More stock investing tips on the subject of hedging.

Once you’ve opened an online broker account and consider yourself a stock investor, there are a few basic things you’ll need to think about when dealing with your investments: you’ll want to grow your portfolio but you’ll also want to protect any gains that you do make with that portfolio. If possible, you’ll also want to avoid experiencing any losses. That’s where the term “hedging” comes into the picture. When I was first starting out as an investor, I heard this term used all the time but didn’t exactly know what it meant. If I understood what it meant back then, I probably would have lost less money as a first time investor and beginning stock picker.

Hedging Your Stock Investments: Some Basics

The other day, I covered the topic of options trading and offered a simple explanation of how it works. This time around, I’d like to discuss the more general topic of hedging — a topic or investment principle under which options trading usually falls under.

So what does “hedging” entail? How about this analogy: the simplest way to think of it is that it’s a form of insurance. Hedging is simply insurance. If you’d like to make sure that you protect your investments (and particularly your gains) to some degree, you can do so by applying a hedging strategy.

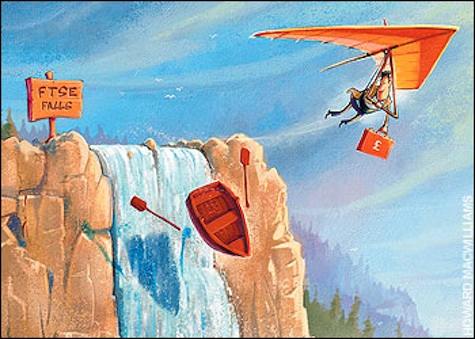

Money is money, no matter what currency.

Money is money, no matter what currency.

While I’m thankful that I can insure just about anything from my home to my cat, as a young player in the stock market years ago, I became doubly excited when I discovered that I could also insure my portfolio. Even better, insurance for your investments comes free (unlike other forms of insurance out there).

There is far more to this than one article can tell you, but allow me to share with you one basic hedging strategy that I’ve used successfully. Here’s a real world example which I’ve used: buy stocks or options in pairs. So how does it work?

When I feel that I can afford to take a little more risk with the money I have in my discount broker account, I dabble with leveraged ETF investing and buy one of the well-known leveraged etfs. One of my favorites is the Proshares Ultra Dow fund (DDM). This fund tracks and achieves 2x (twice) the performance of the Dow Jones Industrial Average. When the Dow goes up 1%, this stock goes up 2%. So as you can imagine, this is a very volatile asset and if you’re not careful, you can certainly stand to lose some major money.

When I buy this fund, I always hedge in order to insure my investment. For instance, if I buy 200 shares of DDM, I also buy 50 shares of ProShares UltraShort Dow30 (DXD). DXD does the same thing as DDM except it’s a short ETF, which means that when the Dow goes down 1%, DXD goes up 2%. So owning DXD has helped minimize losses in my portfolio.

Of course it also minimizes gains to some degree, but if my biggest problem is that I lost 25% of what I could have made, then that’s fine with me. I take my other 75% and invest it and make more. I believe that it’s better to make a little less rather than lose a little more.

You may also say that why don’t I just own a stock index fund outright — one that tracks the market exactly? Wouldn’t it result in the same thing as purchasing DDM and DXD, which may tend to cancel each other out? The difference is that I can fine tune how much hedging I do in order to get results that I have a little more control over. With the combination of DDM and DXD that I purchase, I can control the amount of gains and losses I end up receiving, based on how my funds track the market.

Other Hedging Strategies

You may be interested to know that diversification strategies provide ways to hedge your portfolio as well. We’ve written about using different asset classes to help with diversification before, and in particular, the products introduced in our EverBank review may be effective for this purpose. If you’re open to investing in foreign currencies as a form of “hedge”, then check out:

- EverBank WorldCurrency Single CD – a certificate of deposit that represents a single currency. EverBank has 17 individual foreign currency CDs that offer returns based on local currency rates.

- EverBank WorldCurrency Basket CD – a certificate of deposit that represents a basket of currencies. This is what is called a multi-currency CD, and when you invest in it, your funds are diversified across 3 to 6 currencies depending on what type of WorldCurrency Index CD you purchase.

- World Currency Access Deposit Account – this is a money market account that invests solely in foreign currencies. You’ll need at least $2,500 to open an account, but it certainly provides a way to hedge by using foreign currencies (without having to get into Forex).

- EverBank MarketSafe CD – this is another foreign currency CD offering, but it has no downside risk. Unfortunately, they have limited application times for buying in.

- EverBank MarketSafe BRIC CD – this is a risk-free CD that invests in the BRIC currencies (Brazilian real, Russian ruble, Indian rupee and Chinese renminbi).

You can also hedge in other ways but they don’t always work. Gold has always been regarded as a safe haven for investors in down markets. You will often notice that when the stock market goes down, the price of gold tends to go up, which makes buying the shares of a gold ETF (such as GLD) pretty enticing. GLD may offer some protection here.

But (and there’s a but!) the problem is that gold is a commodity and commodities aren’t always as reliable as we would like. Sometimes gold follows the market. So you may not want to put all of your hedging dollars into gold.

These are only a few examples of how hedging works. This is one of those subjects where reading a book about hedging may well be worth your time. Protecting your money is always worth it!

Here are a few articles you can read on the subject:

Contributing Writer: Tim Parker

Copyright © 2010 The Digerati Life. All Rights Reserved.

{ 14 comments… read them below or add one }

I don’t know much about hedging, so perhaps I shouldn’t comment.

I’ll just say that the reason that I don’t know much is that I don’t care to know much. I agree that hedging is a form of insurance. I generally aim to avoid paying for insurance except when it is absolutely necessary. I have to have health insurance because the costs of treating an illness can be huge. But even there I go with high-deductible insurance which keeps the premiums lower and which means that I am using the insurance only in rare circumstances.

So my take on hedging is — Are there other ways to achieve the goal? My view is that risk can be diminished through diversification and by paying attention to valuations. So I just don’t devote any of my mental energy to learning about hedging.

It could be that I am wrong. It could be that I am missing out on something good because I haven’t bothered to learn enough about it to see the good in it. But we all have only so much time and there are so many demands on it that I have elected to take a pass on this one.

Rob

“Even better, insurance for your investments comes free (unlike other forms of insurance out there).” This is completely false.

Your ETF strategy is curious. You go long 200 and short 50, why don’t you just go long 150?

Finally, diversification is not the same as hedging. Diversification is using asset classes with low correlations to lower overall portfolio risk. Hedging is using correlated assets to minimize risk.

Bender, tell us more. 😉 I thought about going long 150 as well, and wonder why Tim didn’t just do it that way, but maybe people like to have fun with mixtures and combos of ETFs that they buy?

We don’t purport to be experts here at all. And I’m far from being a top investment expert, but I do like to ask questions and seek ideas and strategies from others who may have the experience I don’t have in these areas.

I also think that the word “hedge” is used casually by many people to mean “protect”. But thank you for pointing out the technical difference between diversification and hedging.

With regards to going long 200 and short 50, this is a strategy to not just hedge but also to reduce volatility (ie. lowering risk) in one’s portfolio. The is a very popular strategy used by long/short hedge funds. This type of trading usually involves negating the some of the Beta (volatility) in the markets while isolating the Alpha, which is the return in excess of the compensation for the risk taken. The premium collected from the short sale can help cover the cost of the long position, making the pairs trade inexpensive to put on. Hope that helps SVB….?

Sorry if I sounded harsh. What really caught my eye was the statement about free insurance. This is the equivalent of saying there is a huge inefficiency in the market that none of the quants have spotted.

On to the specific trade. Putting aside any tracking error there may be in the 2x long/short ETFs, in my view strategy is a simple long 150 2x DJ30 (it hasn’t removed any beta, it has just reduced the position size). Do a simple spreadsheet analysis, run the long 200/short 50 vs. a long 150 trade (use a random number generator, add a trend factor if to if desired). I think what you’re going to find is that you end up at the same place (except you paid 2 sets of the transaction costs for the long/short trade). Simple example: Let’s say on a given day the DDM is up 3 and the DXD is down 3 (again we are ignoring the tracking issues). The long 200/short 50 trade is up a net $450 for the day (200×3=600, less 50×3-150 for a total of 450). The long 150 trade is up a net $450 as well (150×3=450).

Maybe I’m missing something and the trade really is designed to exploit some inefficiency between double long double short ETFs. If this was the intent, I’d love to hear a more fulsome explanation of the strategy.

A simple example of the type of market neutral HF strategy Arjun is referring to is more like Long 100 AMR short a similar value of UAL (assuming you are trying to capture the AMR alpha) in effort to become market neutral. As long as the AMR/UAL spread doesn’t converge the trade is golden. Of course HF traders do this in a much more robust and sophisticated fashion. But going long and short the same asset (in this case essentially the same asset), doesn’t reduce volatility, it reduces your exposure to volatility (which you could have done by simply entering a smaller trade to begin with).

Very interesting topic. I’m just a beginning investor so this is new for me. The good thing is having the control whether the market is going up or going down. Because you can leverage on the amount that you invest on both sides of the equation (i.e. DDM+2X and DXD-2X), you certainly can control how much you earn (or lose).

However taking advantage of your new found “leverage” would still require you to go back to the same aged old question – “how do you know if the market will be going up or down”? And for a beginning investor like me…it’s like going back to square one… 🙂

While I follow what you are saying in your example of EFTs, I really do not practice hedging like this. However, I am not opposed to owning individual stocks. I make it a habit to only follow a group of about 10 stocks and I feel that is my comfort zone. I tend to buy and sell within certain ranges and overall feel good about the long term outlook of the stock.

>Even better, insurance for your investments comes free

It really isn’t free- any hedging strategy sacrifices some potential gains to shield against potential losses. That isn’t saying that it is a terrible idea, but you should be clear it isn’t free!

You don’t have to get so exotic for hedging either- just keeping some % of your investments in cash hedges against stock losses. Getting exotic tends to be more expensive- for example the leveraged funds have much larger fees (~1%), compared to (0.09%) for a Schwab S&P 500 Index Fund (SWPPX) .

-Rick Francis

I agree with Bender that this is a somewhat fruitless hedge. If you assume that the ETF’s are accurate in their tracking of the DOW, then this investment is identical to investing in 250 units of a DOW index, or 125 units of DDM. Take the following:

Invest 200 into DDM, 50 into DXD. Say the DOW increases by 3%. The DDM position goes to 212 (200 @ +6%) and the DXD position goes to 45.5 (50 @ -9%), for a total of 257.5.

If you simply put 125 into DDM (200 – (3/2) x 50), you’d get the same results – 257.5 (125 @ 6%).

Also, as Bender mentioned, if there is an inefficiency in one of the ETF’s, then the assumed tracking is off, and there is room for profit. Otherwise, this hedge just leads to extraneous trade charges.

Sorry, that last line is off, I meant:

132.5 (125 @ 6%), which is the same net difference of +7.5 units.

I like the fact that your blog is the only one of the major 10 PF blogs I subscribe to that actually attempts to introduce more complex investment ideas. I might be a total newbie but it helps to at least be introduced to these things. Thanks SVB.

@Eric,

Thank you for your kind words! It means a lot! Honestly. 🙂 I try to introduce more esoteric concepts on occasion, especially stuff I’d like to learn more about, personally. Investing is a passion of mine but unfortunately, I haven’t found the time to dedicate to it in order to become what you call a “serious” investor or someone who spends several hours per week on it. Maybe one day?

Also, what do you think of a blog that jumps from options trading topics to topics like “how to sew a button on” and online couponing. Isn’t variety the spice of life? 😉

This sounds like a very bad idea, as Bender has mentioned above. Hedging reduces risk, but of course, (a) reducing risk reduces return, so it’s not a free lunch, (b) if reduced risk is what you want, you can reduce risk at a lower cost by simply allocating more of your portfolio to bonds instead of stock.

Then there’s also the issue that the 2x leveraged index ETFs don’t deliver 2x of the annualized index return, but rather 2x of the daily return. This means that those ETF only deliver returns similar to the annualized index returns over very short terms. Read this article.

So that leads to alternative (c) for reducing risk: stay far from those leveraged ETFs in the first place.

Options trading might be good; however based on my 6 years of experience playing with options, if you can’t afford higher risk, never touch options. But with a starting capital of around $3000-$5000 on Optionsxpress, everyone can play options. What I can tell is, if you really want to play options, try to sell call instead of buying call or put, constantly it generates me profits of around 3%-7% per month.

Yes, it’s true that you need around $100,000 in order to be able to sell call, but it can be worth it.