Should you invest via direct lending and become a Lending Club investor? Let’s check out Lending Club’s investment performance and loan returns, and review peer to peer lending as an investment strategy.

If you’re looking for alternative investments with high returns, where else can we put our money to work? The stock market is still the way to go for the long term, but a lot of investors have been itching to find other opportunities, to seek some growth for their money and to hedge their investment portfolios.

So where to turn?

There’s an intriguing option that can be an alternative place to invest your dollars. You may have heard of Lending Club and peer to peer lending as a viable way to earn returns on your money, so I took a closer look at how people made money this way. I reviewed Lending Club’s Investment Analysis report (by Javelin Strategy & Research), and came across some interesting data, which we’ll discuss further.

Lending Club Overview For Investors

This network allows you to invest in fixed income securities and is a less traditional way to put your money to work. The idea is to fund the loans of borrowers “directly” through the use of a “match making” network that brings borrowers and lenders (e.g. investors) together. It’s a perfectly legitimate and effective way to borrow money and to get a personal loan without the use of a bank, and lowers the costs that are shouldered by lenders. If you are on the funding side, then you may be able to enjoy higher than average returns on notes that you take out on these loans. The risks involved in these investments are “graded” by Lending Club so you have a good idea how much risk you are taking on for the returns you are getting. The risk of default is fairly low: it’s below 3% (a number taken since 2007). Even with the overall annualized default rate taken into consideration, you can earn an average of over 9% annually.

How To Get Started With Lending Club

Signing up with Lending Club is free. You can link your Lending Club account to your bank account pretty easily to begin investing. Investors may be able to receive occasional cash bonus incentives throughout the year. In fact, there’s one such offer in place right now.

How To Invest With Lending Club

Lending Club is a network that allows you to lend money to people looking for unsecured loans ranging from $1000 to $25,000 in size. You can select specific loans to fund or use a “Lending Match” tool to help filter which loans to fund in part or in whole. The goal is to build a diversified loan portfolio, where you spread out your money across many loans. So this network matches lenders to loans in a “many to many relationship”, with each lender usually funding several loans and holding several notes, while each borrower’s loan receives funds from many lenders.

Average Statistics from Lending Club

|

A note is what represents the obligation that a borrower has to a lender, and for the lender, it usually corresponds to the portion of the loan that he/she funds.

As a lender, how would you make money? Well, you’ll collect money from borrowers — their loan payments plus any late payment fees, minus a 1% service charge to Lending Club. If you’re a typical lender, you’d build a loan investment portfolio of $6,501 containing 37 notes, each note valued at $169.

What Are The Investment Risks?

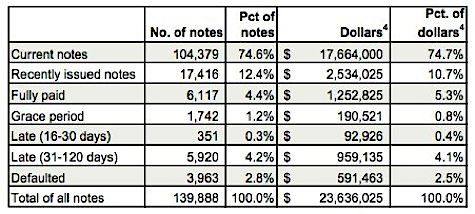

Like any other investment, there’s risk! With higher returns, you can also expect higher risk. Loans are unsecured, so borrowers can just default on you and stop paying up. Or they can retire their loans earlier than you expect. If anyone defaults, their account goes to collections, affecting their credit scores. Lending Club tries to mitigate this risk by allowing only borrowers with a 660 or higher credit score to participate in the network. But to give you some idea of the risks you’re dealing with, here are some statistics describing the status of Lending Club notes in this environment.

This breakdown gives me a basic idea of where the risk lies. The table shows how loans are broken down according to how they’re being paid out. Fully paid notes are those prepaid loans that were paid off early, while those described as under “Grace Period” are those loans that are given some time before they’re characterized as late (the grace period is 15 days at Lending Club).

The main risks lie in those notes that are fully paid ahead of schedule (due to interest rate risk), that are under the grace period, considered late and that go into default (resulting in actual investment loss).

Lending Club Investment Performance and Expected Loan Returns

So how much can you expect to earn? Well, Lending Club categorizes its loans according to rate and risk levels. On average, personal loan interest rates are quoted at 12.3%. But lenders actually earn around 9% on average after taking into consideration all the “things that don’t go as planned”. Take away the service charges, early retirement of loans and all those pesky defaults, and what you end up earning becomes lower than the quoted rate.

Given all these facts, let’s see how peer to peer lending via Lending Club stacks up against other traditional forms of investments:

How Lending Club Compares To Other Investments

Of course, these figures will vary per year. But here’s a snapshot of how an initial investment of $10,000 grew from June 2007 to November 2008, across various investments.

| Investment | Amount At End Of Period |

|---|---|

| Lending Club | $11,594 |

| One Year CD | $10,678 |

| Six Month Treasury Bills | $10,501 |

| Nasdaq Composite Index | $6,604 |

| Standard & Poor’s 500 Index | $6,289 |

Based on relative performance, direct lending seems to have fared pretty well in the past, and may be a viable form of investing.

How Liquid Is Your Investment?

One more thing about investments — make sure you know just how liquid it is. Real estate is illiquid, while stocks are fairly liquid unless you find yourself underwater, in which case, your stake sure doesn’t feel like something you’d like to liquidate anytime soon. But what about your loan portfolio? Well, Lending Club recently introduced a note trading platform called FOLIOfn that allows you to buy and sell notes to improve your liquidity and cash flow. It’s still new, so just how effective this platform is, remains to be seen.

What’s The Cost?

For all the work they do, Lending Club will take out a 1% service charge from any earnings you make. The effect on your annual returns is less than 1% because it’s not an annual charge. Using the note trading platform will cost you 1% per trade.

Should You Invest Via Direct Lending?

So what do you think? Any chance you’d consider putting some of your money to work with Lending Club? I’ve said it before (in my Lending Club review) and will say it again — I feel that lending through Lending Club (or through some other peer to peer lending platform) as an investment activity seems to be worth trying out, if you treat your loan portfolio as a way to further diversify your core portfolio of stocks, bonds, real estate and other traditional asset classes.

Copyright © 2009 The Digerati Life. All Rights Reserved.

{ 24 comments… read them below or add one }

Good article. Thanks for laying it all out. I’ve been pondering trying Lending Club myself and your information is most helpful. I think we’re all scrambling to find a better place to put at least a little money!

I plan to get started either this week or next with a couple of low dollar investments just to get the swing of it. I am glad to see another review on it, I am still a little skeptical.

The suggestion I’d give for those starting out with a new investment is to start small. By doing so, you’ll get the hang of things and can build up the experience. It will also minimize any losses you incur. Start small and build up gradually as you familiarize yourself with the new investment.

Yes hello this seems like a viable idea to the current insecurity of the banking world but would it come with the same guarantees or insurance of any kind? It seems that this method may be ripe for abuse as it is largely untested by time and the courts but perhaps my view is overly cynical and could you blame me?

You could do something similar, but internationally. Check out http://www.microplace.com where you can invest money with a good return in microfinance – lending to low income third world women entrepreneurs. (Like Kiva, but you can earn up to 5% interest). What a great way to make a return, and know your investment is being used by women working their way out of poverty.

BPT,

Thanks for the tip! I haven’t heard of MicroPlace yet, so I appreciate the info! I also wrote a Kiva review here, for those interested in the idea of microlending and helping out small businesses in the international landscape. As you’ve indicated, Kiva is not for profit.

Those last two services are a bit more interesting to me. I’ve studied microfinance quite a bit, and it is an amazing concept that literally changes lives. Because our workable/’investable’ income is quite small, I’m still a bit wary of Lending Club, but it seems like a better place to put the money than almost anything else.

I may just be a cynic, but wasn’t this whole economic crisis started, or at least snowballed, by the practice of lending money. Not only lending money to people who couldn’t pay, but lending it to people who were spending it a little too freely.

I checked out the prospectus reports at Lending Club, take a look at the people wanting these loans. Many of them are already over their heads in credit debt or their spending carelessly- one guy wants $20,000 just to pay for his son’s wedding. The solutions to these issues are to grow up and get frugal. Taking out another loan to pay off credit isn’t going to solve everything. I’m sure there are some honest folks out there, like the kid who needs about $2000 to finish school, he’ll then be off working and will most likely pay off quickly (in my opinion, as opposed to wedding dude and “personal loan” chick).

I’m simply a little hesitant to lend money to support the bad habits of people spending money they don’t have to buy things they don’t need to impress people they don’t even like.

Just a *humble* opinion.

ilikeaccounts,

Good points. You are absolutely right. In every network and community, we’re bound to encounter members who use the community to further goals that we may or may not agree with on one level or another. But as a Lending Club member, I’m on the lookout for specific loans to fund. I’m all for funding businesses and people who need just a little help to advance themselves further.

Many years ago, I had a cousin who wanted a new lease on life. He wanted to leave our native country to strike it out as an immigrant. Now, there was no way he could have done it without the help of his family. A few of us pitched in to give him the money for tickets, passport fees, and the like. The long story short, he got out and is now living very well elsewhere. He has purchased a house and is now helping others (his own family) to improve their lives as well.

This is the kind of story I’m hoping to replicate when I use Lending Club. Of course, not all stories will be this way. And when approaching the lending network as an investor, you may not even think of the human side of things. Many lenders just use the “Lending Match” tool to build their diversified loan portfolio. Many investors approach this purely as a “business decision” and view their transactions impersonally.

I present Lending Club here as an investment option, which people may or may not find appealing for their specific reasons. I do find it highly interesting to read everyone’s different views on this subject!

Starting small is always a good way to approach new investments, and Lending Club is no exception. Also remember to diversify your loan portfolio to reduce the default risk. So if you have $100 to invest, lending the minimum ($25) to four people is safer than lending the full amount to one person. I’ve thought a lot about default of those loans and ran some simulations that might be interesting to potential investors. Here’s my two-part Lending Club Default Analysis. Since Lending Club is relatively new and doesn’t have a long performance history, only time will tell the true returns everyone is going to get.

I am not sure if I am reading this correctly, but if I loan out 100 dollars and the default rate is 2.5%, does that mean that at the end of the year my principal is down to 97.5?

The other thing I would want to think about is that the interest rate that they give out is 12.5%, so they must be charging a lot higher of their borrowers. Which is much higher than what is charged for anything else. Does that then imply that for borrowers this is the lending of last resort?

I think peer to peer lending is an amazing concept and one that will again change the way people ultimately live, borrow, and get capital. With all of the bad news at banks I often wonder how the Internet and peer to peer lending will simply change banking forever, i.e. make it a smaller and less significant player in the business life of people. However even though I seem to be waxing eloquently about the virtues of peer to peer lending I should say that I am not sure I am a believer in ANY type of lending right now.

I appreciate the stats that you posted, but my question is when were those stats derived and how will our worsening economy affect those stats going forward. With so many people losing jobs, having little savings, and getting increasingly more desperate I believe the default rate on all lending will continue to rise. In my local area our unemployment just hit 13.7% county wide. In the city that is closest to me unemployment just hit 17% and shows no signs of slowing down. While I realize this is probably not the case across the entire country my belief is it is still very bad out there and I would concerned with any lending in this market. Once the economy starts to turn around this will be a different ball game.

Don’t forget about the income and net worth requirements for becoming a lender. While they don’t verify anything and you can go ahead and open an account, you are violating the terms of the agreement. If anything goes wrong with your money or loans, you’ve got no ground to stand on.

Interesting info.

2.5% default rate is pretty high. Thats close to junk bond level of defaults. Course with a high default rate you get high interest and 12% is pretty high. You just have to be well aware that you’ll likely lose around 2.5% of your loans.

For this to work well for the lender its quite important to be very diversified with the loans. Put smaller amounts into many loans rather than larger amount into few loans. If the average lender has 37 notes out then thats pretty well diversified.

Jim

By receiving a referral you are able to get $50 free to invest.

I signed up this morning and found the site extremely user friendly and easy to go through. I have already selected notes and everything. I’m really excited to see how this turns out.

Sally

@Michael,

To answer your question, the stats I posted were for the last 18 months (ending 2008). I’m also curious about how these stats may change over time, as it incorporates the potential for additional risk, going forward (as you mentioned). At the same time, you’re getting people with good credit who are ready to move to this new platform given how banks and financial institutions have been behaving lately.

I foresee more activity in the peer to peer lending realm, while I’m not exactly sure how the level of risk will be adjusted during a poor economy. It’s possible that risk levels remain unchanged (as “good” borrowers continue to overwhelmingly outnumber the “bad”), but we’ll need to see how things go.

Some of the keys to this economic recovery run contrary to what’s described as “responsible personal finance”. I’ve read that we should be spending more and that financial companies should be less restrictive with their lending policies. There should be more money flow and liquidity all around. I’m looking at a lending network as one solution to the liquidity issue.

But as a PF enthusiast, I find it ironic that we should now start espousing spending, lending and borrowing as a way out of our economic mess.

Greatly written article. I have been in low dollar investments for some time now. It can be really profitable if you have the right skills.

Sadly, they do not take into account loss on sales of loans:

For example, if you have a $25 loan and do not receive a single payment on it and see that it’s going into default. You go to FolioFN and sell the loan for $5 to get some money back, your return is -80%. However, LC doesn’t take that into account and will still list your return as 0% on the LendingClub side.

Great way to inflate their investment return %, also very very sneaky. Be careful.

How much of lending club’s own money is invested in their peer to peer loans? If it’s really as a good deal as they claim, then they should be putting up a substantial sum of their own money.

Notice that the 31-121 day late bucket is huge — over 4% of loans in there. I suspect a huge chunk of those are heading into default as well.

It’s going also going to be an extreme pain to get enough loans to make a well diversified portfolio especially compared to just buying a bond index fund.

Here’s what wikipedia says about the default rate:

“In addition, because Lending Club’s loans cannot default in their first 120 days and the chance of default tends to increase with age, the default rate experienced so far may tend to underestimate the total default rate that investors will experience over the 3-year lives of the loans. Since new and growing portfolios have a high proportion of new, default-free loans, the default rate experienced so far may require particular caution when evaluating new portfolios and may be a less reliable estimate of the future overall default experience and hence of future overall returns.”

Rather than take loan risk, if you have extra money to invest you should consider some deep in the money covered calls on large cap dividend paying stocks. It’s easy to do, and it pays better than interest rates.

Fixed income investments offer less risk than covered calls. I wouldn’t do options without learning about it as much as possible. Lending Club offers a great fixed income option. To learn how to trade options, check out these online brokers. They offer free resources and education in this area.

If you want something more conservative, it’s best to stick with bonds and Lending Club.

Here’s the latest limited offer at this time: if you decide to become a new investor and invest at least $2,500 within 45 days of signing up, you will be granted a bonus of $100 in your account. This is an immediate 4% cash bonus applied to your initial investment. I quite like how Lending Club introduces these seasonal promotions every so often. If you’re willing to fund your account with just a little more, they’ll often give you a little extra to encourage you to make that move.

I see the benefits of using Lending Club but I am still skeptical about lending money through Lending Club. Before I sign up I would love to find out what % of lenders who do not get paid back their full money with interest? I doubt it’s 100%. I do like free $100 for sign up. What are terms and conditions for this $100? Thanks.

Editor: Please check the statistics we’ve offered in our article above for more details on Lending Club investment risks.

The 4% bonus is no longer effective, but the new offer in place is a 2% cash bonus that is based on an investor’s initial investment amount. If your initial balance is between $2,500 and $14,999, you’ll get a 1% cash bonus; if your balance is between $15,000 and $49,999, your bonus is 1.5%. If your balance is at least $50,000, then you’ll get 2% in cash (with the maximum reward being $2,000).