One of my best friends while growing up currently lives in London. She’s called me to say she was coming over to visit the U.S. with her family to check out the Northern California coast. Then she proceeded to gloat over the fact that she was going to do some serious shopping over here. That’s because her money has longer to go here with the dollar being so weak against all forms of currency lately.

There are certainly more ominous consequences to a falling dollar, but from our vantage point as consumers, we’re seeing the fallout affect us in our everyday lives as fittingly described by The New York Post in this manner: the depressed dollar is “turning Fifth Avenue into a virtual flea market for global travelers.” In an older November 2006 article, we are shown the difference in price between some goods selling in the U.K. and in the U.S. Note that I’ve recalculated the prices here based on much more recent currency exchange rates:

For example, a pair of ladies’ straight leg 7 For All Mankind jeans retails for £169 (

$327,now it’s $344) in British department store Selfridges. In American department store Bloomingdales, the same pair of jeans sells for $143 (£73.80,now it’s £70.20).An Apple 30GB iPod retails for £189 (

$366,$384) in the UK, and for $249 (£128,£122) in the U.S.Make-up is also much cheaper for European travelers. Stila Tinted Moisturizer sells for £20 (

$39,$40) in the UK, and $28 (£14.50,£13.70) in the U.S. But on Web site strawberrynet.com, it can be bought for as little as £8 ($15.50$16.)European travel companies report that bargain-hungry shoppers are taking advantage of the favorable exchange rate to stock up on cheap goods.

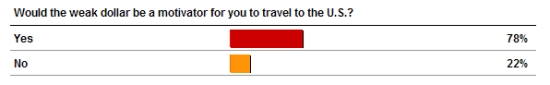

You can just imagine all the “power shopping” that’s been going on since last winter, mostly by tourists. A quick poll by CNN.com establishes this point:

Well I’m absolutely downright envious. My BFF is going to save a bunch of money while embarking on a vacation lined up with wallet-depleting shopping sprees: just how ironic is that? But I wish her luck hauling her booty back!

So what exactly IS happening to our once almighty dollar? Why am I getting shafted in the international front while my friend is gallivanting around the world buying up stuff on the cheap? It’s mainly something to do with our ballooning trade and budget deficits and whether we like it or not, the world has got us by the you-know-what.

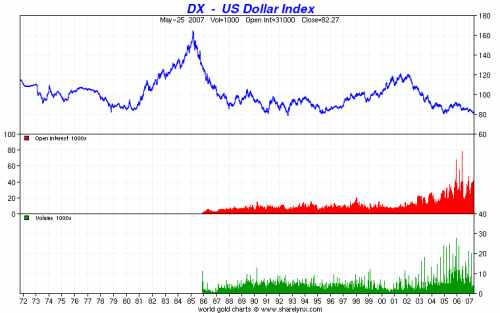

Here’s a peek at the dollar’s health, which you can measure through a variety of means including this convenient gauge:

The U.S. Dollar Index

The U.S. Dollar Index is calculated by averaging the exchange rates between the US Dollar and six major world currencies: Euro, Japanese Yen, British Pound, Canadian Dollar, Swedish Krona and Swiss France. It gives an indication of how well our currency is doing against the rest of the world with the components illustrated as follows:

|

|

|||||||||||||||||

The USDX averages the exchange rates between the US Dollar and six major world currencies.

These world currencies are those of 17 countries (12 countries of the Euro zone plus the five other nations whose currencies are represented in the USDX) which constitute the bulk of international trade with the United States, and have well-developed foreign exchange markets with rates freely determined by market participants. In addition, many currencies not included in the USDX move in close correlation with those that are included. The USDX is computed 24 hours a day, seven days a week.

This index started in 1973 with a base of 100 and is relative to this base. This means that a value of 120 would suggest that the U.S. dollar experienced a 20% increase in value over the time period.

The historical performance chart of this index depicts the depth of the slide, showing how the USDX is now touching 80!

U.S. Dollar Index Chart (1972-2007)

Looking at this graph, it’s hard to believe the dollar can fall further now that it’s scraped the bottom in the last 35 years — but it certainly can. I’m not too happy as this is making me stingy. No matter, I’ll still keep a stiff upper lip and play the good hostess to anyone who decides to visit us. They’ll need to repay the favor when the tides turn…. which I hope won’t be too long from now. In the meantime, here’s where you can keep an eye on the dollar.

Image Credit: Time Magazine; Chart Credit: ChartsRUs.com

Copyright © 2007 The Digerati Life. All Rights Reserved.

{ 23 comments… read them below or add one }

Many people that suspect that until the US loses it status as being a world leader the weak dollar doesn’t hurt too much. People still view the weak dollar as a buying opportunity to get things one sale, which is a helps things.

If they start to view the dollar as cheap, then we start to have a real problem.

Actually its spelled Pwning, not Powning 🙂

OK OK I’m a computer geek!

But great article, although not such great news. We’re sinking in the pit. Have you seen Children of Men (actually set in the UK!) and Aeon Flux? Kinda seems like thats where we’re headed >

Happy Rock,

Like everyone else, I’m wondering when the hurt will end (and no, I’m not looking at the big picture here, just my own pocket).

HAHA! Amber, thanks for the note, how can I possibly misspell a word that isn’t even a word (in the dictionary sense)? Correction made, though someone here at home who plays WoW claims both spellings are acceptable, but I’d very much rather use the cool official/original term ;). But yeah, the dollar is killing us, especially those of us doing monthly remittances to families outside of the U.S. (I’m not necessarily speaking for myself here.)

I’m thinking it will be a few years before the dollar gains it’s strength again. We’re hurting right now and unless our real estate turns soon, we’re going to have to ride it out for a while.

Thanks for posting about this very important topic. Everyone I know has been talking about this and you explain it well.

I have a friend who is trying to get us to sell our US stock and only invest in international sotcks and mutual funds. What are your thoughts on this?

Oh!

No offence meant, but I’m quite pleased that the dollar is weak now. It means that I’ve saved a bundle on things like my server charges and so on that are paid in US$.

I was actually contemplating coming for a visit (probably to Philly) just because the exchange rate was low, but have decided that I still can’t quite afford it.

In compensation, stuff in the UK is more expensive than in the US even when the exchange rate is more typical, and I earn less than I would over there. So in fact I’m not better off at all.

You are killing my head with the updated prices in the NY Times. If I want to compare “now” vs. “now”, I have do the math from Pounds to US Dollars or vice versa. For instance the jeans are now $344 in England, but in Bloomingdales, they are £70.20… which is how much US dollars?

Maybe now you are thinking of boosting that international allocation a bit beyound the 20-25% that you said you previously had.

Nice, I’ve been looking for a good data source on this. I’m not looking forward to the loss of wealth caused by the combining of a devalued dollar, dropping housing prices, and strict access to credit. It’s gonna be a painful few years I think.

Does this account for the fact the economy is at least 1000 times bigger than it was in the 70’s. I can’t imagine the big three oil companies earning 1 billion dollars in 1970 versus 40 billion or so this quarter alone in 2007.

Money is only a theory in pratice, just like when the tide falls, the sea rises so eventually the sea falls and the tide rise. Europe fell before it became stronger, America fell before it became stronger, Europe rose again, America will rise again, what’s your hurry? For the love of money, what’s your hurry?

Um, we’re missing an important point here. If all the foreigners are coming to the US to buy, buy, buy……who really is winning, winning, winning? It’s the Americans! Don’t you think it is about time that instead of us buying stuff from others, they are finally coming here and buying? Not only are they buying, they’re INVESTING.

Just remember, when Suddam Hussein was captured, he was hiding in that hole with $100,000 US BUCKS! Not euros, liras or whatever. The good ole American dollar. It’s because the US buck is the only thing of value.

Know why the stock market is taking such a huge dump globally? It’s because we sold them our mortgage holdings and they gobbled them up.

We should welcome tourists and encourage them to spend, spend, spend.

It’s about time!

this is true – it was the same when $1 was worth $1.50 canadian – and we went up there to shop. Now the CAN and the USD are almost on par.

The massive amounts of devaluation of the USD over the last 8 years is just amazing.

I know a few military members stationed in the UK who have used the weak dollar to their advantage by selling some of their own items via eBay.uk for the more valuable pound, or even going so far as to import select items at dollar prices and resell them for pounds. One has to be very careful with that though, as there are certain laws regarding importing and taxes.

@JEM,

I wouldn’t be selling US stocks in reaction to what’s been going on. That would just be timing the market — effectively selling an unfavorable asset and replacing it with “the fad of the season”. Instead, I would suggest keeping a well-represented portfolio with all asset classes such as US stocks AND international equities included. Ultimately, we don’t really know how US vs foreign equities will be slugging it out in the recent years; even though it points to a serious US bashing, it doesn’t mean it will turn out that way. The most prudent approach is to carry diversified positions in the major investment classes and stick to those positions.

@Plonkee, well enjoy the currency effect while it lasts. I’m sure I would if it were going in my favor!

@Lazy,

It appears that the prices in the US are different from those in the UK but you can certainly see the main difference in prices nonetheless. If you bought jeans in the UK for example, it would cost you $344 there but only $143 if you purchase it here. Whereas in the UK the same jeans would cost £169 there but £70.20 for a British tourist going shopping here. And YES! I am beginning to dollar cost average into my international funds and look forward to more buying opportunities!

@Boomie,

I’m expecting tourist spending to be economically stimulative, so in that sense, it’s good.

@Patrick,

Wow, that’s a thought! I’m sure there are many ways to capitalize on this. Wait! I have an idea. I’ll write a post about it :).

It looks to me that prices in England are inflated. If the same goods cost less here, that’s better for the US, right?

You have a point. I guess my point here is that everything is relative. At the micro level, I feel that by seeing how my friends are spending so easily while I harbor the realization that the dollar we hold isn’t going the same long way, the psychological effect here is for me to hold back while watching others spend it up. Another point of “envy” and the reason I feel even “stingier” is that I feel less inclined to perform the same activities: fly out and travel as easily as I’d like to and have the same great vacations due to higher prices elsewhere.

What do I wish? That the dollar doesn’t crash. What I’m concerned about is that the dollar continually deteriorates with time. If so, then we’re at risk for inflation and subsequently, recession. Here’s a great article by Michael Sivy on this subject.

I am in the process of selecting some mutual funds for my retirement savings and due to the free-falling USD I am staying clear of any mutual fund based in USD. I mean, if the fund goes up 10% in a year but the USD has dropped another 10% then my investment has given me a return of 0%.

I also recently read an atricke there an american reporter referred to the mexican dollar, as a retort I usually refer to the American Peso now. 🙂

The weak dollar isn’t necessarily bad, but it could be bad from the local consumer’s point of view.

the figures also do not include import taxes etc which tend to be higher on many goods outside of the u.s.

there is nothing wrong with a weak dollar. if you are comparing in retrospect, then you should also talk about how for many years, u.s. has been able to buy things cheaper in europe than in the states for european goods, been able to travel to europe cheaper than the cost to travel to the u.s. etc, etc.

bottom line, is that u.s. has it good. a high trade deficit means that foreigners have to spend those dollars sometime and they will have to spend them on u.s. goods and services. sure they could get rid of the dollars for euros or something, but then whoever is buying those dollars would still have to spend on u.s. goods and services. oil is traded in u.s. dollars, so although it hurts our individual pocket books to spend more on gasoline, those u.s. petro-dollars have to be spent on u.s. goods and services in the end, whether directly or in the future indirectly.

more spending on u.s. goods/services means that u.s. companies continue to earn profits and u.s. employees continue to have jobs.

u.s. still has low inflation, low unemployment, etc compared to europe. sucks in the short term.

I am on the receiving end too. Going back to Thailand to visit is going to be more expensive with this currency issue.

I’ll be another voice to ask, where is the bottom? The last two times the USDX hit 80, Japan and China bailed us out with massive dollar buys to keep their debtor solvent. This time, Japan’s economy is stagnant and AFAIK they’ve said that they won’t be buying any more dollars… and China is REALLY messed up, with worse domestic debt problems than we have in the states. What’s more, OPEC is making noises about moving to the Euro for oil exchange… which would be a mess for the US.

My question REALLY is – what would it take to turn this around? Is Ron Paul on sound economic footing when he says that we should ditch fiat money entirely and tie our currency to something? According to him, fixing the budget/deficit problems is a temporary solution, but to keep it from happening again we have to make it impossible to print money out of thin air. Is he talking through his hat, or is this kind of drastic change (dropping the Fed) the strong medicine that the US actually needs to survive?

The Dollar has went through some severe devaluations in the the past, in the 1970s it also lost a lot of value against all major world currencies and then rebounded in the 80s. In the early 90s it fell again and then rebounded. This time the decline will be even more pronounced. This is the effect of having a currency that is owned by foreigners, countries like China, Saudi Arabia, Japan, and a number of others hold large amounts of US reserves. There used to be a time when the dollar was tied to gold, but in the 70s Nixon nixed Bretton Woods fearing foreign holders of

Dollars would dump them for gold. Now we have massive levels of unsustainable debt, we are dependent on foreign countries to keep us solvent, many of these countries are strongly anti-American like China and Saudi Arabia. The Europeans are wooing these countries now, and more of them are storing their wealth in Euros. So we in the US are in a serious pickle, even our neighbors to the North, who hold Polar Pesos, now have currency that is more valuable than the Greenback.

I’m a computer programmer, so economic analysis is not my strong point, but it seems to me that a Global Economy requires a Global Standard of Living and ours is too high.

Am I wrong? Why?