Health care has come a long way, hasn’t it? Ailments used to be treated with tonics made from roots and other raw, unprocessed ingredients from nature, while non-invasive options to surgery are now much more prevalent. Conditions that used to be threats to our life and health in the past are now simply just minor annoyances or chronic conditions.

It’s a long road to finding miracle treatments and cures for many medical conditions. For every drug that finds its way into one of your pill bottles, many drugs fail to make it to your pharmacy, and many more of these medications see tens of millions of dollars in investment before they are rejected, or shelved. The average consumer who asks why treatments are so expensive must remember that the cost of developing a drug also incorporates the costs incurred by drugs that didn’t make it through the development process.

Risks Of Investing In The Biotechnology & Pharmaceutical Industries

Why is this information important to the investor? A number of reasons come to mind. First, good investing is never a bet. Before buying any stock, you must try to find out everything that you can, not only about the stock but also about its sector. One thing to take into account about biotech investing is this: it’s fairly high risk. Your investment could lose 50% or more with just one announcement, so you must be extra careful when investing in this particular sector. To highlight the risks inherent in this sector, I’ll start with the concerns that you may face as an investor in biotechnology or pharmaceuticals. Let’s take a look at some examples of biotech investments gone wrong.

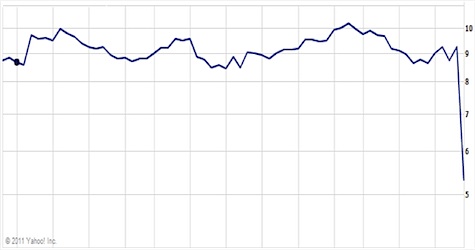

Stock Profile #1: Pain Therapeutics Inc. (PTIE)

What we have here is a chart of a small biotech firm called Pain Therapeutics Inc. (PTIE). On June 24, 2011, they announced that a pain medication that they had been developing was rejected by the FDA. This medication wasn’t rejected because it failed to perform well but because the FDA requested additional information, thereby slowing the evaluation and approval process. This is hardly a death blow for the drug but merely a delay. However, if you were an investor in Pain Therapeutics, you would have lost 43% of your investment overnight!

Sure, what made headlines here is that big move down on their stock chart, but there is also something else to consider: the chart also shows that you made little to no money up until the point that you lost nearly half of your investment. This kind of risk is why you must be careful about participating in this sector.

Stock Profile #2: Pfizer (PFE)

Pfizer (PFE) is the largest biotechnology company in the sector and its stock behaves differently from other biotech stocks. In fact, many professional investors refer to Pfizer as the place where money goes to die. Let’s look at the chart to see why that’s the case:

What you see above is a five year chart of Pfizer; during this period, you’ll notice that longer term investors weren’t able to profit much from the stock. You would have done better by investing in an S&P 500 index fund.

These profiles show that stocks here appear to be pretty volatile, and this is a sector where a lot of money can be made or lost during big moves.

The Positives Of Investing In The Biotech Sector

In order to understand the positive aspects of this sector, one must understand how biotech companies work. Often, small groups of doctors or scientists will get together and work to develop a drug. They form very small companies and sometimes become publicly traded, in an effort to raise enough capital to continue research. Often, these small companies do fairly well and actually make a lot of progress with their research and development efforts (say for a particular drug), such that they capture the interest of a larger pharmaceutical company who buys the entire company in order to gain the right to complete the development of the drug.

Of course, the investor who owns shares in these small biotech companies stand to make a large amount of money if the stock and company they hold are acquired. With an acquisition, share prices usually command a premium, potentially resulting in a 50% or more profit for the shareholder. It’s impossible to know when a company will be taken over in this way, and investors are rarely well advised to invest with the hopes that a company will be acquired in this fashion.

The Best Way To Invest In Biotech Stocks

It’s certainly not fair to generalize the entire sector. There are a lot of good biotech companies if you’re looking for an individual investment (look at Biogen Idec (BIIB)) but a better way to make your biotech investment is through an ETF (exchange traded fund). A few to look at include XBI, FBT, and IBB. Each of these ETFs invest differently in the biotech sector but the one thing that each one will give you is a broad exposure to the sector.

| ETF Name | ETF Symbol | Description |

| SPDR Series Trust SPDR S&P Biotech ETF | XBI | The SPDR S&P Biotech ETF aims to follow and track the returns of the S&P Biotechnology Select Industry Index (ticker: SPSIBITR). This ETF is a better choice for more conservative investors. |

| First Trust NYSE Arca Biotech Index Fund | FBT | This is an ETF with fewer stocks in its portfolio but is known for great returns (perhaps due to its more concentrated nature). This is for more aggressive investors. |

| iShares Nasdaq Biotechnology | IBB | The iShares Nasdaq Biotechnology Index Fund tracks the NASDAQ Biotechnology Index®. The performance of this ETF has been in line with the S&P 500 yet this investment carries more risk than the general S&P index. |

More on this topic in Seeking Alpha.

By owning ETFs, you’re better diversified since you aren’t vulnerable to the price swings of one company’s stock. Any investment losses that may occur when a company has had its drug rejected wouldn’t have as large an impact within the context of an ETF. In general, when you’re dealing with volatile sectors, the best way to invest would be through an exchange traded fund.

Bottom Line

There is a healthy demand for biotech stocks, as people will continue to fall ill and develop health related conditions throughout their lives. We can all expect innovation and advancements to bring solid growth to this industry. But remember that while demand continues to be strong for new and better medical treatments, many treatments won’t make it to the marketplace. This is one major cause for volatility in this dynamic sector. So if you’re considering investing in this field, you’ll have to be particularly attuned to the risks.

Copyright © 2012 The Digerati Life. All Rights Reserved.

{ 3 comments… read them below or add one }

Excellent post! As investment vehicles, I like both stocks and ETFs, but avoid mutual funds. You have given the perfect example where ETFs play an extemely important role in diversification. A Biotech ETF allows a small investment to be diversified among a variety of riskier assets.

Thanks Ken! One of my earliest investments was in the biotech sector, and that was over 20 years ago. I had purchased into a biotech mutual fund from a well known fund family (ETFs were not available back then) and I still remember just how volatile it was. So you guessed it — I eventually just bailed out and shifted into a general index fund. A good friend hangs on to Pfizer as well, and he hasn’t made progress with it for quite a while. If you’re going to invest in this sector, you’ll want to consider this as just a small (relatively aggressive) part of your portfolio.

I invest a portion of my portfolio in healthcare and biotech. About 20 years ago, I invested in Amgen and did very well. It has its risks and rewards.