Anyone who’s walked into their local bank or applied online for a loan has probably heard of the term FICO. A good FICO credit score will help you snare the best loan rates. Like your favorite soda, it’s something that’s manufactured (okay, calculated) by using some mysterious formula. You can thank the Fair Isaac Corporation for your FICO score — they’re behind myFICO.com, the best resource for your FICO credit information and for credit score monitoring.

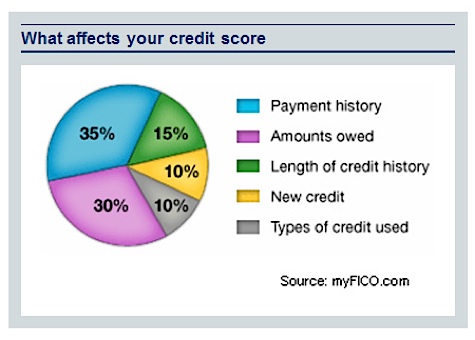

So how is your credit score formulated? Now I haven’t taken any tests but if I did, I’m sure I’d do better than my neighbor who just bought a house and has a newly leased luxury car. What follows is some information you’ll find explained in many financial sites, but I found that it’s pretty helpful to review the basics anyway. So let’s go over how a FICO credit score is broken down:

Your FICO Credit Score Information: What Does It Mean?

Your Payment History: 35% of Your Score

A little over a third of your FICO credit score revolves around your payment history. The quality of your payment history is affected by certain actions you take, such as: how long you wait to pay your bills, how many bills you have that you aren’t paying at all, if you’ve had suits filed against you, and anything that a collection agency may have on you. Here’s when your past behavior can come back and bite you. Do you know where you stand?

- Excellent: If you’ve had a history of paying your loans on time with no missed payments, then you can expect a strong score. Having a variety of loans in your record also helps.

- Bad: Are you staring at a hefty debt load because of your credit indiscretions as a youth? If you were maxing out all your cards at age 18, you may now be saddled with tens of thousands of dollars at age 25. You’ll have to work hard to improve your credit score.

Here’s the thing about your payment history: even if you only pay interest on your loans, as long as you maintain good payment habits, you will usually score well in this area. Most companies are also willing to work with you, so if you make payment arrangements, try to stick to them and everything should work out fine.

The Amount You Currently Owe: 30% of Your Score

Another 1/3 of your FICO score is based on what you owe right now. Every credit card you have in your name, every outstanding loan you have, and any active debts you own will contribute to your score. This part of your FICO score can fluctuate greatly. Technically speaking, it measures how much you owe relative to how much credit is available to you. So how are you rated?

- Excellent: If you have a wallet full of cards and pay all your bills on time, you are a shining star in this area. To gain points, maintain a small balance without any missed payments and keep your unused credit accounts open.

- Good: An occasional late payment, having no balance, or closing off all your credit accounts after you’ve paid them off may ding your score a little but still keep you in favorable territory.

- Bad: You’re in trouble if you max your credit cards, borrow a lot of money, or have a tendency to rent a flat screen television every year just for the Superbowl without paying the rental fee until you’re served some papers.

New Credit and Credit Types: 20% of Your Score

About 1/5 of your FICO credit score will be split between two areas that are pretty similar. One area relates to new credit accounts while the other area relates to the type of credit you have and use.

New credit, at 10% of your credit score, will cover anything you’ve done recently involving your credit. Applying for a slew of loans in a short period will have a slight negative effect on your score, so pace yourself when signing up for credit. This area refers to actions such as: applying for a credit card or opening a high interest savings account (whether you get one or not), receiving recent credit inquires made to your report (due to new credit applications), or making any resolutions or payment arrangements with companies you’ve had a past problem or dispute with. Believe it or not, working out an arrangement with a company to resolve a past due credit issue may count toward new credit as you’ve taken steps to establish a positive credit history.

The type of credit you have comprises 10% of your score and refers to the various lines of credit you carry. If you have a credit card, mortgage, retail store account, or finance account, this will all affect this area of your FICO score. The more mix and variety you’ve got to your credit lines, the better it will actually be for this part of your score. Your score receives a boost if you’ve had various types of credit which you maintain in good standing.

The Length of Your Credit History: 15% of Your Score

At some time or another you’ve probably heard someone complain that they don’t qualify for a particular loan or account because they have a “lack” of credit. This is actually quite common, so to establish initial credit, you may have to get a less than desirable credit card and use it faithfully for a few months. It goes without saying that you’ll need to use your card responsibly for some time in order to garner a good FICO score.

This final piece of your FICO credit score takes into consideration your oldest account and the average age of all your loans. You will be rated based on how long you’ve had credit (if any), how long it’s been since you’ve opened a line of credit somewhere, and how long since you’ve used your accounts. This part of your score will likely drop if you’ve built up great credit but have decided to pay off your credit card; hence, you may want to think twice before throwing away your cards and closing down all your card accounts. It’s therefore always a good idea to have a few active accounts open even if you rarely use your credit cards.

The FICO Credit Score Formula

In summary, your FICO score is based on approximately 1/3 payment history, 1/3 how much you owe, and 1/3 how long you’ve had credit and what type of credit you have. Your credit rating is something you can track on your own or by employing credit report monitoring services. If only this type of information were taught in our schools! I’d love to have a required course for high school students that go into great detail about credit and debt management, but unfortunately, it looks like we’ll have to continue to figure things out the hard way. Well hopefully, this article serves as a little bit of a primer on your credit information. By knowing exactly what factors contribute to your FICO credit score, you have the power to fix your problem areas and help kick that score up to where you need it to be.

For related information on your credit score and how best to manage and track it, check out these other articles on how to pick up an Experian credit score and report and where to get free credit scores.

Copyright © 2009 The Digerati Life. All Rights Reserved.

{ 10 comments… read them below or add one }

Who cares about FICO scores, the economy in Malaysia is so good that if we need money we just job hop to a higher salary, the boom in Malaysia is thanks to China ! We in Malaysia are enjoying high growth and high inflation, I do not understand all this complaining. We have to thank China for our strong growth as our economy was going down until March 2009 and China rescued us by buying our commodities. Currently there is strong job market, 2 jobs for every worker, we have to import in foreign labour to do jobs that locals do not want to do ! We have high inflation, an example is a local dessert called “cendol” selling for $1.20 in local currency a month ago, is now selling for $ 1.80 in local currency. Thats a hefty increase, so don’t complain, enjoy the boom !

One rude awakening I had last month was a drop in score due to a cancelled credit card. American Express decided to double my interest rate, so I closed the account. I had a very large credit line and though my balance was low, closing the account decreased my credit score, though my total debt has dropped substantially!

Capital One has notified me that they plan on doubling my rates by August, so I am closing that large credit line as well.

I’d rather take the hit on my credit score than be blackmailed by these credit card companies.

@Paul: IMHO a better thing would be to just transfer your balance out to a lower rate card or pay the balance if any, than closing the card. This way you would actually end up improving your credit score.

FICO is fully rigged against your financial health. I have no credit card debt, just paid off my house and only have a small car note. What did paying off my house get me? A drop of 50 points. Yes, that’s right, lets penalize the guy who has never had a late payment in over 10 years, saves money and lives within his means. God help me when I pay the car off I’ll probably go into the 600’s. Common sense would say I’m the safest guy to lend money too but that’s not what FICO is about.

It’s a strange system. At least with this info, you can learn some of the rules.

Having the best FICO score or credit score possible should be a high priority in your life because it can have an effect on some various things. Just getting a new job or a promotion within many companies these days will really depend on having a good FICO score.

Although I have great doubt it will ever actually come to be, people would probably do much better in life if credit was a mandatory semester taught in high school.

@Annie: That seems to be extremely true these days. Even landlords check out a prospective tenant’s credit records now during the application period.

Like some people have said here, FICO reflects (to a large extent) a person’s financial health. Financial health does not mean only money or good reserves or property, it also means the ‘ability to repay’ the financial obligations.

Credit information is good information for many who want to get their houses and vehicles financed as things have started looking up after the dreadful recession last year.

What started the recession was this reason: banks and institutions lent out more than they could collect from borrowers; result, banks lost funds and many closed down. The rest is history but keep this in mind. Learn about the past and avoid repeating it!

There’s a lot of information out there about how to improve your credit score. You can certainly learn a lot by checking out the myFICO.com site which has an active forum, community, tools and products on this subject.