Here’s my personal experience as a long time subscriber to a popular investment newsletter.

Timing the market is one subject that remains anathema among staunch long term investors. I would certainly consider myself a long term investor, having been in the market since 1990. However, here’s something I’m only now admitting: that I have since the early 1990’s subscribed to a newsletter that preaches long term investing yet also practices some form of market timing. I pay around $200 a year for it.

I am hardly a market timer as I rarely trade stocks or mutual funds. We’d be lucky to incur a few transactions a year on stock sales mostly triggered by portfolio rebalancing. So what am I doing with this newsletter? To our minds, the author of this newsletter truly understands the economy and the markets so thoroughly that we’ve decided to buy into the information he offers.

We try to keep ourselves abreast with what’s going on, reading up on trends, analysis, commentary by hearing what knowledgeable experts have to say. So far, the record of this particular “expert” has been pretty good, and probably beats whatever we could have done on our own.

No matter how strong a position you take with investing, once the markets gyrate wildly, it becomes too easy to succumb to the extreme discomfort of volatility and uncertainty. Does this mean we are using a paid newsletter as some assurance to tide us over these bumps? Are we using this advice as some kind of crutch? To some degree, YES, but we also feel that we are aligning ourselves with someone whom we respect as a true expert, whom we have trusted over the last 20 years and whose investment philosophies we’ve wholeheartedly agreed with.

This is not, by any means, the only place where we get our financial information. We try to round up our information from various sources as well: from books, magazines, periodicals, sites, forums. We don’t blindly follow a single expert’s advice since we make decisions based on our own situation, but we do appreciate “the second opinion”, which allows us to feel assured about the direction we’re taking with our finances.

Some may think we are foolish to waste $200 a year on someone’s advice but we look upon it as yet another investment — not necessarily something we strictly adhere to at all times, but something we use to inspire and guide our decisions and the directions we’ve taken with our money. That said, it remains the case that the newsletter tries to time the market by watching economic indicators and long term timing models.

In order to defend the position that this newsletter takes in terms of market timing, I’d have to cover market timing strategies in more detail, which I unfortunately do not have room for in this post. So I promise to follow up on further thoughts on this subject at a later time.

As for my parting words — I’d like to know what you think of investment or financial newsletters in general. [The irony here is that any self-proclaimed guru can offer a newsletter: even “expert bloggers”!] This is just one more way I try to enlighten myself on the nuances of finance. Majority of newsletters do rub me the wrong way with their promises and prophecies of overnight riches. Also, a good number of them seem to focus on short term strategies or stock trading, which isn’t something we subscribe to. But there are some that espouse long term and diversified investing as well. Behind some newsletters there could very well be someone credible with a strong investment performance record for a long period of time.

For additional information, I may tend to look into the Hulbert’s Digest (a “rating service” that ranks investment newsletters) though I’ve heard that some long term performance rankings and ratings are given an artificial boost due to “backtesting”, which utilizes hypothetical portfolios and data that can be prone to manipulation. At any rate, I found this critical view of newsletters worth digesting, though I remain open-minded about the whole thing.

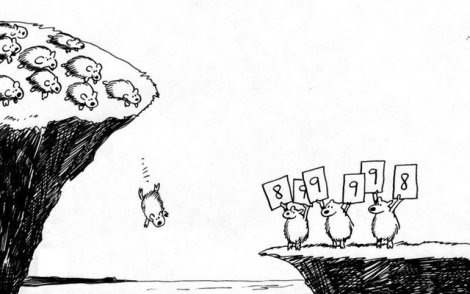

Image Credit: Wagner Blog

Copyright © 2007 The Digerati Life. All Rights Reserved.

{ 11 comments… read them below or add one }

I used to subscribe to a couple of financial magazines, but they didn’t really seem to offer anything that was of value to me. It’s entirely possible that there are worthwhile newsletters / publications that I just haven’t looked at. My philosophy to this point has been long term, diversified investing.

I don’t subscribe to anything that costs me money. I can find a wealth of information for free on the internet, in the newspaper and in other free sources. At the same time, if I picked up all of these sources and averaged them out, the end result would be “I’m not sure what the economy will do and I am not sure when it will do it”.

In light of this, I’ve given up trying to time the market. I invest in companies and fund with strong fundamentals and then ride it out for the long term aiming for a balanced portfolio with a risk level I’m ok with.

Gal

The trouble with investment newsletters is that they are self-fulfilling in many ways because they tip up smaller companies to their subscribers who in turn buy and drive up the price, and everyone thinks they’re geniuses.

Unfortunately when these same buyers take profits, the price goes back down rapidly and it can prove difficult to sell their shares as liquidity dries up and they have to accept a much lower selling price.

I agree that majority of newsletters suffer from a few obvious problems. If stock picking and trading is your gig, then they may float your boat. The newsletter I like focuses more on asset allocation and macroeconomic theory and helps to try to forecast long term trends. Mrs. Micah may have concluded that it was a subscription that only preached “buy and hold” — I’d like to clarify that on the contrary, the newsletter practices market timing based on market trends so yes, during the last couple of decades, it’s influenced us to buy into weaker periods and to sidestep major losses by doing some portfolio fine-tuning based on recommendations. Again I’d like to emphasize that this newsletter is not the only source of information we use to make our decisions, but it does figure quite a bit in setting some direction for us.

I wouldn’t call ourselves staunch “buy and holders” because we’ve reacted to market trends in the past. After all, the only way to benefit from a market trend is to capitalize on it prior to it unfolding completely. So far, I would have to credit this newsletter as helping us stay abreast and proactive with market trends in this manner. Would you consider it a crutch? Perhaps, but I’d prefer to look at it as further “education”.

I have used a couple of newsletters in the past but have found that unless you make absolutely every trade they suggest (and some have suggested a lot) you will not hit their returns. In addition, unless people are willing to subscribe for the long-term, then you are just speculating. I would suspect that most people buy subscriptions for the short-term dreams (I have), but realize quickly that it rarely happens that way. Like anything in investing, we need a long term focus.

Good post,

The Dividend Guy

I think I would recommend “spontaneous investors” to stay away from newsletters since real value is probably derived if you use for long-term investment strategy and to keep abreast of current market conditions, etc. like the Silicon Valley Blogger does. I agree with The Dividend Guy here.

I often wonder a bit about these newsletters, and borrow a copy to read once in while, but I have never had a subscription myself. In the same way that I take health magazines with a grain of salt (since they are general information not specifically tailored to my situation) I think you have to take investors’ magazines the same way. Age, risk tolerance, retirement goals, etc. are different person to person and it would be impossible for an anonymous newsletter to consider all of those factors.

Now, if you’re a studious investor and you use it as a tool to determine your own investing strategy, I think that’s fine. If you’re not a studious investor and you hope to be TOLD what to buy, it’s a mistake and you’re better off investing in an index fund.

I guess it’s like so many other financial tools in that the value of it is dependent on the individual. I think Quicken is a worthless pile of junk, for example, but for many other people it’s a lifesaver. If it works for you, it’s worth the money!

Having reviewed quite a few newsletters, I agree with most of whats is said here. Like many things in life, newsletters have positives and weaknesses.. yes there are outrageous claims.. and at the same time, there are some really smart & connected people out there who rather operate newsletters instead of running a fund or be a personal advisor.

The most important thing is “what is your objective” and can you find a newsletter to meet your objective? If the objective is clear, and a newsletter can serve that specific purpose, it could be really good deal in terms of time save as well as new ideas and second opinion on market trends.

My mom in her 60’s doesn’t really have the know how to get all the “free” information out there so she just uses a newsletter for investment advice and it has worked for her. She subscribes to Bob Brinker’s marketimer and she did get out before the 2000 bust and got back in ’03. I envy her returns. She just figures that the annual subscribtion fee has paid for itself many times over.

As someone who has written sales letters for many investment newsletters, you might say I am biased. But the fact is, in order to sell a newsletter needs to talk about its track record. And they can’t lie about it because the consequences would be severe. So check out the track records of newsletters you are considering.

That said, one person I know has made a fortune using gold and precious metals newsletters. The subscriptions add up, but the money he’s made make the cost insignificant. Could he have gotten the same advice for free? Not from these industry insiders.

Have you tried shortzilla.com? I’ve had a good experience thus far. It’s all about shorting stocks — if that’s your thing.