It’s one of those things I fiddle with — those little financial tools from CNN Money or Bankrate.com that tell you how financially adequate you are. Aren’t you curious about how you stack up against the general populace? These money tools are meant to dish out test results to help us keep track of our own fiscal health and progress, and may give us some insights on how others are doing as well.

So what do you expect your personal net worth to be? You can get the answer from a net worth calculator such as this one from CNN Money. I first ran this tool around 5 years ago, and ran it again today. I’ll discuss some interesting results below.

Analyzing & Comparing Net Worth Numbers

With regards to net worth, it is assumed that your home or residence is included in the calculation. Given this, if you live in a high income area and if you’ve been lucky enough to purchase a house sometime before the 00s, then you may be in better shape than the average person. National records indicate that anyone who joined the house buying bandwagon or started investing by the late ’90s or so may be worth at least $50,000, thanks to home equity built in (the real estate recession notwithstanding). But in California and other high priced areas, the numbers are a lot more skewed, thanks to a perpetually inflated property market. In many ways, the collective net worth of Californians seems to have been influenced mainly by how long we’ve lived in the golden state.

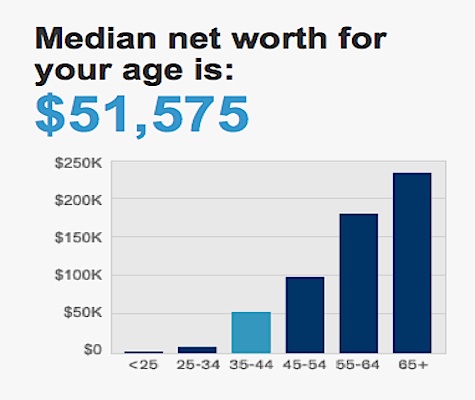

Median Net Worth By Age Group

If you reside in an area with a fairly robust and expensive housing market, then just by owning a house and sitting on equity while the market rose would have given you some kind of decent net worth that would be in line or further improved from what is portrayed in the net worth charts below. I found it interesting that 5 years ago, the household median net worth for people in the age range of 35 to 44 and with an income level of $100,000 was tagged at $44,875, as per CNN Money’s calculator.

Net Worth Snapshot Taken In 2007

Today, however, the calculator looks to have been revamped to show different results.

Net Worth Snapshot Taken In 2012

While these numbers don’t necessarily look like tough goals to reach, what caught my eye were the discrepancies in the results from 2007 vs those in 2012. For the 35 to 44 age range, the numbers see a slight uptick in expectations (from $44,875 to $51,575) while net worth levels for other age ranges seem to have undergone larger adjustments. Could the data behind this calculator be telling us something? At any rate, those in the 65 year and over group look to have jumped in net worth in the span of several years: one way to interpret this difference is that the numbers may be reflecting changes in the general population’s economic situation. Of course, another interpretation is that we’re seeing results based on a different data source.

But, let’s take a look at another set of statistics along these lines.

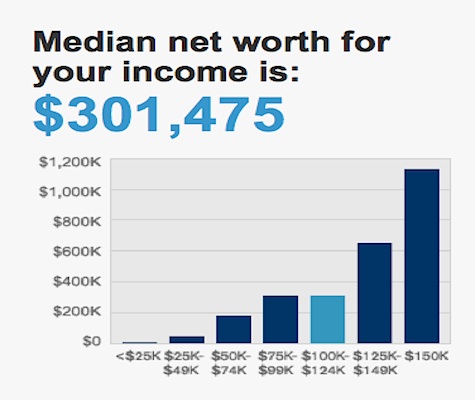

Median Net Worth By Income Group

So how does net worth relate to income? Let’s suppose you make $100,000. Five years ago, given this household income, the median net worth was expected to be $363,125.

Net Worth Snapshot Taken In 2007

Fast forward to the present, and the new calculator shows us these numbers:

Net Worth Snapshot Taken In 2012

Again, you can see some changes in median net worth, through the years.

Net Worth Accumulation In Silicon Valley

From those national figures, let’s move to a regional perspective on finance and wealth. Achieving any form of net worth given an income of $100,000 to $130,000 ALONE is quite difficult to swing where I live, in Silicon Valley. Incidentally, that’s the typical salary earned by a local engineer. This may seem extravagant to some, but our cost of living is quite high here: think gas, rent, property taxes and everything else in between (no thanks to the California budget crisis), and try swinging that with 2 or 3 kids and it’s not as outrageous as you may believe. For some perspective, you can check out this article on the minimum budget required to survive in California. It could be an eye-opener.

Given the cost of living in California, expecting a nest egg amount of over $300,000 supported by a $100,000 income may actually be a bit of a stretch for a family of four (e.g. that is, you’ll really need to stretch your budget to make it happen). Hence, people here have concocted ways to build their net worth without solely relying on their income — we beg, negotiate and network to gain those stock options that may just give us an edge, and we risk our futures in equity locked into highly priced shacks we own.

This exercise has made me wonder how people have actually accumulated net worth in Silicon Valley. Many of my peers have done so via property ownership accompanied by risky leveraging techniques and strategies, through stock options or by starting their own businesses, by having dual income families or smaller families, or as radical as it may sound: having children late or never.

A regular 9-to-5 income of $100,000 for a family of 4 is going to be tough to cut it here, unless you’re ready to make serious sacrifices by living an ultra frugal lifestyle or by settling in distantly located bedroom communities that surround the Bay Area. And in the free-wheeling, go-go spending atmosphere of Silicon Valley, making such lifestyle changes and choices can be the mother of all challenges.

And for many of us, we only hope this situation is not forever.

Created December 28, 2006. Updated January 20, 2012. Copyright © 2012 The Digerati Life. All Rights Reserved.

{ 26 comments… read them below or add one }

As a newcomer to Silicon Valley, my vote may not fully count, but here it is anyway. I looked at a few cost of living calculators before I came out and one said that I’d have to increase my income by 225% if I planned to own a home. However, if I wanted to rent, I could get by on 87% of what I was making back in Boston. Considering that I got 25% raise largely due to the cost of living, that’s a good help towards my net worth. I’m not going to be chasing after further appreciation in this market.

The other thing that hit me is that $100,000 is probably close to what two incomes bring in other places of the US (perhaps it’s more). It seems like two incomes are increasingly necessary in the US. So I have to ask, is the $100,000 a result of two incomes in Silicon Valley? If so, it would seem you may be underpaid to live there. If not, perhaps you should consider how you’d do on $50,000 in another part of America. Would that be enough to raise 2 children, buy a home, etc. or would that be stretching it?

I think you have two factors… 1) a single income family can be tough to begin with 2) you live in an area where purchasing a home is obscenely more than renting (in which case, I’d recommend renting if you aren’t already doing so).

Lazy Man, great points. Right now, our cash flow relies on one income while one of us strives to try to hit the elusive startup jackpot. We live in a home secured under attractive terms relative to many we know. We’re not counting on our situation being this way for the long term. If the startup thing doesn’t work, someone’s going to get a new job! But yes, we expect to remain in a cash tight situation for another 2 years. Thanks for your insights — it’s always great to hear from another Valley resident.

Hello from another Silicon Valley blogger! What is interesting from the graphs is that anyone making more than $75k has a median net worth greater than those in the highest (55-64) age category. Just out of curiosity, have you read the net worth formula (as a function of age and income) outlined in The Millionaire Next Door? And, good luck on the startup thing.

Thanks pfstock, nice to hear from a “neighbor” and fellow engineer. 🙂 I have read The Millionaire Next Door and will probably expound further on that sometime. Thanks too, for your good wishes.

The median networth for my age was a lousy $2,145!!!!

thats pretty sad.

I think someone in the thirties should have atleast 10,000 in savings!

This calculator – I’ve seen it elsewhere – is pretty silly. It says that according to my age, my net worth should be some really huge number, and according to my income, my net worth should be $1,100. Which should I believe?

This calculator is based on median stats, so based on your income or your net worth, you could presumably get different results. These are median numbers anyway so what’s important is to see how you fare relative to these numbers. If you’re doing better, then you’re in better shape than many people out there.

Interesting.

I agree the first part is achievable even in the nightmare that is Silicon Valley by the sound of it, but the second figure seems a bit “pie in the sky” to me?

I’m trying to determine the great variance between the two figures (median net worth for age versus income). I’m going to say that the median net worth for income is way off and that the net worth for age is a more accurate number.

@Tim: That was pretty much my experience with this experiment!

For what’s it worth ( no pun intended ). I’m 34, the sole breadwinner in my family, make $80,000 a year and I work in the tech industry in a major midwestern city. I’ve easily achieved the numbers for my age and income range on CNNs site. This may sound harsh, but I think the lot of you are destroying your futures by chasing a remote dream in a very expensive spot. There are easier ways and places for amassing wealth.

@Christian,

I agree with you. I feel that as I grow older, it has become more and more apparent that living in the West Coast with such crazy cost of living numbers is becoming less alluring. I’ve enjoyed living here when jobs were aplenty, when I was young and had the energy to pursue big dreams in tech — maybe strike it big one day? Well, in many ways, things are no longer the same (okay, these days, a LOT of stuff sucks for us here — our state is broke, our schools are broke, we’ve got sky high unemployment and our homes are still inflated in price), but what I have keeping me here are still mighty important — extended family and the weather. Now if only I can convince everyone in my family (in laws, sister, etc) that we should all just up and leave and move to somewhere more affordable!

Thought to add a few more tidbits on this topic: in the time I’ve spent blogging about personal finance, the space has really undergone changes, and while bloggers may have evolved from being mere bloggers to becoming budding online entrepreneurs, what has not changed is how many of us remain interested in airing our laundry when it comes to money.

This brought to mind an interesting article in the NY Times about this particular subject — the obsession that many people seem to have about their net worth. The article focuses on people who enjoy managing their money online and giving the world a peek at their net worth. It also has nice mentions and coverage of popular money tracking sites like Mint.com and the defunct Wesabe, with its premise being that as we’ve become more comfortable with the Internet, we’ve also started to move more of our lives online, going as far as divulging many aspects of our private lives that we hold dear — in particular, our personal finances. Now I suppose that without this particular obsession, there wouldn’t be much reason for PF bloggers to exist and there wouldn’t be much fodder for us to capitalize on.

Well, the article zeroed in on one person’s approach to monitoring his net worth. Eric Mill’s site, called OhNoMyMoney.com got some cool coverage.

A look at Eric Mill’s net worth chart:

Unfortunately, the site has virtually shut down because it relied on Wesabe, a net worth tracker that is no longer supported.

Ok, this may sound self-serving, but I also wish that this article explored personal finance blogging a little more deeply, because let’s face it — if you want to feature a community who’s willing to share their financial information with you, their net worth, their debt journey and their innermost thoughts on money, you won’t find a more interesting group than the PF blogging set. Wouldn’t you agree? 🙂

Do you track using financial software like Quicken aside from Mint? or are you using something homemade like an Excel workbook?

-Don

I use Quicken 2002 for Mac for my finances 🙂 My banks don’t support any of the integration features of the newer versions, so I’m hesitant to switch. I track our net worth, but I’m definitely not obsessed.

I like to track my net worth on a monthly basis. This way, I am in a better position to know if I’m spending more than I earn. It is also very encouraging as you always keep your budget in mind since you want to make sure that your net worth has improved at the end of the month.

Another trick I found to make sure to not forget is to publish my net worth on my main blog (The Financial Blogger). A few people know who I am and read my blog but I don’t really mind. After all, it’s only money!

I try and keep an eye on things, but if things take a downturn I try not watch it as much because it can be depressing. As I have gotten older, I do definitely keep my eye on things more.

I think it is good to monitor so you can keep track of your financial health. However, try not to be obsessed – the sun will still come up tomorrow.

I have been interested in tracking my net worth. I think it is fine but you can take things the wrong way. You don’t want to obsess about the number. You want to use the number as an indication of how things are working and think of changing your strategies if it isn’t working. But this is something to watch over years, not over days or weeks.

One thing I think many posters do not take into account here is that the very poor aren’t going to be posting on this site. The median income for my zip code is $36,000 a year for a family. For those without a college degree making more than $20,000 a year is doing well. People making $36000 a year and saving 10% is $3600 a year times 25 working years is $90,000. And in truth the few I know in this income bracket will rather go to Disney World before they die than save $3600 that year. Perspective.

At what point did you start measuring your net worth?

Net worth is just a way to take your assets and liabilities into account. So you can start gauging it at any time — whether you’ve got debts and few assets or the other way around, it still proves helpful. Of course, there are some critics out there who may think that tracking one’s net worth is a terribly materialistic endeavor. But I prefer to think of it as one way to help us become a bit more financially accountable and it’s an easy way to see our financial progress.

I live in southern California which is not much less expensive. It all starts with savings, however small. If you start early enough with even a meager amount, you will have sufficient retirement savings. When my wife and I started out, we made savings a priority. It allowed us to buy our first house when I was 27 years old. In fact, I assumed the existing (5.25%) loan.in 1973. I kept saving and invested in rental property in the late 70s and achieved financial independence by the time I was 38 years old. Did I sacrifice a lot? I do not think so! My (2) children went to private school, we bought our dream house in 1976 and still took vacations. Savings helped me do these things and I did not earn a 6 figure salary then.

I was pleased to find that I am above the median in both categories… until I scrolled down into the comments and saw those student loan numbers. Definitely going to have to get those taken care of before I try calculating my net worth again!

Something odd about that networth vs income chart– seems like a rather large bump for every 25k of annual income? Funny I thought after taxes nothing would be left! Or maybe it’s the effect of age mix differences between the bars?

I’ve attended school and worked in the valley for almost three decades now, and my take is that it doesn’t have to be all that expensive to live here if you have modest tastes. Sure keeping up with a Jones who is fully vested in AAPL options means nothing left at the end of your paycheck. But if you live like ordinary middle class Americans outside of the valley, it’s not that much more– and the higher income can go toward investments rather than trying to impress the neighbors (hint they won’t notice, it’s all in your mind). Not having cattle is a matter of choice in my view.

@freebird,

Those charts are odd indeed — you’d think there would be a softer curve across age groups rather than the hard jumps we’re seeing here. My guess is that it’s an oversimplification of the data, which you’ve referenced. Re your point on living more modestly — yes, I believe you hit the nail on the head. The reason for our massive debt crisis is because too many people are overextending and too many feel entitled these days. It’s about instant gratification and how you can “one up” your coworker or neighbor. But the last laugh is with those who are able to conserve during the boom times in order to survive through any economic cycle.

I’ve mentioned before that we should “make hay while the sun shines”, but what we do with that hay is pretty important. Best to store what you can of it so that when the rains come, you continue to have a dry bed to sleep on.

I started working in a group where I quickly learned the mechanics of the image game. The one upmanship pursuit of status is a financial mutual assured destruction reminiscent of the cold war arms race. Bid higher to gain advantage and the next guy calls and raises. So every dime you spend today just raises everyone’s future expenses, including your own. Remember that old line from the movie War Games, the only way to win is not to play. Better yet rather than buying new missiles, put the money in shares of companies that make them. Maybe that’s breaking the “rules”, but it’s one way to come out ahead (worked so far anyway).

I got brainwashed in college but lucked out when I started working in a group who talks cattle rather than hat. These men and women are remarkably financially astute, each has a unique area of specialty where they earn side income. Opportunities are out there but they require both capital (savings for most of us) and the willingness to spend off-time learning the ropes. Anyway in our group status comes from being the recognized expert in our area and not from the bling that our kids are buying. Our occasional hot returns are joke topics “it won’t last, it never does”, but rest assured the average returns over decades are substantial.

Anyway this from a bunch of middle-aged tech workers in the valley who aren’t worried about losing their paychecks.