Wondering what our investments have been doing? Well, I’ve been kind of naughty. It’s been a while since I’ve done a decent portfolio checkup, and have really just trusted our holdings to the market gods for sometime now. In other words, our investments have been on auto-pilot for quite a while, tolerating quick peeks from us now and then. We haven’t been treating it right so here’s where I’ve stolen myself a few hours to see what’s been going on. Thanks to this blog, I feel compelled to do this more often.

After 20 months, I’ve finally been able to take another full snapshot of our investment portfolio. Though I did a cursory review 4 months ago, it was not as thorough as the evaluation I gave our investments well over a year ago, so for the sake of a fair in-depth comparison, I took 2005’s allocation and will review it against what we have today.

Investment Portfolio Asset Allocation

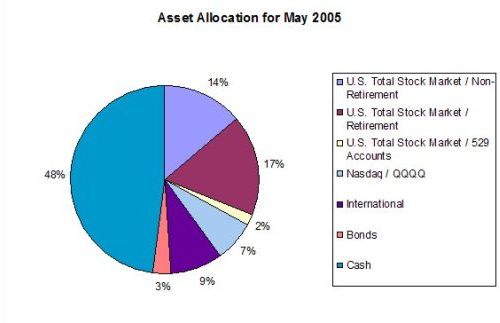

Our asset class breakdown is as follows: retirement, regular (or non-retirement), and 529 accounts for my children invested in the U.S. Total Stock Market Index in ETFs and mutual funds. There’s a small amount invested in the Nasdaq QQQQs and in bonds. We have international equity holdings and a good portion in cash.

In May of 2005, this is what our portfolio allocation looked like:

The portfolio was quite overweighted in cash in 2005, while equities only consisted of 49% of the portfolio. We’re pushing 40, but we’re still young enough so that we shouldn’t really be investing like seniors yet. So we did something about it by practicing a buy during dips strategy throughout the year. With time, the portfolio balance shifted due to the strategies we took actively, as well as the drifting it did on its own according to specific asset class performance, and as such, this portfolio instead now looks like this as of December of 2006,

which is much more according to my desired weightings. It looks like I’m not going to have to do much of anything given how things aligned themselves on their own in the last year and a half! I’m a happy camper since I’m no longer pressured into liquidating anything right away and for now will also avoid incurring a tax hit. This will give us time to mull over our financial strategy for this coming year.

And since I love tables, here’s the side by side allocation comparisons showing the portfolio shift:

| Asset | May 2005 % | December 2006 % |

|---|---|---|

| U.S. Total Stock Market / Non-Retirement | 14% | 29% |

| U.S. Total Stock Market / Retirement | 17% | 17% |

| U.S. Total Stock Market / 529 Accounts | 2% | 4% |

| Nasdaq / QQQQ | 7% | 6% |

| International Equity | 9% | 11% |

| Bonds | 3% | 2% |

| Cash | 48% | 26% |

| Individual Stocks in the Video Game Sector | 0% | 5% |

Conspicuously absent, however are any concrete plans for representations in investment real estate and additional foreign vehicles (e.g. bonds, currencies). I’ve talked on and off about this the last month: that we’re contemplating on possibly creating positions in these areas at some point, but we haven’t really gotten around to discussing it seriously yet. We may never act on it either, since it’ll take some considerable research and time to investigate and our main concern right now is just to watch how our funds are being spent while we try to launch a business on one salary. There’s enough financial worry to go around these days.

A more subtle approach to tweaking this portfolio is to increase positions in other classes that will hedge our U.S. market exposure. Perhaps we’ll add to our international equity position. Now there are signs that the overall U.S. market may be toppy right now so our general inclination is to remain cautious and neutral going forward.

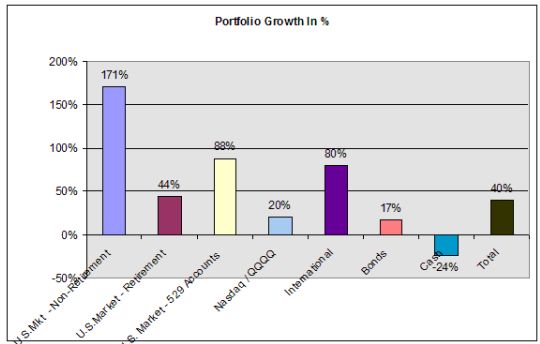

Investment Portfolio Growth

Interestingly, the growth of this portfolio — the total increase being 40% in the last 20 months — is attributed mainly to two reasons: stock market gains and stock option sales which we were forced to apply when my spouse resigned from his corporate job to strike it out on his own. Our savings rate has not been as healthy as it was many years ago prior to having children, so I can only thank the market for keeping us on track towards our goals. For the most part, we used existing cash to buy into equities, hence the 24% drop in cash.

I was actually quite hesitant to perform this financial checkup, as I was bracing myself for unpleasantness, especially after we sold off options at poor prices this year. However, the checkup yielded better than expected numbers, and all in all, I’m quite satisfied with our progress, albeit beset with some trepidation regarding our cash flow situation as we embark in a new phase in our lives that will hopefully be more rewarding as it is exciting and stressful. I’m quite curious about how launching a new business will affect our finances and in the days and months ahead, we shall find out how it all plays out as I continue tracking our situation through thick and thin.

Copyright © 2007 The Digerati Life. All Rights Reserved.

{ 1 comment… read it below or add one }

Very interesting. Thanks for the information.