This is part of our series on “scary money tips and stories”.

Have you heard of the world’s worst mortgage? It’s this fictional doozy from MSN Money:

An interest-only, payment skipping/minimum-payment-option-enabled, negatively amortizing, no-money-down, no documentation, prepayment-penalizing, 3-month LIBOR 40-year adjustable-rate mortgage with a balloon.

But even though that loan is fictional, there are some real-life mortgages that may keep you awake at night.

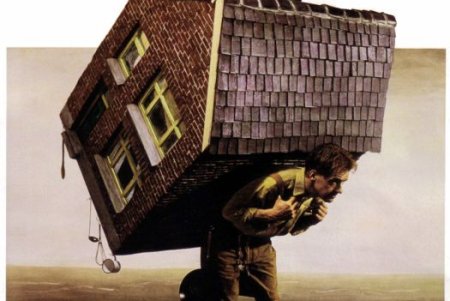

Mortgage Loans That Can Give You Nightmares

There are so many types of loans to cover you as you buy a house, but there are some I’d think twice before applying for. There’s this cluster of risky mortgage loans that was very popular during the housing boom but now is just getting its comeuppance. I’d rather rent until I can afford less expensive loans that don’t have some hidden booby trap that springs out and forces me to foreclose. Unless you’re comfortable with the risk, I’d avoid these if I were you:

Subprime Loans:

These are non-traditional loans that are offered at a rate higher than prime for those borrowers who do not qualify for prime rate loans. Those with bad credit and who are at high risk of default, will be offered these loans if they decide to be homebuyers. Critics of subprime lending point out that due to its nature, this type of loan is taken out by people who usually are not able to fulfill their payments and obligations. And therein lies the risk because a subprime loan could be fine if you are able to make good on it. However, people fall into the trap of getting into a loan based on a low teaser rate and don’t plan on the consequences when it resets. As we have read in the media, predatory lending practices exist in this industry thereby often causing default, eventual foreclosure and even bankruptcy.

Stated Income Loans:

The fact that these were also called “liar loans” somehow didn’t sit too well with me. Though it may sound like a good deal: you’re able to avoid the documentation needed to prove your income (supposedly a benefit for those with irregular income reports), these loans are highly problematic once mismanaged. In other types of loans, the bank assumes liability for the loan as they screen the borrower for eligibility; but if the borrower takes out a stated income loan, he takes on that liability. If he defaults on the loan, he may be cited as committing fraud. Interestingly though, it is rare that such borrowers actually get prosecuted for fraud. The reality is that stated income is another way for people to stretch into houses they can’t afford (they are just hoping things will turn around or they can refi or sell at a profit). A recent colorful example of such loans gone bad and its nasty consequences can be found in the saga of Casey Serin, a real estate investor who suffered foreclosures and notoriety for indiscriminately taking on liar loans.

Option ARMs:

When I first heard about this loan which belongs to a mortgage loan classification called a “neg am loan”, I thought it was great because it sounds so flexible: you can decide to pay your regular principal and interest, interest only or a minimum required amount that could be lower than your actual interest. That last option is a catch because the difference between your minimum payment and interest is then added to your mortgage. The danger is that if you are not fiscally responsible, you can end up owing much more than your house is worth. Stats show that around 80% of option arm customers make only the minimum payment. Ouch! More details of how scary it is here and here.

Interest Only Loans:

This may not be as bad as the Option ARM but can also blow up in your face. You pay interest only for three to ten years then after that period, you are required to start paying down principal along with interest. If you aren’t prepared to cover those payments, you’re hosed. It may be a reasonable choice of loan if you’re moving from your home before the interest only period expires so that you are not subject to the payment reset, or if you have the money to pay this down later.

There’s someone we know who is highly concerned by her highly leveraged position in rentals right now. She owns homes in Arizona, Nevada, and other “hot” property markets of the last few years but she’s now struggling with the negative cash flow she’s experiencing after loan rate readjustments. The only recourse is to sell off some of these money pit properties but she’ll have to take some losses if she does so. This is the common story plaguing new real estate investors who entered the market late. I feel badly for her.

This is the unfortunate situation when you become over leveraged with properties especially when they are purchased at the peak of the housing market. The temptation is great to follow suit like so many others who found the siren song of real estate investing as their answer to their financial future. They forgot all too easily that timing and risk should not be ignored when entering such serious financial transactions. When things get too complacent and rosy, there’s usually a catch, with the market pendulum just about waiting to swing to the other side.

If you bought your house at the peak, it won’t be half as bad if you put down a large down payment or got a fixed rate loan or bought it with cash (which is a less common occurrence given the price of properties nowadays). That is not the scenario most people take because of one very common reason: AFFORDABILITY. Many new mortgage loan products were therefore fashioned to assist prospective homeowners to afford homes regardless of their financial situation. And these loans are a pretty scary bunch, particularly to those folks who probably need them the most: if you’re least likely to afford such a loan but you can only qualify for such loans, then doesn’t taking on such debt make for a toxic situation?

Caveat: My position here is always to take things conservatively and to proclaim: buyer beware. Do your research before taking on the financial burden of a new loan.

Copyright © 2007 The Digerati Life. All Rights Reserved.

{ 19 comments… read them below or add one }

We got suckered into some bad loans about 3 years ago and we are still recovering. Once you are in, it is difficult not to continue making the same mistake: bigger and bigger HELOCs, more and more cash out, etc. Plus, the mortgage companies overvalued out house significantly in order to get us into the loan. We owe 5% more than I think our house would sell for at the moment.

Rocket Finance: Did you find that a lot of it was to do with “encouragement” from lenders and perhaps even your own agent? I found my agent very trustworthy and he remains a close friend. But when we purchased our home in 2002, we found ourselves having to deal with the lender, facing one of the “best” from Citibank Mortgage. Our loan went through without a hitch but not without a lot of “pressure” to go ARM and have a HELOC account open “just in case”. I told her “I didn’t need it” but she made me feel foolish for skipping on the very low rate HELOC at that time, which we didn’t need at all.

*sarcasm*

Perhaps if I were “smarter” I could’ve opened that HELOC, used the money, shoved it in the stock market and made tens of thousands of dollars! Or maybe I could’ve used the money to buy an investment home in 2003. I would have made some money despite the market downturn. Maybe.

It goes to show, those who work in the industry are trained to make you take on more debt even if you don’t need it. They’re not doing their job if they don’t try.

SVB,

Good article. I love that fictional mortgage description.

With the seeming growth in numbers of more complicated mortgages over the past several years, it may be unreasonable to expect most people to wade through the details to make a truly informed decision. We have forced disclosure laws, after all, that require truth-in-lending disclosures that have long conceded that simplified, required disclosures are necessary in more traditional loans, let alone the more exotic ones as of late. But aren’t you reluctant in seeing choice, even ones you think are unwise, regulated away?

Beyond the features of the financing vehicles, it seems that buyer myopia enters into this some too. Outside the sphere of the “hot” markets that you identify, we don’t find ourselves in a bubble driven much by speculation. There just was never that high of a growth in prices. Qualifying seems to be the issue. Approving buyers on nothing down with looser income requirements has allowed homebuyers to buy when maybe they just shouldn’t have–not because they are in complicated financial instruments, but because they are in a house that couldn’t, even in better markets, allow them to resell short-term and pay the mortgage simply due to transaction costs. And generally the no-downpayment option indicates no savings. That means if so much as a stiff breeze comes along, you have may have no choice outside of foreclosure.

I think people assume that whatever the bank told them they can qualify for is what they can afford. Unfortunately, qualifying for a loan is completely different than being able to afford a loan. The bank looks at a few financial records. They have no clue about your lifestyle. They don’t know if you have kids on the way. They don’t know what the market will be like.

Before taking a loan, figure out what the payments will be for the entire life of the loan IN THE WORST CASE SCENARIO. Don’t just calculate best case or average case. Make sure you could handle even the worst case or at the very least have a contingency plan for handling the worst case. Remember, the bank is NOT on your side. They’re in this to make money on you.

Gal

Well I loved your post especially the conclusion, the loans are designed to be affordable, I was thinking to go for a home loan, but now i would do some research and then take a plunge.

Wow. That worst mortgage is a terror. Just in time for Halloween too! 😉

Reading about all this makes me glad to be renting. We’re definitely not in shape to be buying just yet. We’d have had to get a subprime loan and all that baggage. *shudder*

When I read this I feel better about my life. We live in a small town house in south fl. It fits out needs but we kinda wanted more. 4 years ago when we bought the bank approved us for up to 300,000 with some fancy finance options. My hubby was still in school and I knew that they were approving me for MUCH more than we could truly afford. We ended up buying a modest townhome and after our downpayment only borrowed 116k. We may not have bought our dream home but the payments are VERY affordable and we don’t have to deal with all that worry. And to think, they almost talked me into interest only! Yikes!

Your comments on these loans are telling. You begin by mentioning the pros of the loan products, then assert they are “bad” because the BORROWERS were “fiscally irresponsible.” And that’s where I have a problem with blaming the products or those who sell them. No product is inheritently good or evil, they all have a place, but any loan can be inappropriate. The borrowers were presumably responsible adults legally able to sign a contract.Maybe we should be going after the schools, not blaming the lenders.

Great post,

I have learned many useful resources from your blog. Thanks for sharing this information and hope to read more from you. Refinancing for a fixed rate mortgage can lower your rates and give you peace of mind. By setting your mortgage rate today, you know exactly how much your interest will cost and how long your loan will last.

Fixed rate mortgages also allow you to buy down the rate, saving you thousands if you keep the mortgage for several years. You can also extend the loan period to reduce monthly payment amounts.

For great info on the borrowing process, read the book “How to Borrow Money From a Bank” written by a banker with secret about borrowing that will help you with successful borrowing. You can find this book at Amazon.com. It has over 60 pages just chock full of great info for the low price of 19.95.

There are two nightmares plaguing our society today. The first is buying a gem of a car, and the second is getting stuck with an expensive refinance mortgage loans.

Funny how few of those loan products are actually still available these days. In fact, there is a limited Neg Am loan and limited stated income loan available and that is about it!

Times sure have changed!

You’re actually right — times have changed and it only took a real estate market meltdown to make it happen.

But when things start to shape up once more and money starts to flow again, who knows? Those loans that vanished can become fashionable again.

I agree! That Neg Am loan was favorable in the 80’s as well but stated loans was new this go around! I also think that values had a whole lot to do with this crunch as well. I have seen homes at 40% of what they once were. In fact $2MM purchase in 05-06 is now going for 899K WOW!

It is very true that there are so many sub types or forms of getting mortgage loans but i think the best is to stick with the traditional mortgage loan and don’t get carried away be some lenders who basically force you to buy into adjustable rate mortage. If you get into ARM the risk is actually on you and if you buy into a fixed rate mortgage the risk is on the banks or lenders.

Thanks

I’m surprised with mortgages calculating tools that how people believe in those. Are these tools really help in estimating mortgages ?

Sturat,

I am sure the use of these calculators is a start to get a ballpark idea about what one’s mortgage will be like. I’m certain people go beyond these tools to get the real figures down. I doubt people would actually peg their entire hopes on what an internet tool has to say to them. I might get some basic idea of what financing I’ll require via the calculator, but that’s it. I’ll be consulting with a lender and my bank for the hard numbers and details.

I think the stated income loan types are a good reason that we are in this huge mortgage mess now. Its not all to blame, but it definitely is a part of the terrible oversight and poor judgement by law makers to push lenders to do low income loans as well.

Great article. Very interesting points.

The picture made me LOL.

When will this mess end, I can’t wait for the day when people are getting back to work, and people are getting into homes!