Learning to invest? We cover some of the basics of stocks, mutual funds and ETFs.

If I were to ask 10 everyday people to tell me what they think of stocks, ETFs, and mutual funds, I bet the results would look something like this:

- All of them would have some preconceived notion about stocks.

- Most of them would have heard of mutual funds.

- And maybe 1 or 2 would know about ETFs.

Interestingly, the ETF, although widely unknown, is one of the fastest growing investment products in the financial realm. But let’s take a look at all three of these financial vehicles and see how they stack up.

The Scoop On Stocks

First, although in a strictly legal sense, a person who owns a share of stock doesn’t technically own a small piece of the company, it’s quite alright to think of it that way. Other than cash, a stock is the purest way to invest because it is a direct investment in one company. This can be both good and bad. It’s good because when good fortune follows that company, the investor will reap the rewards of that good fortune. The downside is that an individual stock exposes you to financial risk and is vulnerable to the effects of negative events at several levels: a stock is sensitive not only to shifts in the market but also to shifts in the underlying industry and company it represents. In order to control risk and have a reasonable shot at making money, an investor must diversify. This is impossible with a single stock so it is not advisable to have all of your money in one basket, so to speak. For more on this subject, check out our stock investing tips and our advice on how to trade stocks.

The Matter With Mutual Funds

There are two ways to ensure that your investments are adequately diversified, other than buying a fistful of unrelated stocks: you can choose to own mutual funds or ETFs (exchange traded funds). Many of us happen to be very familiar with the mutual fund as a type of investment that’s made available to us through our retirement plans at work. If you have a company sponsored retirement account such as a 401K, you probably own shares of a mutual fund. There’s the kind that’s actively managed and then there are the uber popular index funds. In both cases, there are baskets or collections of investments that form the fund. Think of them in terms of a puzzle. There are many pieces that come together to make the picture. There is a manager of the fund who is buying and selling mostly stocks and bonds for the fund in an attempt to make you money.

Image from Fidelity Investments

The sad truth is that these fund managers are largely unsuccessful about keeping pace with the market (forget about beating it!) because the fees that are charged to the customer (you and me) wipe out some of the gains made by these funds. In other words, fund managers must achieve extra gains just to make sure they’re able to cover the fees and charges that go with operating and managing their funds. But here’s the bright side: investing in mutual funds is a great investment strategy for those investors who do not have time to follow their money closely. Stock mutual funds (particularly index funds) are a nice step above extremely safe high interest savings accounts and money market funds, and a great way to get your feet wet with equities.

Exchange Traded Funds or ETFs

The ETF is similar to the mutual fund in that it is a basket of investments that’s often quite specialized. Just like mutual funds, ETFs have a particular investment focus. There are ETFs that are only made up of technology stocks, or energy stocks. There are those that follow the movement of the Chinese economy and those that track a basket of commodities like corn and wheat. While ETFs are traded on an exchange throughout the day just like a stock, a mutual fund only trades at the end of the day.

ETFs do have managers but they are not managed as actively as some mutual funds. Most of the underlying stocks stay the same over time which helps keep the fees on these funds much lower than what you’ll experience with many mutual funds.

Much like mutual funds, ETFs work well for the retail or part time investor because they have some diversification already built in, given that they represent a collection of stocks (or other assets). With an appropriate amount of research and patience, you may find that owning ETFs can be a successful investment strategy; these assets can certainly become a healthy part of your portfolio.

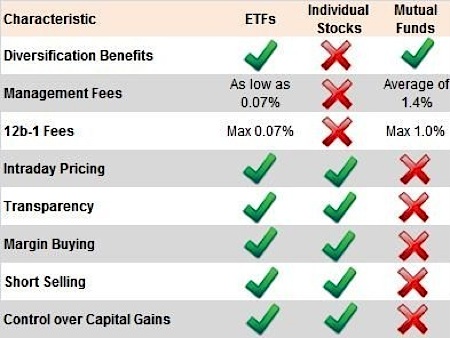

For a quick visual comparison of how stocks, mutual funds and ETFs compare, here’s a table I’m shamelessly borrowing from the ETF Database, a great resource for everything on ETFs:

So Where To Invest Your Money?

I and many others believe that you should think of your investments in two parts: your retirement money and your discretionary money. My opinion is that the best place for your retirement money should probably be in mutual funds. Your money should be in a mix of safe funds and relatively more aggressive funds depending on your age and how close to retirement you are. Although mutual funds may not soundly beat the market, they do tend to track it closely — particularly if they’re index funds — so over time, you can expect to accumulate a healthy retirement if you leave your accounts alone. I would certainly not take egregious risks with my retirement money.

As for the other portion of your assets — your discretionary money — you can place this in any investment you feel comfortable about, whether it be in stocks, ETFs, mutual funds (or in bonds, REITs and other asset classes) but I’d be careful to do sufficient research before taking on any risk. The important thing is to stay well-informed, diversified and realistic about what you can earn from your investments. Keep in mind that whatever you invest and put at risk shouldn’t affect your family adversely should losses occur due to a bad decision.

Take a look at all these types of investments and decide what is appropriate for you. If you don’t feel comfortable making that choice, talk to a trusted expert in your area. And learn as much as you can.

Contributing Author: Tim Parker from Elementary Finance

Copyright © 2009 The Digerati Life. All Rights Reserved.

{ 15 comments… read them below or add one }

Having a strategy in the stock market is very important. You should know when to buy a stock, your selling price and how long you will hold the shares. When you choose a strategy follow its principles and don’t change your strategy every day. Many traders who lose money don’t sell the stock and continue to hold it till the stock price returns to the price they have bought.

I had no idea what ETF’s were. Thanks for informing me.

The important thing is to stay well-informed, diversified and realistic about what you can earn from your investments.

That’s harder than it looks.

My view is that today’s knowledge of how stock investing works is primitive. Important research has been done in recent decades. But many of today’s “experts” are reluctant to consider the implications of the most important findings. So we are in a Twilight Zone re our understanding of what really works.

The other side of the story is that we all need to invest in stocks if we hope to finance decent retirements. We badly need to learn but we are not yet in a place where as a community of investors we are open to learning experiences. What a mess!

Rob

Just curious: in what strict legal sense is an owner a share of (common) stock not the owner of really small piece of a company?

Great advice, this is an excellent resource. I didn’t have much knowledge of ETF’s before and only had brief knowledge of mutual funds. Keep the info rolling!

Frank,

I know what you mean. As far as I know, if you own a share of common stock, technically speaking, you own a small piece of the company that issued the stock. Now, as someone who’s hosting this article, I of course, was tempted to question this statement (by our contributor, Tim). But instead, I thought to maintain this aspect of the post as is and have Tim (our contributor) share with us what he actually means. I’m opening the floor to him for a response. It’s interesting to note we had the same questions in mind.

I think the ownership issue can be broken down into pieces based on the type of stock you own. If you own common stock, it gives you voting rights, usually, and a right to profits distributed; whereas with preferreds I believe you don’t have voting rights but are higher up on the payout scale (in case of bankruptcy, etc., you’d be paid before the common stock holders).

It could be that until you hold more than a certain percentage of the company’s stock, no legal distinction kicks in to say that you’re entitled to any say over the company’s management, etc., etc,. Someone who took corporate investment finance in their MBA should know the exact answer to this…. in other words, I think Tim is right – it’s fine to think of yourself as the owner if you actually possess the stock in your own name. If you just hold it through your broker, it will be held in your broker’s name. And until you own enough of it anyway, for all effective purposes you’re not an owner since you have no management influence. That’s what I would think.

I wish I knew a trusted expert in finances. I don’t really trust anybody, they seem to all have a stake in where my investment money goes. And I don’t feel like I have the time to be as well-informed as I’d like to be.

My version of diversification includes real estate in my retirement, and while that’s also dependent on a larger market, it seems safer to me because people will always need a place to live….

I believe ETFs are a great investment vehicle. They have all the advantages of MFs, and more! The biggest advantage is the low charges, that can make a huge difference in the long term.

Frank asked: Just curious: in what strict legal sense is an owner a share of (common) stock not the owner of really small piece of a company?

The best way to think of it is this: You hold no real rights even if you have partial ownership in a company. If stockholders were truly owners, then wouldn’t they be liable if the company were to fall into debt? I think of it more as getting interest out of lending the company our money, rather than us, actually buying and owning a piece of the company. My source is “Real Money” by Jim Cramer, page 33.

The other place you can see it is in the payout hierarchy. Should a company go bankrupt, the bond holders get paid before common share holders. If those with common stock actually owned an interest in the company, what would be the reasoning behind that?

ETFs are the wave of the future. They allow investors to participate in the rallies of commodities without the extreme risk of the futures markets. They give leverage to investments because they have options attached to them. They can be short sold with no uptick rule either. My favorite is USO which tracks the price of oil.

ETFs are definitely worth considering over normal funds given their cost structure – the only question that we are currently discussing is if “buy and hold” strategies will stay the right investment strategies at all given further increased volatility in the markets.

Thank you for writing such an informative article and especially for explaining ETFs. I am interested in investing in ETFs but am unsure of exactly how to go about it. Any help would be greatly appreciated.

ETFs are an ever safe mode of investing, and I would most certainly recommend them over normal funds

I rather enjoy ETF’s for things like options trading. They are much easier to track then stocks but lack some of the growth potential.

As far as what Hank says, I don’t know if I’d go so far as to say they are safer, but they are easier to track and more diversified. Any risk that happens will occur less quickly, but all the same. If that makes it less risky for you, then by all means, take fewer chances!

Great post by the way.