How Much Should You Allocate To International Investments?

If you’re after growth and want to be well diversified, the conventional wisdom is that you pack your investment portfolio with some foreign punch. Some articles advocate a 50%/50% distribution between foreign and domestic investments, though I think that’s a bit much — for us anyway! Up to this point, we’ve already upped our foreign exposure from 10% to 15% within our asset allocation, so far staying within the confines of equity investing, which we’re most familiar with.

In general, here are some guidelines on how to determine how much of a foreign position you should carry in your asset allocation.

Calculating Your International Allocation

It appears that we’ve been quite a bit too conservative all these years with regards to our international position. It actually looks like we can afford to go as high as a 20% – 25% position here, since we don’t expect to touch our investments for an indefinite period of time. This should work because we’ve already carefully earmarked some cash to tide us over our short term financial requirements, thereby allowing us to fund more long term investments. Here’s a look at our allocation:

| Allocation % | Style | Description |

| 25% | Aggressive | How long should you stay in the market (Investment Length)? more than 10 years. Amount of volatility: Significant |

| 20% | Moderately Aggressive | Investment Length: more than 10 years. Amount of volatility: A good amount |

| 15% | Moderate | Investment Length: more than 5 years. Amount of volatility: A modest amount. Expect moderate growth. |

| 10% | Moderately Conservative | Investment Length: 5 years. Amount of volatility: Limited, as you seek stability. Expect modest growth. |

| 5% | Conservative | Investment Length: 3 years. Amount of volatility: Not much, with stability being a higher priority than growth. |

| 0% | Very Conservative | Investment Length: 1 year. Amount of volatility: None — your holdings are for the very near term and stability is of utmost importance to you. |

Given that we’d like to reallocate further into the international realm, I’m refreshing my mind on the subject. How about a brief reminder of some of the issues?

What Are The Risks And Costs Involved?

Keep in mind that foreign vehicles are just inherently more expensive due to various additional tariffs, markups, costs, fees and taxes, and that they are also risky for the following reasons:

#1 Currency risk

Currency exchange rates fluctuate along with the international markets, which can cause your gains or losses to be more pronounced. When you receive dividends or redeem your international funds, your returns are converted back into US dollars, so you’ll find that your returns are affected by trends in the currency market as well. Typically, if you own foreign funds, you’ll find that you’ll have better overall fund returns when the US dollar is weak.

#2 Relatively stronger volatility

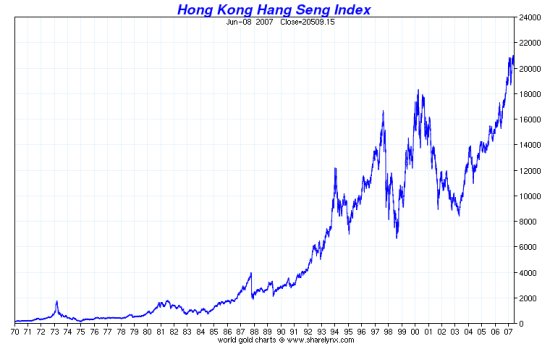

It’s just a given that international market swings are wilder. I still recall when the Latin American markets dove in the late 1990’s and around four years ago. The emerging markets will literally give you vertigo as evidenced by this historical Hong Kong Hang Seng Index chart. It’ll offer you a wild and choppy ride, if your money is ready for it!

Historical Hong Kong Hang Seng Index Chart (1970 – 2007)

#3 Exogenous factors and social, political and economic events

If you read the papers, there just seems to be more action going on overseas. Coups, terrorism, political upheaval, market bubbles and busts, and sweeping global changes happen all the time. So it’s not surprising that your money bobs around in line with these occurrences.

#4 Foreign markets operate differently

The rules are different elsewhere. We all need to live with how they run things outside of our borders. Investors are at the mercy of the rules, regulations, policies, laws and accounting standards and practices of external markets and different lands.

#5 Less liquidity and less data about your investments

There’s just less to know about the markets and systems abroad and there may not be enough information available about the companies and investments you’re interested in. With definitely much more data available about our companies in the home front, you wonder why we bother with foreign holdings. Again, this is a diversification tactic designed to lower your overall portfolio risk.

These caveats don’t faze me. I’m thus reviewing the different ways to invest overseas and checking on a few of these as possible opportunities to pursue.

The Different Ways To Invest Globally

#1 Equity mutual funds

Like anything else, if you’re new with this type of investing, I’d recommend that you try mutual funds. You can get into global funds which invest primarily in foreign companies but also buy into U.S. companies. Regional and country funds are more specific as they concentrate their investments in particular geographical areas (e.g. Latin America, Asia, Europe), in individual countries (e.g. China, Russia, etc) or in emerging versus developed regions. And lastly, you can try foreign index funds which simply track international indexes. This is something I stand by as I’ve done well with international funds since the mid-1990’s. I just wish I had designated a larger allocation to them when I first started investing in my 20’s!

#2 Exchange Traded Funds for foreign indexes

ETFs for foreign indexes work like mutual funds except they are traded like stocks. So you get the diversification of the index in the body and transactional behavior of a stock. I do own some ETFs in the MSCI EAFE arena which I’ve been happy with.

#3 American companies that invest overseas

This is a relatively conservative way of going international. Why not do enough research on big US companies and find out if they have offices and businesses abroad? This could be more your style. Take a look at this About article regarding this strategy.

If you own or buy Coca Cola stock (this is just an example), you are buying into a global corporation that derives a significant percentage of its revenues from countries other than the United States. Merck & Co., the pharmaceutical giant, does most of its business overseas and much of it in Europe. Some of the other big names that earn most of their revenues in foreign countries include:

- Texas Instruments

- Altria Group

- Applied Materials

- Exxon Mobil

- Advanced Micro Devices

- Colgate-Palmolive

#4 American Depositary Receipts (ADRs)

If you like investing in individual companies, you can try ADRs. These are stocks of foreign companies that trade on US stock exchanges. They transact as if they are US stocks by carrying dollar share prices and paying out dividends in dollars. Since I don’t really own stocks in the first place, I’ve skipped on the ADRs, but these could be suitable for single stock investors.

#5 Foreign Stocks that trade in US or Foreign Markets

Though less common, you can also trade in foreign stocks that trade in the US or in their own native market. Canadian stocks are such an example. They are available to trade in US markets in their regular form. Additionally, you can trade directly in foreign stock markets but in my opinion, you’ll need to know what you’re doing before you try this. I’d personally skip this option because it’s so much easier to achieve foreign representation in your portfolio via other means.

#6 Foreign Bonds

Nope, I haven’t invested in such bonds yet. All I know is that they are issued outside of our borders and can have funny designations such as “Yankee bonds”, “Bulldogs” (from the U.K.), “Matadors” (from Spain), “Samurais” (from Japan), and “Rembrandts” (from the Netherlands). There’s also this thing called a Eurobond. Yes, these are all terms for foreign bonds! I’m not quite sure I’ll get into this anytime soon.

#7 Global and International REITs or mutual funds

I was happy to hear about the opportunity to invest in REITs representing foreign real estate (typically commercial) property. The Schwab Center for Investment Research suggests designating 3% to 5% of your portfolio into global REITs or global real estate mutual funds. They’ve done fairly well with moderate volatility in recent years so I’m casually considering this avenue. It could be a while before I actually dip my toes in this water though! Some encouraging stats:

In the five years ending in 2006, a diversified portfolio of domestic REITs returned 23% annually, four times that of US stocks. Diversified global REITs yielded close to 27% per year in the same time period.

Returns do fluctuate, so it remains to be seen how 2007 is going to turn out for this form of investment.

#8 Foreign Currency CD or Money Market Fund

If you simply want to hedge a portion of your cash, you can open FDIC-insured CDs from Everbank made available in various world currencies for a $10,000 minimum deposit. They’ve also got “single-currency money market accounts” that are FDIC-insured for a $2,500 minimum. For more information, visit Everbank and check out their offerings. Check out our article on foreign currency hedging as well. Suffice it to say, pure currency plays get us excited.

Copyright © 2007 The Digerati Life. All Rights Reserved.

{ 10 comments… read them below or add one }

Just a reminder that not every foreign country suffers from coups, terrorism, and political upheaval. Which you all knew anyway I’m sure.

plonkee, certainly. I had wanted to point out that the external events such as political upheaval and so forth could be a risk factor in international investing, especially if you enter the realm of emerging markets.

The market risk is probably in the short term in cases such as terrorism occurring in developed nations like the U.S., U.K. and other parts of Europe, but there is risk nonetheless, which you can’t escape when putting your money to work anywhere.

I think everyone should remember that foreign does not just mean China or India. The fact that we believe foreign markets are more volatile is just not true. Even the TSE (Toronto Stock Exchange) is a foreign market and they aren’t exactly volatile compared to the DOW or S&P 500.

I also think we should invest more in foreign markets since the US is just one part of a big world and it would sort of act as a hedge for the falling dollar.

I think 20% definitely and not a stretch at all at 30%. Growth outside the US will be much more sustainable with a higher trajectory than the US for the next 50 years. The US is an important slice of the pie…but not 80% worth.

You make some interesting points and I agree with many of the commenters.

I also want to point out that even if international markets are more volatile (which is not a statement that I take for granted), modern portfolio theory shows that the over-all volatility of a portfolio can be reduced by including more volatile assets, provided that there are not correlated with our main investments.

That is, even if international markets are more volatile, they do not always move in lock step with U.S. equity markets, and this means that the over all risk of the portfolio can in fact be lower.

Diversification is a one of the most important reasons for investing internationally.

I like the Vanguard Global Equity fund in a tax-advantaged account…It kicks off some gains that might turn away some from having it in their brokerage account…

You make a good example with Coca-Cola as being a US company, but with interests globally…Everyone across the world loves Coke products 🙂

VHGEX offers low costs for such a fund, has been doing very well and tracks top companies from across the world…I think its currently something like 55% US and 45% Int’l…

For a 20 or 30-something looking to be balanced and with a 20+ year horizon, I would think having at least 20% in international juggernauts is necessary…AT LEAST!

And that’s to say that EFA is a quality fund that I also own, but adding something with a global identity is something to consider getting to the 20% in your portfolio…

SVB,

Thanks for your submission to the Festival of Stocks. Currently, I am gettig foreign exposure through Global companies. Will need to look more closely at truly foreign stocks in the future:-)

This post is included in the August 13, 2007 edition of the Festival.

I use Fundadvice.com’s Ultimate Buy-and-Hold Vanguard portfolio with the addition of Wisdom Tree’s DLS ETF to gain access to International Small Cap/Small Cap Value asset classes:

50/50 US/International allocation

50/50 Large/Small within above

50/50 Value/Blend within each of the above

For the bond component:

50% VFITX (US Treas Intermediate)

30% VFISX (US Treas Short-Term)

20% VIPSX (Tips)

If DLS ever has a dividend, Vanguard can reinvest it into the ETF sans fee. If you pair DLS with Forward’s PISRX in a 90/10 (DLS/PISRX) down to 60/40 (DLS/PISRX), you can buy PISRX as an NTF through VBS and treat the combination as an asset class in-lieu of DLS.

You can also use VGTSX and VTRIX in a 50/50 split and get exposure to large developed markets and Emerging Markets w/o the 0.5% VEIEX fee that is paid to the fund.

Just my $0.02

Nice work on your investments. As part of my ongoing mission to find the absolute best tools to make money, this is without a doubt at the top of my list. I STRONGLY recommend investments to EVERYONE interested in running a successful online business!

i think currency risk is the biggest risk when investing in Forex. Is it true?