This is part of our series on “scary money tips and stories”. In some high cost of living areas, it now takes at least almost $80,000 to live.

I’ve often expressed how life changes once you have a family to raise, beyond the time and effort it takes to care for kids and run the household. Financially, it can become somewhat more challenging as well: since the typical case is that your budget rises along with the number of people you have in your family. Without conscious efforts to throttle spending and to keep a close eye on your money, expenses can balloon to unexpected amounts. If this is what’s happened to you, you are not alone: this is a plight all too common for so many families today, when it’s often the case that it now requires two incomes to cover even basic expenses and make ends meet.

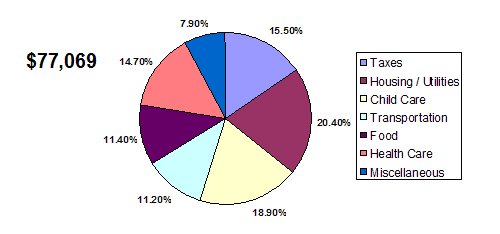

What drove this point home for me is this new study that came out last month, the California Budget Project report, detailing how much money it now takes to fulfill the minimum living requirements of a family of four just to live day to day in the place I call home: the San Francisco Bay Area. These numbers did *not* include college tuition savings nor retirement funding.

These scary numbers tell me that even if you have a good job, it may not be enough for your family to live on. With a growing disparity in income and expenses, people have been moving out of the area to be somewhere else. This also explains why trusted labor here is pretty expensive: outsource a job and prepare to pay. A home repair visit can set you back $50 an hour while day care runs around $1,000 a month.

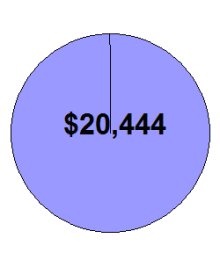

Let’s take a look at some basic, minimal budgets that are required to sustain a family. The federal poverty line is at $20,444 for a family of four (in 2006) while here in one of the most expensive areas of the nation, it takes three and half times that amount or $77,069 to survive. The basic expenses of any household budget are officially the following: taxes, housing/utilities, child care, transportation, food, health care and other necessities (a mysterious bucket specified by the study).

| Federal Poverty Line For Family of Four | ||

|---|---|---|

|

Other bare bones budget numbers for the Bay Area: a single adult requires at least $29,633, a four person household with one parent working requires a minimum of $53,075, a single parent household of four needs $65,864.

What I found interesting was how a four person household with two working parents cost 45% MORE to maintain than a four person household with only one working parent. This is mainly because the family with a stay at home parent doesn’t have to pay for child care or transportation. I’m amazed that the difference in budget can be attributed to these spending categories — so this tells me that unless the other spouse makes more than $30,000 or so, then it may not be worth having them work. Given the higher expenses of two working parents, to break even, you’d need the non-working spouse to bring home ~$30,000 to make it worth taking the extra job. The gap in the one parent budget versus the two parent budget is approximately $24,000, so if you consider taxes, you need roughly $30,000 to cover that budget difference.

It also seems that high cost of living areas are found in metropolitan areas where housing and transportation take out a big chunk of the budget.

If you’re curious about how other places fare, here’s a diagram comparing the monthly budgets for 2 parents and 2 children in eight communities around the nation. These numbers were from 2004.

What makes it insane in California (and potentially any other high cost-of-living state) is the housing problem. Despite the plunge in real estate prices we are seeing today, housing is still incredibly expensive.

So how do people survive around here given these living requirements? Well, people get *very* creative. Some common strategies that people take range from the prudent and resourceful, to the highly risky. Expectedly, many plans involve sacrifice.

How People Survive in Expensive Areas

- People skip essential insurance.

- They take on a lot of credit card debt.

- They band together as a family unit under one roof.

- They rent out living space.

- They delay having children.

- They work several jobs.

- They do work shifts within the family.

- They live off their home equity.

I mentioned before that I have extended family who have uprooted themselves from our native country to come here and seek a better life for their children. These parents have left their established professions from their former home to start fresh in this new world. They have it much worse than I did when I first moved here as a college student, because they come here with four children in tow, and as of yet, no employment prospects. The father just took the bar this summer hoping to become a licensed lawyer in the near future. Guess where they are living? With more members of my family in a newly bought home, which despite its spacious size of four rooms and three baths and a large family room, has become a crowded environment housing eleven people. What’s keeping these two families under one roof at this time are the soaring rents and insane home prices in this area.

Until there’s a way to pay, there’s this kind of limbo, which we always hope won’t be the situation for too long. If only the jobs they do find actually provide incomes that can make it possible for them to live here. Otherwise, a move across the country may be in the offing.

Copyright © 2007 The Digerati Life. All Rights Reserved.

{ 41 comments… read them below or add one }

Wow. I read through that report and was amazed.

yeah i recently moved from the dallas are to d.c. and i can definetly see the difference in the cost of living

Good article. My city in Canada (Calgary) has seen housing prices rise substantially in the recent past. Luckily, we bought our house before the rise as my wife is a stay-at-home wife. I don’t think we could afford that if we did need to buy now.

We chose to have my wife stay home because of the child-care costs – unless she were able to earn enough, minus bus passes, clothes, and all the other costs of having a job, it is just not worth it.

Thanks for the article.

The Dividend Guy

Agreed, thewild, DC has a higher cost of living than a lot of places.

The California one scares me….well, money is just scary all over right now.

Between the $20,000 that the federal poverty line is for a family of four and the $77,000 that is for the minimum budget for California’s average-sized family falls the range of amounts that is the minimum required to support a family. Depending on where you live, your financial requirements can vary. And depending on what you do, these requirements can be made easier or tougher to achieve.

The $77,000 budget is the case in some parts of the nation but in distinctly high-priced areas. Thus, it is also the case that the highest foreclosure rates are in these very places too — where housing has just gotten very expensive. It seems like in order to get by in these places, you need a good, decent well-paying job, you need to be able to watch your spending like a hawk and live fairly simply. To get a bit “more”, many parents turn their household into a dual income family.

To live on one income in California, that one income earner needs to have a pretty solid, well-paying job to make it work. The one working parent scenario is a rarer thing where I live these days but I gather in other states, the one-income household may still be the norm.

I’d like to hear if that is the case.

Really some interesting stats. In the area I live in, northern New Jersey just across the Hudson from New York, the expenses are probably on par with what you’ve mentioned. The neighborhood I live in has townhomes starting in the mid-500s for a 2 bedroom. $77,000 would be a massive, massive stretch for a family of four. Property taxes alone run $8000-$10000 per year, for example.

Now, all that having been said there are many one-income families. A lot of them are like ours – one toddler – but the cost of daycare and transportation is so insane that it simply makes better sense unless both parents are earning huge wages. Since it tends to be young families, most people aren’t.

So we do see a lot of struggling families but at the same time people who are committed to a family-oriented lifestyle. I would guess that 99.9% of the families we know plan to move “further out” as their kid(s) get older, to find good (and free) public schools and lower housing costs. The interesting experiment will be to see if some of the frugal lifestyle that’s imposed on all of us now due to housing costs will be maintained as we “go west”.

I don’t think so. I see a lot of my friends from my old hometown in the South with two incomes. Their expenses are less, but they are less careful with cars, plasma TVs, etc. Day care and schools are cheap. Transportation is cheap. So despite the lower cost of living, they tend to spend MORE and live a LESS frugal lifestyle.

It’s interesting to observe. Maybe it’s just my friends, but I don’t think so – as an accounting guy in college a lot of my friends are also CPAs, finance analysts, etc. People who understand money. It’s just that the only way most people impose that discipline is when it’s forced on them. I think as the pressure eases, people forget. I imagine that might happen to me if I moved to a cheaper area – Kansas City or somewhere deep in the heartland. I don’t know. If I move to western Jersey, the housing costs will be a little better but not much, so that would probably keep things in check.

Whew, wordy, but as always, SVB, some very good and thought-provoking stuff to read!

Good article. I’m always impressed how creative immigrants can be in tackling financial obstacles. Shared living arrangements is very common. I know my own family did that (we lived with my grandmother for a few years), and relatives who arrived later lived with us. While not ideal, these are the things you have to do. More people should consider it. Of course the dark side of many immigrants is that they 1) don’t buy insurance 2) are more likely to be too creative in their taxes if they have their own business.

I’m from San Jose but had to move to the MidWest to get away from the expenses. It’s sad that such a beautiful area is so inaccessible for most.

I loved the article. Thanks!

One reason that my husband I want to move is that the area has a high housing cost and overal low wages. It’s a beautiful area, but it’s not worth the struggle.

I thought it was interesting that they glossed over insurance. On the other hand, I would have thought health care would be a lot less for working people (due to health insurance being included in the job).

I am currently the stay-at-home partner in a one working parent household of four. I often find myself thinking about how much money this decision has saved us, and I am sure I would have to make much more than $30K to make up for it even in our low cost of living area. Having the time to cook from scratch, do basic home repair, diy projects, and gardening to put food on the table save our family thousands of dollars a year over the cost of child care and transportation. The best part is that it also provides for a slower pace of life that is healthy and enjoyable.

I saw the words “Bay area” and stopped reading. Even _I_ know (and I’m australian) that there’s no use complaining about budgets when you live in the most expensive area on the planet.

I live in a similarly expensive area and can relate to the ways people try to save money on the cost of living.

The ways that have helped us the most or are currently doing so are banding together as a family unit under one roof and working our schedules around so that somebody is available at all times to take care of the pre-school age children.

Since housing and child care are both incredibly expensive ($500,000 will buy you a tear-down or “handyman’s special” on a minimum size lot in a not great neighborhood and a 3 year old will run you $700 or more for day care) both these solutions save a lot of money.

Bad ideas are not carrying (enough) insurance, running up the credit cards, or using your home equity. I know sometimes people run out of other options, but these should really be a last resort.

I’m speaking here as someone who was upside down on my condo for a couple of years, had maxed out cards and went through 2 fires and a flood in 9 years. The housing market went up, all our debt is paid off, and insurance pretty well rebuilt the place *twice* but there were scary moments there and I don’t plan to ever be back in that situation.

Thats amazing. Back in the good old days the father made for than enough for the family, now it take both spouses and the kids working. lol

Living also in a HCOLA, I can say it’s totally not worth working unless you’re pulling in $50k with the cost of daycare! Gee whiz it’s like $2k/month here! Ugh.

But most people I know pull in at least $50k each so they have to work because to make do on one income is a lot tougher than having the extra $50k.

Great research SVB!

When I look at that, I consider myself lucky to live up North where it doesn’t cost much to live.

Daycare is so expensive, it is sad, but it really makes you think twice before having another child!

Living an hour outside Boston, I know people doing all of the “how to survive” techniques; usually each family is doing more than one. Personally, my husband and I looking for someone to rent a room, delaying children, and he’s working an extra job.

I plan to stay home for a while once we have children, but if we can’t pay down our student loans, I’ll need to do some sort of part-time work to bring in $1000/month just to get by.

I live in a very expensive city and have a fabulous deal on an apartment. I am a teacher and was able to negotiate a reduction in my rent in exchange for tutoring the landlady’s son. I save about $200 a month this way. Even so, I was amazed when I got my paycheque for my new job, and saw how much I was losing in taxes. My rent, at porper market level, would be almost half of my pay! I don’t know how people do it in a city like mine without having roommates, or being rich. I am very lucky to have the place I do!

This is an excellent report, and it illustrates how much people have to sacrifice just to live in places like the bay area. I work as a part time real estate agent and the last home I listed was 800k in San Francisco. The buyers who purchased it was 3-4 families who put a small down payment and are paying a huge monthly PITI.

I also have many relatives who came from China and are in the same situation. 2 families under 1 roof and they even rent out the basement. They put their life savings into the down payment.

This is one of the reasons I’m moving out of San Francisco after I graduate from college in December. I was born and raised here but it doesn’t make sense to tie up my entire investment portfolio into a down payment then dump most of my income into living expenses. I’ll be back in 30 years when I’m wealthy enough to not care and I’ll just rent a nice high rise at that point and have my passive income pay for it.

Its just gotten way out of hand in some areas of the country such as the bay area. Its true that in general incomes are higher here than other parts of the country but it still doesn’t match up with the sky high real estate prices. The real silent killer is property tax, which goes on forever.

I live in the east bay area where houses sell for 500k and yet rent for 1200-1500/month. One has to be a pretty darn crazy speculator to buy a house given that choice.

These surveys are always based on poor to average personal finance choices so they present an overestimate of what budget is required given some personal finance diligence e.g. live close enough to the job to not need a car or at least two cars. I swear there are more cars than people living on this street! Also don’t eat out every week, buy quality stuff – it lasts much longer (check craigslist list to see how much free stuff people are giving away because last year’s model is no longer fashionable), don’t subscribe to everything, etc.

Our two (adult) person household has an annual budget of no more than 30k. I can’t imagine having two kids would increase costs by 47000/yr.

That’s crazy… I live in rural South Dakota and can easily live on $700-$800 a month for my self, and could probably support a family of four on $2000-$3000 a month…it wouldn’t be a luxurious life, but it could be done.

Thank you for the insightful comments and for sharing your experiences. In the Bay Area, I’d say you must be an astute saver or happen to be very fortunate if you can live on $30,000 a year (for two people). This includes expenses such as basic insurance (car, health), rent/housing, food, utilities, etc. There are certainly ways to cut costs — maybe cut on the insurance especially if you are very healthy (choose a very high deductible plan), live in a one room apartment and so forth. You can be quite lucky and have family members help take care of housing for you as well. But renting a one room apartment can barely be done under $1,000 a month. Hats off to you if you can live on $30,000 for 2 people. That’s quite an achievement!

Some good links:

Think the Bay Area is expensive? It is

Living the high-priced life

Bay Area rental market

I’m surprised no one has said this yet (except for a reference to it by Brent), but for those non-Californians reading this, the Bay Area does not represent the entire state, especially in terms of cost of living. Much of the state is devoted to agricultural endeavors, where day laborers manage to work full time on less than minimum wage and still send money to family outside the country. Many other people in blue collar and white collar work can live comfortably in other areas, specifically those in the northern and San Joaquin valley areas. Even San Jose doesn’t cost so much; plus, they’ve got awesome public transit!

Living in Hawaii, we experience a very high cost of living. I guess it’s the trade off for living in paradise.

Thank you for submitting this post to the Carnival of Family Life. It will be included in the next edition scheduled for Nov 19th at An Island Life.

I used to live in Silicon Valley…I now live in South Africa. People here are often surprised that my South African husband (an engineer) did not opt to apply for a green card and queue up for his piece of the American Dream after we married because they literally have no idea how costly it is to live there. We sat down and literally “did the math” and discovered that we can live a much more comfortable lifestyle on just one income here in Cape Town (which is very similar to the Bay Area in climate and lifestyle) than on two incomes in Silicon Valley.

And so I sold my house in San Jose, packed up my furniture and belongings, and moved half way around the world. I’ve now had four years of not struggling to makes ends meet, having a maid, a decent car, eating out a couple of times a week, a really nice vacation every year, staying in five star B&Bs in beautiful locations, and living in the kind of house I could only sigh over in California. I’m not going back.

(I keep a blog at http://sweetvioletsa.blogspot.com/ where you can see some of this beautiful country.)

Recently I receive a 70000USD before taxes offer from a Californian company. Having a wife and one kid (one year old), can I expect a good living for me and my family with such buying power?

Thanks.

Tlr.

Wow what an interesting article.

Do you know where can I get info on the a family of four in Hawaii–cost of living.

I just wrote a blog entry recently (see sig link) about how affordable the cost of living is in our Tri Cities area (Southeast Washington State). Having said this, our family of 7 requires at least $50,000 (assuming little to no debt) to pay the bills. Nice article Silicon Valley Blogger! 😉

I just bought an old farm house and I think all of the faucets leaked. At first, our water bill was outrageous. Then we took the time to systematically fix all of the problems and our bill was lowered in no time. My husband and I were able to fix most of the problems ourselves and saved money being our own handymen.

Friend. this is a nice topic. as the economy of each country is growing, the expectation is also growing. so we have to change our statistics to run a happy life. money is really essential for this things.

Family budgeting is very important, this is to avoid financial disorganization that will lead your family towards serious money problems. Being organized with money will allow your family to have more fun and enjoy life more.

Wow, this is enlightening. Sadly, it can only be assumed the costs of living will continue to rise every year

Thank you so much for this information. I have a family of 6. I have 2 year old triplets plus a 4 year old all girls. Its hard to see all these statistics. I couldn’t imagine working and having my girls go to daycare, me working would not even pay for the daycare, how scary! Thanks again, I will be following you

There is a guy in the UK called Martin Lewis (Money Saving Expert), he thinks it’s possible for us in the UK (for a couple) to live on £4,000 per year (about $6,000), however he cleverly misses out nearly all monthy costs (rent, mortgage, council tax etc). I personally think that in the UK, for a couple you would need about £10,000 minimum for the year, if you add 2 children to that it would probably be about £15,000 ($23,000).

Thanks for the stats and in-depth breakdown. I’m currently looking at starting up my own business, but I’ve been debating when the right time will be based on the expense of having my family of four to provide for. While I’ll start off with less income than I am making now, the payoff will be better in the end. It’s all a matter of timing! 🙂

Does anyone have statistical info on what a family of four in the US spends on pharmacy drugs in a year?

$77,000 a year for four people to live in San Francisco? That would definitely be the bare minimum, that’s for sure. That’s why I live up here in Santa Rosa and commute…

It’s been a couple of years since this blog was posted and the cost of living hasn’t gone down any. Calgary is another extremely challenging place to live inexpensively, but then so are most of the major cities in Canada. I think you’re right when you say it takes a certain amount of luck to be able to live on a shoestring. But having a breakdown like the one you provided can be helpful also. Knowing exactly where your money is going each month is one way to control your finances. Anyhow, hopefully things get better for us soon.

I couldn’t imagine how a family of 4 could last more than a few months on 20k+ a year, that is insane!

It depends on how you do it though. For instance, having lived in Phx, Boston, and the Bay Area as well as Sacto, pay vs expenses isn’t nearly as different as you would think. Living an hour outside of Boston, and commuting was the same cost as living in the Bay Area and commuting, or at least within $20 a month. Heating and cooling was way cheaper in the Bay Area. IN terms of a spouse making $$, it really depends on what the spouse does. For instance, if the spouse makes $30K a year, but gets health insurance or other benefits that improve the family living situation, that needs to be taken into account. Teachers, and many folks that work for school or university systems also get other perks, such as discounted mortgage rates, and loans that should be taken into account.

For many, the excellent public schools, adult education opportunities, and such make staying in the Bay Area — at least for some part of their work life, a very reasonable choice. If you have to put your kids in private school in order to get a better education then often the costs will even out. Other Bay Area perks that can make life much easier include easy grocery delivery, stores that are open later than other metro areas, and again excellent education options. Its all in what your priorities are AND what your field is, as that will have a great impact on earning potential as well as lifestyle.

“……………Much of the state is devoted to agricultural endeavors, where day laborers manage to work full time on less than minimum wage and still send money to family outside the country………”

OK, but their children ( often 4 or 5 children per family, or more) get free lunch, free K12 education (about $4900 per child per year), free medical care, priority registration at Public universities. If they fill out a tax return, they not only get a full refund of everything withheld, but they get every child tax credit available and the earned income credit (EIC). In other words, they get money they never paid in.

So they benefit while struggling tax payers suffer.

BUT, guess who really REALLY benefits….. the American “Farmer” – large agri-business units that are often family owned, but huge operations, nonetheless.

Middle income taxpayers subsidize each one of their low paid non-health insured employees so that Mr. “Farmer and his descendents continue to accumulate vast tracts of land. These “Good Americans” grow rich while we pay for the things they do not provide their workers so that their privileged —hole teenage sons can drive F350s towing jet skis like they are kings of the Earth.

How about H1B visas ? Year after year we hear of a shortage in technical workers. There is no shortage, but the “accountants” feel it is cheaper to pay 2 someones from some 2nd world nation instead of 1 US citizen. These are the same accountants who decide on job cuts, but none of their ilk ever get down-sized.

JOBS ???? Guess what – you can’t send everyone to college – a society needs people to make things. But we don’y make most of what we use – China does –

This is obvious, but we wonder where are the jobs. How often have we heard stories about the Captains of Industry, such as Boeing Executives making “Strategic Partnerships” with China ? Translation: Give Chine our technology, they will master it and use cheap labor to out compete us until the US does not make the product in question any longer.