I’ve had some interesting conversations with other personal finance bloggers and have also read about what folks have shared about the subject of net worth. Some people include real estate in their net worth picture while others don’t. I actually do. Figuring out your net worth involves properly categorizing what you have and interpreting how they fit into this financial equation. So how about we check out some of the basics behind determining net worth? We’ll need to know which items fall under the Asset category and which go under Liabilities.

When we fill in our financial categories, the intention is to work towards creating a personal balance sheet in which Assets minus Liabilities equals our Net Worth. Assets create positive value, whereas Liabilities are what is owed, and Net Worth is the difference between the two.

Let’s have at it!

How To Figure Out Your Net Worth

1. List Your Assets: What Do You Own?

Before we can figure out what our net worth should be, we need to classify a few things. I’ve created a “Table of Assets” to start with. It has been said that there are certain assets we should consider increasing or optimizing while we may want to look at non-financial and non-earning assets with less priority. But what, if anything, is good about a non-earning asset? Well, we all derive enjoyment or use from our personal property, whether or not they hold any resale value or represent equity. An automobile, for example, provides for quick access to where you want to go. A home provides you with shelter. Even though these two assets do not provide us with capital gains or an extra income, they are valuable assets and they allow us to live our daily lives.

|

Here’s a look at Earning and Non-Earning Assets. Earning Assets are recognized as both cash and investment assets.

|

Now let’s look at financial asset and non-financial asset categories. Determining how you’d classify your assets this way may be somewhat tricky when it comes to paperwork. For instance, a mortgage (piece of paper) is a financial asset to the banker, although the house itself is not a financial asset for the homeowner. Sometimes people rent out a room in their house, or buy a property as an investment to yield investment income, making that home where they live into an earning asset. And what about car rentals –- aren’t car rental agencies using vehicles as earning assets?

So depending on how you are viewing or using an item, the same thing can be an asset or not (or even a liability).

|

2. List & Identify Liabilities & Forms of Debt

Intermediate Term Debt allows people to acquire things that are expensive and which would be useful now. Why would we incur debt? The reason many consumers apply for loans or put stuff on credit is because saving up for a purchase takes time and these people may not want to lose the usefulness of a particular item by having to wait too long. But the truth is that people are just unable to wait things out and would rather succumb to instant gratification. But this is beside the point. Debt is a form of liability and it’s something we should pay attention to and recognize as part of our Liabilities category.

In the Long Term Debt category, buying a home provides people with a place to live, and college loans provide earning power. Purchasing a rental property or buying a business with a loan should be scrutinized carefully. Yet both a rental property and a business are considered earning assets which will help in paying back the loan used to finance them. Short Term Debt is a mix of unexpected purchases, fixed expenses, and discretionary use of income.

Let’s list all this, shall we?

|

3. Calculate Your Worth. Assets – Liabilities = Net Worth

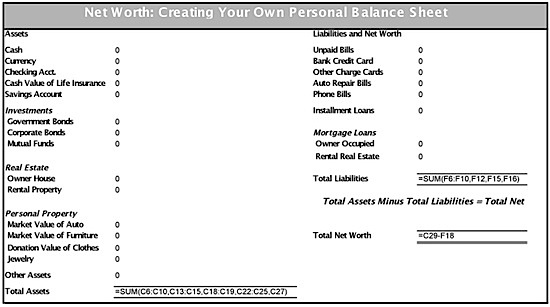

Once we’ve jotted down our Personal Assets & Liabilities, we move on to the final step and compute our net worth. We now create our own personal balance sheet. Anyone familiar with balance sheets from accounting and company financial statements will recognize the format here. Assets are totaled in the left side column and liabilities (expenses) are totaled on the right side. In the case of a company, the result of Assets minus Liabilities is Owner’s Equity. For our personal financial calculations, the equivalent number is Net Worth. Other financial statements found in accounting such as an income statement or cash flow statement can also be created to address our personal situation, but a balance sheet is one that is popularly used for personal purposes and fits a daily use need.

Your Personal Balance Statement in Excel. See more: Personal Financial Planning, Harold A. Wolff, @1992, pp. 40 – 45

Since an income statement is a yearly total, it can only be created at the end of the year. Whereas several balance sheets can be filled out throughout a year, to observe the changes in your net worth. You can use the same format or layout each time you run a calculation, but change the figures as your situation changes. You could create balance sheets quarterly as the companies do, or prepare this monthly. Or you can do this exercise every time you review and evaluate your investment portfolio by using rebalancing strategies. Creating a personal balance sheet and reviewing this on a regular basis can be a great tool to assist you with focusing on your financial life and progress.

How Do You Value Assets vs Liabilities?

Now you may wonder how we should value the stuff we own for purposes of filling out the Assets column. To fill this information out, you will need to figure the dollar value of items such as the market value of your furniture. With clothing, there are tax donation guides available which help you to figure the current value of what you own. For instance, a pair of jeans might be worth $15. If you have to watch The Antiques Road Show to discover what your furniture is worth, so be it.

The liabilities side is easier, as you can find out how much it is that you owe on your loans, bills and credit card statements. The idea here is to increase your assets while decreasing your liabilities. Remember that no one is without bills. Often, our liabilities have provided us with a great service and may have been unavoidable, but you do want to work on decreasing the value of the liabilities and increasing your positive growth on the asset side of things.

Copyright © 2011 The Digerati Life. All Rights Reserved.

{ 2 comments… read them below or add one }

So what is your net worth? Mine needs more work for my age, or maybe I have high expectations.. I am 30 years old and only have $150,000 to my name. It would be interesting to know who has made it to a million by the time they were 30. It would be great to aspire to that point.

I got to a reasonable point when I hit 30, but then again, that was during the dot com age, so the economy was experiencing a huge boom, especially in technology. Silicon Valley was partying quite heavily back then. Since then, net worth hasn’t grown very much for me given the myriad expenses we now have (we tripled our household since then, if you count the cat). 😉 So with cash flow not keeping up with that growth, well, expenses have soared and it’s become much harder for my family to grow our net worth. Our main source of net worth growth right now is the investment markets. Ask me this question again in the next few years as we work on turning our businesses into true valued assets. 🙂