Could your investment portfolio use a dose of bonds?

We often cover the world of equity investing here, and we’ve also discussed safer investments like the stable certificate of deposit. This time, we thought to cover some fixed income investing basics. I suppose if we categorized all the investment information out there (and there is a lot), the amount of attention given to bonds would probably be dismally low compared to the attention given stocks. Why? Investing in stocks and equities seems more glamorous and exciting. Bonds are boring and predictable. It’s no surprise, then, that many people invest much more heavily in equities than in bonds. However, glamor aside, I have found that the average investor really does not truly understand bonds.

Investing In Bonds: Make Money The Boring Way

Bonds are essentially an IOU issued by a given entity where you are really providing a loan in return for the promise to be paid your money back, plus interest over a period of time. Bonds can be issued by the federal or state governments, municipalities, schools, and corporations as a way to raise money. Each issuer, like you and me, has their own credit rating. In return for your loan, you as the investor can hopefully reap the benefits of a return of your initial investment plus a stated interest rate. Because of these factors, bonds are considered to be an income producing investment (from the interest) that’s more conservative than stocks.

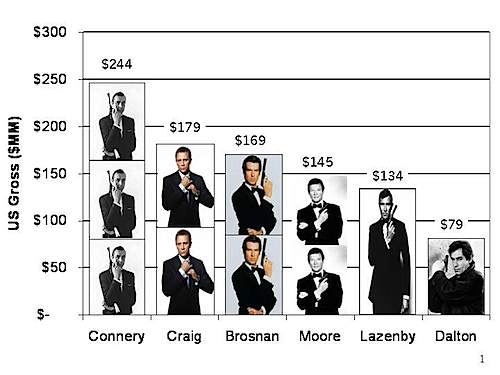

These (James) Bonds made money for their investors. Yours can too!

These (James) Bonds made money for their investors. Yours can too!

Why Should I Invest In Bonds?

Perhaps you’ve checked the best cd rates available and you’re interested in higher returns, but with less risk than what you’d get with equities. Are bonds the ticket? People tend to think of bonds as the ones they were given at birth (savings bonds worth a whopping $50 at age 35) or something designed for only the older and most conservative investor. However, I would contend that nearly everyone should consider bonds for at least a portion of their portfolio.

There are three main reasons why.

1. First, bonds are a good hedge against stock market fluctuation and tend to perform in an opposite manner. So, if your stock portfolio is not performing well, hopefully your bond portfolio is; hopefully your bonds are at least holding their own. Of course, what your stock to bond ratio should be really depends on a number of factors such as your age, tolerance for risk, and so forth.

2. Second, bonds can provide a fairly consistent stream of income for those who need it. And, those who don’t currently need income to live on can instead use that income to reinvest into other investments.

3. Third, having a balanced portfolio not only reduces overall portfolio volatility, but also stops you from trying to guess when to be in or out of the market. More often than not, it’s best to keep a balance within your investments and “hold the course”.

What’s The Risk?

There are two main risks that are associated with bonds.

1. The first risk has to do with the bond issuer, and how creditworthy they are. This is often referred to as credit or default risk. Generally speaking, who is most likely to pay you back, the old US of A or the struggling corporation with no earnings? You get it…. This risk can best be mitigated when you purchase bonds from high quality issuers that are rated by third party rating agencies like Moody’s and S & P, and when you diversify your bond exposure among several issuers rather than just one.

2. The second main risk is interest rate risk. Bonds are sensitive to changes in interest rates because bond prices move in the opposite direction of interest rates. Here’s a simple example: you buy a bond for $1,000 that pays 4% interest. If, hypothetically, prevailing interest rates are 4% then rise to 5%, then most new bonds issued will pay a higher rate of interest than yours. Therefore, the inherent “value” of your bond goes down. Investors would obviously want to purchase newer bonds with higher rates than yours. So, if you wanted to sell your bond you would have to sell it at a discount. This risk can be reduced by having bonds of different maturities (diversifying with short-term, medium-term, and long-term bonds) or by holding a bond till maturity. Short-term bonds have less interest rate sensitivity than long-term bonds.

How Can I Get Started?

Any online broker, mutual fund company, bank or other financial institution can help you trade bonds. There’s quite a variety of bonds available for purchase — government, corporate, junk, etc. Or you can also buy bond index funds or ETFs. Check out your favorite discount broker, bank or fund company for more information.

A note on pricing: when brokers act as principal on a fixed income transaction, a markup is included in the bond price; but if the broker acts as agent, they charge a commission. The industry average markup or markdown per transaction is 2.5% to 5% built into a bond’s price. Also, if you intend to purchase bond mutual funds or ETFs, then pricing for these types of products applies instead. Here are some places where you can trade bonds:

|

Misconceptions

Frequently people complain that bonds “pay too low” or contend that it is the wrong time to invest in bonds. The technical side of this is a bit beyond the scope of this post (perhaps another day), but on both of these accounts, investor sentiment ignores the inherent purpose of having bonds in the first place — to counteract and balance our stock portfolio with lower risk investments and/or to provide a source of income. Whether the yield is low or whether we think that the timing is wrong is irrelevant to the overall, long-term health of our portfolio.

Though boring, perhaps it’s time to consider adding bonds to your portfolio if you haven’t already. The extra level of diversification they offer will help create a more balanced portfolio that will take the guess work out of investing and add a bit more stability to your returns.

Contributing Writer: Todd Smith, CFP

Copyright © 2009 The Digerati Life. All Rights Reserved.

{ 16 comments… read them below or add one }

I don’t find much appeal in bonds, except for inflation-protected bonds.

My view is that stocks offer the best long-term value proposition. So I prefer to go primarily with stocks except at times of insane overvaluation (which unfortunately happened to apply for the entire time-period from 1996 through 2008). At times when stocks offer a poor long-term value proposition, I want to be in the opposite of stocks, an asset class that assures that I will be at least maintaining my initial investment value (so that I can move that money into stocks when the long-term value proposition for stocks is again appealing). That’s inflation-protected bonds (either IBonds or Treasury inflation-Protected Securities).

My view is that bonds became popular at a time when inflation was not a big factor and when inflation-protected securities were not available and that they are now an outdated asset class for the typical middle-class investor. The objection is not that they are boring. It’s that they are neither the best growth asset class (that’s stocks) not the best safe asset class (that’s TIPS or IBonds). I see bonds as an in-between asset class that no longer serves a purpose not served by the two essential asset classes (stocks and TIPS).

Rob

This article gives some basic fundamentals in bond investing. However, if you buy bonds issued by a corporation you can get higher returns. For example, I bought a 5 year bond issued by GMAC paying just over 5% when typical CDs where paying around 3% in 2004. Of course I was sweating bullets in 2008 wondering if GMAC would make it. They did and I got all my money in 2009.

Bonds in the US govt are very safe. If the government defaults we have a lot bigger problems than the small amount you have in your bond and I would worry more about the big picture.

Generally I agree, it would be good to have some of your portfolio in bonds.

When my father died, he changed the terms of his will because he disapproved of my having left my husband. Instead of setting up a trust for his wife so that she would get the proceeds of his investments, leaving the principal untouched, he had several thousand bucks a month doled out to her — he did this because he was afraid if he left the entire amount to her in one lump sum, she would promptly donate it all to her church, a prospect he abominated. I was to get whatever was left, but since her mother lived to be over a hundred, he figured she would easily outlive the principal. As an extra slap in the face, he made me the executor of this arrangement, which would have drained the principal to zero in a little more than three years.

My financial adviser had me move the money out of CDs, where my father had stashed it, into a short-term corporate bond fund. This returned about a dollar or a dollar-fifty for every two dollars I had to disburse. Because bonds are considered a conservative investment, no one could challenge my fiduciary responsibility to my father’s third wife.

She lived another three or four years. By using this strategy — and by paying myself the maximum amount I could justify as a fee for managing the estate — I managed to preserve about 60 percent of the inheritance.

I continue to hold a portion of my portfolio in bonds, which provide a degree of stability to your investment strategy. It’s crazy to put everything in stocks.

Interesting article. I guess I never really thought about bonds. I do invest in the stock market so maybe I should broaden my portfolio with a few bonds. Thanks for the info and links!

I love the James Bond reference. Nice job there.

The only difficulty that I have investing with individual bonds is the cost to get in and diversify properly. If you want to buy a bond then your minimum purchase cost is usually in the $5k or $10k level for a single purchase. Then to diversify you should have 10-20 different bonds. That means you’re in for $50-100k minimum. If you’ve got that amount to invest then fine. But if you’ve only got say $10k to invest then you’d be taking a risk to throw it all into 1-2 bonds. Even good, healthy companies can fall on hard times and default in a few years.

I’ve got about 8% of my portfolio in bonds, although I keep questioning if that truly is the smart move at only 31. I’m thinking I’m losing for the sake of some security that won’t be there if the economy collapses anyway.

Rob, Did you actually use your timing system to catch the S&P500 at the bottom, and lock in the 48% gain from there? If so, I might be ready to buy your newsletter!

I was really hoping Brosnan would be the best… he is the best Bond!

Bonds can be completely boring at times. The coupon rates which are affixed to government bonds can make them a tad enticing though. Check this out.

Regarding the James Bond reference — I grew up with Roger Moore playing the character. But I’ll have to say that for me, Brosnan is the best fit. He’s what I always imagined Agent 007 would look like. 🙂

As for investment bonds — they’ve done well for us by adding balance to our portfolio during the past few crazy years. They were a great cushion for us when the sky was falling on the financial industry not too long ago.

While your article gives a strong case for bonds, I would still go for stocks if asked to choose between the two. But I don’t want to invest in penny stocks. I’d rather go for low market cap stocks with lots of value. I also agree that stock market is more exciting. But it’s exciting because it’s risky. So unless you have $5,000-%10,000 to risk, it would be best to stay away from it.

Rob, Did you actually use your timing system to catch the S&P500 at the bottom, and lock in the 48% gain from there? If so, I might be ready to buy your newsletter!

I don’t have a newsletter, NoGuru.

Nor do I have a “system.” All that I recommend is that investors take into consideration the price at which stocks are selling before setting their stock allocations. Is it a “system” when we take the price of cars into consideration before buying them? Or sweaters? Or comic books? Or bananas? I sure don’t think so.

The “system” language is the product of the hundreds of millions of dollars that The Stock-Selling Industry has directed to the promotion of Buy-and-Hold Investing. The idea is to persuade middle-class investors that stocks are the one thing that we buy for which we do not need to look at price. I don’t buy it. And the entire historical record shows that I am right to be skeptical of this exceedingly self-serving (and, frankly, astonishing) claim.

There might be some short-term profit potential for The Stock-Selling Industry in persuading us all to invest ineffectively. I see no benefit to the middle-class investor. And my person view is that The Stock-Selling Industry gets hurt too when the reckless promotion of Buy-and-Hold sends the entire economy into a deep recession or depression. Who is left to buy stocks then?

If you check my podcasts from March 2009, you will see that I was indeed letting my listeners know that stocks were priced at that time to provide good long-term results. I don’t offer predictions of short-term performance because there is a wealth of research showing that short-term timing doesn’t work. The people who bought stocks at the prices that applied in March 2009 are not smart because we have seen a price run-up in the months since but because they bought at a time when the long-term value proposition was strong. That’s what matters, in my view, not these temporary price gyrations that most investing “experts” made so much fuss about.

And, yes, that last insight came to me via a wonderful (and yet flawed, like all the humans) “expert” going by the name of John Bogle. Bogle got very, very important stuff right and Bogle got very, very important stuff wrong. Both things happen to be so (in my assessment!).

Rob

Can i buy an put option on a bond future? or a call? And is that Bond index reflecting Price or Yield?

Rob replied: “I don’t have a newsletter, NoGuru. Nor do I have a ‘system.’ ”

There is a problem with your reply, Rob. First, I think you claim to be of the Behaviorist school, yes? Yet, your waving away of having a ‘system’ as if that was synonymous with ‘scheme’ or ‘con,’ is incorrect. Most fee-only advisors (which I would recommend you consult with) properly ask their clients to begin with a WRITTEN investment PLAN. This plan starts with their current assets, their overall goals – like retirement age, their investing ‘style’, their risk threshold, the things they wish to accomplish – like funding vacations or children’s education, etc. This, is a system.

In short, my own use of the word ‘system’ is generally not used in any pejorative sense, but is merely reinforcing that for myself, professional planners, and for successful investors, the need to decide ahead of time what the philosophy and such is, will be your best guard against just what you appear to be doing — deciding ad hoc and on a real time basis, and without a pre-thought formal plan, whether to recommend buying, selling, or staying put.

You appear to have written a book on saving whose ideas were well-received. In that book, you laid out your own budget, plans, and techniques for saving to reach your goal. That is exactly the same technique that needs to be carried forward from saving to investing. I’m surprised you don’t use that method, since it served you so well in the savings effort. Rob, why don’t you post your budget and your investment plan (meaning what you intend to do going forward, with specificity) any longer? It seems that if you hope to garner any sort of credibility at all, that would be the first step.

Good luck in any event, and I suggest you not only take the Behaviorist’s slogans, but that you also actually read and consider their books in-depth, and consider what techniques they recommend are available TODAY in order to offset human nature to panic at the worst possible time. My own research finds that they tend to lament the inability to do better than buy a well diversified mixture of stocks and bonds, and hold them for long periods of time.

Thank you for submitting your article to my weekly Financial Independence Compilation. Hope to see another one soon.