What happens when the U.S. dollar is weak? There’s a general ongoing trend that has been simmering for quite sometime now. No, it’s not global warming though it’s also a global matter: it’s the “Buy America” trend, which you’ll note through stories like the following.

In the American suburbs around where I live, there is a lot of foreign money flooding in, snapping up properties that have been greatly devalued in terms of foreign currency exchange. If the dollar is weak, then the goods here are cheaper and we become a magnet for big time bargain hunters everywhere else. To foreign interests, we are hosting the biggest garage sale there is.

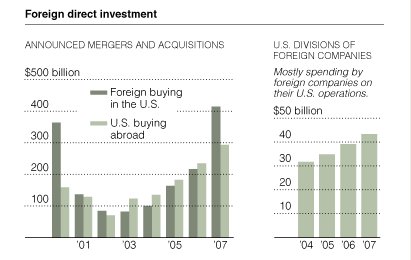

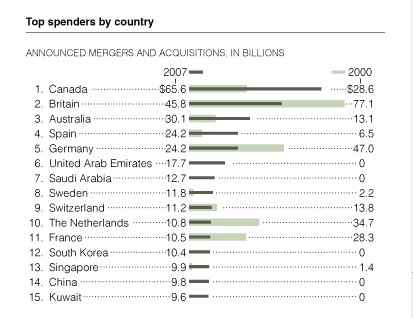

As a result of the economic imbalances we are seeing, you’ll be reading more news articles like the following: in this New York Times article, Overseas Investors Buy Aggressively in U.S, we see that the falling dollar and the credit mess have been turning troubled American companies into yummy fodder for foreign investors.

On investments:

For much of the world, the United States is now on sale at discount prices. With credit tight, unemployment growing and worries mounting about a potential recession, American business and government leaders are courting foreign money to keep the economy growing. Foreign investors are buying aggressively, taking advantage of American duress and a weak dollar to snap up what many see as bargains, while making inroads to the world’s largest market.

The weak dollar has made American companies and properties cheaper in global terms, particularly for European and Canadian buyers. Even as Americans confront the prospect of a recession, economic growth remains strong worldwide, endowing oil producers like Saudi Arabia and Russia and export powers like China and Germany with abundant cash.

In this CBS news article, A Feeding Frenzy For Foreign Shoppers, we see that a good percentage of retail shoppers from abroad are flocking to our malls for super discounts (relative to prices in their own lands), thanks again to the weak dollar.

On malling, shopping and store-hopping:

We’ve always had Brits. We’ve always had Irish people, Europeans,” said Parisi, director of Elegant Tightwad shopping excursions. “But now they’re coming in droves. In droves!”

Because with the dollar near record lows, to Europeans like Elizabeth Morton, it looks like we’re giving it all away.

The influx has been awesome. One million Europeans are expected to visit New York City this month alone. That’s about 50,000 more than last year. Picking the foreigners out at Big City Outlets is easy. They’re the ones dragging suitcases behind them.

and in Foreign Buyers Snap Up 2nd Homes in U.S., squeezed property owners are parting ways with their real estate as they get bailed out by international buyers.

On real estate:

The events of 2007 have made the U.S. much more affordable for international home buyers. Severe dollar declines against the euro and pound have made U.S. homes much cheaper for Europeans. But even foreign buyers without that sort of currency advantage are benefiting from sharp drops in housing prices at a time when problems in mortgage lending are keeping many Americans out of the market.

I’ve also heard about this huge piece of land covering 1000 acres in Napa county complete with king-sized mansion that is on sale right now for $35,000,000. Who’s buying? Someone from France.

To overseas investors, our cheap real estate, cheap dollars, cheap companies and cheap merchandise are great bargains for the picking, and these investors are not wasting any time gobbling up these assets. Plus, they’re probably setting up shopping trips to Saks Fifth Avenue and Rodeo Drive while we all visit K-Mart and Target. Hmmmm….. 😉

We need foreign investments to keep our economy oiled and chugging along, but when I hear of iconic companies and valuable real estate changing hands outside of local borders, I can’t help but feel a little nervous. Where will this lead us? But we don’t have much choice here — as Senator Charles E. Schumer (Democrat of New York) has expressed about major Wall Street banks that have been offering up their shares for sale: “Given the situation that these institutions find themselves in and the fact that there’s a pretty strong credit squeeze, there are only two choices: Have foreign companies invest in these firms or have massive layoffs.”

So welcome to the Sale of the Century!

It’s just a shame that we’re the ones on the other side of these fantastic deals.

Image Credit: All cartoons on this post are stills from a clip created by the well known political animator Mark Fiore. The video is a great satirical animated cartoon about the U.S. economy.

Copyright © 2008 The Digerati Life. All Rights Reserved.

{ 16 comments… read them below or add one }

Great point about foreign investment in our large banking institutions. Not only are they possibly getting a great deal in the long term aspect, they also are going to get board seats and say so in the direction of these large “American” banks going forward.

Recession???? All of this is just a short term fix. And truth be told, it has been happening over past 3 decades. Reagan and Clinton have just as much blame as the current administration. This is an interesting perspective on this(the midas touch) just another reason i feel sorry for who ever the next president is for mr or mrs next president

I’m not too worried. This will help correct the trade deficit. And eventually the dollar will be strong again. Call me an optimist! 🙂

Yeah it’s unfortunate that we’re the ones up for sale but it could be a good thing? We’ll have to wait it out and see what happens in the long run.

I’m one of those buying up America. Luckily, though, I’m just and American living in Europe. In addition to investing in the dollar, I also try to make my purchases in the U.S. (online) and have them shipped to me overseas. Even with the extra shipping, it’s usually 30%-40% cheaper.

The truth of it is, in order to get exports rolling faster and support US based maunfacturing, we have had a “weak Dollar” policy since Clinton.

But, as Buffet said in interviews, you can’t devalue your way to pros”parity”

I’m trying to develop the equanimity to really handle any situation, including recession or America losing its world power status…

I’m planning our family vacation in London this year, and the exchange rate is horrible. I feel like I’m living in Mexico based on the “dollars” value to GB pound, or even the Euro.

Ultimately ownership will go to those that are the most productive. Not those that consume the most. The latter will then be paying the former. There has/had to be an end to how much credit the rest of the world is/war willing to extend to the US. Now they are buying up equity instead. I would do the same.

What would happen if Americans “buy American” by not buying products sold by formerly American companies, i.e. by shifting spending?

Those are really great points you made. It does seem a little bit scary considering we are on the outside looking in rather then the other way around.

This has happened before, I think. Perhaps someone can correct me.

Around the 80’s, the Japanese came in and bought up quite a bit of America. This was when the Nikkei was something like 30,000 (as presently around 12- 15,000).

Leading magazines like Fortune and Forbes wrote stories on why the Nikkei cannot go below 30,000 etc.

The wheel turned and many of the Japanese had to finally sell at prices lower than they paid in the first place.

Actually it should be a mark of pride that the whole world wants to invest in America.

So, don’t worry, be happy.

From here in the UK, it sounds pretty good. I don’t really have a problem with foreign investors in the UK (or US or wherever). If you’re happy to invest overseas, you can’t be surprised if Johnny Foreigner wants to invest in your country. After all, insularity is bad for prosperity.

We’re seeing the results of the rush to globalization both of trade and corporate structures. Like ERE said above, there was a limit to how much US debt could be bought up before other countries decided to buy up assets to prop up the value of that debt. The weak dollar is an artificial means of keeping a dying economic structure (American manufacturing) alive.

I don’t worry too much about foreign investment, though. Worrying that “American” Citigroup is being invested in by foreigners (gasp!) is silly. Citigroup is a global corporation. Most of the big corporations have substantial overseas investments themselves, and to think that they are “American” companies – in this day and age – is simply wrong.

It’s a bunch of disturbing trends, and I doubt any of the current candidates are even vaguely close to being willing to tackle some of the structural deficiencies in our economy to ‘fix’ it. Oil dependency? Health care system? Weak dollar? Entire generations with no savings for the future (and even if they have it, almost entirely invested in the equity market)? No! Better to worry about the estate tax!

An interesting read. Thanks for sharing it!

Best Wishes,

D4L

Our Real Estate brokerage has actually been running ads targeted at foreigners with tags like “Buy now. Weak dollar makes the dream possible.” Now pretty much is the time to take advantage though, because the most desirable areas (Such as New York City) will probably recover much more quickly than the rest of the country.