Like many of us, you might have some credit cards, a personal loan or two, and a home loan. If you’ve ever wanted to sit down and do an analysis of your current loan status, you might be tempted to put it off due to the time and effort it would take. However, a site called Credit Sesame offers a solution to help you tame your debt and finances without eating up too much of your day.

Like many of us, you might have some credit cards, a personal loan or two, and a home loan. If you’ve ever wanted to sit down and do an analysis of your current loan status, you might be tempted to put it off due to the time and effort it would take. However, a site called Credit Sesame offers a solution to help you tame your debt and finances without eating up too much of your day.

Get Help With Optimizing Your Debt

So what is Credit Sesame? It’s a free online service and tool that allows you to optimize your debt situation. Beyond just allowing you to keep an eye on your credit status, it also offers a way to help you manage your debt better. It aims to optimize your existing debt and can help those who are looking to borrow funds in the future. Here are its main goals:

- Credit Sesame lets you track your credit score for free, month after month.

- You can monitor and keep watch over your credit, loan payments and debt information all at once. They offer reports and recommendations that show you how your debt set up can be better improved.

- The information they provide you can be used to create a financial plan, to answer questions about your debt (e.g. should I refinance or think about consolidating my loans?) or to simply check up on your financial health.

- You can find more optimal, targeted loan offers and mortgage refinancing opportunities. By knowing about your credit, Credit Sesame will be able to do a better job with matching you to the right financing offers.

You start off by signing up for a free account with Credit Sesame. You’ll be asked to supply some information. Like Credit Karma (another company we’ve covered in this space), Credit Sesame requires that you supply your Social Security Number. That would be the tradeoff for getting the information you want at no cost. Even so, this is pretty much similar to how credit bureaus and other such agencies track your credit information. Once they obtain your SSN, they’re able to build your financial picture based on data that they automatically aggregate from various sources (e.g. credit agency, lenders, banks, etc).

In the case of Credit Sesame, your SSN is used to get your credit score and information from the well-known credit bureau Experian. Since we’re handing over key information about ourselves, you might be wondering how safe this service can be. Fortunately, Credit Sesame uses the same level of encryption that banks and other financial services implement.

Credit Sesame Review: Get A Debt Analysis & Access Your Credit Score

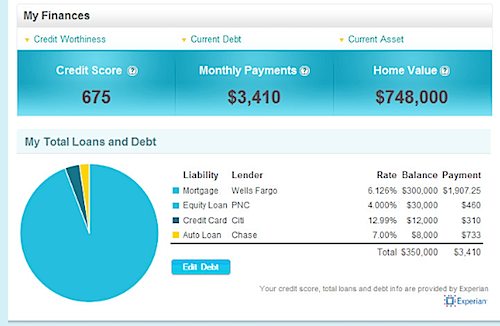

From this info, you’ll then receive a high level debt analysis such as the following:

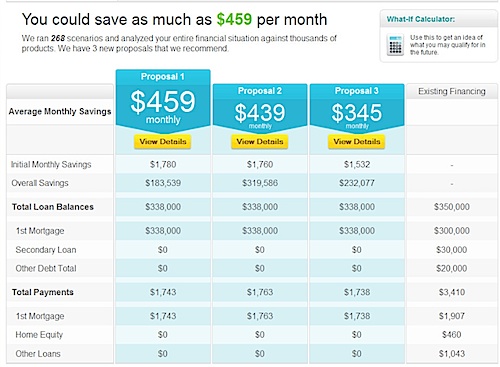

While you can also manually enter your own credit and loan data, it can take a lot of effort to do, so it may be best to let Credit Sesame do the work for you. After a swift study of your finances, the service is able to compare your needs to the plethora of loans and financing options out there. In turn, you’ll be offered the three best proposals (and loans) that will help you avoid paying too much interest in the future.

The offers you receive are derived from a process that sifts through thousands of loan products which are then matched against your credit profile so that you are prequalified. The leads that you receive are well matched, which results in a much higher chance of getting the loan you want.

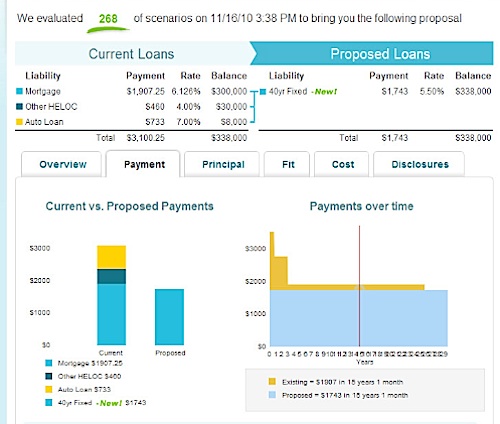

You can apply for the loan you prefer online. But before you do so, you may want to check on the kind of payments you’ll be making. You can also compare your current loans to proposed loans and see how your payments will affect your finances over time.

If you’ve applied for a bank loan in the past, you might have experienced some lack of communication on your status as your application made its way through the system. In contrast, Credit Sesame updates the status of your application so you know where you stand whenever you log into your account.

Check Your Free Credit Score

The personal attention doesn’t stop there (and it’s still free to you). Credit Sesame also provides valuable financial tools that help you analyze your mortgage information and the value of your home, as well as your debt to income ratio. For a deeper understanding of your creditworthiness, you can go over your free credit score (which is actually available on a monthly basis) and see whether or not you’re making the best of your debt payments. If there’s a loan out there that offers a lower rate than your current loans, you’ll hear about it. Note though, that the free credit score is not a FICO credit score as it is obtained through Experian (which has its own credit rating system).

If you’re expecting a change in your income or debt picture in the near future, there’s a What-if Calculator that can demonstrate the types of savings you can expect or how much of a loan you can prequalify for.

Credit Sesame Keeps You Alert & Saves You Money

Sometimes it doesn’t take long for changes to hit your credit score or for your debt to grow. You can stay on top of these types of changes with alerts. These alerts can let you know when new financial products are available to help you. It’s also possible to set a specific financial goal and to receive a notification when the right loan or product hits the market. This is great if you have a target like buying a home or refinancing your existing home.

Credit Sesame has a look and feel that’s garnered favorable comparisons to the popular budgeting and financial site, Mint.com. You can even check Credit Sesame out on Facebook or follow it on Twitter. Plus, the Credit Sesame blog has advice on timely topics like the loan modification process, holiday spending, and winter energy savings.

As mentioned above, it’s free to sign up for this service. Credit Sesame earns its income on fees from banks and other institutions when members like us sign up for loans and close on loans that save you money. It’s worth mentioning that while you’re offered the chance to apply for loans, this isn’t a debt settlement or debt consolidation service. Instead of paying a monthly fee for a debt consolidation company to arrange your debt payments and credit, you can manage your own finances and make your own debt, credit and loan decisions by using Credit Sesame’s free tools. You’ll quickly find out just how much you can save by using their site.

If you’ve been putting off the task of looking for lower rates for your loans, credit cards, and other debts, you may want to take a quick break to introduce yourself to Credit Sesame. With tools to help you find the best rates and gain a broader picture of your financial state, Credit Sesame has the potential of saving you a lot of money over the long term.

Copyright © 2010 The Digerati Life. All Rights Reserved.

{ 5 comments… read them below or add one }

Last I checked, it was illegal to be compensated on closed loans. It’s what’s known as a RESPA violation. The FTC should look into how this site works, as it may have been built on an illegal foundation.

According to your review Credit Sesame is the most sophisticated program I’ve seen so far. If trial period is free, I will look into it…

Thanks for the run down on the software, I am looking forward to trying it out. I must say I am positive towards any software and websites which help users to sort out finances. When I first started my business I found managing my finances was the hardest part. With the right banking services and software just like this I managed to handle my money more effectively.

Thanks for the post.

Credit Sesame seems like a great thing to try out. But isn’t the credit score not a FICO one? I need to check on my FICO score and would prefer that.

@Vanna,

Credit Sesame does not offer FICO scores but they use their own scoring formula. I don’t believe you can get a FICO score for free unless you are applying for something and a lender actually checks on it for you (making it free, in the process). Credit Sesame, however, provides you transparency into your loan accounts and may be able to tell you how you can save money based on suggestions/recommendations they make. They perform some analysis for you. But you don’t lose anything by trying it out since it’s free anyway. You don’t have to follow their recommendations either. So it’s worth it to just get the information.