You don’t need a lot of brains to be rich. In fact, there’s not much of a correlation between intelligence and wealth.

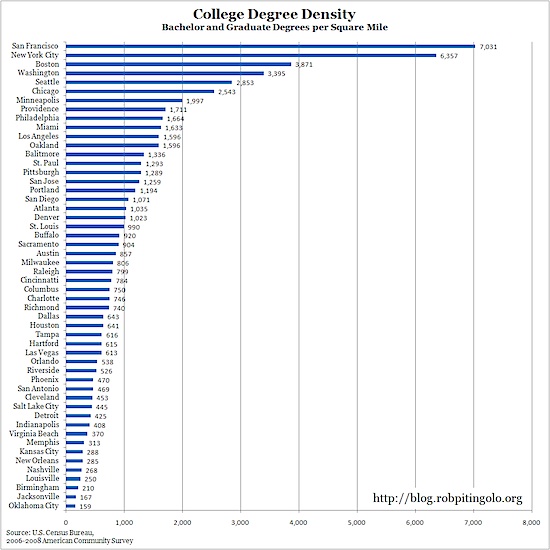

I found a few pretty provocative studies and discussions on the subject of being smart. Rob Pitingolo, who runs a blog called Extraordinary Observations, has come up with a chart showing “where the smart people live”.

He’s developed several charts which are all based on some in-depth studies he’s conducted on his own. You can read about how he’s come up with these figures in his article here. It follows that metropolitan areas would have a larger population of people who have attained higher levels of education, but there’s a lot more to this than meets the eye, and a lot more data here that Rob has dissected.

You Can Become Financially Successful Without Being Extra Smart

It also makes sense to me that there are certain factors that attract educated people to certain places — wouldn’t these places be helped by the fact that Ivy League schools are located there? Or perhaps more white-collar jobs? And what about wealth? Is there some tie-in here between being smart and being wealthy?

So let’s check out Rob Pitingolo’s chart on “where the smart people live”. Here’s what it looks like:

If you’re interested in the details, you can read about his analysis on his blog.

Anyway, this leads me to another intriguing study I came across. It’s one that points out that being smart does not necessarily lead to financial success and wealth, even as education and intelligence have been pegged to have a certain correlation with the ability to generate and make money. Apparently there’s a predictable relationship between having brains and earning income:

Each point increase in IQ test scores is associated with $202 to $616 more income per year,” the study contends. “This means the average income difference between a person with an IQ score in the normal range (100) and someone in the top 2 percent of society (130) is currently between $6,000 and $18,500 per year.

But making money or generating income is not the same as keeping that money (enough to build wealth). The study states that being intelligent or more educated can probably help you make money, but it won’t necessarily help you become wealthy (because growing your net worth assumes you’re actually holding on to the money you make). Instead, you can look to your personality as more of an influence on your finances. There are certain personality traits that help with building wealth, such as impulse and self control, fiscal discipline and such — and even less intelligent people can possess those attributes.

Here are other noteworthy aspects of the study (and here’s yet another article on this):

According to the study author, “Being more intelligent does not confer any advantage along two of the three key dimensions of financial success (income, net worth and financial distress),” with intelligence test scores having a weak relationship with income.

People with higher IQ scores have been shown to have problematic financial behaviors and debt problems more often than those with lower scores. So what could cause such fumbles? Are “smarter” people less inclined to spend time on monotonous financial tasks? Or could arrogance (thinking they’re so smart) be their financial downfall?

Whatever the case, the point here is this: being intelligent doesn’t equate to being rich. I believe it’s all about the choices you make.

Created June 23, 2010. Updated September 30, 2012. Copyright © 2012 The Digerati Life. All Rights Reserved.

{ 21 comments… read them below or add one }

I actually like the third option for “why” in that USA Today article you linked: smarter people have better memories, so they remembered to put down their financial mistakes on the surveys more often. In my life, I haven’t seen a strong correlation with being smart and being busy or intelligence and arrogance. There are plenty of low-IQ, arrogant busy-bodies out there. (and high-IQ, arrogant busy bodies)

You bring up an interesting point about the correlation between intelligence and wealth. Smart people may earn more, true, but I’ve also heard that there are many “smart” people who don’t do too well in investing, simply because, as smart as they are, they let their emotions get the better of them. They sell low, buy high, and make all kinds of classic investor mistakes. Likewise, there are many “average” people who can do well, simply because they’ve learned the basics and they’ve learned how to use their emotions to their advantage.

I think the graph per square mile is going to be skewed simply because San Francisco and New York City are so much more dense. I wonder what the results / 1000 would be?

People with higher IQ scores have been shown to have problematic financial behaviors and debt problems more often than those with lower scores. So what could cause such fumbles?

Often I find that you’re only as strong as your weakest link. A high I.Q is a good thing by itself. But people with high I.Q.s might in some cases feel that it is not necessary to become strong in other areas. That can hold them back.

Making friends (contacts) is a big part of achieving financial success. Being fit (confident) is a big part of financial success. Developing good habits is a big part of financial success. Having a high I.Q. does not mean that you cannot develop these other strengths. But in a percentage of cases people with high I.Q.s might elect not to on the thinking that they can get by on their high I.Q.s

Rob

Whether you are wealthy or not, being smart is never a bad thing. Having a good aptitude to learn things will probably end up saving you time and money in the long run.

I agree with Kevin, I know very smart people who cannot invest well or even manage money.

Luck, intellegence, timing, and skill all factor in at some point to being successful and maybe even wealthy

If everyone in the town where I grew up (population: 1000) was a member of Mensa, we still couldn’t crack that chart, because of population density. I understand that there are factors other than population density that come into play (and, in fact, the list is not identical to the rank of cities by density), but it’s obviously going to be a huge driver.

When we read studies like the one referred to in this post, we should not forget that these studies only tell us about averages. Many individual events make up an average. There are some very smart people who make a lot of money because they are smart, there are some very smart people who do stupid things with money. The same goes for people who are not considered as smart based on IQ.

Nice post with the perfect title – I agree completely. Personality traits and habits (e.g. discipline) are both important factors in generating and keeping wealth.

The book Millionaire Mind is a great read on this topic. It shatters the myth of personal intelligence (high IQ, good grades in school) being the driving force behind achieving financial success. On the contrary, it shows how the personality traits (interpersonal skills, being persistent, attitude) are the key factors in determining success.

I like your point that being educated does not necessarily mean you will become wealthy even though you may earn more money than your less educated counterpart. This shows how the more we make the more we spend. Ultimately the secret to wealth is simple: spend less than you earn and save or invest the difference. If you can live below your means and manage your debt, you will create wealth, whether you are in the educated group or not.

Sometimes I think spending a lot of money on an education is not worthwhile at all, especially when you see so many people struggling to pay off their student loan debts and unable to get a job in their chosen profession. I do think your ability to make friends as Rob suggests is really the key — networking seems to be the way to help yourself climb up the ladder of success.

This is a great article. Many of the people I know that are extremely wealthy didn’t finish college. They are simply more innovative, creative, and disciplined than others. Sometimes I think that college just teaches you what everyone else knows and that will rarely help you in the real world.

I’ve read about the lack of relationship between IQ and Net Worth also…

I personally think that the brightest of us are so involved in the non-financial areas of work, and have such passion about their work, that they don’t have time to become financial wizards…

IMO, the other contributing factors are ability to communicate in a friendly manner, having a great group of friends or connecitons, creativity, discipline and confidence. It’s a blend of these elements that make high Net Worth easier to obtain.

Nice additional research includes for your article! I’ll have to check them out!

Brains have nothing to do with it. It’s about personality and habits. You can make minimum wage and still build up respectable savings if you have the right frugal habits. It’s not about reason or logic, the common signs of intelligence. We all make purchase decisions based on emotion, then con ourselves into feeling okay about it with logic. I’d love to see these studies based on high emotional intelligence…

I have always believed “street smarts” is more likely to get ahead than “book smarts,” which your article convinces me of. Further, the rich are especially good at hiring “smart” people to do the hard work, while they let their money work for them.

True, you can get rich without being smart. Athletes and musicians do it all the time. ;o] But learning one’s trade is extremely important in order to be successful in it and THAT’S where the money comes from; not necessarily the IQ. For instance, if you’re looking to buy penny stocks, sell penny stocks or otherwise speculate in the stock market, one needs to define their limits and then abide by them! Not only does that take intelligence, but also EMOTIONAL intelligence. Thanks for the article!

Matt @ mi401k.com

Well I have to concur, being smart doesn’t correlate at all to being wealthy. Now being smart, you can remember all kind of shit, phone numbers, graphs and other type of data. You can remember when or where you’ve read it. You can combine multiple sources into one stream of knowledge. You can do Black-Scholes in your sleep (that one I haven’t mastered yet, at least not in my sleep) and you know not to waste money on the “investment of your life” (=house/apartment) and you know that investments yield dividends (which houses/apartments don’t).

You can know all kind of shit. Your dad knows all kind of shit and your grandpa knows all kind of shit (intelligence is 80% inherited, sorry guys). None of this will every show on your bottom line. You find idiots running multibillion dollar corporations, you find idiots starting up SMB’s and making shit loads of money. You can have even more idiots complaining how some other idiots jumped ship, made CEO and got rich of the stock options (in a storm, even turkeys can fly). Then they started another company and went tits up (no proven team there).

And you know, I wish I was an idiot sometimes not because even idiots become wealthy, but so I could be unaware of things, I could always excuse my deficits. And now what? I have no excuses and my bottom line doesn’t correlate and I’m aware of it.

And you guys talk about EQ or SQ — so people that are smart are emotionally or socially retarded? Are you kidding yourself? There are a lot of smart people (Mensa smart) who lack a lot of EQ/SQ, but do you think Steve Jobs lacks EQ? He doesn’t, he’s just allergic to idiots, which makes him clam up (or tell Bill Gates off, which is hilarious). So stop kidding yourself, there are smart people out there with very high EQ and SQ, they know more about spending less and making more, all the shit you need to know and it’s still not happening for them. (That’s why they make comments on blogs, while drunk and having to regret them in the future.)

Oh another one, college and intelligence do NOT correlate, actually I would say it makes you more dumb (yes, I have a college degree, I was the 3rd in my year and what a waste of time). For entrepreneurs, college actually has a negative influence on free thinking and creating your own visions. KNOWLEDGE put to PRACTICE so many times that it’s not a competence anymore but an INSIGHT (when you know exactly WHY things occur) — that is not part of your college degree.

While I’m at it, why not explain correlation and causation? Now shit can correlate (like a Fortune 500 having a new CEO, and the revenue pops up) or there can be a causation (like when a F500 company’s revenue pops up since the oil prices go up, due to the war in Iraq). So when you say IQ correlates (or NOT) with wealth, do you consider if wealth just “happened to happen”, more than the IQ causes you to be wealthy?

One thing that high IQ does cause is arrogance, since smart people are very aware of themselves being smarter. Yet even worse, smart people don’t think of themselves as smart, they think of others as dumb. (Oh I will regret this post.)

Anyway if you think I’m an idiot visit beemobile.se/idiot and if you feel that I’m frustrated beyond recognition by idiots who make a lot of money visit beemobile.se/money.

Smarts or Having Money?

Could it as simple as “Less” IQ’s are bright enough to work hard for their money, vs the Smart People whom want the cash to come easier, and without working hard for it?

Just a thought.

The people that I know personally who are the most well off are always people who work directly with their hands. Plumbers, electricians, and hair stylists have the opportunity to work for an employer and to work for themselves in their spare time. The money that they earn in their spare time is always paid in cash. Its tax free income, which helps them to move ahead financially.

Fun article, Logo!

The big flaw in Pitingolo’s study is he incorrectly correlates a college degree with intelligence.

I wonder if he has a degree? 😉

Totally agree with you. Reminds me of a saying we have in the financial industry “In order to be a good investor, all you need to do is keep working at it. In order to be a great investor, you need natural talent.”

Thanks Len. Intelligence comes in all colors and forms…. perhaps intelligence is honed and sharpened by one’s environment and Pitingolo may be drawing on that. Certainly, a college degree can only enhance one’s mental/social skills, but whether it’s worth the cost these days is another story.

Len makes a good point! If the article is using college = smart as the basis, then the levels of income would be more in line with education level and not necessarily intelligence.