So how long do you think you will live? I am thinking I will make it to age 81. Well, if I’m lucky. My grandmothers lived to be 88 and 93 so that’s pretty good. The men in my family have all passed in their 60s or 70s. Uplifting thoughts, huh? Morbidity aside it really is important to think about your life expectancy and whether you are really ready to live for a century.

The following table shows the chances that an American man or woman will reach the target age specified, given that they’re currently middle-aged (in this case, that age is 40). If you’re looking for something more accurate, you can do a search for a mortality or longevity calculator. These statistics are for the “average” man or woman and do not really account for things like genetics, lifestyle, etc.

So, what do you think your chances of living to a hundred are? Of course, the fairer sex always wins this particular “race”, if you see it as such. Here’s how it generally breaks down:

Life Expectancy Rates

|

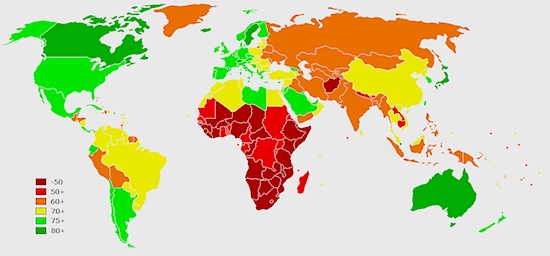

Following is a Wikimedia map to see what life expectancies are like around the world. If you can’t make out the label and details, just click the graphic and it will expand to a larger image. Basically, this is what the colors break down to: Dark Red = life expectancy of under 50 years; Red = life expectancy of 50 to 60 years; Orange = life expectancy of 60 to 70 years; Yellow = life expectancy of 70 to 75 years; Light Green = life expectancy of 75 to 80 years and Dark Green = you’re expected to reach 80 or older. Well isn’t that interesting! People in Australia and Canada on average, live the longest?

The good news is that there are more centurions alive in America today than in the past, and the U.S. has been in the forefront of medical advances. Also, lifestyle changes and diet allow us to increase our chances of living longer each day. The flip side of this are the issues posed if we do beat the odds: not many of us may be financially prepared to live long lives. For some of us, it would have a potentially disastrous effect on our families.

For instance, a poll by Money Magazine found that 3% of respondents worried about losing their health, 69% of losing their mental abilities, and 60% of running out of money. Where do you fall? What worries you most? Personally, my biggest fears are that of losing my health and running out of money. Not necessarily for my sake, personally, but because I would most likely become a warden of the state or a burden on my family or both.

Financial Retirement Planning For A Life Expectancy of 100

Let’s go through a few issues involved when planning for the distant future. Here are a few considerations I found important:

1. Review life expectancy numbers.

Of all the assumptions made in financial planning (inflation, rate of return, tax brackets, etc.), your life expectancy is probably one of the biggest of all. Using the wrong number can be detrimental. I would always suggest using a higher number than you think. The averages listed above are just that, averages. They do not reflect anything about diet, exercise, family history, etc. I have always focused on the century mark as a “worst” case scenario.

For instance, based on your projections, you may want to ask yourself: how would you fare should you live to a 100? But, this is the part that truly becomes overwhelming for people. Here’s an example I’d like to run:

Using the landmark ages above (85, 90, 95, and 100), how much would you need to cover your expenses should you spend $75,000 a year currently? The answer (excluding social security or pension payouts) would be $2.5 million (age 85), $3.6 Million (age 90), $4.6 million (age 95) and $5.9 million (age 100).

Those numbers look daunting for anyone. It’s no wonder that people run and hide from planning and avoid trying to provide for their future. But, with the proper planning and due diligence on your part, these numbers seem less awe inspiring. For instance, there are other considerations you’ll need to make — perhaps your expenses may not be that high, or you may be expecting social security and/or pension payments that will supplement your portfolio earnings. Some of us may even consider working past retirement, and may therefore need less. But the point of all of this is to have some idea and plan for it.

2. Visualize your retirement years.

I think it’s a good idea to visualize your retirement years as definitively and concretely as possible. This will help you narrow down exactly what your expenses will be. Part of that is knowing where you are going to live (check out this piece on best places to retire for cheap).

Don’t make the mistake my parents made by moving to some remote area in Colorado. Not only are their winters rough, but access for family members flying in for support is harder and expensive, medical care is less abundant, and networks to nurture and support their older days are few and far between. They also did not think about the practicality of living in a farm house structure. While charming in its own way, it offers a host of challenges for my father’s health now and will become more problematic when they reach their 70s and 80s. Of course, they retired in their 50s and did not think of these things. So, please know where you will live and why.

3. Don’t underestimate your retirement expenses.

You also don’t want to underestimate your retirement expenses. Many people assume that they will spend around 85% of their current expenses in retirement, but that’s pretty arbitrary. You must factor in again where you will be living, your expected lifestyle, getting help as you age, and the huge costs of healthcare. All these factors can lead to your retirement expenses (or income need) being the same or even higher than when you were working.

Some scary statistics from the Employee Benefit Research Institute study showed that a 65-year-old today would need to have socked away at least $122,000 to have a 90% chance of fully covering his or her future healthcare costs. And, that’s with employer-sponsored retiree insurance. As if retirement wasn’t hard enough for many people. So check if you’ve saved and invested enough for your retirement. Make sure to factor additional costs in and try to become properly insured to cover the extras (long-term care, etc.) Otherwise, as you reach the century mark you may easily run out of money.

So, how long do you think you’ll be around? How does that factor into your planning and your current savings and investment plan? Please do yourself and your family a favor and get as specific as possible about your retirement plans. You will most likely be around a lot longer than you think and you want to be prepared.

Created March 8, 2010. Updated June 24, 2012. Copyright © 2012 The Digerati Life. All Rights Reserved.

{ 12 comments… read them below or add one }

It is pretty dang daunting to see how much moola it will take to retire. Phew. My hope is that we can pay off our mortgage early enough to stash extra cashola during some golden years. The hard part is guessing at what you will need in terms of long term care facilities. Or even retirement living. I wouldn’t want to be a burden to my kids in my old old age, but I would also want to live in a pretty dang nice retirement facility too! Phew. Lots to think about. Time to go find some more money to save!

Yikes! I’m Canadian. I’d better get saving! This article certainly is an eye-opener. Thanks for the great information!

Happily futuristic 🙂

I’d really better start saving then! I guess it really is never too early to start saving for your retirement. Now, time to find a good place to invest in.

It’s scary to think of how much you really need in order to live at your current level once you retire. You made some very good points here – bookmarked this post.

When I start to think about my retirement savings, I get the heeby jeebies!!

Retirement is expensive! This is why it’s important that you continue investing and saving. Even if you have a 5 million dollars in savings and you have everything planned on how you’re going to spend it for your retirement, it’s not going to be worth that much 10-20 years from now. By the way, I’m also surprised about Canada and Australia’s results.

I hope I don’t live to 100. Retirement is already to expensive as it is. Saving enough money to be a retiree for that many years will be almost impossible for many people.

Don’t get played by the likes of Lehman and their fraudulent accounting. Put your retirement money into safe and secure investments.

Another thing to think of is the coming technological revolution, what some guys call the “Singularity”. Whether you believe in it or not, it’s predicted that at some point medical technology will advance to the point where life expectancy will start increasing faster than the progression of time. So, for example, in one year that passes by, your life expectancy will increase by two, thanks to new medical technologies and treatments.

Once this happens, it’s a whole new ballgame…

I am planning on living into my 90s since my mother lived to nearly 99 years old. I would rather plan for a longer time and have too much than the opposite.

Yikes! 70+? I’m not sure if I want to live that long. I only hope I’ll be healthy but recently I doubled my monthly savings for my retirement. I plan to save 3 times more than the recommended amount. Underestimating expenses at retirement is the biggest mistake! Great post and visuals!