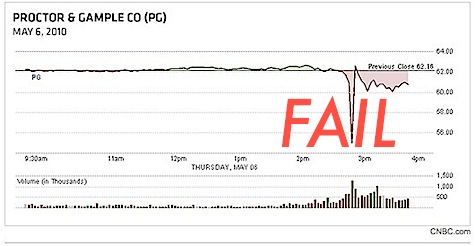

Lots of blame to go around for yesterday’s “close to” 1,000 point crash in the Dow Jones. You can point the finger at the European sovereign debt crisis for this, but you should also throw in some dunderheaded moves by some trigger happy traders to get the formula for an epic one day collapse. And to think that these people get paid a ton of money because they’re so much smarter than all of us. 😉

According to multiple sources, a trader entered a “b” for billion instead of an “m” for million in a trade possibly involving Procter & Gamble, a component in the Dow.

So erroneous trades are a contributing factor for this major Dow stumble. Initial finger pointing reeled in Citigroup’s name in the mix.

According to a person familiar with the probe, one focus is on futures contracts tied to the Standard & Poor’s 500 stock index, known as E-mini S&P 500 futures, and in particular a two-minute window in which 16 billion of the futures were sold.

As expected, there’s been some back pedaling about what happened here from those who may be possibly involved. At any rate, some trader with butter fingers isn’t about to admit he typed in the wrong letter in his order (a “billion” instead of a “million”?). While investigations take place, let’s not forget that foolish money mistakes happen all the time, particularly when people act on emotion. So before you press any buttons on your own online broker account dashboard, just make sure you’ve taken a deep breath and triple checked the orders you’ve placed.

Dow Jones Crashed: Stupid Trader Error?

So how about some funnies in response to yesterday’s action?

If you’re a day trader, you may not be smiling, depending on which side of the trade you’re on. Long term investors, hang tight — it’s just another day on Wall Street.

Images from HotFail.com, SethBarnes.com, 2DayBlog.com

Copyright © 2010 The Digerati Life. All Rights Reserved.

{ 10 comments… read them below or add one }

Wow. that’s a serious fail…

Those pictures made me laugh out loud! I’m sure we could all use a little chuckle, especially those who watched that crash live. I kept blinking and wondering if I’d had some kind of neurological event. The nice thing is, it was mostly over in about 10 blinks! 😉

I still bristle when I hear someone in the financial field defending the need for bailouts. Well, bailouts are not going to deliver us from these butterfingers.

Just wanted to post up that the trader ‘fat finger’ mistake has merely been a rumor floating around and was denied by Citi. Here’s a more adequate look at what happened for those technically inclined.

Jay

@marketfolly

Thanks Jay. Seems like we all want to pin the blame on something, so when the opportunity asserts itself, we all rush to judgment. Regardless of how it all transpired, the “fat finger” theory remains funny. This just means that no heads will roll because of the incident, which is pretty much status quo.

Thanks for this post! Something to laugh about with this “phenomenon”! We’ll see then, after all the investigations are done =)

I happened to be watching the market that day, and it was crazy during that time. Obviously it was easy to see that glitch or no glitch, some sort of panic had set in. For that reason, I am not a big fan of diversification in only stocks (as in international, small cap, large cap, etc). When the market is in a free fall, you are toast. And you can wipe out a large percentage of your portfolio overnight.

Needless to say, the stock market (apart from 2009) has been a source of disappointment for a lot of people.

Vexing Wall Street digits misjudge QWERTY, blue-chips fall, zoinks!

Seriously – being off by three orders of magnitude because of a typo would be pretty bad, and make me wonder what type of IT controls are in place. But the explanation about a positive feedback loop being set off makes more sense to me. More generally, it’s a bunch of people and systems trading based on numbers, rather than the underlying value of the company itself.

That was a scary day. I am not convinced of the whole “innocent error” explanation at all.

Not only, “no heads will roll” or “status quo”, the trades were negated for lots that were affected by 60% or more. So basically, again a bailout for fat cats and wall streeters (they are the ones who trade daily). What about folks that lost 50%?