Mint.com has a feature I’d like to discuss, which is called “Financial Fitness”: it’s about making personal finance cool and at the same time, measurable. For those who are new to Mint, it’s a free online personal finance tool you can use to make a budget and track expenses.

We all know how personal finance as a subject matter can be pretty dry and boring. Managing our money on a regular basis can be a tedious task, especially those particular tasks that are repetitive and mechanical. Let’s face it, the fun parts of finance are the ones that result in having our bank balances grow and swell: at least, that’s the stuff I get excited about seeing the most!

Use Mint.com To Measure Your Financial Fitness

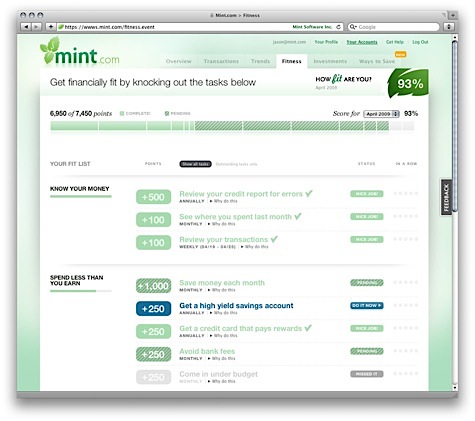

So enter Mint.com’s new feature, which addresses this very issue. Their Financial Fitness feature is designed to make personal finance fun and interesting; it aims to impart financial advice through a point system. I think it’s a good direction, since I’ve noticed that anytime we incorporate goals and measuring sticks to activities that we do, it gets exciting and challenging. Why do you think that so many people find Weight Watchers’ point-based diet menus so effective? Same thing with video games — they’re so addicting because you just can’t help but try to beat that high score.

According to Mint, Financial Fitness is defined by five personal finance principles as such:

- Know your Money

- Spend Less than you Earn

- Use Debt Wisely

- Invest Your Savings

- Prepare for the Unexpected

This feature uses these principles as a guide for informing you about whether you are on track to achieving and maintaining your financial health. Here’s how it works: Mint identifies those tasks and actions that a user must perform in order to be recognized as financially fit. For instance, reviewing your credit report, building an emergency fund, opening a high interest savings account, avoiding bank fees and completing your budget are examples of these concrete tasks which are assigned points. Now if you achieve any of them, you receive the points towards your fitness score. Your goal? What else but 100% financial fitness!

What’s more, for each particular task, you will be coached with suggested, actionable steps that you can take to fulfill the task and make progress towards your financial goals. You’ll have tools, calculators, providers and products that will be available for this process. Here’s where Mint performs an online advisory role by helping users find guidance about what they can do to improve their financial status.

Thrive: Financial Advice Through Online Tools

All this talk brings to mind another web site that has done something fairly similar. Thrive (found at JustThrive.com) is also another free personal finance tool that provides you with financial planning advice and tools at no cost to help you manage your money and work towards your financial goals. Besides the fact that they’re both in the same space, the similarities they have with Mint are hard to ignore, but don’t let it stop you from checking them both out!

Thrive also has a scoring system in place to let you know how you’re doing financially, and it’s based on calculations made against certain aspects of your financial picture, such as your spending rate, account transactions and debt-to-income ratio, among other things. Your financial health score is reflective of your Spending, Debt and Savings activities that have been captured in the Thrive environment. Of course, with that score comes the opportunity to receive financial advice and guidance from Thrive, aimed to help you make changes to improve your status.

I’ve yet to fully test drive Thrive, so I’m certainly looking forward to checking out their distinguishing features soon.

Copyright © 2009 The Digerati Life. All Rights Reserved.

{ 14 comments… read them below or add one }

Great review. I’m contemplating starting at a site like this in the near future. Up to now, I’ve been on custom spreadsheets, but it’s just not working for me anymore. I’m going to be testing the waters on these two sites!

Thanks for the mention, SVB – we’re looking forward to your further look at Thrive. The similarities to Mint are an interesting subject: our Financial Health component has been part of our application from the start and was available when we launched to the public back in October, and Mint has just recently introduced their beta version of “Financial Fitness”, which does seem to have a striking resemblance to portions of our Financial Health.

But I do think there are differences, and much of that is in approach. For example, Mint has repeatedly mentioned making it a bit more “gamelike”, which isn’t a direction we really want to take things: your money isn’t a game and we realize that. By setting up a point system, they’ve established a token economy, where you are working for the token instead of the actual meaning and we think the meaning is in the behavior – we actually want to help you make things better.

It is a bit like school: Mint wants to give you a grade. And there are decades of research that show that when you do that, you make it about the grade instead of actually teaching people how to build financial wisdom, which is one of our core values. Thrive’s Financial Health score is not meant or messaged as a way to compete against yourself or others, and isn’t the point of working on our advice – our users aren’t working for the grade, they are looking for a way to understand what they are doing. For us, the score is a monitoring tool: it isn’t the actual goal.

And rather than being an add-on, advice is at the very core of our process – almost every new feature we design is carefully inserted into our Financial Health metrics so that we can help guide people through their financial life. I’m actually working today on one of the new features we’re building right now for Thrive that will introduce a whole new element of Financial Health. And like all our advice, it isn’t just a simple action you take for points: it is tied in to all the other Financial Health components to improve your actual financial life.

So we’re looking forward to your review, to see how these differences play out for you. We always invite people to compare sites, so that they can find what works best for them – there is no one-size-fits-all solution, and I think there are good ideas coming out of Wesabe, Rudder, and some of the other applications that offer different services than Thrive.

And as always, for anyone using Thrive, we are constantly improving and we not only welcome feedback, but actually work to learn as often as possible. You can shoot me an e-mail directly at matt@justthrive.com or to our support folks over at support@justthrive.com with suggestions, and we’ll do our best to make Thrive better and better with your help.

Hi SVB,

Sounds like a great tool.

The school system should teach a basic financial course in elemetary school. Most people in this country and the world have only a limited knowledge of finances.

Thanks for the review.

Ryan

Just mentioned Mint on my site since I signed up for it. Will look at Thrive and await your review of it.

I have to say I’m late to the Mint and Thrive parties…. I should check Mint out. I think I’ve figured that I can just budget on my own, what can Mint do for me? But I’ll give it a try soon.

Ryan: I think the schools don’t teach finance probably because many of the teachers, principals and other education representatives may not even know it properly! Heck, the government barely understands it!:)

I went to the Mint website to register and it sought bank details. Although it is Verisign secured and all that, I don’t feel comfortable giving out bank details like that. So, it will have to be spreadsheets for now.

I love Mint (other than their horrendous support).

If Thrive can actually support their product, perhaps it will be a win!

MLR

MLR: We actually consider our central mission to be helping people, and you can’t do that without top notch support. We respond personally to every e-mail we get, usually within the first few hours (and often the first few minutes) of receiving it, and if you call the number on the bottom of the site, you’ll get one of us if we’re in the office. In fact, you usually get me: since I design the new features, I’m usually the one who answers the questions about them! =]

Ryan/MoneyEnergy: We just had some of our team in DC for National Financial Literacy Day, and a big part of the problem with education is that it is neither mandated, nor is it considered part of the core of what we teach kids. The role of school is expanding; historically, teaching about money was part of the family role, but since financial literacy is so degraded among adults, we can’t expect kids to learn it from parents who don’t understand it much better. We actually work hard to make Thrive educational, and we’re working on adding some tools to make it more useful as a teaching tool…we even have some folks in the office next week that are trying to integrate financial literacy into Teach for America! So we’ll get there, together, eventually.

I think that Mint.com is taking a step in the right direction by becoming more versatile and adding more dimensions to their features

@ Colin —

Meanwhile they have left the cost basis incorrect under the “investments” tab since it rolled out.

I don’t care about new features if the current ones don’t work.

And I really do love Mint, so don’t take this as me just hating on them. I just hate their support!

MLR

Definitely worth having a look at! Mint is definitely something I’ll take a look at, as I do need to manage my money a lot more effectively. Maybe trying the beta version is a really good idea. Hmmmm…..

This is a great review of Mint! Online personal finance management tools like these along with others such as Wesabe help individuals track their expenses and keep them within their planned budgets. It also gives us more ideas on how we can promote better money management to our clients.

Its such a great post. The way Mint makes people try to reach for the high score makes anyone motivated about their finances!

I like the features & reports in MINT. This way I can manage my monthly budget and set targets for the quarters.