The case against short term trading.

Over the years, I’ve learned to gravitate towards long term investing as I gained more education and experience with investing. This is the strategy that involves building a diversified portfolio and following an asset allocation that is in tune with your risk tolerance. It involves a commitment to keeping a portfolio invested in the markets, regardless of market behavior. Like many finance enthusiasts out there, this is my preferred manner of investing, and here’s why:

7 Reasons To Invest For The Long Term

#1 It’s easy enough for anyone to do.

Creating a diversified portfolio based on your preferred asset allocation is straightforward and can be set up right away. Even if you are a new investor just learning the ropes, you can learn quite a bit by signing up for a free brokerage account with one (or more) of these topnotch online brokers, where educational materials are freely accessible to their customers.

While some of these brokers emphasize and promote trading activity, this doesn’t mean that you can’t build a portfolio here and set it up using long term investing strategies. You can check with these online discount brokers and mutual fund companies about setting up an automatic investment plan where you contribute money on a monthly basis while having your portfolio chug along on autopilot.

Investing for the long term is not rocket science and is easy to understand. What’s really awesome about it is that you don’t need to do much at all to do really well using this strategy. Plus it takes much less effort and work than the alternatives.

Now contrast this to perfecting the “art” of short term trading and market timing: you’ll find yourself attending seminars, learning how to trade, going on margin, playing with options, needing to constantly do active work (scanning screens, paying attention to charts, prices, graphs) and studying to try to make money on a daily basis in the various markets. Not to mention staying up late and waking up early just to participate in the market action. Then there’s that little matter of potentially losing your shirt. It just seems so draining after a while.

Day trading seems like a huge pain in the arse and not everyone is built for this. I personally know a day trader who’s an expert on foreign currency trading, but he sacrifices quite a bit of time doing the work and investing on software, books and information. Don’t get me wrong — there are people perfectly BUILT for day trading. But the question is: are you one of them?

If you’re an average investor who does your investing on the side, I’m not quite convinced that all of your short term gains (which are subject to income tax and transaction fees, by the way) can ever beat the returns you get from the effects of old-fashioned long term compounding.

#2 The power of compounding is your friend.

One complaint I hear from those starting out as investors is this: it takes too long to make any money in the market. Everyone seems to want that immediate gratification and quick results. That was why the dot com era lulled so many people down the wrong path, convincing them that anything they touched was golden….on paper. Practically everything was on an uptrend, and everyone enjoyed the thrill of making quick virtual money. Unfortunately, many a portfolio did not meet with a happy ending.

If we had just all ignored how the market was behaving then, and focused on the long term, that particular boom/bust cycle wouldn’t affect us so grandly. Long term investors with their eye out into the future usually ignore current market conditions, or at least, don’t obsess over them. They may tweak their portfolios a bit, but they don’t overreact to market movements.

Our focus should be on starting an investment plan as soon as we can, and investing on a regular basis. This strategy will then allow your money to compound through the growth of reinvested earnings and a regular savings plan. You also don’t have to wait that long to see the effects of compounding: the formula, called the rule of 72, tells you how long it will take for you to double your money. Given a reasonable long term rate of return of 8%, you can expect to double your money in 9 years: 72 / 8 = 9.

Because of the power of compounding, the earlier you start investing and the longer your time horizon, the more portfolio growth you’ll be able to achieve.

Image Source: H&R Block

#3 Passive investments are convenient.

You don’t have to do much with a long term portfolio. Long term investors are proactive while short term traders are reactive. A long term investing plan requires much less time to set up, manage and evaluate than any other form of investing. Plus, you’ll be far more relaxed with more time on your hands by going this route. Those who are traders pretty much play the market for a living, finding out quickly that to succeed, they’ll need discipline, nerves of steel, intestinal fortitude and emotional control. I don’t know about you, but I’d rather leave the ulcers to those adventurous folks.

#4 By staying invested, you avoid making costly mistakes.

Being an emotional investor without an eye on the long term can be potentially costly. If you tend to jump in and out of the market based on how the market is behaving, you’ll run the risk of missing out on those powerful rallies that can catch you unawares. Just take a look at this graph that shows the effects of being out of the market during strong market rallies.

From Schwab.com:

We studied portfolios to see what happens when you miss the top days in the market. Our research, looking at returns from 1996-2005 shows that missing the market’s top 10 days cut the return by more than half on a portfolio of stocks, represented by the S&P 500.

S&P 500, 1996-2005

Image Source: Schwab.com

#5 A long term view lowers your risk.

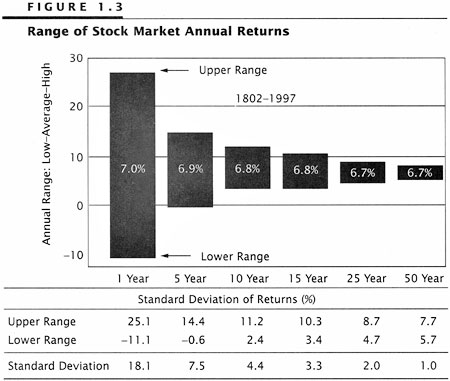

When you’re invested for the long term, your average return becomes much more stable over time and it’s less likely that you’ll lose money. What does that mean? Studies show that as we lengthen our investment horizon, the average annual rate of return over that timeline becomes less variable. That is, the longer your time in the market, the more likely you’ll receive the long term average annual rate of return. And by knowing what type of long term return I can get out of the stock market, I’m more likely to stick to a plan that involves equities and to remain patient as I wait for the power of compounding to work its magic. I know that these returns are not 100% set in stone, but I’m taking the calculated risk anyway.

From Schwab.com again:

We studied the highest return, lowest return and average annual return of the S&P 500 over various holding periods from 1926. We found that as you move from a one-year holding period to a three-year, 10-year, and finally to a 20-year holding period, the number of negative returns experienced goes down. In fact, there’s never been a 20-year period with a negative return.

Image Source: Schwab.com

In this chart from Yahoo Finance, you can see that with longer investment horizons, the variability in rates of return diminishes.

With the stock market, the shorter your time horizon, the more “random” your expected rate of return will be. For those who insist on “investing” for only a year or less, it would be just like taking a gamble or playing a game of chance, as this web site explains.

#6 A long term view gives you time to fix your investment mistakes.

If you were “lucky” enough to start investing very early in your life, you’ve got an advantage over everyone else: you’ve got TIME. Time to recover from any mistakes you make with your money. A bad year in the stock market can easily be neutralized by several successive good years. If your portfolio isn’t performing the way you like, you’ve got time to tweak it into something that should be solid enough to address your future financial goals.

#7 Your rate of return is boosted by stock dividends.

Dividends are great because they add to the overall value of your equity investments. They’re yet another element that can boost your rate of return, and are there to reward you as a long term investor and shareholder. I look upon dividends as a “buffer” for my investments in the sense that they help neutralize poor returns from stock price alone, while adding the icing on top of positive stock price performance.

Parting Thoughts

The typical learning curve for an investor begins when he or she gets their feet wet by placing some money in the stock market on a stock tip. I, along with many former colleagues, were in this boat sometime ago, before we found out that some discretionary income plus peer pressure and a sense of competitiveness over who can achieve the highest rate of return in the shortest amount of time can be a recipe for quick financial wipeouts. But we were young and silly then, so we can all just chuck it up to inexperience and youthful bravado.

These days, we know better. And most of us champion the prudent approach of taking a long term view towards investing as opposed to randomly playing the market when the urge strikes, although I do still have many buddies who like to time the market and feel more comfortable being invested for short periods at a time. My market timing buddies aren’t able to commit their portfolios to market forces without perpetually worrying about their money, and have thus felt more secure trying their luck with guessing when to enter the market and when to pull the trigger. So far, I’ve heard that the pay off from this strategy hasn’t been that exciting.

With all the benefits of long term investing, I still don’t quite get why anyone would prefer to day trade rather than to invest. Unless of course, they’re doing a mixture of both strategies. Though for those pursuing such a dual strategy, I’d sure love to hear which approach yields you the better returns!

Copyright © 2008 The Digerati Life. All Rights Reserved.

{ 19 comments… read them below or add one }

Excellent post. One of the biggest reasons why so many people end up losing money when it comes to investments in stock, real estate etc is that they want to earn too much too fast. Anything that sounds good to be true, it is normally just that, too good to be true. Not to mention the number of scams out there with people looking for an unsuspecting prey to be their next victim.

Keep Blogging,

Jack

I definitely agree with the point being made. Complimenting long term investing with proper diversification and risk adjustments makes for a wonderful saving package. It won’t make you a millionaire of investing in a couple of years but it will make your money work for you in the long term.

I can appreciate your post. I think that investing for the long-term is an intelligent, prudent strategy.

But I’ve also had experience trading in the short term and I wouldn’t write it off completely. It takes more time and effort but you don’t have to be a genius or devote countless hours in order to see above-average returns.

My mother, an elementary school teacher, has gained 50-70% per year by simply buying good stocks that have had bad news push the stock down.

That’s not to say short-term investing is easy or a guaranteed money maker. But you can control your own destiny. If you only trade money you have and stay disciplined, I think it would be difficult to lose your shirt.

Finally, to answer the question at the end of your post. I’ve made almost 100% this year just trading stocks. Yahoo, Ford Apple — these aren’t risky penny stocks. And I have a strict policy to sell a stock if it goes below a certain level. Of course, I have my retirement money in low-cost index funds.

#3 is the real center of this issue. If you are willing to do a lot of work and follow your investments closely, you can probably produce better gains and lower your risk. Obviously, that statement needs more explaining, but this is not the forum.

If you don’t have the time or the interest then the traditional long-term index fund is the way to go, and these rules are ideal for someone in that situation. Good post, keep it up.

Thanks for this very knowledgeable article. I am just coming out of a couple of companies I am a director of and have been wondering what the best thing to do with my money would be. This article has certainly opened my horizons as to my options and what may be best for me 🙂

Great post. If you add that investing in quality companies, having an appropriately diversified portfolio, and consider that stocks outperform bonds over the longer term, you have a winning formula for success.

Reason 8: You can invest for the long term from the beach sipping a margarita.

Great article. I’m a financial planner by day , and super web-empire builder by night and I always have to try and go over this with people again and again. The story of the cousin/brother-in-law/guy -at-work who makes tons of money trading the market seems to be the biggest urban legend going. Of course, no one can explain to me why if they make all this money they still work at their other job. Hard data like this is always a help.

Great post! Did you know that many companies out there offer Direct Stock Purchase Plans? You can buy stock with out going through a broker in these companies saving a TON in fees.

After your set up with some of these companies they even pay your fees for any reinvestments you make. Another great thing is when you reinvest it can be as little as $25 to $50 an investment. How many of use could afford this versus waiting for that windfall so we can invest $1000’s at a time to off set broker fees? You can go to my site, where I have a list of over 150 companies with DSPP with links to their home pages, plan prospectus, and enrollment forms, and it is all FREE.

70 of the companies are in the fortune 500.

Good Luck to all of you I wish I had know about this 30 years ago.

If you are buying mutual funds, then buy and hold is a great strategy. But if you are buying individual stocks, you have to know when to sell. Things are great as long as the company’s growth is accelerating, but one bad quarter often leads to another, and another.

This is something I’ve learned from a few financial experts. Too many new investors are concerned with how they performed the previous month. This is however only one small portion of their overall financial well-being. They should be more concerned with trending over time, as that’s a truer reflection of performance.

Great post. I have a friend who simply does not get the idea of investing money at least up to his 6% 401K employer contribution. He doesn’t believe what I tell him about long-term returns and keeps trading actively. If he makes $50k/year, that’s over 3k in “free money” that he practically throws away.

He is not a dumb guy i think :-), but he doesn’t really seem to understand that if I am investing $1000 in SP500 in a 401K with a 100% employer match, and he invests $1000 in his brokerage account, he has to achieve at least 120%-130% returns just to start on the same place as me..

Reason #8 – Taxes. If you trade in a taxable account then short-term profits will be taxed as income. For most people trading this will be anywhere from 20-35% (fed + state). As a short term trader you have to work that much harder to stay ahead. As a long-term investor I can keep that 20-35% and let it continue to work for me as compounding continues to work its magic.

As Mr. Warren always states he is in it for the long term with companies he understands. He has done all right, so if it is good enough for him I think it is good enough for me.

I think you can easily combine both short and long term investing. You can watch your signals weekly but overlay them with strong risk analysis. You don’t want to miss out on a bull run just because you are committed to one strategy.

The premise of missing the ten best or the worst is based on a notion of clairvoyance that you could miss just THOSE days. This idea is based on market timing as predictive. To that point, it is a fool’s errand. This “missing the ten best” myth has been perpetuated by an industry that is only paid if you stay invested. Wall Street has not figured out how to get paid for sitting in cash.

If you review many of the studies, you do find that many of the “best” days are recovery days following some of the “worst” days. If you were not invested in the worst days you would not need the best days to earn back what you lost. Losses hurt a portfolio worse than gains because losses and gains do not have a linear relationship. Remember that a 50% loss requires a 100% gain to get back to par. I use two trend following models published in the mid 90’s that got you out of the markets in early 2000 and in late 2007. The models did not get you back into the markets until mid 2003 and am

still on the sidelines now. Having avoided both 50% bear markets, you do not have to rush to get back in to earn what you have lost. If you want to continue to listen to Wall Street you will continue to be dumb money.

I hear where you are coming from, it’s all good information. But, I have made substantial money by day trading. However, you do need to be educated, and I wouldn’t advise a rookie investor to go out and start trading penny stock without any knowledge. Two things you must know before you invest in penny stocks: Do not invest any money that you can’t afford to lose; know your exit strategy (do not get greedy!) and stick to it!

I missed this article when it first came out. I just discovered it on Tip’d. You’ll always have tons of people to agree with you when you make a case like this. It’s the financial advisor’s dream post as it’s right out of their sales literature. Most PF bloggers would agree with you too. I tend to agree with David and Noelle.

Yes, you can make money investing for the long term, especially during a secular bull market like the one we had from the 80s to 2000. But I think a secular bear market began with the Nasdaq crash, so returns will be choppy with a downward bias through this period. The first decade of the secular bear has already played out that way. I think we have another decade to go.

You can make money or lose money whether you are a long term investor or a short term trader. You just need to choose the strategy that works for you. That’s easier said than done. I’m still working on mine. 😉

Good post. We must be on a similar wavelength as I wrote about market timing around the same time frame as your post. Check it out here.

Buy and hold is good in that it doesn’t require much sophistication on the investors part, but it relies on two critical elements – that the market will eventually go higher no matter what intermediate fluctuations occur AND there is enough time left in your investment life to see a profit. The depression of the 30’s required over 20 years before the market rose above its pre-crash highs. A waiting time of that period would spell disaster for all but the youngest investors. This is why one can’t simply ignore a continually declining market if it appears the overall long trend is no longer up.

The Schwab chart showing dismal returns by missing the best market days is misleading. What it doesn’t take into account is how your account would fare if you also missed the worst market days, which is the primary goal of market timing.