Why buying penny stocks can bite you. Two words: Massive Risk.

I received a reader question some time ago about the subject of penny stocks, which are also known as “stocks that are priced for under $1 per share”. I’ve replied privately to the individual who asked me the question, but I thought the subject merited some discussion here, so I’m reprinting their inquiry and the gist of my response.

Reader Question:

I wondered if you would give me your opinion on a stock I own…it’s so little known that I can’t find qualified opinions elsewhere. It’s a company called Serenic that trades on Canada’s TSX Venture Exchange, which is mostly known for mining. The ticker symbol is SER.

I had long talks with management after my broker recommended it and really liked their top-line growth story, but I was convinced because the valuation seemed unreal:

The company has about an 8 million market cap and more than 10 million in revenue (small I know). They also earned 7 cents a share last quarter, yet they are trading at 57 cents! I hope I’m not missing something, the management seems very credible and understated.

What follows are all just my opinions as a small investor. At the same time though, my thoughts are pretty much in line with the general consensus about penny stocks — that they are extremely risky to delve into. While these stocks will more than likely cause you trouble as an average investor, they may, however, work pretty well for a certain group of traders. There is a market for penny stocks, but it’s not the kind of market to get into if you are inexperienced and lack the knowledge to work with this type of “investment”.

I found this document from the State of Wisonsin’s Department of Financial Institutions alerting us to the issues surrounding the purchase and trading of penny stocks. After I scanned through it, I could only ask — could penny stocks have any redeeming qualities as an investment? Given the risk elements surrounding them, I could only come to the conclusion that trading in them is much like rolling the dice.

Ten Reasons Why I Won’t Touch Penny Stocks With A Ten Foot Pole

Some notable points I picked up from the document:

#1 Information on penny stocks is hard to come by. Price and volume data may not be easily or directly accessible to the public and may only be made available to you by the stock brokerage you’re dealing with. Typically, pink sheets for penny stocks are only made available to brokerage firms.

#2 Penny stocks are easily manipulated because they are so thinly traded. More on this later when I write about my own woeful tale about a failed penny stock trading experiment that went sour.

#3 Brokers may want to push penny stocks upon customers because they can charge more for such a stock. Be watchful of the charges a brokerage can impose on you for trading such stocks.

#4 Penny stocks are often marketed aggressively.

#5 These stocks are hard to unload. You’ll need to sell them through your broker, who may not exactly be happy about your decision to sell. Beware of brokers who may be less than supportive of your wishes to sell your stock, and who convince you to keep hanging on or trading these so-called “investments”.

#6 Penny stock brokerage firms may be inflating their track records. Your broker may not be telling you everything there is to know about a stock: who knows? They could be committing “sins of omission” by skipping out on certain negative aspects of a stock. It’s also possible that the glowing stories you are hearing are actually exaggerated or embellished in order to attract and keep your business.

#7 This industry is vulnerable to abuse, fraud and questionable sales practices as seen in their history, and fraught with brokers who use high pressure sales techniques and cold calling.

#8 An oft-quoted statistic states that at least 70 percent (!) of penny stock investors lose their shirts (okay, they lose money), not counting the risks of fraud or abuse.

#9 Trading penny stocks is highly risky. If you somehow make money from penny stocks, be careful about attributing this stroke of fortune entirely to your skill or careful analysis or the due diligence you poured into making your investment decision. It may simply be due to pure luck. These stocks are extremely hit or miss, just like at the slot machines. High risk, high reward, right?

#10 Don’t get fooled by the stock’s low price. Just because you can buy a lot of stock at an incredibly low price doesn’t mean that the stock is cheap. I’ve had friends tell me that they prefer buying low-priced stocks because they are so “cheap”. You’ll have to gauge a company’s true valuation before you can determine whether its stock is worth buying. Who knows, could a stock be so cheap because it’s virtually worthless?

Contemplating The Reader’s Question…

Now my biases aside, let me zero in on some elements of the reader’s question:

- By his own admission, the reader found it difficult to find qualified information about his stock (ticket symbol: SER).

- It’s a Canadian stock and it’s in mining. Good place to be in general, given today’s economic climate. Those are a couple of good things going for it (along with the highly positive spins from management and the brokerage), so I can see the attraction to this stock.

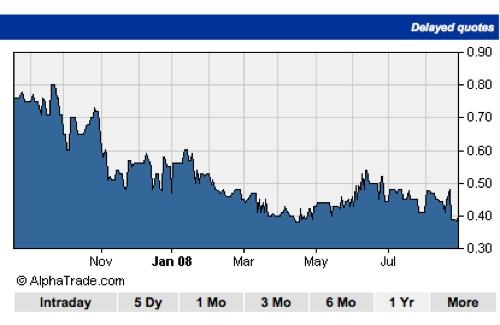

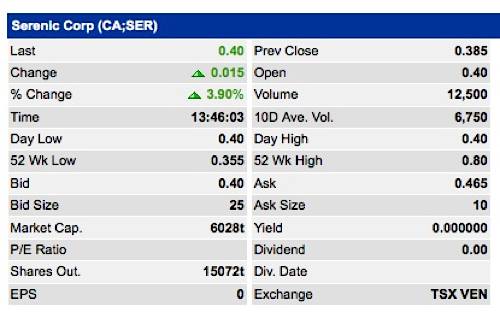

- It was trading at 57 cents? This was many months ago, so let’s see where it’s at now (quotes are from Alphatrade Finance):

Just looking at it now, I hope the reader decided not to continue his relationship with this stock. But one never knows about stocks like these as they tend to be extremely volatile, given how easy they are to “move”.

From a personal level, I’ll also give you one final bonus reason why I’m avoiding penny stocks like the plague. It’s because of my own personal experiences with them. For those stories, you’ll have to stay tuned for my follow up post on how I was dumb enough to succumb to greed and the siren call of a penny stock whose company promised a marvelous future. Yeah, right.

If you’ve got some tips or advice for our reader, or any thoughts on this topic, we’d love to hear about it! A penny stock for your thoughts?

Copyright © 2008 The Digerati Life. All Rights Reserved.

{ 39 comments… read them below or add one }

I have to agree with you here. There are a few people who can make money trading penny stocks, but the key words are “few” and “trading”. They aren’t investments, and just like trading any other type of stock, only a few find themselves on the successful end of the equation.

I used some play money a number of years ago on penny stocks, and it was a wild ride. I remember watching a $250 investment skyrocket to $2,000 in a week, but for every one of those, there were a half dozen $250 investments that dropped to virtually $0.

The biggest thing to remember is that most penny stocks don’t play by the same rules as listed companies. Some aren’t even legitimate companies or are required to report financial data. So the price movements are completely driven by speculators and message board chat rooms. Unless you’re in on the pump and dump scheme, you’re at a disadvantage.

While it can be exciting thinking about the prospect of buying that dream stock that is $0.25/share and watching it go to $2.00 is entertaining, for most people, that’s all it should be is entertainment.

For nostalgic purposes, I have a few stock certificates in my safe deposit box at the bank. One of them is for over 1.2 million shares of a now defunct company that is undergoing a number of investigations for securities fraud.

It was fun to buy into the hype and spend a few hundred bucks on a million shares and dream about what would happen if the company ever made it big, but the shares are worth less than the paper they are printed on 🙂

@Jeremy,

Well what do you know…. I do the same thing as you — I remind myself of my mistakes and failed investments by keeping vestiges of them in my records. I hold on to old certificates and transaction reports that I review time and again to keep these incidents fresh in my mind, so that the next time I face the urge to do something wild and risky again, I have the perfect reminder to put a damper on my enthusiasm 😉 .

There’s a reason why they are penny stocks right? I bought a penny stock once, within a month it was bankrupt. Yeah there’s definitely a reason.

Great photo for this article, haha, penny stocks are definitely a mistake. If you want to gamble, go to Vegas or AC, you’ll have far more fun and probably get better odds! Don’t gamble on penny stocks.

Hah! Don’t make the bull kick your behind! 😉

Jeremy’s point is well taken — that you may get lucky and make a killing with a penny stock, but it’s one of the least favorable ways I know to make money in the market.

Seems like the way to play it, again as Jeremy suggests, is to place your “bets” amongst several such stocks to see which one pans out and *hopefully* makes up for all your other losses. But then again, you’ll be doing just that: placing bets.

I totally agree with you here, the swings are simply too much risk, especially for a little guy.

I loved and lost with a penny stock a long time ago. I personally find it more exciting to go to Vegas, drink free cocktails, and eat at buffets when I’m going to throw a wad of cash on red or black!

Couldn’t agree more with the post. I had heard the same types of things before I bought into the roller coaster of penny stocks, but I had to learn for myself. Ah well. Live and learn.

Joe

Very good post. If the company is in an industry that you really understand and you are read to loose the money why not playing the investment gain, otherwise stay away from it.

This is a great post on penny stocks and a great reminder. Many of the companies are worthless and many are just pump and dump scams. There is very little, if any. regulation and oversight on penny stocks. Most penny stocks do not trade on exchanges. They trade on quote systems.

How about an ETF that shorts the penny stock index? Hahaha. Hey, that might actually work…

Perfect picture. 🙂 I saw the ugly (or just stupid?) side of penny stocks watching the stock trading message board for a struggling company I had work experience with.

The posters hyping up the stock had no idea what was actually going on inside the company, and yet were convincing others that they were authorities. It was sad, scary, and eye-opening all at once.

Hahahahaha! I really love the picture you used for this post. Very funny but puts the heading’s point across quite clear. Brilliant! 😉

I’d have counseled your reader to set up a virtual portfolio on Globefund.ca to track the stock for a few days/weeks/

My experience with IQW stock in a thankfully VIRTUAL portfolio is one of the things that helped convince me of the futility and counter-productivity of investing in individual stocks (for the long run) and instead think about index investing.

IQW TANKED and last I checked was down %70. I am SO glad I decided to track it virtually first, and I hope your reader was fortunate as well.

You can read all about my penny stock virtual portfolio on my blog:

http://www.btgnow.net/2008/08/globefundca-part-1-my-portfolio/

It will also explain how to use Globefund.ca’s tools and services more extensively.

Great post, very useful!

i’m in the markets professionally and i can definitely agree with everything you’ve laid out here. they are trading vehicles and nothing more! very very risky stuff. the odds of picking a winner as an “investment” for the long haul are pretty slim. it would take the work of a CFA (chartered financial analyst) to sort through everything on their balance sheet and determine that the company is actually worthwhile.

steer clear of them and put your money in reputable, established companies if you’re wanting to invest. but, if you’re wanting to trade and take on risk.. go for it haha

Penny stocks seem so manipulated by things like pumping up through spam email that it seems like something to stay away from.

I saw something recently where some people (not the ones sending out the spam email) sell penny stocks short based on the spam email pumping. Apparently they follow some kind of predictable cycle.

Personally though I just don’t want to not mess with it.

I have thought about buying some penny stocks just to say that I own 3,000 shares of a company. That would be a great little nugget to drop in conversation at a cocktail party.

The only good thing about penny stocks is that they are so volatile that they mentally train you. I foolishly started off in penny stocks early on, but when I wised up and decided to invest in non-penny stocks, I could easily manage seeing 1-2% stock price changes.

Great post,

Penny stock investing was never a good idea. A stock is a penny stock for a reason after all.

Their siren call is an apt description.

It’s so easy to fall for the “buy a busload of these cheap penny stocks, hold on to them and when the next bull comes and the rising tide raises all boats, you make a killing”.

The only bull I have seen when I followed this mantra is the one aiming a mighty kick at my butt.

The flip side of this argument is played out each day on http://www.timothysykes.com.

Tim teaches penny stocking specifically BECAUSE so many are frauds. He teaches people how to recognize a fraudulent pump so they can short and make money.

Many were skeptical, but the numbers don’t lie. Here’s an analysis from someone who was one of Tim’s biggest haters:

http://www.goodevalue.com/2008/09/26/how-to-get-rich-trading-penny-stocks/

I agree! I’ve learned my own hard lesson about penny stocks. Hopefully people interested in getting rich quick will find your post and wake up. Individuals investing in penny stocks might as well be playing the lottery.

Buying a penny stock is like purchasing a double edged sword. Penny stocks offer unlimited opportunity to lose or gain everything… The key to all this is whatever you know what you are doing or not.

A good reality check, over expectations plague stock investing. Great post, going to follow you on twitter.

thx/Jerico/admin

Mining Stock Site

Penny stocks are certainly a good investment option if you are an expert. However, it is a very risky investment option. Before you decide to invest in it, you better read up guides on how to minimize the risk that penny stocks are involved with. The volatility is extremely high.

Because of the term penny stock, others think that the cost of investing is minimal. This is why many folks are lured to invest in penny stocks. Penny stocks also have the potential to grow very quickly. But we must also understand that what goes up can come down, so rapid growth can mean rapid decline.

Penny stocks is high risk high reward business and it is possible to make money with it you just have to be very careful. The reason why they are so risky is because they are being promoted by investors who just want to pump and dump it. You as an investor have to watch out for that or join in which I don’t recommend because you never know how it is going to work out.

Thanks! I was looking at a couple of sites yesterday that were promoting spectacular gains with penny stocks using their “special” method. I was kind of interested but am doing my research. After reading all of the comments here I have decided to look to more established companies for investment. I’m not lucky and if it is a game of luck, forget it.

wow! great post, very informative for this matter.. and with funny pix you included.. a big thanks 🙂

Keep in mind that Penny Stocks are just about the most manipulated and over hyped stocks on the market. Despite this fact, making money with penny stocks is very possible

Penny stocks are very risky. It is not worth the “investment” – if you even want to call it that. I think of it more as a gamble for a gain. IF you have spare money it is worth throwing into penny stocks to learn a lesson about their volatility. Good luck!

Wade Stoddard

My concern with penny stocks is that the Internet has turned them into a get-rich-quick scheme for luring doe-eyed newbies.

You can make money with penny stocks… but if anything, it is a more complex and risky investment endeavor than most. Because of its name — it’s just a cent, right? — it is made to look as if it has easy entry.

In fact, penny stock trading should be exercised by people with more experience and savvy… not by novices.

When I was younger I got sucked in by a slick salesman that appealed to my sense of greed (that I think most people have) with the promise of tripling my money in short order. I ended up losing about $70,000. Since then, there have been no more get rich quick schemes in my life. There is no get rich quick way to get ahead. If you made money with penny stocks, you got lucky.

Your posts, are awesome…. Very well written…i am one of your regular readers…

Great article however I have to take issue with #2 and #5 of your “Ten Reasons Why I Won’t Touch Penny Stocks With A Ten Foot Pole”…

#2 – “Penny stocks are thinly traded” – This is far from the truth. Some of these stocks are VERY liquid, too liquid. The dilution is unreal in some cases. However, if they are able to dilute- there is buying. Dilution is the main factor in getting your behind handed to you in penny stocks. In Penny stocks, it’s a simple theory to consistenly bank…. Beat the dilution by buying the hype, and selling the news… Or if you are quick- Buy the news and sell the news.. which I would have to recommend http://www.stocklur.com for.

#5 – “Penny stocks are hard to unload” – This is in line with #2. This should be re-worded to “Penny stocks are hard to unload for a profit”. It’s not because you didn’t have the opportunity to profit, its because you got too gready (in most cases)! A lot of people buy into thinly traded penny stocks, which is your own fault if you can’t unload. This can easily be remedied by level 2 quotes and is a VERY useful tool when trading penny stocks.

To be a success in trading penny stocks you must follow very simple rules.

1.) Trade the news.

2.) Don’t hang on to a penny stock for more than 1 day.

3.) Have a pre-set sell set BEFORE buying in (yes this requires quick analysis of the news).

4.) DO NOT, under any circumstances, chace a price movement.

5.) Most importantly… Your going to lose some. Prepare yourself for this by creating a stop-loss or planning a “if it drops this % I am selling regardless” strategy. If you follow these rules and start learning from past news, you will quickly find out the few 5% trades you went negative on is quickly turned into a profit when you land a 150%er.

Stocklur.com’s news statistics show almost every day the Profits are larger than the loses, a lot of times by a large amount. You can actually see the odds of each article because stocklur artificially reads the press releases and compares them to past history so you get a really good idea of the odds. Everyone has their own strategies but to ignore penny stocks or disregard them as a waste is crazy. It’s all in the strategy. Good luck!

Thank a lot PSNT… I did some reading after I seen your post and found a couple other helpful sites that go into detail exactly what your describing.

Read this..

http://www.squidoo.com/enough-with-the-newsletters-how-to-buy-penny-stocks-the-real-way

Watch out for the hugs pump n dump. SPNG is a perfect example, lots of pumping on message boards. Then the big dump which left investors in the cold. Do your due diligence and take profits.

Hi…I’ve read this penny stocks discussion. I really appreciate your post and you explain each and every point very well.

I actually have to disagree, unlike many people here. The first mistake people make when trading penny stocks is looking at the money they put in as an investment, rather than a trade. It is a high risk vs high reward play. The majority of stocks on the OTC/Pink market are limited information and highly volatile. Fundamental analysis becomes especially important here, and how well you do is dependent on your approach. There are indeed companies at this level that have once traded at a much higher value. There are many situations where a company does make it, albeit there are many situations where they do not. A successful trader is able to benefit from both a bull and a bear market. By understanding market mentality and the tricks of the trade, one can do so. Some OTC/Pinks are worth holding, while the majority should be flipped, or even shorted. Bottom line is you should be okay the idea of losing the amount you put in prior to entering. You can put in a thousand dollars, and lose a thousand dollars. However, on the other end, you can put in a thousand dollars and make over ten times your return. I’ve seen it time and time again. Trading penny stocks is how I initially made the majority of my capital, so your article title should be “10 reasons why the inexperienced shouldn’t buy penny stocks.”

Tyler,

I’ve since adapted more of a “to each his own” mentality when it comes to investing and trading. If one has the inclination to trade and gain tons of experience performing this activity (whether it be in pink sheets or forex or whatever else), then it’s certainly their prerogative to pursue profits this way. I can’t criticize an activity that turns out to be wildly successful for someone else, just because it does not work for me.

You are ABSOLUTELY right in saying that the title here would benefit from some clarification. It should have been restated as you have suggested, which is to specify that this article really refers to the inexperienced. The average investor is likely to be quite inexperienced with trading and penny stocks, so in this case, this article does apply to them. But it should not have been taken as a blanket generalization of penny stock trading for reasons you’ve specified and that I concur with.