We do some math and perform calculations to show who’ll make more money: a college graduate or a high school grad who decides not to attend college. The answers may surprise you!

“When I get my first college scholarship, my destiny will be etched in gold. With a college degree in hand, I will surely take the world by storm.” This is how many new graduates feel when they finally leave the hallowed halls of their University. But just ask many educated folks today — the sense of optimism you get from getting a college degree is tempered by the “new economy” and looming student debt. These days, we all wonder if getting an education is worth it!

The truth is, while a college degree definitely expands your educational parameters, there is no guarantee of employment upon graduation. This is particularly the case for popular majors that aren’t so marketable in real life or that is experiencing a glut at present. Recently, law degrees were being slammed in the media as being less valuable. In fact, in general, the feeling is out there that the value of a college degree is on the decline and it’s a frightening thought: the reason is that tuition costs are rising faster than inflation and a lot of students now finance their stints at college.

Who’ll End Up With A Bigger Nest Egg?

Making The Case For The High School Graduate (With No Higher Education)

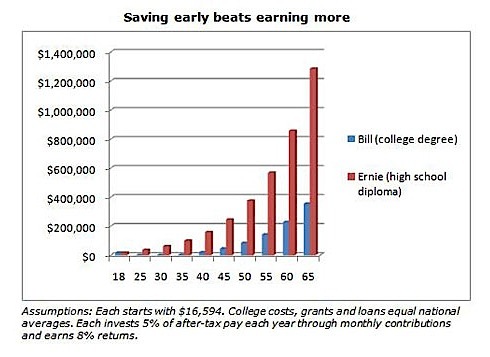

I was particularly taken aback by an example that argues against going to college, given some basic assumptions. This SmartMoney author admits to using a “crude” case study, but it does give you a lot of food for thought if you are thinking about taking on student debt.

Sources: money.msn.com & smartmoney.com

Sources: money.msn.com & smartmoney.com

The case study involves two people, Bill and Ernie (both 22 years old), who start off with a base savings of $16,594. Bill, the college grad, leaves college with a degree and rings up $34,044 in school costs. Ernie has no such costs but invests his $16,594 lump sum right off the bat in investments that yield 8% annually. Bill’s loans have a 5% annual interest but he earns more than Ernie during their entire work lives. Given some assumptions, we are shown that by the time Bill and Ernie hit the age of 65, Ernie would have a nest egg that’s worth almost $1.3 million while Bill would have savings that amount to less than 30% of this amount (in fact, under $400,000).

The differences in this example are dramatic. However, this analysis also makes certain assumptions that may affect the numbers quite a bit. You may end up with different results if some of these assumptions were tweaked even just a little. Some factors that can affect results:

- How much of an income gap exists between the college graduate and the high school graduate?

- How much money do these people decide to save and invest throughout the 43 years (the span of time this example covers)?

- How much debt does the college student take on? What if there was no student loan to incorporate in a particular case? If the parents or family members of this student end up stepping in to cover educational costs, then how much of an effect would this have on the big picture?

Making The Case For The College Grad

This simply illustrates that it’s possible to find a college degree that is purely worthless and not worth the investment. But we can probably make a case for college as well. Here’s my defense:

1. What if Bill was able to cover all his college costs and was not saddled with loans?

If so, then both Bill and Ernie start off at the same savings level. I bring this up because we all face different scenarios when dealing with huge financial costs like this in our lives. In my case, my parents paid for my college tuition, so I grew up with this natural expectation: that parents help pay for their children’s education. In some studies made on this subject, many parents admit that they think of education and schooling as the biggest gift they can give their kids. I’ve seen many cases where people decide to make sacrifices to work themselves to the bone just to help get their kids into top notch schools. I have been amazed at learning about how some families have bonded together — grandparents, parents and the kids alike — for the common goal of getting the youngest ones to school. Those kids end up doing very well and helping their families in later years, a testament to familial connections and the perfect symbiotic relationship. In my mind, the combination of parental support, scholarships, grants, financial aid and contributions from the student himself (or herself) is an ideal approach for tackling the costs of college.

2. Bill can pursue a major that can lead to a career that pays very well.

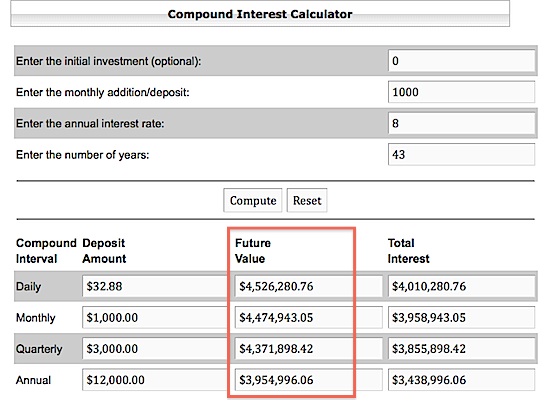

So let’s take the case of cash flow here. Let’s say Bill has no student debt (see point #1). Now if Bill gets a job that allows him to save an extra $1,000 a month more than Ernie, then he pretty much blows Ernie out of the water after 43 years. The extra $1,000 a month that a really high paying, highly skilled job that college can grant you can turn into a $4,000,000 gold mine by age 65. I admit that this is a really simple way to look at things, but as mentioned, you can always make a case for or against a particular matter by choosing assumptions and numbers that support your argument. Here’s a tool that shows you just how much of a nest egg you’d build over a span of four decades, through conscientious contributions and deposits into an investment account.

So I’ll say this: a college degree CAN be worth its initial investment, but it would depend on the major chosen and the career path taken by the graduate. In fact, it’s much more likely that you’ll do much better with it than without it, and that’s why people are still flocking to colleges and competing for limited spots at expensive schools.

3. Bill can make great connections in college, which can end up influencing his future way more than academics can.

Think about those dynamic duos who met in a University setting that ended up making their mark in business.

- Sergey Brin + Larry Page = Google

- Jerry Yang + David Filo = Yahoo!

- Bill Hewlett + Dave Packard = Hewlett Packard

- SUN Microsystems cofounders

Lots of Stanford pride here it seems! But these people would not have had the opportunity to create the kind of synergy that has now changed our world, if it were not for these chance meetings at a top notch school. Again, these are extreme examples of success that you can attribute to the University experience, but the fact is, you’ll increase your chances of meeting people who can potentially change your life for the long term if you take your education to the next level.

In Closing

One more thing: we can do all we can to prepare our kids for a future in college, but I can’t argue against the angst many families feel about how expensive things are getting on this front. I’m also hoping for changes in our educational system as it pertains to costs, especially since I’m one of those parents who’s got a couple of college bound hopefuls.

Created September 30, 2007. Updated July 21, 2011. Copyright © 2011 The Digerati Life. All Rights Reserved.

{ 6 comments… read them below or add one }

I would recommend pell grants and fafsa.

There’s also a quality of life factor. Jobs requiring a college degree often require less physical exertion and more mental exertion than jobs not requiring a degree. That means less likelihood of injury (aside from carpal tunnel). The working conditions are often much better as well.

I grew up on a dairy farm. If I stayed in that industry, I’d be working long hours, be outside in all types of weather, and be at risk of injury on a fairly regular basis. Even if I could make the same money faming as I could from my office job (extremely unlikely, given the up-front costs of buying Iowa farmland), the working conditions for the office job are much better. Sometimes the AC in the office is a bit cold for my tastes, but the temp is never -50 or +110.

Great points Kosmo! That’s surely one thing that your college degree buys — a “cushier” career (usually white collar) with more money. While farming does not seem to hold much appeal on the surface (for a lot of people), the strange thing is that when things get hairy or complicated in my household, my spouse always jokes that we should just “give it all up” and become “potato farmers” or (interestingly) bee keepers in Australia. Maybe the simplicity of such a life seems attractive to the outsider, but the reality is often something else altogether, as you’ve shared.

Well, if you decide to go into farm, go with crops instead of animals. I’m not sure about bees, but cows need to be fed and milked twice a day. You can’t simply take off for the weekend – you need to hire someone to look after things.

Cows also have an annoying tendency to get out at two in the morning. Many a night did the shout of “cows are out” interrupt my sleep while growing up.

I wrote a blog post titled “Going to College in America is a Scam”. You can view it here.

Who makes more depends on everyone different situation. However, I’d bet on average college graduates do a lot better long-term.

Unfortunately, the answer is “It Depends”.

It depends on the major you choose, the school you choose, and your ability to live frugally. I have written some posts on the subject of secondary education value, and there is no one answer…you must answer it for yourself.

But I like your calculation 🙂