Our local news has been going on overdrive reporting the nastiness of our local property market. It seems that attention to this topic has begun to snowball and spill into other markets as evidenced by recent stock market routs.

But when the real estate market was in the clouds, didn’t you get the feeling this would eventually happen? I mean, I’ve seen a lot of my friends borrowing money hand over fist to purchase their first homes for $650,000. I heard how they applied for balloon mortgages and several other loans to make their home purchases squeak through. They took out interest only and adjustable rate loans. Luckily, they’ve avoided mortgage problems because they had a Plan B in case rates increased: they made it work by somehow having more money waiting in the wings to cover any eventualities such as rate adjustments. But those that have no such plans are surely crying right now.

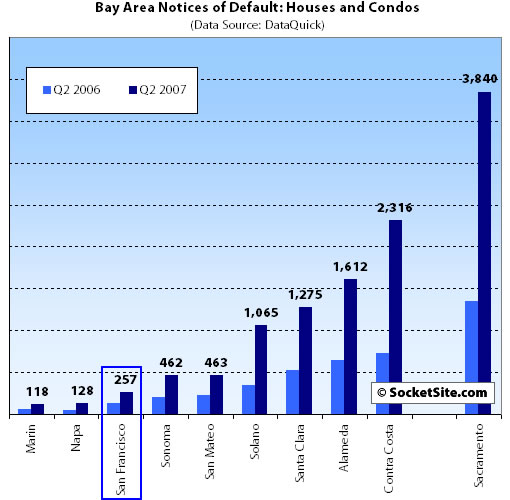

Just take a look at the number of mortgage defaults (impending foreclosures?) in the San Francisco Bay Area — numbers which are probably replicated everywhere in the nation:

Notice that the pain here has been selective. Some of us are untouched, with fixed mortgages or homes all paid out. But too many are suffering with a big messy nightmare in their hands. So who are these people? Our paper has profiled a few of them here.

Reading through their stories, we can see what got them to the brink of foreclosure and what caused them to lose a whole bunch of money from the failed home ownership experience. What has ruined their credit and has caused them great heartache is evident. I’m summarizing these points below along with some quotes from their stories.

How Homeowners Become Easy Victims Of Subprime Lending

Shady realtors gain the trust of vulnerable clients, including friends and family.

It’s a sad state of affairs, but often, many low wage earners can look inwards at their own personal relationships to find real estate professionals cum housing advocates among their friends and relatives just eager to earn commissions at their expense. Unfortunately, some of these realtors may think and say that they have their clients’ best interest at heart. The unsuspecting homeowners are made to think that they can own the American Dream with their realtors pulling out all stops to help them get that house, even if they’re stretched way beyond their monetary limits. The agent may cobble together a bunch of high risk loans and may even personally participate in the lending game. A typical scenario here is that if the homeowner defaults, the sharky realtor/friend/family member heartlessly sues them.

When Cil bought a house two years ago, he trusted his mortgage broker because she’s from Mexico, so he figured she would look out for a fellow immigrant. The mortgage brokerage acted as his real estate agent. He said he was told his monthly payments would be $2,600 a month. The day he signed the loan papers, he found out the payments would be $2,900 a month, not including taxes and insurance. Cil said he balked, but the brokerage assured him that he’d easily be able to refinance in less than a year to lower his payments.

Supbrime lending victims often don’t understand what’s going on.

I’m a fairly financially sophisticated person but I’ll confess that loan terms *still* befuddle me to some degree. I can imagine how a financially strapped first-time homeowner feels about being faced with multiple loan contracts, terms, conditions, liens, escrows and what not just to own the house that’s almost-but-not-quite within his grasp. These buyers are simply guided and told to sign on the “dotted lines” and all will be taken care of. Well, that sucks. They’ve just signed their future away, and not in a good way.

“I’ve learned all this new terminology,” Pitts said ruefully. “I’m what they call ‘upside down’ — that means I owe more than the house is worth. You have to have equity in your house to refinance, and I don’t have any.”

People think real estate prices only go up.

Has anyone told you that home prices only go up? The argument is that of course, you just need to wait long enough and sit out any downturns. Unfortunately, this emboldens many folks to get into a market they cannot afford to play in. I’ve gotten into more than a few animated debates about this with colleagues hell bent on buying houses at absurd price levels. After all, we do live in California and for only half a million dollars you can own that shack outright. It doesn’t help that in hindsight, I’ve lost those four year old debates since even with today’s slump, my colleagues’ homes have appreciated by 50%.

For Bay Area residents, more than a decade of consistently rising home prices may have led to a mob mentality of people overeager to jump into the real estate market, confident they would quickly gain equity.

People overestimate their ability to pay a mortgage over the long term.

A mortgage is a long term debt commitment. A house has a zillion expenses you’ll need to make sure you can afford before you embark on the adventure of owning one. I’ve heard this claim made once too often: “I’m buying that house. If it turns out I can’t afford it later, I’ll just sell it.” Well, okay. Let’s hope you’re not “upside down”.

“When I first bought the house, everything was too good to be true,” Jeff recalled. “No money down, instantly gaining $10,000 in equity. Written in very small print was that the loan will adjust in two years. Everybody I talked to said it would only be a (minimal) increase.”

Life and perhaps, bad luck can interevene.

Funny how life gets in the way of best-laid, solid plans. How easy is it to get derailed from the path you’re taking? It’s a cinch. If you’ve bitten off too large a loan, even the smallest detour away from your financial goals can hurt.

Then she lost her job in February because she was taking too much time off to tend to her parents. Her mother has Alzheimer’s, and her father has arthritis and digestion problems. When the first mortgage payment came due, Gardner realized they were in over their heads and called the lender.

People ignore the risks and don’t think far ahead enough.

How do you convince yourself that you can get that house? Tell yourself over and over: What risks? Let’s cross the bridge when we get there. Interest rates won’t be going up for a while. I’ll work two jobs. Interest rates may go down in a couple of years, you never know…. Check out this absolutely outstanding article by Dr. Housing Bubble about how the threat of foreclosure creeps up and alights upon the unwary.

Pulling out home equity and refinancing have become habitual.

Some homeowners have made it a financial strategy to put their homes on the line by drawing out equity and using the cash to cover their bills and expenses. It’s common around here to take out the equity from your house to pay for home remodeling or upgrade projects. I find even this scheme to be too much of a gamble!

After refinancing more than a dozen times over the years to pull out money, the Gardners now owe $454,500 on the house. She thinks it is probably worth about $350,000. Gardner said her lack of financial knowledge and the need for funds to fix up the house and pay off bills kept inducing her to refinance. Public records show that the home was refinanced four times in the past two years.

The Consequences of Foreclosure

These comments from real victims of the subprime lending and borrowing process have hit home, and it makes me sad to think about how much one can lose just by making one lousy decision.

“I’ve probably wasted $90,000 over the past three years and have nothing to show for it,” he said. “I lost my house, have to relocate my family and ruined my credit. Now my family will probably never own a house again because we will be considered even more of a risk in the future.”

To this day, I’ve wondered this: why don’t people just wait, save up and continue to rent until they can truly afford a home and understand the property market? My recommendation here is that if you decide to take out a mortgage, then wait until you can easily qualify for a 15 year or 30 year fixed mortgage. By opting for predictability and pegging down your loan obligations, you’ll have much better control of your finances. Simply put, it’s not that hard to stay out of trouble: just refrain from buying a house until you *can* afford to.

Copyright © 2007 The Digerati Life. All Rights Reserved.

{ 11 comments… read them below or add one }

I’m sorry but I do not buy the “I didn’t understand” excuse of the Gardners. They know money isn’t free. They just wanted what they wanted and are now playing dumb and blaming others.

I agree with Ted. I feel really bad for people who entered into these terrible contracts, but if they signed up for a mortgage and didn’t understand it, some of the responsibility is theirs. If someone signs up for the Army and then expresses surprise that they are being sent to Iraq I doubt the Army would be too understanding.

It reminds me of seatbelt laws. They are good things, and save many lives, but really – why do we need to have a law to tell people to protect their own lives? Shouldn’t people be concerned to act in their own best interest?

I’m sure that all of the subprime stuff will disappear for a while and then reappear the next time we have a real estate boom, sadly.

In 2003 I was a 23 year old first time home buyer as the market started to go crazy. My then financee now husband and I wanted to buy a home before we got married. He was in school and I was working. I didn’t know anything about buying a home or even living on my own…I was going straight from my parents home and college dorms into home ownership. The first lender I met with made me feel so at home and like they had my best interest at heart. I was naive and trusted her (them). She approved me for a mortgage that was going to be half of my take home pay each month. She was trying to talk be into an ARM loan to make things a little more affordable in the beginning. She did say it likely would not go up much. Everything sounded good to me however just as a precaution I faxed the paperwork over to my father for him to look at…since he has bought and sold over 10 properties over the years and is a pretty savy business man. He called me right away…they approved me for too much, they were chargeing me thousands of extra junk closing costs. And the ARM she suggested was dangerous ground. If I hadn’t had my father to reel me in I would be in way over my head now. Luckily I cut ties with the lender, picked a new property that I could truly afford using only 20% of our take home pay. I can totally see how some novice home buyers could be swindled. Just my thoughts.

To this day, I’ve wondered this: why don’t people just wait, save up and continue to rent until they can truly afford a home and understand the property market?

On my minimum wage income, I can’t save up anything. I would have had a hard time passing up a subprime mortgage if I could have gotten one, as I cannot see any other way I could ever own a home – and I am more financially literate than the average Amedrican.

What are people like me supposed to do, keep renting (with no protection against exorbitant rent increases and thus no long-term security) and learn to like it?

I’m an agent in Southern California, I get calls every week from homeowners needing to sell to get out of these loans…so many times they are already at the early stage of foreclosure. Some I can assist, sometimes they just want the name of a trusted lender. The majority have comments such as “I didn’t understand what I was signing” or “The agent that sold me a house also was new to the mortgage industry and begged me to use them” that one I’ll never understand! why put your trust in someone for the largest purchase you’ll make “just beacause?”

The wave still continues!

Bad loans will continue to explode for the next several years if modifications don’t fix the problem ahead of time. Only time will tell.

Until all these mess are fix, it will continue to bite everyone alive. And I feel sorry for those people who signed and said they didn’t know what was writen in the contract.

but they have to understand taht when they got into these mess they knew they cannot afford it. Buying a house with NO Downpayment says a lot. You shoudl know that if something turns sour, you are in for a big Bang!

Too bad it happened. Anyways, I think we all learn some nasty lesson here.

Modifications need to be made to help these people out. Everyone needs help these days.

Loan problems are still continuing as increase in inflation rate is badly affecting world economy!

I never understood people that have debt to pay and still get mortgages. I understand that you think there is a way out but that is exactly why people get in more and more debt.

Great detail. Far too many borrowers fail to protect themselves with mortgage insurance. Mortgage payment protection insurance will make those mortgage payments in the case of redundancy. However, there is no insurance to cover yourself from making the choice to buy a house you cannot afford!