Is there more to investing than putting your money into stocks, bonds and cash? Find out some ways to spice up your portfolio with alternative investments.

For most regular investors, a portfolio of index stock funds, bonds and savings accounts are sufficient to achieve some reasonable level of diversification. But those who are seeking the potential for greater rewards or who want to address other investment categories that can lend additional diversification to a standard portfolio may want to consider some other interesting options.

Let’s explore various diversifiers and certain asset classes that can be used to strengthen and spice up your portfolio. While not all of the choices are relevant for every investor, we can compare some of these categories and see particular parallels here among specific types of investments. For instance, if you are a risk taker and find aggressive investments exciting, then you may opt to apply momentum investing techniques or options trading to your investment arsenal. Are you a more conscientious investor but still want to add some spice? Then adding some sector funds or picking your own individual stocks may work for your investor profile.

We’ve discussed the “core and explore” strategy for building a portfolio before: this involves earmarking basic investments and asset classes such as traditional equities, bonds and cash for the majority of your money (the “Core” portion), while setting aside a small amount of your investment funds to “play with” (the “Explore” portion). By setting up an allocation of say 90% for core investments and 10% for more adventurous moves, you’ll give yourself the chance to engage in more aggressive investment plays in a more controlled, risk-managed fashion.

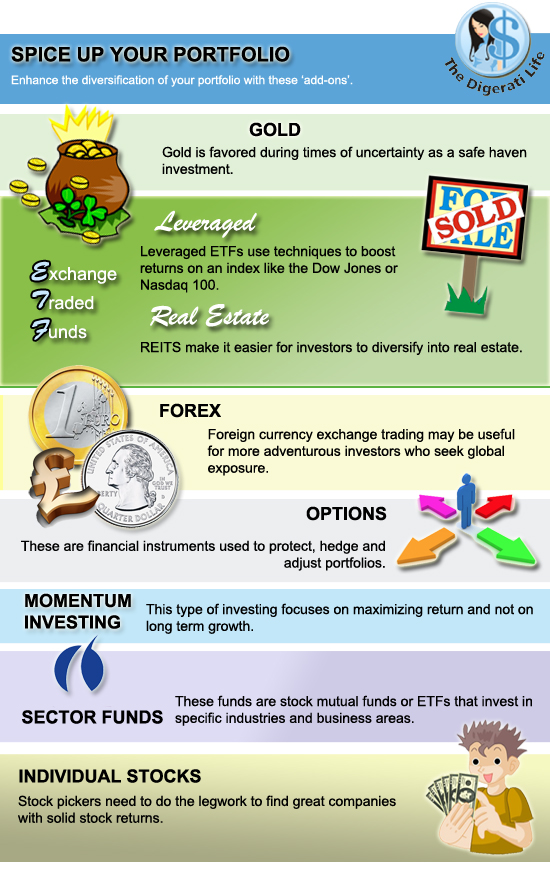

Alternative Investments For The Sophisticated Investor (An Infographic)

The infographic we have below summarizes those alternative ideas for the exploratory component of your portfolio. Hopefully, this compilation can help guide your decision making process.

Apart from the visuals, we are also providing this overview of the various diversifiers:

- Gold and other commodity investments may have a weaker correlation with traditional investments. Traditionally known as a safe haven investment, gold is an investment that investors turn to during times of uncertainty. But it may be worth noting that in recent history, gold has behaved more similarly to (and moved more in lock step with) the equity market than it has done so in the past. Still, you may want to consider a 5% allocation in precious metals.

- Leveraged ETFs use techniques to increase the rate of return on an index like the Dow Jones or the Nasdaq 100. But with extra reward, expect extra risk.

- REITs (real estate investment trusts) are funds that make it easier for investors to diversify into real estate. Investing in real estate and property through ETFs and mutual funds is a great way to achieve a well-rounded portfolio. Think about deploying 5% to 10% of your holdings into this asset class.

- Trading or investing in foreign currencies and markets is a more esoteric and risky way to make your money work for you. Foreign currency exchange (FOREX) is particularly useful for adventurous investors who are seeking international or global exposure. More traditional ways to gain international exposure is by investing in foreign stocks, international or global equity funds and indexes or foreign bonds.

- Options are versatile financial instruments that allow investors to protect and adjust their positions with changing market conditions. Options are speculative and often risky investments but is a popular tool that is used to hedge one’s position.

- Also known as “fair weather investing”, Momentum Investing is a technique used by investors that involves the purchase of over-performing instruments and the sale of those which under-perform. The focus is on maximizing return, and less on long-term growth, thereby making it an interesting approach for more aggressive investors who are comfortable with risk.

- Sector funds are stocks, ETFs or mutual funds that invest in focused or specific industries and business or investment areas. By investing in sector funds, you are targeting stocks or bonds in a particular category. As demand for products or services in a particular industry increases, so do the price and value of their corresponding sector funds.

- Individual stocks can add spice to your portfolio, but you’ll need to do the legwork involved in finding those companies that can help you make money. Individual stocks don’t provide inherent diversification, so you’ll need to work your picks into your overall portfolio. You’ll need to monitor your holdings actively to ensure that they continue to fit your requirements.

- The collectibles market provides a more esoteric way to invest in items of value. This kind of investment is more material in nature and may involve purchases in items such as jewelry, art, cards, toys, antiques, knick-knacks, curios and the like. Seek the assistance of an expert for guidance in this area.

Finally, here are some things to consider when choosing which add-ons to include in your portfolio:

- What’s your investment style? Do you like taking risks or are you more of a conservative investor? The more conservative you are, the less appropriate these aggressive strategies may be for you.

- What’s the state of the economy in your geographic location or in your investment territory? Are things looking up or are they still uncertain? Your response may have bearing upon whether you should seek an overweighting of investments that have international or foreign exposure.

- How comfortable are you with picking out individual stocks or would you prefer to invest in a mutual fund or ETF? If you like having full control of your investments and enjoy learning about companies and industries, then you may have the disposition to be an independent stock picker.

- Have you thought about experimenting with new ways of investing with just a small sum of money? How about trying out Forex or Leveraged ETFs? This matter speaks to how aggressive you can afford to be — if you are a natural thrillseeker who has a talent for technical analysis and who has the time and inclination for studying the mechanics of markets, then you may be willing to experiment with more risky, money-making ventures.

- Do you have a large portfolio that needs some heavy diversification? What about investing in REITs? Investors with a large financial cushion may be tempted to look into a larger variety of asset classes that may provide further risk insurance or pockets of growth and opportunity.

Infographic by Jeremy C Bradley

Copyright © 2012 The Digerati Life. All Rights Reserved.

{ 8 comments… read them below or add one }

Excellent article and good information for all investors. I typically use alternatives as a portfolio diversifier. In some cases I also use certain funds in the alternative space to lower portolio volatility.

The trick to investing is to know what market to invest in at what time. Examples:

Technology: Get in around 1995 and get out in 1999

Real Estate: Get in around 2002 and get out beginning of 2007

Gold: Get in around 2008 and get out last half of 2011

Right now? Definitely Small Business and cautiously, Real Estate

Good start! I would include antiques, coins, art, classic or antique cars, collectibles to name just a few. The more diversified you can be, the better off you are in the long run.

@Krantcents,

I mentioned collectibles in the subsequent list but alas, not in the infographic. But I second your list as well. Antiques and cars are big ones to note, and from what I’ve observed, are the turf of those with more money to spare. But admittedly, I know less about collectibles than I do the other types of investments I’ve discussed here.

Tread lightly in this these “investments”/speculations. The know-nothing investor can lose a lot of money in many of these areas, especially leveraged ETFs, FOREX, momentum investing, and even gold will all back down to earth one day.

@Biz of Life,

Thanks for the important disclaimer. I guess you can say that whatever we’ve mentioned here is what the know-nothing investor should avoid until they actually gain experience and become quite adept at investing. In fact, most people can get by without ever having to deal with any of these investment classes at all. So if you’re new to this world and see some of these terms in the wild, you may want to make an about face and keep this list in mind only for when you’re ready to delve into the more exotic.

Love the info-graphic! Very well done and really helps to summarize the concepts.

And, a bit of no-BS hard-nosed reality about how higher-reward (and, by proxy, higher-risk) speculative-investing can collide with human nature, was just written by the co-founders of one of my favorite new sites, here:

http://www.wealthvault.net/investing/painful-lessons/