Recently, credit card companies appear to be offering sweeter terms for their rewards credit cards. If you’re someone who pays off their monthly card bills in full, then applying for this type of card makes total sense. You’re virtually earning either money (cash back) or items (from rewards points) for the spending you do on your card. It only becomes a problem if you end up accumulating debt, since even with rewards, you won’t be coming out ahead if you carry a credit card balance and pay interest.

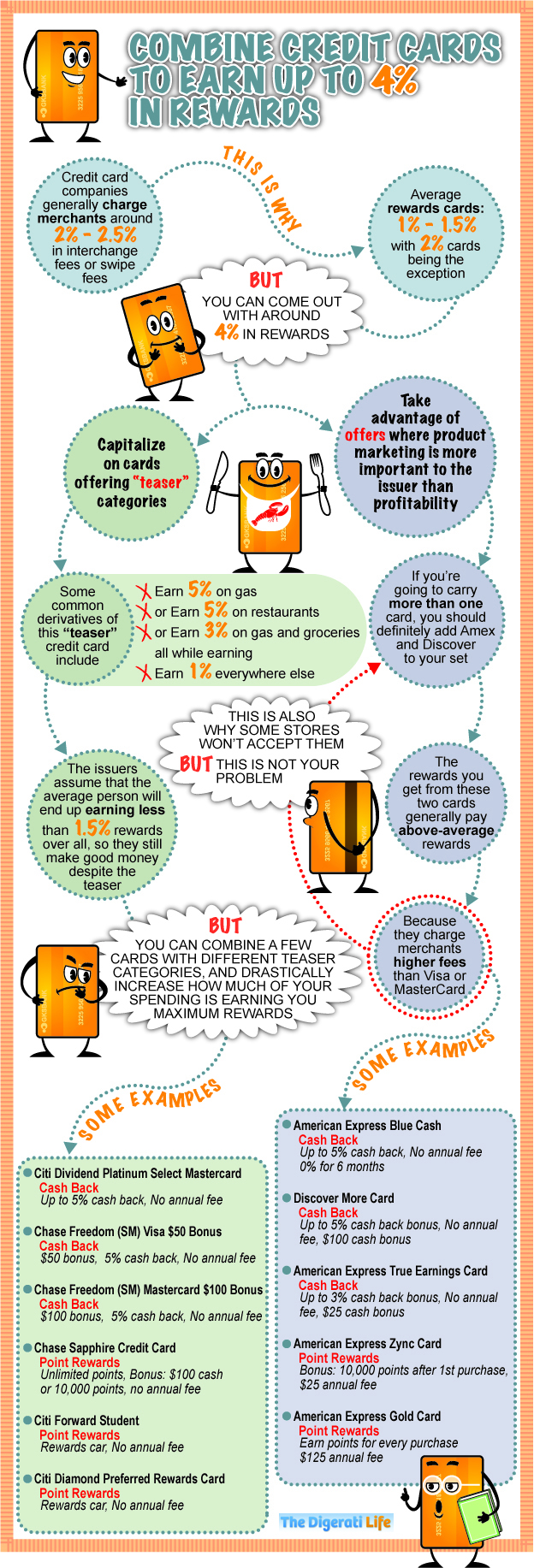

Sometime ago, I published a post that discussed how to combine credit cards to earn up to 4% in rewards. While many card companies claim that you can earn 5% or more in rewards in select categories, the fine print actually specifies that what you earn is subject to certain limitations. For example, the 5% in rewards may be the maximum you’re able to receive and this may only apply to choice spending categories. This means that your average rewards percentage is lower than you may think. The trick here is to find the best way to combine the use of your cards so as to raise your average rewards percentage.

Check out this infographic that was created by CreditLoan exclusively for our use.

Here are some things you can do to get the most out of your rewards cards:

- Capitalize on cards with “teaser” categories. Pay attention to your rewards calendar or schedule (which is available from your credit card issuer) so you can use cards which pay back the most (in rewards) during a particular time period.

- Use a Discover credit card or an AmEx credit card in conjunction with other cards as they typically pay higher than average rewards. While they are not as widely accepted, you can still use them in places you know that accept these cards. And when you do, it’s typically a better deal for you.

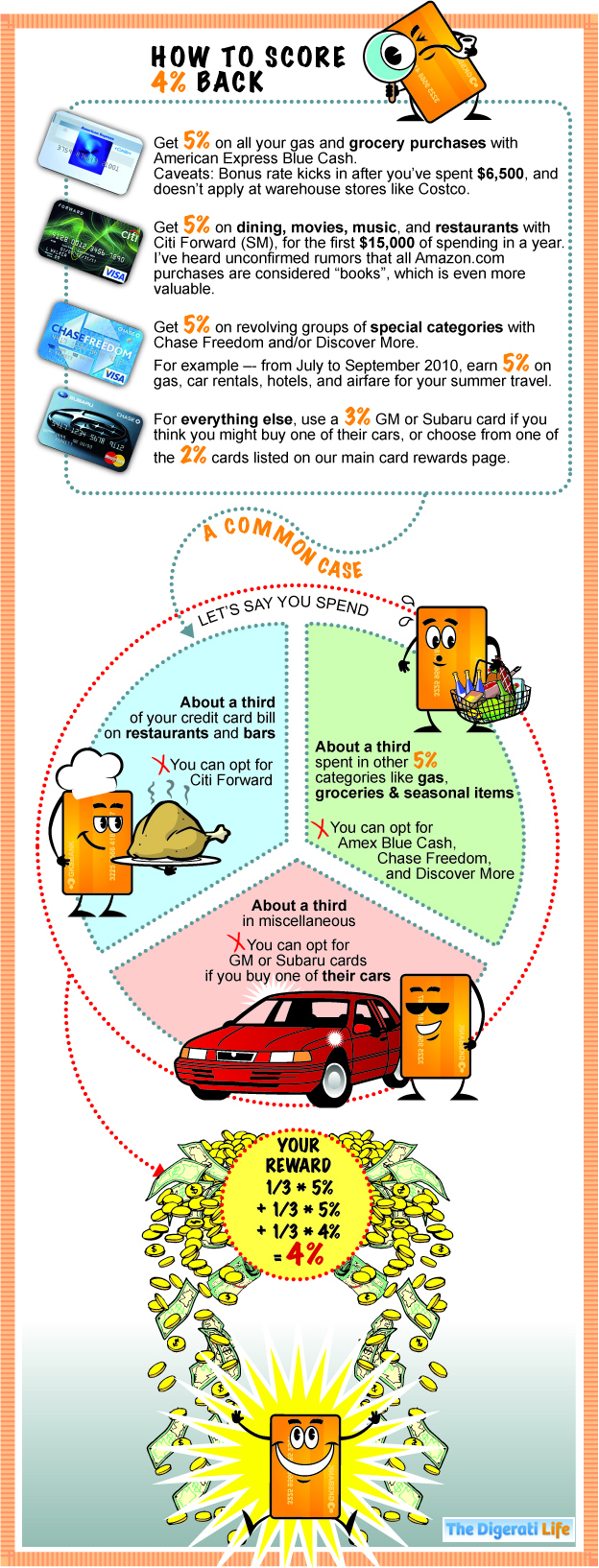

Here’s an example of how you can score an average of 4% of your spending in rewards from top credit card deals:

Disclaimer: Note that credit card rewards percentages and terms change all the time, and card issuers may change the card products that are available to customers. So what we present here are just examples and a guideline for how to use your rewards credit cards the right way. With some proper planning, you can get a lot more back than you think!

Image Source: The infographic was created by CreditLoan.

Copyright © 2010 The Digerati Life. All Rights Reserved.

{ 9 comments… read them below or add one }

Hello ! Just got my new card and I think this is best for me to maintain good credit standing!

Amazing article and great piece of infographic to convey the message.

Thanks

Tami

There are people who may think that credit cards are “evil”. And rightly so, if they fall into the clutches of credit card debt. But if you use cards as a tool, they can actually be used to your advantage. Personally, I’ve never had any issues with credit cards as I never carry a balance. But I’ve used them for rewards and for building my 529 savings account (I have a Upromise card to do this). And for those of you who are so inclined, you can take a good look at the benefits in the fine print — you may actually get some freebies out of your card (e.g. extra perks like travel insurance and benefits, etc.). If you are unable to manage credit card debt, then opt for debit cards instead.

Great article, I was going to create an info-graphic piece for my friends on how I use my credit cards.

Same with the author, my cards use depends on what I’m buying.

2 of my main cards:

Amex Blue Cash

Groceries, gas, and drugs I use my Amex blue cash.

With mint.com I also calculated where my bigger spending is at and it is on restaurants. On that I use Amazon Visa where it gets me 2% off restaurants, and since I do purchase many things from amazon (no tax on most amazon items which saves me a lot of money but they’re not always the cheapest) I get 3% off their own items.

There are things I have to use a store’s unique card like banana republic / macys which gives me better reward on their own stores.

So far, they work wonders for me and I’m always in a lookout for better deals out there.

Yes it is very difficult to discipline yourself regarding credit card usage but certainly when you reach that point then there are some benefits to using the ones you have suggested. I admit I have exchanged all mine for debit cards now and my bank has issued me a visa debit card which I find I can use online just fine. In the future I would consider a new credit card to use as a fuel card – it makes good sense to have an account you pay off monthly so you can easily keep track of spending for accounting purposes. Good post, SVB!

I agree that if you pay your balance in full and on time that rewards are an excellent benefit of paying with a credit card. Another often overlooked benefit of using credit cards for most purchases is that it makes reconciling your bank account each month much easier. For example, if you convert what was 15-20 debit card transactions into one single credit card payment then you dramatically reduce the activity in your bank account, thus eliminating a lot of the “noise” that can make balancing your checkbook more difficult.

Unfortunately, credit cards almost put me under. I am just about 75% of the way to being debt free and can’t wait till the end. I will keep one CC just for emergencies and for car rentals as the rental agencies don’t like debit cards.

Nice piece on credit cards. I do not advise using credit cards, but if you are going to do so, you should get one that is at a low interest rate, no annual fee, and has other benefits as you describe in this article.

Simply, most folks do not handle credit cards well. I wrote an article on my blog on how to manage credit cards (http://www.consumermiser.com/2010/04/02/managing-credit-card-debt-part-1-of-2/) because I am so concerned about how credit leads to over spending, living above your means, and increased debt for most.

Very nice infographic! I have thought about combining credit cards in my daily use for different categories of purchases, but have turned away from it because I thought it would take too long to accumulate enough benefits to get to the “check mail-out limit”