We all have our ways of managing and preparing our taxes, and I’ve always wondered what approach to tax preparation could be both economical and headache-free at the same time. For instance, there are those of us who take the DIY approach by using software such as TurboTax (see our TurboTax review). There are others who use a tax preparation service, while others hire accountants or enrolled agents. I thought to provide a quick review of one popular tax service provider that a lot of folks use.

Get Ready For Tax Season With H&R Block Tax Services

The H&R Block office in my part of town gets a good amount of traffic, particularly early in the year. I’ve used the so-called EZ forms in the past, but between the calculations, paperwork, and the tax laws, filling out federal and state tax forms can be intimidating. From my experience, walking into H&R Block’s office can take some of that pressure off.

You can check to see if there’s an H&R Block office in your neighborhood. If you intend to pay them a visit at the height of the tax season, be prepared to spend some extra time, given how busy things can get. But if you want to skip the crowds, you can also check out their online services or software downloads.

H&R Block Online Tax Services

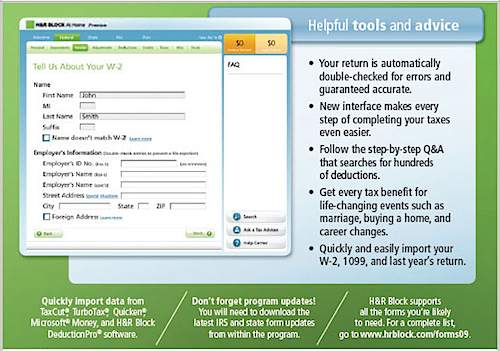

If you can’t make it to a local office, H&R Block offers a few online solutions.

Free Federal Edition + E-file: This is a service that caters to those with the most basic tax situations. If you’ve got a simple tax return, then this may work out for you. The service also checks your return for errors and you’ll have access to various IRS publications. Their Worry-free Audit Support feature may be available for free but this is something you’d need to check. To file a state return, it will cost you extra ($29.99 as of this writing); you won’t be able to import your information from other programs, either. But it includes e-filing. The best thing about it is that it’s available at no cost.

Deluxe with E-file: The next step up for those filing online is the Deluxe service, which is recognized as the choice for investors and homeowners. You’ll get all the features of the Free service, including personalized tax guidance, ability to maximize deductions (e.g. mortgage interest, charitable, etc), ability to capture investment sales, professional audit support, and an e-file. You’ll also be able to import data from other tax software, if this is something you need to do. For a state return, you’ll need to pay extra. The charge is $29.95.

Premium with E-file: Building up on the Deluxe service, you’ll get the features from Deluxe along with live tax advice, Schedule C guidance, resources for tax planning and tax legal matters, tax calculators and tools, and help with rental income reporting. Filing a state return will cost extra. This product is most suitable for those who are self-employed or who own rental property. The charge is $49.95.

H&R Block Tax Software Downloads

H&R Block’s software runs on both the Windows and the Mac. Here are some of their details:

Basic + E-file: This software product allows you to prepare a simple federal tax return for $19.95. It offers tax guidance, checks for errors, and gives you the opportunity to file 5 federal e-files. You can download state tax preparation support for an extra cost. Your data from TaxCut, TurboTax, or even H&R Block’s offices can be imported. And the Windows version supports DeductionPro, which helps you maximize your tax deductions. Price is $19.95.

Deluxe with Federal E-file, State Tax Prep: The software builds upon the Basic version and has similar features as that of the online Deluxe version; it’s best for homeowners and investors. Price is $44.95 unless you don’t need state tax preparation. Without state tax prep features, the charge is $29.95. If you prefer to download the software and work on it on your desktop rather than online, then this is the Deluxe version to use.

Premium with Federal E-file, State: This software is everything that Deluxe has plus extra features; it’s best for self-employed individuals and rental property owners. The functionality available in this desktop version is similar to what you’ll find in its online counterpart (as described above). Price is $59.95.

Tax Tips, Calculators, and More

In addition to tax preparation services and products, you’ll also find tax tips and calculators on the H&R Block site. It looks like the site has been streamlined to be simpler, so aside from the Online and Software sections, you can also utilize their free tax estimator, withholding calculator and self-employment estimator, as well as peruse their helpful tax tips.

H&R Block also mentions their guarantee: if their professionals or their software makes an error on your return that results in penalties and/or interest that you need to pay the IRS, they’ll reimburse you up to a maximum of $10,000. Check their guarantee for more information.

So anyone out there ever take them up on that guarantee? I’m also curious about how you prepare your taxes — do you use a professional or do it yourself?

Copyright © 2010 The Digerati Life. All Rights Reserved.

{ 10 comments… read them below or add one }

I do my taxes on my own using Turbo Tax. Cheapest way to go. How much does it cost for a CPA to do your taxes each year?

I’ve heard some horror stories about H&R block, and in fact one person at GardenWeb.com whose family owns a franchise observed that in some offices employees are untrained–they haven’t even been through the company’s basic tax-prep course. Search H&R Block at Consumerist.com for some interesting reports.

My taxes are complicated because of the wide variety of sources from which I derive income, some of them limited partnerships. For that reason, I have a tax lawyer do them; I know and trust her expertise, and though she’s not cheap, she manages to extract refunds that cover her fee many times over.

If a person’s taxes are fairly simple — say, only a couple of income sources and nothing very exotic — then it would make sense to use TurboTax. At least if you make a mistake, it’s your mistake, and you don’t have to rely on somebody else to file your taxes electronically.

I do mine with H&R but I do it online and it works great and I in can do it in about 30 minutes.

@Funny About Money,

I have heard mixed stories about H&R Block offices as well, but would love to hear the consensus on their online services and products. I have tried TurboTax and will look into H&R Block’s this year. I have an enrolled agent who helps me out with more complicated aspects of my taxes — usually for questions on investment and business matters.

My question: when is it time to switch from DIY tax preparation to getting a professional to help you? From my understanding, H&R Block is usually for those with simple tax filing needs and they’re there to guide you through the basic steps — in the case when you really don’t know what to do. If you need advanced help, you’ll typically need to consult with a professional.

It’ll be interesting to see how all these tax software packages handle the stimulus payments (and complex rules) when people file their returns this year.

My wife’s a CPA and I also have a degree in accounting (got a job in IT and never seriously pursued CPA designation). We use Turbotax – for ease of use more than anything.

I have H&R Block do my taxes for free. Of course I also work for Block. I handle many simple returns due to Block’s clientele, but I am trained and knowledgeable enough to prepare much more complex returns. I have been trained on all US business type returns (excluding multinational corporation), though rarely see anything more complex than sole-proprietorship. I also handle rental properties and investments.

The basic block training is to teach a preparer to cover the returns that form the bulk of Block’s business: W-2 income, Earned Income Credit, Schedule A. Every employee I have met that works for a company owned store (I can’t speak for Franchise stores, but they are held to the same standards) has had to sit through the basic training (13 weeks) and also maintain an additional 24 hours of tax training each season.

If you are using Block, make sure you see a tax professional that has had training in your areas of need and fell comfortable with them. I would suggest using their tax pro finder on the H&R Block website to first find someone with the knowledge base you need and to also make an appointment. The more knowledgeable preparers tend to have full calendars.

I have really never use HR Block, or any of those services. I use an accountant but one thing I do is also do my taxes in Turbo tax or Tax Act as well just to see how they turn out. They may not be exact but it is usually pretty close and it is a good checks and balances. If you do this, you do not have to file, but you can just do it on their website for free.

Just something to consider

As a finanical professional seeing dozens of new clients every year, our tax department is constantly refiling taxes done at the “cheap and quick” tax preparation offices. Our experience has been (with no disrespect to Mr. Block or any of the other seasonal tax preparation service stores) that the tax preparers are quickly trained and have, for the most part, very little experience in the complexities of the tax law.

While using the packaged tax software, while it may compute your taxes and get you a return, you get what you pay for. For those who think it’s “much cheaper” to go to a storefront seasonal preparer, don’t forget how an experienced, qualified, trained professional may evaluate your situation and find ways to reduce or eradicate your tax liabilities by asking the right questions and tapping on years of experience and thousands of returns. Do you pick your doctor based on price? Do you read a book and pull your own tooth just because it’s cheaper? I think not. Stick with the Certified Pros…you can’t beat practical experience — and don’t forget tax planning is a year ’round effort, not just once a year. Or it should be…

Go to a professional tax preparer like a CPA. You may be surprised that the fees could be reasonable for what you get and by far more qualified.