The credit card industry has been operating underneath a patchwork of regulations for most of its existence. Recent events have changed that reality. In February of this year, the CARD Act became effective, outlawing what many feel were some of the most abusive and deceptive bank practices. Last week, the financial reform act passed the Senate, with its signature into law becoming imminent. Among the many provisions of this act are the creation of a financial products safety commission that will regulate most consumer financial products, including credit cards. Another provision will allow merchants to set minimum and maximum charges for credit card purchases, and will forbid credit card processors from imposing rules on merchants that prevent them from offering discounts for cash or debit purchases.

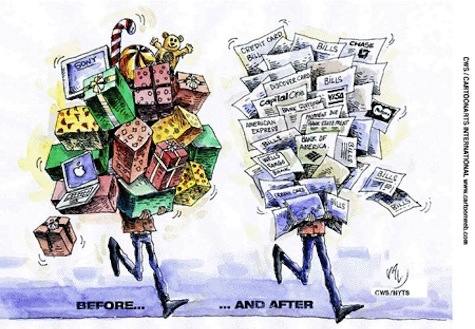

This flurry of new legislation has brought up this issue of whether or not credit cards should be more or less regulated.

Arguments in Favor of Credit Card Industry Regulation

Banks have a long history of unfair and deceptive trade practice that needed to be curtailed. All credit card issuing banks were using such tricks as double cycle billing, in which customers continued to pay interest on purchases, even after they had paid them. Other traps included deceptively marketing “fixed rates” that would go up with little notice or reason, applying to purchases made under lower rates. Such abuses, and many others, had permeated virtually all credit cards available, a clear indication of a market that was not functioning in consumer’s interests. The CARD Act has already eliminated the worst of the abuses, and the consumer financial protection agency is intended to prevent banks from implementing new strategies to circumvent CARD Act regulations.

Image by Vietbao.com

On the issue of merchant credit card policies, the new financial reform package goes in a different direction. It attempts to address merchants’ long standing concerns about the restrictions that credit card processors have placed on the merchant’s ability to restrict credit card usage and to offer discounts for one form of payment over another. One could argue that the net effect of this regulation is actually deregulation, as merchants can now impose conditions on transactions that they could not do so before.

More straightforward was the merchants’ attempt to include interchange fee regulation for credit cards in the bill. They succeeded in regulating the fees for debit cards, but credit card interchange fee regulations were stripped from the legislation before passage. The argument here was that merchants were paying too much for interchange fees. The merchants argued that the cost of processing transactions was much lower than the amount they were being charged.

In the realm of further regulations, some felt that the credit card industry should have been faced with a cap on interest rates. Senator Bernie Sanders of Vermont proposed a 15% APR cap on interest rates, but his amendment failed.

Arguments Against Further Regulation of Credit Cards

In the debate over the CARD Act, banks maintained that such regulations would limit access to credit, raise credit card APRs, and curtail rewards. In debating interchange fee regulation, both banks and consumer advocates felt that the fees, paid by the merchants, allowed banks to offer credit cards with no annual fees as well as reward cards like cash back credit cards (check this list and/or those which offer loyalty points such as frequent flier miles (think airline rewards credit cards).

Merchants derive significant value from their acceptance of credit cards, otherwise they would choose to only accept other forms of payment. It is also observed that any decrease in interchange fees paid by merchants would not result in a direct lowering of prices that consumers paid. Consumer advocates argued that allowing retailers to set minimum and maximum prices for credit cards, and setting lower prices for cash and/or debit, would create a confusing marketplace that undermined the convenience of multiple payment options.

Where I Stand

Being a consumer advocate, I strongly supported the CARD Act. In the final analysis, the CARD Act had little effect on rewards and travel credit cards, and if anything, we have seen much more lucrative rewards being offered since it’s passage. We have seen higher APRs, but I have always felt that raising the APR is a fair way to make money, while employing tricks and traps in a deceptive manner was predatory in nature. At least, APRs vary from card to card and are easily compared, while tricks and traps were buried in the fine print and common to the industry as a whole.

As for banks restricting access to credit, to the extent that has happened is probably a good thing. People with with average credit or better are still inundated with credit card solicitations. If those with bad credit are no longer targeted, perhaps that is not such a bad outcome. The biggest weakness of the CARD Act was the ability of banks to come up with new tricks and traps to circumvent the spirit of the CARD Act. Fortunately, the consumer financial protection agency will be charged with being the watchdog for the interests of consumers.

Where I object to increased regulation is in the area of interchange fees, also known as swipe fees. Despite what retailers would have you believe, these fees are a cost of business that merchants choose. The current system benefits consumers by allowing us to chose a method of payment that we prefer, with the cost being borne by the retailers who primarily benefit from the sale.

While I am a consumer advocate, I believe in the power of the free market. My belief is that government should impose regulations to ensure a fair and competitive market, but they should avoid price controls. If Congress chooses to regulate the fees paid between banks and merchants, they are just picking winners in the market, and consumers lose. Likewise, if they were to set an artificially low cap on credit card interest rates, they would probably end the credit card market as we know it.

Credit cards were giving many consumers a raw deal for decades. Recent legislation, while not perfect, is far better than the previous status quo. I hate to say it, but it looks like Congress did a fairly good job of curbing historical abuses and preventing future unfair practices without resorting to draconian price controls. I fear that the merchants’ partial success on the issue of interchange fee regulation will encourage them to attempt to pass along interchange fees in future legislation. The good news is that we now enjoy a vibrant, competitive credit card market open to anyone with a decent credit history. I supported the CARD Act and the new financial reform bill, yet I feel any further credit card regulation is unnecessary at this time.

Copyright © 2010 The Digerati Life. All Rights Reserved.

{ 3 comments… read them below or add one }

“Credit cards were giving many consumers a raw deal for decades.”

Huh? Credit cards were giving this consumer a fantastic deal for decades. 30 days (theoretically, up to 60 days) same as cash? And 1% cash back on every purchase? Discover lost money on me. American Express would have if they didn’t charge an annual fee. I read about that annual fee in its terms of service, and that’s why I didn’t apply until they finally offered a free co-branded card.

There’s a reason why no credit card company has ever lost a lawsuit over a disagreement in its terms of service: those agreements are airtight. Comprehensive and maybe confusing to those of us who don’t read at an adult level, but airtight nonetheless. People who got “screwed” by credit card companies were screwing themselves, willfully taking on revolving debt and figuring that maybe the laws of mathematics didn’t apply to them.

So now, low-income people won’t have access to formal revolving credit. If you’re poor (like most of us are in our early 20s) and frugal, then indeed you are being screwed – by the CARD Act. Poor people will now have to obtain credit by extra-legal means, or go without. If they’ve proven an ability to pay back small amounts in their entirety, it doesn’t matter. Washington knows best.

The credit card industry has been greedy for decades and it’s time to settle up!

I do agree with you Mr. Pearson. One should do something about this greedy industry!