The good and bad of market timing. Are you prepared to buy and hold forever?

Technically speaking, there’s no such thing as “buying and holding” forever because in order to be a responsible steward of your portfolio, you’d have to take it through times of evolution, growth, adjustment and reorientation, all depending on where you are with your life, goals and financial expectations. Here’s where I split hairs about the concept of market timing.

When I wrote that I subscribed to a newsletter for some financial information, I admitted that the newsletter practiced some form of “market timing”. It was the kind of market timing that didn’t occur frequently (e.g. not for day traders), and which was based on systematic indicators that track the state of the economy and the fundamentals of the overall market. It was a signal-based form of market timing practiced by some who keep their eye on the long-term trends and behavior of the market. Over 15 years ago, I thought I’d try out the service for $200 a year and today, here we are still awaiting each monthly report with curious anticipation, wondering what the author (a money guru in his own right) would say about recent market events.

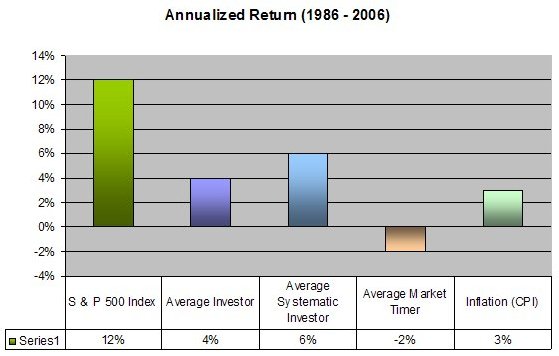

So what I’d like to do in this post is to take a closer look at market timing. I am quite aware about the questionable record that market timers have racked up. For starters, check out these historical statistics that show how different investing strategies have stacked up over the long term (source: Charles Schwab On Investing magazine):

Given these numbers, the market timing strategy looks like a truly horrid plan to pursue. Market timing lagged all other forms of investing here by a significant margin. But who is the “Average Market Timer” being described here? And what does “market timing” really mean? Are we talking about the professional market speculator, the random casual day trader or the novice investor who decides one day to play with the stock market?

Market timing appears to have various flavors and not all timing approaches may lead to investment underperformance. I say this, while citing this piece about market timing, which attempts to describe different approaches that fall under the timing umbrella:

Different Market Timing Strategies

#1 Short-term market timing

Short term market timing refers to day trading or timing cycles that measure out in hours, weeks or months. Many times, people who engage in this are emotional investors. Some are true speculators who do it for a living with an elite group doing extremely well. But unfortunately for the average joe trader, after taxes, transaction fees and other such costs, the approach that involves jumping in and out of equities isn’t really all that rewarding. I have never tried this but lots of my own friends have, and I’ve seen how they’ve fared, making me want to avoid it like the plague.

#2 Long-term market timing

This method is employed by many market professionals — yes, including the newsletters I’ve been talking about — and involves determining long term market trends that cut across several years. Market indicators are monitored in order to identify existing trends and such analysts attempt to describe where the market may be headed. Once in a while, they call out a buy or sell signal that involves some shifts in their model portfolios. I’ve been intrigued by this strategy as it does have a basis on economic and market fundamentals.

#3 Buying and selling an entire portfolio (or a majority of it)

Both short or long term timing usually involves the manipulation of one’s entire portfolio, something I strongly doubt I’d ever attempt. Making dramatic moves that involve your entire portfolio can prove to be disastrous because of the level of concentration you are subjecting your funds to. Timing with a little piece of your portfolio in order to tweak it is fine. Partial timing to the smallest degree you can muster may be okay. But moving in and out of the market with your entire position is a huge gamble anyone is bound to lose. I’m not sure how the experts and professionals do it, but I truly doubt they ever take 100% of their holdings and make a single bet with it.

#4 Compulsive rebalancing and shifting of one’s asset allocation

There doesn’t seem to be any reason why anyone would tweak their portfolio more than a couple of times a year. I’d expect that a properly diversified portfolio wouldn’t result in significant imbalances throughout the year that would entail constant tweaking. By playing with your allocation too much, transaction costs, fees and taxes can eat into your holdings.

#5 Buying and selling stocks given price targets or high valuations

I’ve seen this strategy play out where people set targets to buy and sell. My own experience doing this has only resulted in mediocre returns. In the end, I find that this activity is “just a wash” and a waste of time since winning positions are not given the opportunity to ride further on strength and I find that the record keeping I have to do while dealing with frequent trades becomes a bear.

#6 Buying and selling positions as an emotional reaction

This is plain and simple the wrong way to invest. Any kind of trading that happens due to emotional reactions is the sure way to get burned. This occurs when someone buys a stock based on a tip heard at the office water cooler, or when someone sells his holdings after reading a scary headline in his local paper. If you find yourself too emotional about the stock market and you aren’t able to sleep at night, then you may want to cut back on your positions.

#7 Buying and selling as a strategic move tied to market behavior

If you’ve told yourself that you’d buy and sell based on a well-defined system that you’ve established prior to any market events occurring, then to some degree, you’re making moves strategically. That is, you’ve developed a plan and you’re performing transactions based on the plan. For instance, if you’ve decided you’d do some portfolio rebalancing in a way that your allocation benefits from changes that are further encouraged by the existing market climate, then you’re acting according to strategy. For instance, while the market hiccups, I tend to reallocate funds from cash to equities to take advantage of stocks’ weaker prices. The difference between acting on strategy and acting on emotion is found in planning, anticipation and preparation.

Are all these “bad strategies”? I’d argue not, but your success with them depends on many assumptions and factors. I will agree that market timing is absolutely destructive to the portfolio of inexperienced investors, especially if it is employed as one’s financial strategy of choice. The conventional wisdom is true: TIME IN the market is much more important than TIMING the market. As an average investor, long term investing and staying the course (overused as these terms have been) is the way to go. But as an investor who continually wants to learn, I keep an open mind about this subject and won’t paint all the timing strategies with a broad negative brush.

Now I’m not trying to make an excuse for ourselves and our infatuation with a market timing strategist and his newsletter. In fact, this newsletter aligns with our core investment philosophies which are centered on solid long-term investing. It complements us as proponents of asset allocation, automatic rebalancing, goal setting and risk tolerance assessment.

But I’m also a closet market timer (a contrarian at that!) if there’s such a thing: as someone who buys when things drop and who may sell off just a bit when prices seem lofty. If you’re 90% an asset-allocating-long-term-investing buy and holder, who’s using the other 10% of your assets to explore the vagaries of the market, then you’re a perfectly fine investor in my book: I find that a little experimentation in the markets is healthy.

If you can’t help but be a little scared or excited over what the market is doing, then I’d suggest timing therapy with a little bit of play money. A little bit of buying and selling and dabbling in the market within the confines of a tight financial plan shouldn’t be a bad thing.

Image Credit: Schwab Report, Wagner Blog

Copyright © 2007 The Digerati Life. All Rights Reserved.

{ 15 comments… read them below or add one }

10% playing around shouldn’t do much damange. Eventually, I’d like to have some money invested in funds which are people-friendly and earth-friendly. That’s not what I’m going to base my retirement on, but I think it’s good to support such things. Plus, I expect tht such companies will be doing better as people become more socially/environmentally aware.

I have two pictures of a market timer. One is a studious person who has zillions of graphs and sometimes makes good predictions. The other is an emotion-driven person who thinks that this or that is going to happen based off a little reading.

I don’t have the time to be the first and I expect I’d be the second if I tried timing it. So none of the above for me. 🙂 Indexing.

Mrs. Micah,

I agree with you 100% — I am a big fan of indexing and that’s where 95% of our assets lie. This covers the physical diversification and layout of our allocation.

The timing aspect is a little trickier. Do you buy and hold your indexed funds or do you practice systematic investing? Do you sometimes participate in “portfolio shifting” (or light market timing) based on market changes or do you stay put with your investments no matter what? When do you rebalance and how often do you do it? I sometimes time my rebalancing activity during times of market upheaval to take advantage of the asset value discrepancies experienced during such times. However, I wonder myself how much of this type of activity adds to the growth of my portfolio.

As investors, most of us employ various methods to help our wealth grow — just curious how many are pure “buy and holders” vs “portfolio shifters”. 😉

showing my ignorance here: why couldn’t a person just hold the S&P500 stocks and get the 12% return??

N8J, my guess is that we are all stupid and think that we can beat the S&P500 index years after years and prefer to trade stocks or mutual funds by ourselves. Obviously, we lamentably fail most of the time 😉

Market timing is a bit of gambling if you don’t know what you are doing, and if you do, then you are better off day trading 😉

n8j,

Definitely a very good point. The issue is whether people will actually decide to put all their funds in a 100% S & P index fund despite those statistics. Also, those numbers are NOT guaranteed so given your comfort level with risk, you’re not going to commit all your money to the S & P. We all don’t know what tomorrow will bring so people balk at taking this 100% S & P approach and maybe opt for an even more diversified portfolio that includes International stocks/index funds and Bonds. Where people put their money depends on so many factors such as age, risk profile (how comfortable you are with volatility), goals and so forth, so entrusting all your money to the S & P isn’t what everyone signs up to do.

The question I have: who here sat through the 2000 dot com bust and didn’t feel the slightest bit uncomfortable about their money in the S & P index?

Many were unable to sit through that period with confidence, so they sold out of their positions — but that meant they had to worry about how to get into the market again. Market timing constitutes figuring out when the right time is to sell and the right time to buy, and you have to be correct both times!

This is all a personal choice — but what’s most important is that you know yourself well enough that you’re happy with your long term investing plan.

Lots of people (such as JLP ;)) don’t believe in any form of market timing. I, however, believe you may be able to enhance your long term investing strategy with some minor form of market timing — for example, doing your portfolio rebalancing during certain market periods. If one market phase has one asset overperforming and another asset underperforming, I’d most likely do my portfolio shifts during that time period.

Read more on portfolio rebalancing here.

Could it all be a wash? Who knows — I’d love to see some stats that support the case that strategic portfolio rebalancing doesn’t yield stronger results than automatic portfolio rebalancing. Any takers?

I label myself as a buy-n-holder but as you point out there is no such thing, really. I do ‘shift’ my holdings; for example I just rebalanced by exchanging some of my European index funds for Asia-Pacific to lock in some gains and shift to a slightly less hot area. So I didn’t buy and hold until death, exactly.

And I do time in the sense that right now, for example, I am shifting my current investments away from the US. I don’t go back and sell core holdings most of the time, but I’m certainly going to stay away from adding to those positions for a while. And if the market goes much further south (and what I believe to be key indicators get much worse) I will probably start shifting those core US domestic stock index funds out.

So I am very anti-market timing while, at the same time, market timing. It’s probably just a matter of semantics: when is it timing? If you hold for less than 1 week? Month? Year? Decade? My grandfather bought and held until (literally) he passed away for the dividend income. I’m not sure that was the greatest use of that money, but according to his view I was a pretty flighty investor making 2 trades a year…! 🙂

I, unfortunately, time the market with new money. i.e. I try not to buy if I feel that market is overvalued (or certain segments of it are overvalued). I don’t think it’s a good strategy – it’s just flaw in my investing strategy that I am acknowleding… 🙂

I too have read and posted about the Schwab market timing study, and I don’t believe that the average investor (of which I am one) is able to profitably practice market timing.

Portfolio rebalancing is not a form of market – it is simply the practice of the recoginzed statistical axiom that things tend to regress to the mean in the long run.

Market timing is everything when it come’s to investing.

I should know, I picked a list of 10 UK shares that could benefit from a Christmas rally if we have one, just as a bit of fun, and posted it on my blog over the weekend, and since then the market’s completely tanked and I’m left looking like a complete idiot as they’ve all dropped 🙂

In the real world, I always believe that you should always follow trends. Even when bottom fishing it’s best to wait for clear signs of a trend reversal before buying in otherwise you are just catching a falling knife.

Ive never bothered with market time, I just put my money away into a quality mutual fund and call it good.

Great post. I think my style is very similar to SVB. I do rebalance at least once a year and set aside some money to buy more equities when the market is weak.

I’m a fairly passive investor. I have made some changes to my portfolio over the last year but they had more to do with changes to my “investment plan” because of learning new things and such.

Mike

This is an intelligent and important article.

It is indeed true that there are many forms of timing that are not likely to work out. It is excessively dogmatic to conclude that no forms of timing work. The same historical stock-return data that shows that short-term timing is not likely to work out also shows that long-term timing is likely to work out. If the data can be trusted on one point, why can it not also be trusted on the other point?

To understand why long-term timing is so different from short-term timing, you need to understand what sorts of factors influence stock prices over various time-periods. In the short-term, it is investor emotion that is the dominant influence. Emotions are not rational and thereby are not predictable. Short-term timing does not work because short-term price changes are not predictable.

In the long term, it is the economic realities that determine stock prices. In the long term, stock prices are determined rationally. What is rational is predictable. It is not difficult to predict long-term index prices. This cannot be done with a great degree of precision. But it can be done well enough to tell investors when to lower their stock allocations by 25 percent or so.

Rob Bennett

(I’m the author of the article linked to above on “Market Timing — What Works and What Does Not.”)

i use market timing for real estate investing.

i bought home in CA when they were relatively cheap.

i sold them all in 2005 when they got expensive (from a rent-mortgage ratio standpoint).

🙂

It is fairly easy to find a market timing scheme which has worked in the past. Almost all of the published ones have.

It is much tougher to find one that continues to do so in the future.

When you see that published market timing schemes continue to beat the market less than 50% of the time it seems to me that it is mostly luck.

What works in Investing

Invest Regularly

Diversify

Rebalance

Keep costs low.

Take advantage to tax deferral where possible (Roth/IRA/401k etc.)

Listening to economists and analysts is a bad idea. I have my own investment strategy as posted on my web page. I have also developed my own charts (3) that tell me when the markets are going to do well (short term) and also indicate when they are going to tank…..

Knowing when the market place is bullish is only part of the equation though, investing in sectors that will show the best returns is the other part. Of course when the markets are going to drop significantly everything in my portfolio goes into money market-global bonds and cash.

Knowledge is key and my webpage mutualfundwealth should help you develop your own individual investment stragegy.

Doug T……The mutual fund guy

http://www.mutualfundwealth.com/