If you’re an investor or business person, one concept that will keep surfacing is the concept of diversification. And one way for investors to diversify pretty effectively is by investing in foreign markets. For many investors, their exposure to such markets is confined to international mutual funds or stocks. But there is another world out there that you may be interested in digging into a little more, and which is mostly built for those who are more aggressive traders. It’s the foreign currency market. Remember that if you hold an international investment, then the currency exchange rate influences your gains or losses quite a bit and can dramatically alter your returns. It helps to understand the underpinnings of currency exchange and perhaps gain some insight on how this kind of market works. Those of you who have the tummy for it may want to delve into some aspects of effective currency trading too.

“Forex” is the nickname given to the foreign exchange market. And like any other market, you can make some bucks in it in various ways. A major component of this is currency trading, which we’ll explore here.

What is Foreign Currency or Forex Trading?

The currency exchange rate is the amount at which one currency can be exchanged for another. For consistency, I’ll use the U.S. Dollar and Euro as examples. The exchange rate is always quoted in a pair (EUR/USD or USD/EUR). Exchange rates can fluctuate widely based on economic factors like inflation, industrial production, and political occurrences or wartime conflicts.

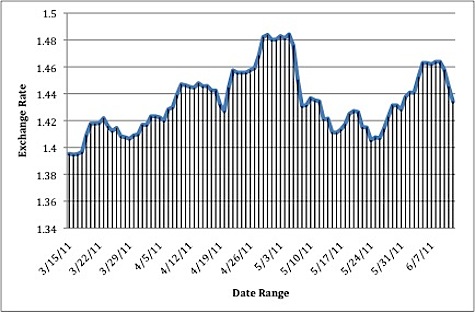

Here’s an example: on June 12, 2011 the currency exchange rate for EUR/USD was 1.00/1.43. In other words, every 1 Euro is worth $1.43 and every 1 Dollar is worth €0.696. While it may seem that those switching from dollars to euros are “losing money,” this is simply an illusion since we’re converting from one monetary unit (currency) to another. Money is not being lost here, and is only lost if the rate changes and you end up doing an opposite trade. Note as well that economic factors must also be taken into account. Consider this graph showing a 3-month trend:

On the left axis, the exchange rate is given as “Euro (EUR) in US Dollar (USD)”. The bottom axis shows the date range. Here, we can see the wide variation, even within a three-month period. Investors interested in foreign markets follow the exchange rates closely to monitor the best circumstances and find the best opportunities for converting funds and investing internationally.

So How Does Forex Work?

Using data from the graph above, we can determine that the average exchange rate was 1.4348. The period low was on March 16th at 1.394. The period high was on May 5th at 1.484. But what do these numbers actually tell us?

For one, the rate represents the number of US Dollars that one Euro can purchase (you can also calculate the converse from this data). So here’s how a trader would think: if I believe that the Dollar will increase in value against the Euro, then I will buy Euros with my US Dollars. Here, the word “buy” can mean at least two things:

(1) literally buying currency -– that is, converting actual Dollars to real Euros OR

(2) investing in a market that uses the Euro as its currency base. Once I’ve bought Euros, I can sell them back if the exchange rates fall, and I will make a profit!

But as you can see, May 5th, instead, would have been an excellent day to convert Euros to Dollars. On that day, 1 Euro was worth $1.484. March 16th would have been the opposite: 1 Euro was worth $1.394.

The Differences Between The Forex Market vs Traditional Markets

The mechanics of a currency trade are nearly identical to those in other markets. Let it be said that trading in foreign currencies carries a high level of risk. Your profitability hinges on timing the market successfully (and can easily be a gamble if you aren’t careful). Those seeking to invest in foreign markets must understand the fluctuations. A good source of tracking information is Oanda.com, a website that allows users to track the exchange rates and to learn how to trade Forex.

The foreign exchange market does differ from traditional markets in a few ways:

- Because we are trading in currency, the bulk of the market is liquid. Investors trade actual US Dollars for another “real” currency or they must have the liquid funds to invest in foreign country assets.

- The market is not centralized. Unlike investing in a conglomerate, Forex is geographically dispersed.

- Customers can buy and sell currency at all hours of the day. There are brokers in Forex that operate 24/7 except on weekends; and in most major cities, currency exchange offices are open every single day.

- A variety of factors can affect the exchange rates. If there is a regional conflict in Central Europe, for example, the value of the Euro may decrease.

- The profit that one can generate from Forex is typically lower than what you can get from other investment vehicles. However, depending on the currency pair, there may be potential for huge growth if an investor closely follows the trends and converts his/her money on a day when the exchange rate is particularly favorable.

- Leverage is important. The more money you have in a foreign currency vehicle, the greater your return when you do decide to convert back to US Dollars. For instance: if I have 5,000 Euros in a money market account and I decided to convert it back to US Dollars on March 16th, I would have yielded $6,973.60. If I had made the same transfer of €5,000 on May 5th, I would have yielded $7,421.70. Obviously, watching the trends can mean huge gains if you’ve invested large amounts.

Forex Tools and Tips

In currency trading, investors and brokers use technical language that may be unfamiliar to those new to international investing. As you familiarize yourself with the terminology, trading Forex will become easier.

- Technical Analysis. To develop their own strategy, currency traders (a broad term that refers to anyone who trades currency or who opens an account in foreign funds) study currency trends and charts, like the ones available at Oanda.com. Past market movements are used to help predict future activity.

- Fundamental Analysis. This process involves keeping a close eye on economics, social and political events and then assessing the rise and fall of the exchange rate. If a political conflict in Germany, for example, coincides with a fall in the value of the Euro, then I might equate the two and hold off trading until the conflict subsides. This is tricky business, but may prove to be an effective strategy for some investors.

- Demo Accounts. Many websites offer free demo trading accounts so that you can “practice” Forex. Visit xe.com or oanda.com for more information — practice makes perfect!

- Know the Risks. As with every investment, know the risks! I can’t reiterate this enough. Trading on the foreign markets can carry a high level of risk, but has the potential for great returns. If in doubt, contact an investment advisor who specializes in foreign currencies to help you make a decision.

- Know your options. If you’re worried about where or how to invest in foreign currency, remember that you have options. You can start simply by converting US Dollars to a foreign currency, watching the trends, and then converting it back when conditions are favorable. Other strategies will entail opening a money market account or a certificate of deposit in a foreign bank account or in an American bank that allows accounts in foreign currency: check this article on foreign currency hedging with EverBank products or consult your financial institution for information.

Should You Invest In Foreign Currencies?

Here, I speak from experience. I have several thousand dollars invested in Euros. I closely watch the exchange rate (almost daily) and I’m keenly aware of the political and social impact that the European Union and Eurozone can have on the exchange rate. When I started dealing in Euros, I was worried about the risk…and that’s completely understandable. But anyone interested can try it out and gain experience along the way. It just requires a little bit of patience and setting aside a few minutes each day to check on the vital information.

If you’re interested in adding some spice to your portfolio, then you may want to consider currency trading. If you want lower risk exposure to foreign currencies, then open a CD in a foreign currency. But be aware that the risk of loss still exists (due to currency risk), even with these CD products.

Copyright © 2011 The Digerati Life. All Rights Reserved.

{ 1 comment… read it below or add one }

I’ve always been interested in pursuing offbeat investments or those that the crowd tends to avoid. But given the risks, I would only try a small fragment of my funds on this stuff. Anyone do forex on a regular basis and with big money?