need to take note of the discrepancies and address them.

10. Finalize your work. The point of balancing your checkbook is to make sure that you are on top of your transactions. The process may reveal that you’ve got missing items and may help you track pending transactions better. Whatever the case, you’ll be able to account for each item and address bank or statement errors if there are any. Now once you’ve confirmed each transaction and all your numbers are in their proper places, you can keep note of your final balance — it’ll be your starting point the next time you go through the balancing process again.

And that’s it. The more often you perform the steps listed above, the more confident you can be that the amount listed in your register is an accurate reflection of the amount of money you actually have to spend. Many people choose to rely upon their online banking account balances to determine how much money they have in the bank. But unless you’ve got a big cash buffer sitting in your account, you may be risking an overdraft by not balancing your checkbook on a regular basis.

Now, the old method of manually recording your transactions may turn some people off and that’s okay. For those people, there are software tools out there that can take all of this to your computer. The process works in much the same manner, however instead of recording each transaction in your checkbook register manually, you keep a running list of transactions and you enter them into your computer every day. The nice thing about financial tools like these is that you can easily download and print out reports, see spending patterns and automatically connect and balance your electronic register with your online bank account. One of the more popular software tools for doing this is Checkbook. The best part about this software is that you can try it for free (you have to pay $19.95 for the software after your trial is over). CNET gives this product four out of five stars, so if you are in the market for such a solution, check out Checkbook.

Copyright © 2011 The Digerati Life. All Rights Reserved.

{ 2 comments… read them below or add one }

I used to faithfully keep track of every expenditure as it happened, in a paper check register. I even did that for a few years after I began using Quicken. But I did away with the paper register and now I just go to my bank’s online portal and download the transactions for the checking account into Quicken. I do religiously reconcile my checking account each month through Quicken. I would probably be more lax about this if I were able to keep an extra $500 or $1000 in the account, but we get pretty close to zero each month before payday. My husband is not very good at telling me or even remembering how much he spent at the store, so I have to check the bank online site regularly to make sure I put those amounts into Quicken so we don’t overdraw the account. I usually give him a set amount of cash and he’s not supposed to use the debit card, but often if he runs out of cash he simply uses the debit card, even though we didn’t have money budgeted for these additional expenditures. I do try to keep a couple hundred in savings to move over quickly in case we are about to overdraw due to one of these purchases. When it comes to my husband’s business checking, we have to pay monthly taxes to our state, county and city, so I absolutely have to reconcile his accounts monthly before paying those taxes or I might miss a deposit and therefore miss paying the taxes due, and would have to make an amended return. I would rather not have to go through that hassle. Helpful steps in this post!

@Mrs A,

I know you do a lot of accounting so this is pretty much second nature to you right? I’m guessing you have this down pat as part of your regular routine. I am far from being the “accountant type” but acknowledge the need for proper financial tracking. But it’s just something I don’t like doing. Instead, I minimize transactions where I can so I don’t have to bother with them (lol). 😉 This is one aspect of personal finance that I am not so thrilled by (along with taxes and insurance).