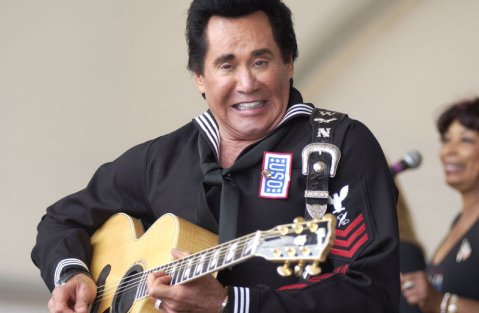

Some people do seem to want to work forever…. like this 66 year old guy:

Here’s a short snippet from a Larry King Live interview with this senior performer — Wayne Newton:

CALLER: May I just say quickly, please, and a quick comment and a question. You look terrific. You should be so proud of yourself with all of your talent and accomplishments, Mr. Newton. May I ask you, please, do you think that this “tap on the shoulder” that you received with your heart problem is saying to you, maybe you should spend more time with your family and possibly, even retire or semi-retire?

NEWTON: Well, I thank you for the question. Number one, let’s deal with the last question, what I think about retiring or semi- retiring, no. I’m one of those people that think that you need a reason to wake up. And to lay in bed and wait for something to happen to me is not where my head is.

There are people who enjoy keeping busy and even holding down jobs all the way till their twilight years. In the course of writing my previous post that discussed the idea of working past retirement, I discovered that a significant number of people are considering skipping out on retirement altogether and instead staying employed for as long as they are physically able.

Yet there are also tons of people who just don’t have a choice but to keep on working beyond the age of 65, simply because they haven’t saved enough for their retirement or didn’t start saving early enough.

So it goes without saying that it would be absolutely awesome if we could retire on our own terms to pursue the things we’d like to do. Taking on a job in our senior years is something that should be an elective and not a requirement. And though the concept of retirement may have changed for many of us — many prefer to continue working instead of relaxing — retirement is still a goal most of us would like to attain, just so we get control over what we’d like to do with whatever time we’ve got left in the world.

For those of us who are not workaholics and who would prefer to retire on time, here are a few recommendations to consider:

How To Get The Kind of Retirement You Want

#1 Start investing early.

This is by far the most important recommendation made to anyone who would like to retire on time. It’s one of the most ubiquitous tips I’ve read about investing, and for good reason: the earlier you start investing, the longer the magical power of compounding can work on your funds, thereby ensuring you a healthy retirement.

#2 Invest for your retirement before you invest for college.

Given the competing financial goals we face — buying a house vs saving for our children’s tuition vs saving for retirement — it can sometimes be difficult to work out our priorities. But there is some conventional wisdom that governs how we should execute our long term financial goals.

I’ve read the arguments that favor saving for retirement over saving for our children’s college education: if you have the money, put it in a retirement kitty first, and save for your other goals later. The reason for this is the fact that many options exist for those going to college: you can get student loans, find a cheaper college, and possibly qualify for financial aid. With retirement, we’re largely on our own (do you really think the government is there to help out?), and having others help us out in our old age is not something most of us will find palatable.

#3 Invest with any amount you can afford.

A lot of people make the excuse that they don’t save and invest because they just CAN’T. I know someone who says he just cannot afford opening a retirement account because all of his income goes to supporting his family. Yet he’s a heavy smoker and drives a fairly expensive car that requires some maintenance. With some adjustments and heartfelt effort, he could very well be on his way to building a decent retirement nest egg. Freeing up even just a $100 a month to put in an investment account is really all that it takes to build a simple, diversified investment portfolio.

#4 Don’t pass up free money.

Those who skip on their 401k contributions do so for various reasons. Most of the reasons are simply excuses along the lines of “not having enough money”, or retirement is just too far away to worry about. But if we’re willing to stoop over and pick pennies off the ground, then we should also be willing to contribute to an employee-sponsored retirement account, especially if matching contributions are being made by your employer. How could anyone possibly say NO to this free money?

Don’t forget too that the tax benefits of retirement accounts allow for your money to grow even faster. Another form of “free money” you should look into is your ESPP plan (if you have one). If you contribute to an ESPP account, you typically get your employer stock at a discount from the market price. You’re therefore guaranteed a certain percentage gain from a stock purchase because of this discount. How is it done? You buy your employer stock then turn around and sell it the very next day for a profit, thanks to the applied discount at purchase; or you can hold on to see if the stock rises, for even fatter gains.

#5 Avoid procrastination and letting life “take over”.

Let’s face it, thinking about retirement and more generally — financial management — may not be the most exciting thing in the world. We’re faced with distractions on a daily basis and we’re living busy, hectic lives. If you’re like me, you’re constantly wondering where all your time has gone, by the end of the day. So it’s way too easy and tempting to have our financial matters take a backseat to everything else; but by going along this path, we may eventually find ourselves in our middle age with meager savings. Being more proactive about our finances and taking a more serious look at our long term financial goals should help us avoid this plight.

#6 Avoid money mistakes.

Sidestepping money mistakes is just as important as doing the right things in order to maintain our financial health and to keep us on track with our retirement goals. There are certainly mistakes that we sometimes cannot help but commit as part of gaining financial experience, but let these mistakes serve as lessons that should not be repeated.

Personally, I’ve made quite a number of financial missteps, ranging from trying out short term market trading and investing with my emotions, to getting involved in silly multi-level marketing schemes that cost a lot in upfront fees. One of the more damaging financial traps that you can easily fall into is the credit trap, also known as getting into too much debt. This robs you of your ability to save for retirement. If you have a lot of debt, you’ll have to retire your loan obligations first before you tackle the issue of investing for your retirement.

#7 Create sensible financial goals and prioritize them appropriately.

Lots of people have financial goals, but many of them are short-term in nature. In our consumerist society, it’s typical for us to myopically prefer to save and invest for material goals such as a vacation, a new car or some other big ticket item. To get ourselves ready for retirement, we’ll need to weigh our retirement goal against these shorter term goals and ensure that we’re not ignoring the important things.

#8 Invest in a way that fits your age and risk profile.

Investing too conservatively, especially when we’re young, can be detrimental to our retirement while investing too aggressively while we’re older may have the same effect. So it’s imperative that we take stock of our risk profile and employ a prudent approach to investing for the long term. Just the right diversified long term retirement portfolio can be the ticket to keeping your retirement plans and schedule on track.

#9 Get interested in finance!

Having money may be an exciting thing, but managing money can be pretty dry and boring, so much so that people decide to sweep their financial matters under the rug until something unpleasant happens. And even then, many of us live in denial of financial disasters that are lurking in the distance. If we can all muster enough interest to pay attention to our finances more often, there would be less foreclosures, bankruptcies and consumer debt rung up around the nation. If finance is just not your thing, you can still get your finances and your retirement in order by outsourcing some of the work. Why not hire a reputable financial adviser or a professional who can help you work out your retirement matters?

#10 Fund all available retirement accounts, if you can.

Say you’ve been able to tame your debt problems and you’re finally ready to invest some money. Once you’re in this position, you’ll need to evaluate your financial priorities. For me though, I’ve always found that putting my money first into accounts where they can grow the fastest is actually more exciting than saving money for the “next big toy”. On this note, the best place for money to grow “unhindered” would be in tax sheltered or tax-advantaged accounts. Employment retirement accounts and IRAs are great places to keep your money working for you without taxes taking a premature bite.

The sooner you apply these tips, the better chance you’ll escape the fate of the working aged. 😉 Though I personally think it’ll be fun to keep working all the way to a ripe old age, just as long as you do it on your own terms — maybe just like 66 year old Wayne Newton, who looks like he’s still having fun. Or is he still working because he got waylaid by personal bankruptcy some time ago?

Image Credit: Wikipedia

Copyright © 2008 The Digerati Life. All Rights Reserved.

{ 11 comments… read them below or add one }

All great tips. Alot of people don’t seem to invest in shares, or at least don’t start until later in life. But it’s important to build up a portfolio as early as possible.

Crippling our retirement funds is very easy to make. I’d like to add one more important tip: regularly maintain your savings – Monitor risk, asset allocation and diversification.

The best thing to do, if you’re not financially literate, would be to consult witha professional at least once a year.

Lots of people nearing retirement age now thought they would have a pension and a 401k that would provide them with a decent retirement, and then corporations started to underfund pensions, default on pensions, get rid of pensions, and so on and so forth. But its amazing what you can do in even ten years if you put your mind to it. The truth is, there are no guarantees in life, period, but understanding how money works can help you get the most out of it. Thanks for some great advice.

I find that a lot of this advice is echoed in many places, but they seem to fall on deaf ears quite often.

I have “argued” the benefits of matching 401k contributions with many colleagues who still refuse to put money into a 401k. It’s quite possible that they feel “less control” over such an account, being as it is an employer sponsored account? I don’t get their logic, but the main complaint I’m hearing is that their money gets “stuck”.

I guess long term savings doesn’t sit well with some folks and can be a foreign concept. Having money in liquid form and within reach is a preferred avenue for many.

I am 22 now. Do you think I should get a pension plan now? Grrr I’m getting old lol

I would like to retire from the job I don’t like and do the one I do like forever!! I think Wayne Newton’s got the right idea – he found the job he wants to do forever. 🙂

The only thing “retirement” means to me is that it’s a point where I can live off of the income of my previous work and thus I can make choices about how I spend my time that don’t use income as a factor. That, to me, is what retirement is.

I skip the 401K contribution because for the past 3 years, the 401K for my employer has lost more money than the employer contribution would be. So, it’s not really free money. It’s just another way to lose money.

sick of my job and the people iwork with for the pass 30 years. stressful changes in my career have put me in a position such that i would like to retire as soon as possible but without a steady job i cannot meet my financial commitments. i don’t know what to do. any help

Harry,

You need to work on Plan B. Begin developing an alternative source of income (or several of them). Cultivate them while you still have a job. Then take a leap and focus on your new work after it starts returning income. This is what I did with my own situation.

I was employed in a 9 to 5 job for 18 years (I actually still enjoy this kind of work and may return to it again someday, if the tech industry will take me back 😉 ), but then I started blogging on the side. After developing my blog, I was able to turn it into more of a business. I now run my own business full time as a pro blogger.

But I did make a miscalculation — I expected to be “retired”. Well, it turns out that what I’m doing for my blogs is far from retirement. It’s even more work than when I was employed 9 to 5. I thought it would be easy, but no, it isn’t. In order to sustain this business (any business?), it takes work, dedication and desire. But the good news is that it’s work I love to do. Though maybe one day, I’ll take a break from this and go back to the nine to five once more . 🙂

Choose a cheap place to retire – like a tropical island in the 3rd world where you can live on US$10 a day. regards.