I picked up my first personal finance book as a college senior. As soon as I read it, I wanted to go around telling every other twenty-something how important it was to get their finances in order as young adults.

Unfortunately, my girlfriend rolled her eyes at me and my friends couldn’t have cared less. Sometimes you have to do a bit of prying to show people how much easier life can be if you have your finances in order as a twenty-something before the real life trials and tribulations kick in.

How To Manage Your Money In Your Twenties

Let’s take a look at the advantages that twenty-somethings have when it comes to matters of personal finance, and why there’s no better time than today, to get your financial life in order. The earlier you start caring about your money, the better!

Let’s Look At Compound Interest

There’s a reason Albert Einstein said, “The most powerful force in the universe is compound interest”. Coming from a man who studied physics, forces, and atoms for his entire life, that’s saying a lot.

The most important factor in compound interest is TIME. As a twenty-something, you — hopefully — have plenty of years ahead of you. But don’t waste these years because even a couple can set you back for the rest of your life.

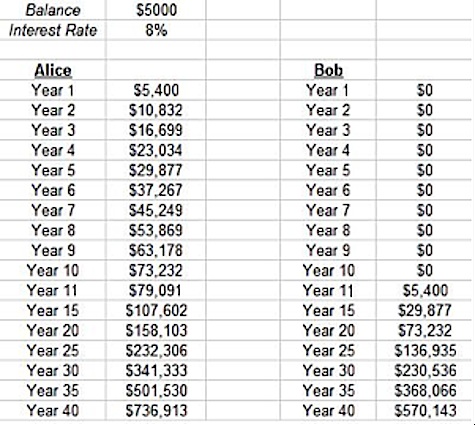

Let’s take a classic example that illustrates the power of compounding: Alice is a 25-year-old who starts investing $5,000 a year at 8%. She invests for 10 years and stops. Her money continues to gain interest until she is 65. Bob doesn’t start investing until he is 35-years-old, but he invests $5,000 a year for 30 years at 8%.

So who has more money? Alice. Don’t believe it? Check out the numbers.

Because Alice’s money sat in equities for 10 years before Bob even had a chance to invest, more of her interest and returns had a chance to accumulate and really kick in over time.

In total, she invested only $50,000 of her money, while Bob invested $150,000; yet Alice still came out ahead. Now imagine if Alice had kept investing $5,000 a year. She would have well over a million dollars by the time retirement rolled around and she would be financially set.

Time To Build Good Credit

I always thought it would be really helpful (though a bit awkward) if a girl or guy confessed on a first date if they had bad credit or not. I’m sure America’s debt woes would quickly improve and wasted dates would be weeded out because, let’s face it, bad credit is unattractive.

A lot of twenty-somethings don’t think about their credit, but knowing the ins and outs of your FICO credit score can save you thousands of dollars throughout your life.

Want the simple and quick way to get good credit? Pick up a credit card or two. Start out with secured credit cards if you want to establish credit. Use them sparingly. Pay them off in full every month. Then ask for a credit increase every year or two. Done.

When you’re in your twenties you have the opportunity and the time to build credit properly. With good credit you’ll receive better interest rates for your car and house, and those savings will equal thousands of dollars over a lifetime. In fact, with good credit, you’ll even qualify for better personal loan rates if you want to borrow money. You can also negotiate for better rates for those loans you already have. You can qualify for balance transfer cards and the harder-to-get 0% APR credit card offers that are reserved for reliable credit card customers. That’s where the irony is — have great credit and you can obtain cheaper loans; have terrible credit and you pay through your nose.

Now let’s take a specific example that shows good credit at work. When you decide to buy a house and you’ve got great credit, your interest rate will be pegged at a lower interest rate than if you have horrible credit. For purposes of illustration, let’s say your good credit gets you a rate of around 5.5% (yes, interest rates have seen lower levels, but this is just an example). Those who have bad credit would typically qualify for higher rates, so in this example, they’d probably receive something along the lines of 6.5%. A few percentage points don’t seem like a huge deal, but over the life of a thirty year mortgage, it’s a GIGANTIC deal.

So say you buy a $300,000 house. If you have a 30-year mortgage of $250,000 at a 6.5% interest rate, the house will end up costing you $700,111. That’s $333,548 just in interest! If you buy the same house with a loan sporting a 5.5% interest rate, the house will end up costing $642,260, with the interest totaling $276,322. A 1% change in the interest rate will cost you $57,226!

It’s Easier To Save When You Have No Kids

You often hear from twenty-somethings that saving at their age isn’t a priority and they’ll just do it later because they’ll be making more money in the future. Yes, that’s probably true. But you’ll also have additional costs you didn’t consider, like those expenses you incur once you have kids.

According to MSN Money, a child will cost an average American family approximately $249,000 from the time they are a new born until they’re eighteen. $249,000 for one kid! That’s about $14,000 a year!

Your income will probably be higher in ten years, but if you have two or three kids (as is the case with the average family), it’s likely that you could end up with a net income that’s similar to your low-level entry job today, after all your family expenses are accounted for.

I don’t want you to swear off having kids. I just want to show you that you’ll never have it easier financially than when you’re a twenty-something with no children. Take advantage of the simplicity of your life, where you can go home after work and research a Roth IRA, instead of having to help your 8-year-old with their science project.

No House To Worry About…Yet

The American dream is alive. I’m in my twenties and I’m already envisioning my “dream home”. Outdoor eating area, whirlpool, cavernous study. I want it all. A lot of people assume that being a home buyer is in their immediate future.

You may think that saving and getting your finances in order will be easier when you’re older, but will it be, once you have the stress of a mortgage, house repairs, property taxes, and homeowners insurance to think about? You have time to prepare for this purchase, but it’s going to be tricky if you don’t have your finances and savings in order when you decide to buy your house.

For example, to get a lower interest rate on your mortgage, it’s beneficial to pay 10%-20% as a down payment. That doesn’t sound like much, but if you assume a house costs $300,000, you’ll need to put down $30,000-$60,000 of your savings as a deposit.

You also have to factor in property taxes which, depending on where you live, can cost $3,000-$4,000 every year. There are also household repairs to think about. The general rule of thumb is to set aside the equivalent of 1% of your home’s valuation for repairs and maintenance. Know that these hidden costs add up and will make a serious dent in your future income from month to month, so it’s beneficial to prepare as early as you can for this eventuality.

As a twenty-something, you have extra money while you’re renting or living at home that you won’t have at other times in your life. Use that money to invest, save, and get ahead so you can be on top of your finances when you reach your thirties, forties, and later years. It turns out that we spend a lot of money over our lifetimes. But by taking action at a young age, we can adequately prepare for different financial milestones in our lives without having to face insurmountable issues.

This guest post is by Austin Morgan, from Foreigner’s Finances. It’s a great follow up to the other article I’ve published on goals to reach by the age of 30.

Created January 11, 2010. Updated June 4, 2012. Copyright © 2012 The Digerati Life. All Rights Reserved.

{ 22 comments… read them below or add one }

Thanks for this interesting post. I always appreciate that each and every person must get a financial education in young age so they can start their financial planning at early age and save money for future.

It does make sense, personally I would perhaps get a better job!

Great Article. While commenting on a financial blog concerning bankruptcy and Dave Ramsey teachings, one of the points I made was the importance of financial education. Some consumers can avoid bankruptcy by learning good financial basics. Unfortunately many consumers with major debt issues do not have the time to get our of debt by making financial changes and need bankruptcy to get back on their feet. As a bankruptcy attorney, I try to teach clients a little about the choices they make and point them in the direction of good financial learning tools. This is one I will add to my reference list.

As a twenty-something, this is a great article! I am 24 and have learned a lot about personal finance. I am aggressively paying down debt and hope to be finished with ALL (except mortgage) of my debt in 2 or 3 years. That will be a great feeling when it happens!

As an aside, my mother-in-law (bless her heart) is now retired (at age 66) with (almost literally) nothing in her name. She’s living off of her social security checks. (Don’t ask me how…) She’s never learned from her mistakes though. She hasn’t learned to be frugal: her AC/heat is always on full blast and her TV is on for 20+ hours a day, even when she’s not there. And every time my wife and I visit with her, she’s talking about buying more clothes and unnecessary CRAP!

I, most certainly, have learned from her mistakes. I definitely don’t want to have that lifestyle when I’m retired…

I agree- great article. While jjeffjackson posted that as a Bankrupcy Attorney he teaches “a little to our clients”, as a Certified Financial Planner(tm) I spend most of the early time in a client relationship teaching financial literacy and living debt free. We deal mostly with folks with money, and coaching them to change their habits surrounding money is extremly gratifying as we see their balance sheet go from liability heavy to asset heavy. We only deal with those who want to have a good night’s sleep, night after night. One of the first questions I ask in the initial appointment is “what wakes you up at 2 AM?”

Agree, I came out of college with no debt at all but really with no personal finance knowledge for myself. I have read I wIll Teach You To Be Rich and it really helped me settle and learn the basics for my own personal finances to get started with investing and budgeting.

Learning from other peoples mistakes is the way to go. I’m 23 and just graduated from college in may of 09. By working through college I was able to graduate with no debt. Working also allowed me to start a 401k, and in the last 8 months my net worth has tripled – partly because of the markets but also because of savings.

Watching my money grow is exciting and far more rewarding than going out to bars every night.

Great Article!

I wish I had learned a little more about finances and investing and compound interest when I was still in my twenties!

It took me until I was much older than that before I realized the value and importance of compound interest!

Eric

Nice article, I am in my twenties and I think your article has certainly opened up my mind. I am looking forward to build up my knowledge about finances now.

It’s too bad that too many young people don’t have a better appreciation for credit. Among those in debt, their ranks have been rising. It can really foul up important things that require credit, like buying a house, in the future.

This is great advice for people of any age. But yeah. I wish I had known in my 20s what I know now!

Yes I agree, start planning for stuff right now! It doesn’t matter if you’re 18, 20, or 25. Unless a James Dean like accident happens to you, you will be 30 before you know it. You don’t want to tell your future partner that you can’t pay for that wedding until you pay off your credit card.

Another solid article from Austin. Great job man!

Austin,

I have coordinated “Financial Peace University” several times. The comment I hear most often is “I wish I had known this when I was in my twenties.”

Of course it is never too late to learn, but you are helping people in their twenties to put their game on now. Hopefully, they will look back some day and say, “I am glad I learned this in my twenties.”

Keep up the good work!

Hey guys,

Austin here. Thanks for the great feedback on the article. I’m glad we all agree it’s a problem, but pf blogs like the digerati life have the power to change the way twenty-somethings think about money.

My new mind set for posts is: “how can this help my friends who struggle with money?” It helps me define my goals for writing and it hopefully creates some tactical results.

Thanks!

-Austin @ Foreigner’s Finances

Excellent Post! I am the poster child for what happens to someone who didn’t learn these lessons earlier in life. It’s never too late though, and the quality of my life has improved tremendously since I got on the financial responsibility band wagon. Good for you for starting so early in life!

Austin, this is terrific financial advice for college students and other 20-somethings to follow. In fact, it’s really great advice for anyone to follow. Saving money and building good credit is something that everyone, regardless of age, should strive to accomplish. However, you are definitely right that it’s much easier to start these habits earlier in life rather than have to rebuild later.

College students in particular can tend to have a more difficult time saving money because there is always something that “needs” to be bought. Whether its a coffee to help stay awake studying for the next day’s midterm, a snack in the the student union, or textbooks and other supplies for the semester’s classes, students definitely struggle with balancing financial priorities.

At bookrenter.com, we help college students save money by offering cheap textbook rentals. At the end of the semester, students can send the textbooks back via UPS for free. At a regular campus bookstore, often times students find themselves having to purchase new books instead of used because of availability, and selling back books at the end of the semester doesn’t always work that well if the book isn’t going to be used for the next year.

Thank you for this article, and for helping to further people’s understanding on how to save and how to spend better!

An ideal plan gives you a complete picture of your current investments and liabilities, your net worth, cash flow, goals and a specific plan to achieve those goals. When you are young, you tend to live for the moment and do things as they come, but it’s very important to secure your financial future. At the same time, it does not have to be at the cost of a good lifestyle.

As a twenty-something myself, it’s encouraging to see that other people of my age are passionate about getting their finances in order now so that they can get on and enjoy the rest of their lives.

As you covered here, I think that the most overlooked part of personal finance is the power of compound interest, which by definition is a friend to the young! Check out online calculators such as calculatecompoundinterest.org to get an idea of how saving even the smallest amount each month can have massive effects in the future.

I like how you defined your goals. I also like that you do the math and show the numbers over time. This can give people the realization that their manageable goal of x dollars per month can accumulate more than they realize.

This is very nice advice that I’ve learned from this blog post. It has clearly shown to me how I can care for my future, starting from day one now, instead of wasting my finances in my early twenties. I hope to be a better man due to your financial education.

Building good credit is only important if you plan to borrow in the future. Debt is the enemy of wealth, and I’m not willing to worship at the alter of FICO. Having no credit score, and borrowing no money is what I want my daughter to learn. I wish I had learned about the debt myth and our nations current credit crisis a lot earlier.

I agree with general premise you expouse about delaying the gratification of a new home, I just think it should be delayed even more. If you deal well with money there is no reason to wait on home ownership and pay cash for a house. I didn’t, and faced a few unexpected life expenses in the first few years of home ownership, if it were not for our emergency fund we would have been in big trouble.

Other than that I agree with your other points. Save and invest while you’re young and compound interest will have the maximum results.

The good ‘ol classic ‘Richest Man In Babylon’ is still a great first book to read, with its timeless money lessons. It’s the one I wished I’d read as a college senior!