Earlier on, I wrote an article about some historical trivia surrounding our beloved currency. Today, I will resume the money facts but this time, with a more practical bent. These facts are ACTUALLY useful and could change how you look at money.

FACT #1: There’s such a thing as the penny debate.

Why is the penny still around? It seems like an inconvenience to use. Well if you found out it was worth more to make a penny than its face value, wouldn’t you still hold on to it? There have been active debates on the plight of the penny online and offline from mainstream news to online community commentary, which I am republishing below. The big question: should we scrap the penny or keep it in circulation?

Pros:

- Gallup polls show that 2/3 of Americans want to keep the cent around. A pro-penny lobby even exists called Americans for Common Cents. Polls found that 58 percent of Americans stash pennies in piggy banks, jars or drawers instead of spending them like other coins. Some people eventually redeem them at banks or coin-counting machines, but 2 percent admit to throwing pennies out. Still majority recognize the penny as part of American history and tradition.

- It’s a hedge against inflation, by virtue of the accurate pricing it can offer consumers.

- Charities love the penny as they are a common form of donation. Without the cent, they would suffer greatly as the penny is the most frequently donated coin, and charitable organizations receive tens of millions of dollars a year in pennies alone.

- Small business merchants prefer the penny for easier cash transactions. Other penny lovers are contractors who help supply pennies and consumer advocates who fear the rounding up of purchases.

- It is believed that doing away with the penny will hurt the economy by causing nearly $650 dollars per year in a sort of “penny tax” that would only benefit businesses. Prices would be changed so that store owners would keep the change from the rounding required without pennies. During economic recessions, penny circulation increases dramatically as people roll and spend them. The government has also made over $500 million in profit from the penny in the last 15 years which has kept the national debt from rising as fast, so it is unlikely that the penny will go away any time soon.

- Some shrewd folks on community sites have suggested that if pennies are worth more than 1 cent, you could theoretically go to the bank and take all your money out as pennies, sell them for their base metals to be melted down, and make a profit from this process. You can then repeat this process indefinitely which hints at potential arbitrage opportunities to be exploited. But if this turned out to be a popular scheme, then the government would probably close this loophole. Is this legal? Until we hear of a case that proves otherwise, then it is believed to be so.

Cons:

- The penny is also called the “nuisance coin” for obvious reasons. It is extremely rare to find a vending machine that will accept pennies (though contrary to popular belief, a penny is legal tender) so it’s no surprise that most people simply keep their pennies in a jar and never use them, or just don’t keep them at all.

- It’s worth more to produce than its face value due to higher metal prices, for the first time in history. The Mint’s announcement is a milestone, because coins have historically cost less to produce than the face value paid by receiving banks and have usually been moneymakers for the government. The cost of materials alone is already higher than the cent’s face value. Above and beyond that, there is also hardware and labor to produce coins which should also be considered as part of the total cost!

- We pay taxes on a currency that appears unused, obsolete and undervalued.

- Just like the pro-penny group, we have the anti-penny brigade.

FACT #2: Your torn up dollar bill or mutilated coin can still be worth something.

If you’ve somehow torn or destroyed a paper bill, or bent a coin (although I wouldn’t know how this could be done!), there is hope! You can redeem slightly damaged currency from your local bank, but for serious cases, you may have to do more.

Paper money that has been mutilated or partially destroyed may in some cases be redeemable at full face value. Any badly soiled, defaced, torn, or worn-out currency that is clearly more than half of the original note can be exchanged at a commercial bank, which processes the note through a Federal Reserve Bank. More seriously damaged notes — those with clearly less than half of the original surface or those requiring special examination to determine their value — must be sent to the Department of the Treasury for redemption.

You can try to claim the equivalent of your damaged money by following these steps.

FACT #3: Not all unauthorized coin production is considered counterfeiting.

Say what? It’s actually all a matter of terminology. Now don’t try this at home or you’ll still end up where the sun don’t shine.

It is universally thought that any unauthorized production of coin money is an act of counterfeiting. Technically, this is not so. Only those coins illegally produced from metal of less value than the original coins are considered to be counterfeit coins. Though still a criminal act, the unauthorized production of coins of the same metallic value is considered to be “duplication.” At any rate, those who choose to help the Fed with its printing and coinage work often end up doing perfectly legal duplication work in license-plate production at their state penitentiaries.

FACT #4: Know how and when it is illegal to destroy money.

Nothing in the law forbids anyone from destroying coins, in spite of a belief to the contrary. Defacing or mutilating a coin and then passing it as currency is another matter. The intent to commit fraud is what is being penalized in this case. As far as paper money is concerned, leaving money in your pants pockets to be drenched in a washing machine won’t harm your bills. That’s because they are made out of linen and cotton fibers, which aren’t affected by water. On this note, here’s an interesting but unverified observation from an online forum:

It’s illegal to modify money in a fraudulent way (i.e. make a defective mint Penny and sell it for a thousand dollars), but it is perfectly legal to retrieve the base metals from money, just as it is legal to possess shredded paper money (and use it for stuffing pillows, toys, etc).

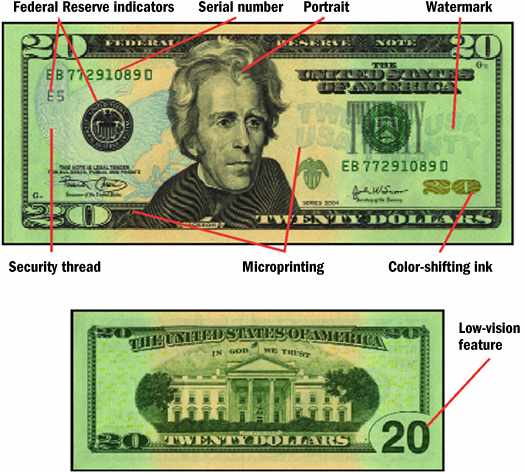

FACT #5: There are many security features built into the paper bill.

Of course you already know that it’s tough to get away with counterfeiting money. There are many security features built into a paper bill today. Some such features include the use of cotton and linen rag paper to make money so it should be obvious that it is against the law to produce or handle this type of paper. Special inks, microprinting, color shifting ink, distinctive colors per denomination, watermarks and embedded polymer strips have been added to our bills to prevent their duplication and recreation. Above all this, the Treasury redesigns notes every seven to ten years.

Here are some graphics that point out the security features on our money!

More Fun Facts About Money:

Federal Reserve Bank of San Francisco: Fun Money Facts

Copyright © 2007 The Digerati Life. All Rights Reserved.

{ 8 comments… read them below or add one }

I believe the government has closed the loophole of melting down money for their base metals – http://money.cnn.com/2006/12/14/news/melting/index.htm

Lazy,

I had assumed earlier that it would have been acceptable to melt coins if there is no intention of profiting from it. But given your article, it appears that ANY form of melting is illegal. Well that clears it up! Thanks for the tip!

Many other countries have abandoned low value coins and notes. In New Zealand the coins are 10c, 20c, 50c, $1, $2 and the smallest note is $5.

From a personal view, this has greatly reduced the amount of valueless coins rattling around my pocket, bags and car. From a Government viewpoint, the costs of minting low value coins has decreased and the higher value dollar coins last much longer than the equivalent note again reducing costs. From a banks’s viewpoint they have reduced their costs of handling small coins and, as goods are still priced to the cent, increased the use of EFTPOS (and fee income) as people still want to pay the ‘exact’ price.

I saved my pennies last year to the tune of $312.34 of just pennies over $1200 in change total. Pennies have as much value as you give them. I pick up every one I see. So if you don’t want your pennies send them to me. Also don’t banks make or lose millions based on fractions of pennies.

You saved $312.34 in pennies last year? That’s nearly 100 every day. What are you doing that you wind up with 100 pennies every day?

i have a damaged $20 bill and no bank account.

the bank refused to exchange it because i did not have an account. the right side is intact.

the left:

RESERVE NOT

THE

UNITED ST

OF AMER

EB8749789 _ _

TWENTY DOLL

Can they refuse to exchange it?

A store did not want to take it which is why

I went to a bank.

I would like to see an article comparing coin collecting vs. paper currency collecting. Pros and cons of each, etc. and also how they both compare to more traditional investment vehicles.

Fun facts, I have to try that shredding money and stuffing my pillows! What dreams I will have 🙂