If you haven’t heard of them before, SmartyPig offers a savings product that allows you to earn a relatively good rate. These days, this type of return is a little harder to come by for a safe, liquid account. But what’s great about SmartyPig is that they encourage building solid financial habits, with the help of their savings system. You can, of course, compare SmartyPig with other accounts with top interest rates, but you’ll soon find that this product has unique features and a great return that stands out in this current economic climate.

So What Exactly Is SmartyPig?

SmartyPig represents a new twist on online bank accounts. It’s an FDIC secure free online savings account that is meant to encourage you to save for your financial goals in a more concrete fashion and which allows you to invite others to contribute to your savings goals as well. It reminds me of Upromise, because it invites the possibility of sharing a savings goal with family and friends, thus turning the task of saving money into a social activity, if you so choose.

Is this any different from having a savings account like ING Direct Orange Savings Account, for instance, which lets you categorize your funds by using subaccounts? It is, in the sense that the emphasis is on getting you to automate your savings program for the clear purpose of reaching particular goals. Certainly, there are many ways to fulfill this same end, but in my opinion, SmartyPig makes it more visual and interesting. To see what I mean, let’s review some of their specific features.

SmartyPig Savings Account Features

Here are some of the advantages of having a SmartyPig savings account (or online piggy bank):

1. Get a free account.

This savings account is FDIC insured. It’s a great way to save automatically, if you link this account to other checking and savings accounts. Get started with a $25 deposit.

2. Save for your goals.

SmartyPig is a savings account and scheme that allows you to set savings goals that you fund. This savings vehicle aims to help you visualize and focus on your savings goals. Once you create an account, you can then add any number of goals and manage them. As mentioned, the purpose here is to set up an automatic savings program to get that goal funded. Your goal should be of an amount between $250 and $250,000. SmartyPig allows you to calculate a timeline by which you can reach your targets. It’s basically a high yield savings account with savings tools built into one environment.

SmartyPig Goal Details

SmartyPig Goal Details

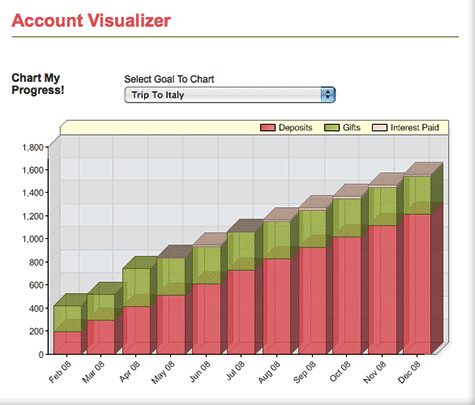

Visualizer Feature

Visualizer Feature

3. Use the SmartyPig Cash Rewards Card to earn cash back towards your goals.

SmartyPig now has a prepaid reloadable card that allows you to earn cash back as well. You can get up to 10% in rewards or cash back just by shopping at certain retailers that are affiliated with SmartyPig while using this card. The cash back you earn can be used towards building your savings account and reaching your goals.

4. Redeem your savings.

Once your savings goal amount is reached, what then? Well, your recurring contributions will stop and you’ll have the choice of redeeming your savings in one of three ways (or a combination thereof):

- Once you’ve met your savings goal, you can expand your buying power by shopping at one of SmartyPig’s retail partners. Apply your savings to a retail card such as Macy’s, Amazon.com or Travelocity to receive up to an additional 12% on your money. This way, you’ll get additional cash boosts.

- Put your savings on the SmartyPig MasterCard® debit card.

- Or return the amount to your bank.

Redeeming Your Savings

Redeeming Your Savings

So upon reaching your savings target, you can take your money plus interest and use it however you’d like.

5. Earn a good rate on your savings.

The interest rate you’ll get by saving with SmartyPig is reasonable and competitive. It’s in line with what you’ll receive from high interest savings accounts these days.

6. Have others contribute to your savings goal.

This is where SmartyPig distinguishes itself from any other savings account. You can speed up the process of reaching your goals through the help of social media! SmartyPig can help you share your savings goals with friends and family via your social network. You can link your SmartyPig to your FaceBook or Twitter account, use a widget to show your goals and progress via your blog, or send email to inform people about how they can contribute to your special goals (such as a wedding, baby shower or other event). Anyone with a SmartyPig account is conveniently set up to receive cash gifts. A cash gift is a practical option you may want to consider when a birthday or a holiday rolls around.

Social Features: Facebook, Twitter, Email

Social Features: Facebook, Twitter, Email

Other nice extras include their integration with well-known money management sites like Mint.com, Wesabe, Geezeo, etc., as well as the availability of a mobile interface.

In conclusion, I think that while SmartyPig has some redundant features that you’ll find in other savings and spending tools that are already available out there, I do think it’s a great vehicle for those who would like to get truly focused on saving for a purpose. It provides a clever savings set up for anyone who needs a little extra help and motivation to save. And it’s worth signing up for if you’ve got generous friends and family!

Copyright © 2009 The Digerati Life. All Rights Reserved.

{ 8 comments… read them below or add one }

That’s an awesome name! I wish I was in the meeting in which they decided to name their bank this 🙂

It is automatic savings that really make the difference, it takes away the possibility of “waiting until next month” to do it.

John DeFlumeri Jr

I will check it out, but I am pretty happy with my current ING account.

-Dan Malone-

Having it automated and systematic makes all the difference! On top of my regular automatic savings I have an ING account where I transfer another $100 a month that I never check. As time flies by it is amassing quite the nest egg. The faster time goes the more I save in that extra account at a high interest rate.

Dave

First time I’ve actually stopped to read about Smarty Pig. It’s a really interesting concept, and I think it will gain a lot of traction in the social web.

One of the features that intrigues me the most is getting another 12% if you select the gift card option. I already do a lot of my shopping at Amazon, so getting 12% in free money is a big proposition.

Good review. I like SmartyPig quite a bit. It usually boasts the best interest rates of any of the online banks I usually use, and it’s pretty easy to use. Thanks for sharing your thoughts.

Love SmartyPig. It’s helped me stick to my savings goals and it does a better job with keeping me focused on things of higher priority. I tend to want to spend whatever money lands on my lap, but SmartyPig keeps me honest.

I think that there’s nothing much that’s new here in terms of features and rewards. For instance, debit cards come with most savings accounts these days (e.g. HSBC Advance or Perkstreet account) and you can get cash back reward savings with similar returns from a shopping site like Ebates.