Remember the time when it was easy to get cheap credit? Well some of us are certainly missing those days. We’ve mentioned here time and again that getting a good rate on unsecured credit will now be a lot tougher than it was a few years ago, especially when it comes to credit cards (no thanks to the economic downturn). Are 0% interest credit cards and those cards that promise low ongoing rates, free balance transfers, and flexible repayment terms now a thing of the past?

The truth is, these credit cards, known as prime credit cards, are not a thing of the past; they just simply aren’t as easy to get as they used to be. This is because they cater to people that can demonstrate the ability to repay their loans by having strong credit scores. I’m talking about the credit cards in this list:

|

Why Are We Sitting On Tight Credit?

So, let’s take a look at where we are and where this industry is headed. Back a few years ago, people depended pretty heavily on the equity in their homes to pay back the balances on their credit cards. In a normal household, it was not unusual to see a cash out refinance or a home equity loan being used to pay off more expensive debt. And, since home values continued to rise, lenders were somewhat lax in their credit underwriting criteria, especially if you owned your own home. But, the housing market went up in smoke and mortgages began defaulting everywhere, bringing down home values. People were having trouble simply putting food on the table, let alone paying for their credit cards. Result? Lenders began declining credit card applications for all but the most qualified applicants in an attempt to stem the losses.

Which brings us to today. Now that the economy is beginning to show signs of stability, you can be sure that those lenders that survived one of the worst economic recessions in U.S. history will be extremely careful when determining who can carry prime credit cards and who can’t. Long gone are the days that a 600 credit score will land you the 0% balance transfer credit card, top perks, or even any credit card at all.

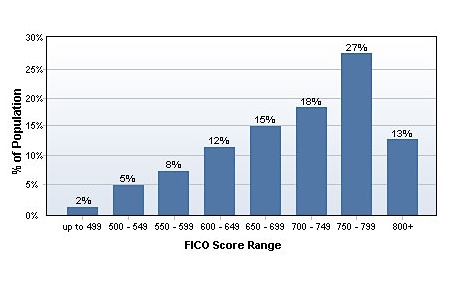

Here’s a chart that shows the percentage of consumers that fall in various credit score ranges:

Image from Bankrate.com. How does your credit score stack up?

Image from Bankrate.com. How does your credit score stack up?

In many cases, borrowers must have a score in the mid to upper 700’s to even be considered. And, many prime lenders are taking a closer look at the subprime revenue model and bringing back fees such as an annual fee, application fee, monthly maintenance fees, and so forth. Of course, these lenders aren’t quite to the point of requiring security deposits yet, but I’m not sure I would rule it out!

How To Get Approved For A Prime Credit Card

While it is much better to have a prime credit card than a subprime card, the truth is harsh: when it comes to getting a credit card, many people are going to be left out in the cold by prime lenders. Let’s take a look at what it takes to obtain a prime credit card in today’s market:

#1 Criteria Number One: Strong credit history. If you’ve got some late payments, a collections account or two, or a foreclosure on your credit history, you might as well leave the prime credit card companies alone. They won’t even talk to you if you’ve got a credit score lower than 700.

#2 Criteria number two: Stable job history. There is no way that you can repay debt if you aren’t employed. You know it and they know it. If you haven’t held a job for a minimum of 1 year, you are considered risky, no matter what your credit score is.

#3 Criteria number three: Debt to income ratio. This one is a bit tricky, but in a nutshell, you have to be able to demonstrate the ability to repay your debt by not being in over your head. This means that if you have a mortgage, car loan, credit card balance, etc. that exceeds 32% of your gross income; you’re probably going to be out of luck with a prime lender.

Of course, each lender has his or her own ideas and policies when it comes to determining who can repay debt and who can’t, but rest assured, they all consider credit score, job history, and current obligations to be primary indicators of an applicant’s strength. The best thing you can do to help you secure a prime credit card is to strengthen your financial position and improve your credit score, else you’ll just have to accept paying more for a subprime credit card product.

Copyright © 2010 The Digerati Life. All Rights Reserved.

{ 5 comments… read them below or add one }

Being an investor who’s quite interested in interest/ROI, I always try to stray away from usage of credit card credit (redundant, eh? XD)

I suppose my biggest gripe with it is usury. The typical card I’ve seen goes around 20% in monthly interest. Surely they could go lower, couldn’t they? Even if I was payment consistent, missing one could mean getting reamed by said usury. But I’m also very slow and deliberate when it comes to my transactions, so I never need to buy anything on impulse (that’s what cash on hand is for.) But if I was pressed to use a credit card, I’d settle for a pre-paid in spite of all the fees. But I suppose it ultimately comes down to what you want out of that card.

A couple of notes on using credit cards.

1. There are some credit cards that generally sport lower interest rates (check them out here). So it’s important to shop around!

2. If you’ve got good credit, there are cards that give you lower rates based on your credit history. A card like Citi Forward rewards you for good behavior:

From Citi Forward’s Terms:

Rate 1 looks to be available for those with the best credit, while rate 4 is what you get if your credit isn’t too great (I would presume).

3. If you pay your balance in full each month, you won’t care about interest rates. I don’t even know what rates my own cards have, as I don’t care given that I pay in full all the time. I just don’t pay interest.

Several months ago, I applied for the Penfed card that gives 5% cash back on gas. They turned me down because my debt to income ratio was high, and I had only been at my new job for a few months.

I’ve heard similar stories on forums of how this card is not the easiest to get. Maybe this is considered a prime card, so I’ll try again soon.

Are there any credit cards which guarantee approval?

I am in the process of building my credit and I need at least 2 credit cards which can be approved.

I appreciate your help. Thanks!

@farzan,

Try these instant approval cards. Or check out secured credit cards, which are useful for building credit for new credit card customers.