It’s not just how much you make that matters, but also how much you actually keep.

There are but few words in the financial vocabulary that strike fear in me, and TAX is one of them. The annual chore of preparing and organizing my financial documents that comes around February or March never fails to raise forth in me just a tad bit of anxiety, perhaps because at the very end of the exercise, I find out, like in most years of my existence as an income generating individual, that I will once more pay out what seems like an enormous sum from my coffers — a sum that was just getting comfortable where it was situated in my savings account, kicking off a few nice rounds of interest and dividends.

Only a couple of times in my life have I been blessed with a tax refund. And one of those times was on the very first year of my professional career when I was still on the 1040-EZ. I’m sure this sentiment is shared by many others. So like a chronic condition that we need to live with for eternity, taxes are something that we try to manage as well as we can.

How much income tax do you pay? As for me, I just know it takes out a good 30% of our household income each year. I don’t even bother with the marginal bracket calculations anymore. I just know it’s been 30% out the door, or more! — depending on whether I had to pay some penalty or the dreaded alternative minimum tax (AMT) thanks to the huge swings in income we’ve experienced in some years.

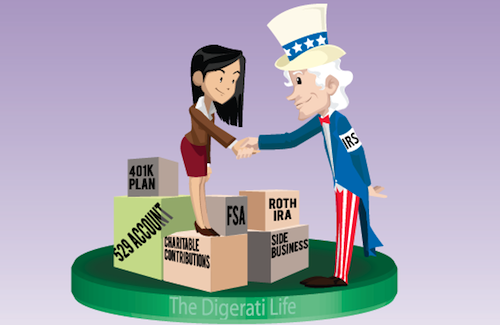

We all want to do whatever we can to reduce our taxes. In general, we can accomplish this by limiting our adjusted gross income (usually by shifting regular income into tax advantaged accounts), as well as by taking on tax deductions and tax credits. But let’s look at some specific strategies.

7 Tax Strategies For Regular Employees Or For Those Holding Down A Job

The big tax breaks are found in the realm of business and real estate, but there are things you can do as an employee that can help you take a bite out of your tax load. I’d like to share some tax pointers for those who are holding down jobs and are employed. I’d call them tax tips for the working stiff, which you can use to mitigate the tax hits that come your way:

- Participate in your employer’s benefit plans for pre-tax treatment on the following:

- Commuter Benefits. I once held down a job in the city, and back then, I had to pay for parking or mass transit on a regular basis. But by participating in a commuter pre-tax program, I easily saved $1,000 a year on commuter fees.

- Group Life Insurance. Some employers offer life insurance plans and when they do, the premiums can be pre-taxed.

- Group Long-Term Disability Insurance. This can be pre-taxed as well if this is available to you as an employee, and I’ve actually seen group premiums that were such a bargain that it would be a crime not to purchase the insurance.

- Use a Flexible Spending Plan. Consider contributions to a flexible spending account. You will need to estimate how much you are going to spend because any unused amount is not returned to you. This type of account can save you a mint. Note however, that Obamacare threatens to cap your FSA contributions to $2,500 by 2013. Such a shame, really, since you could use this for daycare or certain medical costs. In my neck of the woods, daycare is around $600 a month. That amounts to over $7,000 a year, and without any caps, the resulting tax savings could be over $2,000 a year. Nevertheless, you can still estimate how much your family spends for health services, medications and prescriptions not covered by your health insurance, and apply for a flexible spending account that can cover these expenses.

- Charitable Contribution Matching. There are employers that hold charity drives with special provisions. If you decide to participate in an employer-sponsored charity event, not only is your donation tax deductible or pre-taxed, but it may also qualify for a matchable contribution from a magnanimous employer. I worked at a company that actually organized charity programs that worked this way, and it was great to see my donation go a long way, thanks to my employer’s matching funds.

- Deduct eligible job-related expenses. Let’s go over a few:

- Educational & professional training expenses. You’ll need to review these carefully, but there is a possibility that you’ll be able to deduct such expenses if you don’t qualify for a tuition reimbursement program with your employer.

- Job-related travel expenses. You can claim tax deductions as an employee in certain situations. For instance, if you deliver materials or items by using your own vehicle, then you can consider deducting mileage, gas or toll fees which you incur on your travels.

- Expenses relating to a job hunt. There may be some caveats to this deduction, so check to see if your expenses are eligible.

- Unreimbursed employee expenses. To be deductible, these expenses need to be ordinary and necessary, and incurred during the tax year. Some examples are: dues you pay as a member of a professional society, home office use, license fees, legal fees, etc.

These expenses are considered miscellaneous, so in order to be deductible, they’ll have to comprise more than 2% of your adjusted gross income or AGI.

-

Don’t pass up the free money: contribute to a 401K Plan!

Yes you’ve heard this all before. But I am still stunned that some of my own friends who can afford it, decide to deliberately ignore the 401K benefit. Why? Because retirement is just “too far away”. A few other excuses I’ve heard: they won’t be in the U.S. by the time they retire, they have “better use” for their money (like buying more stuff), they never plan to retire, or their house is their retirement plan. Understandably, it may be tough for some to find the money to save, but even small regular contributions make a difference in a tax deferred plan. If you and your spouse are both working, you can contribute up to $17,000 each (for 2012). If you are over 50, you can contribute up to an additional catch up amount of $5,500 (limits are raised over time to reflect cost of living increases). However, contribution limits can also be established by your employer so you’ll need to check on their guidelines. Seems like you can contribute at most up to the limit set by the government or by your employer, whichever is less. And if it’s available to you, there’s nothing more enticing than free money with that employer match. - Build up your Roth IRA or Traditional IRA.

If you are 49 and under by the end of 2012, the maximum contribution limit to combined IRA accounts is $5,000 or your taxable income for the year, whichever is smaller. If you’re 50 years or older by the end of 2012, then the most you can contribute to your combined IRA accounts is $6,000 or your taxable compensation, whichever is smaller. -

Donate your unwanted stuff to the Salvation Army or Goodwill.

Don’t throw away your surplus, unwanted items; recycle them and give them to charity for tax deductions! Again, I know people who don’t bother. They go the hard route by planning garage sales, which in themselves can be overwhelming. These folks procrastinate but eventually give up and rent a dumpster (to throw things away). But why? The Salvation Army does pick ups after all. If they don’t pass by your neighborhood, you can still drop off your stuff at donation collection hubs; it’s probably still less effort than dealing with a dumpster. When you donate, don’t forget to pick up a receipt for your tax records. -

Open 529 accounts for your dependents.

A 529 savings plan account grows tax deferred just like a retirement account does so this would be a great idea if you’re planning to pay for college anyway. For some plans, the funds from a 529 account may be used towards internationally accredited schools, even if your dependents no longer reside in the U.S. The tax-free gift limit is now up to $13,000 per giver so that you and your spouse can each give up to that amount to each account without triggering the gift tax. -

Good: Start a home business. Better: Get into real estate. Best: Get into a real estate business.

Any book I pick up about tax management never fails to point out that real estate and business are where you’ll be able to apply the best tax strategies. So that’s something to consider. In fact, this is the year I am strongly considering entering the field of real estate investing, given the massive corrections I’ve noted in certain regional property markets.

There’s just no escaping the tax man, but you can definitely minimize those taxes that you pay out. The breaks are out there but the challenge is to find them and to execute! Easier said than done sometimes.

Created October 26, 2006. Updated January 22, 2012. Copyright © 2012 The Digerati Life. All Rights Reserved.

{ 8 comments… read them below or add one }

I’m going to come look at this when my status as temp.freelancer transforms into fully employed working person.

I got my first full paycheck from the temp agency last week and a THIRD was taken out for taxes. And that was with three or four exemptions for head of household, a dependent, etc.

I have got to figure out how to flip myself out of the daily grind of barely getting by to the magic of comfortably well off.

Barely getting by can be temporary if you manage it correctly. Once you develop marketable job skills you will be able to either negotiate a nice raise or move to another higher paying position at your firm. I know people who have stayed at the first company they ever worked for and now earn $200K plus. Others take their skills and move to consulting firms and work at client sites where the pay rate is $40-50 per hour with only a few years of experience. $90-120 per hour with 10 years or more experience. The mistake is staying at a current low-paying position because you like where you live. Don’t let geography stop you from succeeding.

It stands to reason that if you are going to ask the top 10 percent of income earners to foot over 50 percent of the tax bills, then when it comes time, Uncle Sam should cut taxes and return the surpluses.

All of these are great ideas. Another idea for non business owners who want a tax deduction are energy credits. Some energy efficient upgrades to your home will give you a tax credit. Some of these are putting in insulation, installing an energy efficient water heater, furnace, a/c, windows, and/or doors.

I just sent this to my girlfriend. She was asking about IRA and had a dispute over 401k as well. This will make her see the light of investing.

I also never tried to deduct employee-expenses in my taxes… thanks.

Hmmm a huge tax burden, seems like an idea for a book – oh wait Ayn Rand already wrote that book (Atlas Shrugged)….

Nice article, but anyway taxes are a burden for people who have higher incomes — the more you earn, the more you should pay as tax, so earn less! 😛

@Pavan,

So are taxes now considered a “demotivator” when it comes to income generation? I once facetiously posed this matter to my tax accountant and he said that it was surprising how many people thought this way. That they should earn less in order to decrease their tax burden. It’s something to ponder in some situations, say if you are wondering whether having two incomes in a household can push you above a particular tax bracket — this, together with daycare expenses may be one reason why those in a dual income family may decide to have one parent stay home to care for kids instead. Daycare expenses plus tax obligations may not be worth the additional income brought in by one parent (for example).

In most cases though, it’s still better to earn more and pay tax than the other way around.