Should I get a personal loan? At any given point in time, that’s what a whole lot of us are pondering. Taking on consumer debt has become one hard habit (or vice) to break.

One of the most eye-opening profiles on consumer debt that I’ve seen was one from the New York Times, where they presented a whole bunch of articles and multimedia elements to answer the question: how the heck did America get in the current financial mess it’s in right now? How did we fall into such a deep debt hole?

9 Decades of Consumer Debt: How Our Debt Problems Got Out Of Control

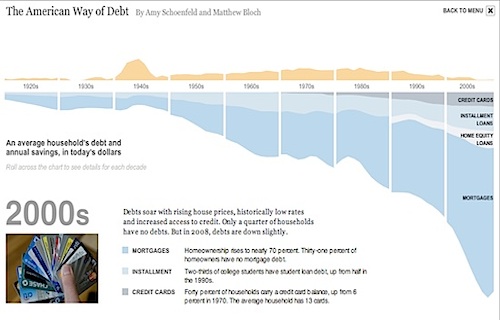

There’s a lot we can discuss about in this series (aptly called The Debt Trap) but I wanted to focus a bit on the interactive feature that gives us a look at consumer debt throughout the years (nicely illustrated by Amy Schoenfeld and Matthew Bloch). The graphic is entitled “The American Way Of Debt” and shows the average household debt and annual savings in today’s dollars, throughout nine decades (1920 – present). It’s pretty incredible to see just how much our love affair with personal loans, 0% APR credit cards and mortgages has caused our household debt to balloon to unprecedented levels (click on the image to enlarge it):

This pic shows the history of our consumer debt (in blue) and our savings (in orange). There are a few notable aspects here, such as how the annual savings rate during our current decade is the lowest it’s ever been — rivaling only the savings rate during the depression years (1920s – 1930s). Then during wartime years in the 1940s, there seemed to be a peak in savings, with American households saving up to $12,800 a year (wow); this situation was credited to wartime restrictions on credit, but by the end of this period, people went back to borrowing more and saving less.

Over time, we see how various debt instruments and products are introduced to the general population. Adjustable rate mortgages pop up in the 70’s, along with Sallie Mae, the largest lender for student debt. The 70’s was also the time when credit card debt began to pick up traction.

Then in the 80’s, we see how debt shifts to mortgages, and this seems to be the turning point for mortgage-backed securities — when lenders began to transfer some of the risk they were bearing onto investors. And things get progressively worse (debt-wise) all the way to the present time, where we now face these sobering facts:

In the 2000s, debts soar with rising home prices, historically low rates and increased access to credit. Only a quarter of households have no debts.

- Mortgages: Home ownership rises to nearly 70%. 31% of homeowners have no mortgage debt.

- Installment Debt: Two thirds of college students have student loan debt, up from half in the 1990s.

- Credit Card Debt: 40% of households carry a credit card balance, up from 6% in 1970. The average household carries 13 cards.

I believe that our collective household finances have never been worse than in recent years: savings have pretty much evaporated with families saving an average of $300 to $400 a year, while dealing with a debt load that’s as immense as ever. The graph shows that all types of debt are up — from credit card debt and installment loans to home equity loans and mortgages. The average debt load has blown past $100,000 and that’s where we are today. The scary thing is that this happens to be the state of consumer debt and savings today, which is only one aspect of the big picture. If you take a bird’s eye view of our nation’s financial situation — the economy as a whole, how our business and government sectors have been operating, the budget deficit — the future seems far from uplifting.

So when are we going to get our act together?

If you’re in debt, here are a few thoughts on how to manage your financial situation:

- How To Pay Off Credit Card Debt

- Get Rid Of Your Debt With These Debt Defying Strategies

- Debt Elimination Tips: How To Reduce Debt With These Dos and Don’ts

- How To Lower Your Credit Card Interest Rates

Copyright © 2009 The Digerati Life. All Rights Reserved.

{ 17 comments… read them below or add one }

The word “ugly” describes this perfectly.

The really depressing thing is that the people who are fiscally responsible LBYM types are getting stuck with the damage caused by the federal, state and local governments and the less frugal members of society.

Four simple steps to get things back on track and prevent a complete meltdown:

1. mandatory retirement savings similar to Australia. As much as it may be an intrusion on personal financial freedom, it has proved to be a better option for everyone than the alternatives

2. skin in the game. If people want to borrow money to invest, they must have a meaningful stake at risk in the outcome. As an example, this means putting down a chunky deposit for a home or investment property and making it a lot harder to walk away from negative equity

3. credit card balances. Instead of fretting about interest rates, introduce a mandatory 10% repayment obligation – at least 10% of the outstanding balance must be paid off each month or the card is stopped

4. entitlement. The entitlement mentality must be ended. The blunt reality is that too many entites (governments and private sector) have spent or pledged to spend too much. The sum total of our ability to meet such pledges has been exceeded. Put differently, the sum total of claims against the contributions of current and future tax payers exceeds the resources of the current and future taxpayers to meet those claims.

I’ll spare you a rant about civil servants’ pensions and health care.

One way or another, a lot of people are going to have to face up to the reality of declining consumer spending.

Binge spending and relentless borrowing is the American way. It’s hard to change the ways of our past, and I don’t think even this massive downturn will keep us down for much longer.

As the FED told us today, inflation is benign and cheap money is here to stay! Party on folks.

The statistic that scares me most is the fact that the average household carries 13 credit cards! That is insane! The curve on the graph is an exponential one, which is really worrying. The only way to reverse the current trend would be for some catastrophic event to take place. Maybe the current global economic meltdown will lead to this.

Off topic, but gold is looking gooooooood folks! Even at the current record high, nudging $1100 it is still seriously undervalued. So do look at investing in something real and tangible, with the best returns you can imagine at present.

See here, how much longer can we carry on like this? The rubber band can’t stretch on forever…. We’re supposed to be facing our comeuppance right now, as we’ve had to experience the worst and longest recession in decades — yet, it seems like we haven’t paid enough for this debt binge. Interesting how this massive ballooning debt has coincided with some long periods of economic expansion and has ridden the back of a long term stock market bull. So when is the debt going to be too heavy to bear, I wonder.

Too much debt should really start to curtail spending. Less spending will surely be a hit to the economy for a while.

It’s pretty incredible to see just how much our love affair with personal loans, 0% APR credit cards and mortgages has caused our household debt to balloon to unprecedented levels

I don’t think it is our love for debt that is the primary problem (I certainly agree that it is a contributing factor). It is the companies that profit from that love that are working hard to stimulate that love that do the most damage. I don’t mean just credit card companies. I mean any company that accepts credit (and that’s obviously just about all of them).

We all are born with a desire for stuff and an inclination to focus on the short term. That’s just our nature.

As a society we decide at different times what to do about that reality.

For a long time, there were all sorts of anti-immediate-gratification messages sent to us all the time — in churches, in books, in movie theaters, and on and on. There were a few messages sent from the other direction from people trying to tell us stuff. Now the number of messages is heavily slanted in the pro-spending direction.

If we want to address the problem, we need to change the slant. Many say that as a society we have no “right” to do such a thing. Yet they accept that the advertisers have a “right” to push from the other direction. For so long as 90 percent of the pushing comes from one direction, the problem will not be solved. If we come to care enough about the problem to question some of our thinking about “rights” to push people one way or the other, we can achieve things.

We have become a marketing-oriented society. Marketing is not bad. It has its place. But its place is not as the central source of information on money-related topics, in my view. We need effective counters to the millions being spent trying to persuade us to do things that hurt us and our society. We need to fight back (fairly, but effectively).

Rob

The problem is there is no consequences for people who behave like this. It used to be when you made a bad debt you worked it off. It used to be that you owed a lot of money to a company, you became an endentured servant to that company (history lesson, most people sent to the US were people who owed money to companies back in England). Now you have bankruptcy which will wipe it away. You loose your job you have unemployment. You retire at a ripe old age of 65 and you have a government pension to live off of and health care.

People have lost their pride. So many people used to think “government handout” … No Way!! Food Stamps? … For Shame !! Now they embrace these things, and even now have books on how to get these things for states and government monies as an industry.

There is no reason for someone who is not educated in the ways of personal finance to know that there is anything wrong with these things. The government wants us to think like that for what ever reason (enter conspiracy theory 1-1034 now). They want to behave like a Robin Hood and they think the masses will like that. They are missing the fact that rich smart people will go where there are less taxes. Many people I know are leaving the country because they are tired of being taxed to death.

What does all this have to do with the amount of debt and savings people have? Well depends on where you are. Everyone feels entitled to live like they make $50,000 a year, even if they are a high school dropout working at McDonald’s. If the Government is helping them out, why would they ever give a second thought about how much debt they have, because that flat panel TV is a right for being an American right?

People get trapped early and have this mentality about buying big and now when the reality is they can’t. This borrowed mentality seems great until the bubble burst and problems occur. I think generations now are changing that mentality and being more frugal, renting more and worrying more for the long term than what the standard american picture looks like.

Sadly I must agree that we must simply accept the fact that this economy is in dire straits but with a little innovative thinking outside of the box, we can get things back on track. Maintaining a positive mental focus is truly imperative during this time frame! Cutting down on spending unnecessarily is seemingly one of the best options we can enact at this point so hold on and stay supportive of President Obama’s agendas and know that his intentions are best when it comes down to making this turnaround effective.

As of 2007 : credit card stats.

“The number of credit cards per cardholder increased to an estimated 4.6 credit

cards per person.” That figure doesn’t count debit cards.

Nice graph….I’ve heard it said that debt is advertised with billions of dollars..looks like a lot of America bought in. It’s sad. BTW I am one of them. I’m trying to make changes myself.

Just to play Devil’s Advocate, is the debt so shocking if we consider that’s over a period of 80 years? If you saw the price of a home over 80s on a graph it would look similar. Most of that debt is mortgage debt. (Don’t get me wrong – I loathe debt and have never had any but a student loan long ago).

Much more shocking to me is the lack of savings. It’d needn’t be the flip-side of the same coin (if I took out a mortgage tomorrow I’d still have plenty of savings) but it seems here it is. That makes households very vulnerable.

Here are some links for understanding banking and money:

7 Page article in The Times on Goldman Sachs

Article in Rolling Stone on Goldman Sachs

The great American bank robbery

How banks gained control of America

How to fix bad commercial banks that take in money from depositors. Simple. People power. The Dutch brought an arrogant bank to its knees in twelve days.

I agree with Monevator. Much of the financial problems usually involve careless use of credit where people and up buying more than what they could really afford. As a result, saving money seems to be a lost virtue.

@Sabrina,

Thanks for the links…. all highly interesting! 🙂

As a bankruptcy lawyer, I get to study how individuals get in over their heads financially. It all comes down to being unprepared. Some people blow educational/ vocational opportunities and are not prepared for the workforce. Others decide to start families before getting married, or building a “nest.” (Even birds instinctively know better.) Others, who are doing well, don’t bother to save a minimum of 6 months to act as a cushion should they lose their job or ability to work overtime. Bottom line: life is expensive. Don’t buy a house unless you have a minimum of 20% to put down, don’t increase your family size if you are not prepared to feed, clothe and educate them with your own money, and never use credit to finance everyday living expenses like gas and groceries unless you are prepared to pay the balance in full at the end of the month.

Cut off the credit and available bankruptcies, foreclose homes fast. Time for a reality lesson. If you don’t have cash, then you can’t afford it. Standard of living has gone down and is only supported by credit. Force the new standard of living into households and into government spending also. Raise age of congressmen who can get benefits.

@Dave,

You have the tough love approach and I like it. I’m ready to take my fair share of pain if it’s going to help the nation. The problem is, nobody wants to do it, people in power are afraid of lobbyists and of changing the status quo, or are afraid that big business will throw a stink if anything gets changed. Any kind of radical change is sure to meet with an uproar. I wish we could be more disciplined as a nation so that we can resolve our debt issues with strong medicine, rather than wait till we get sicker and sicker over time and have to succumb to gangrene (apologies for the analogy).