I’ve been waiting for this chance to host The Carnival of Personal Finance for some time. I usually do this only once a year, so it’s been a while since I’ve been a carnival host and I’m glad to be back on the saddle, so to speak.

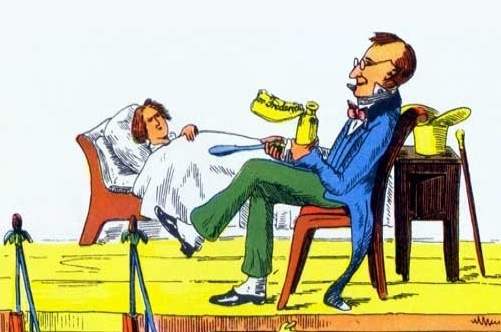

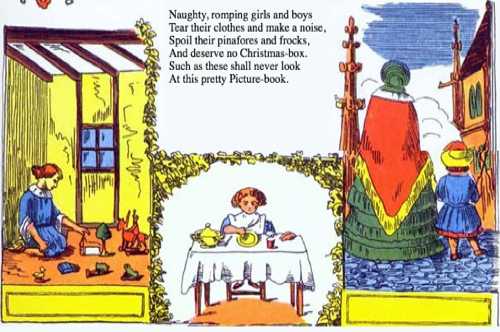

I figure I’d host once I got a good theme in mind, and this time, I think I do….! This edition commemorates a rather strange and bizarre collection of mid-19th century children’s poems (from Germany) called “Struwwelpeter, Merry Stories and Funny Pictures”. You can actually pick up this book at Amazon.

I was introduced to these odd tales by my spouse who has some European roots, and I was immediately fascinated by the Tim Burtonesque / Edward Goreyish feel of this piece of work 😉 . If you like weird, dark cartoons and fairy tales, you might appreciate this stuff.

Struwwelpeter is pretty unusual and even grotesque. It’s a book that’s supposed to teach kids some values, but it’s done in a very old-fashioned way (through fear). In it’s original form, I must warn you that it’s blatantly politically incorrect, will be deemed offensive in today’s world and isn’t appropriate for young kids, but I take it for what it is — part of culture, part of history — as one of yesteryear’s influential (it once supported an entire industry), imaginative, twisted, highly curious children’s picture books.

Can you imagine that these poems were originally written for the author’s 3 year old son? Before you wonder, please let it be known that this is not how I teach my kids our family values 😉 !

With that, I’d like to present this list of over 80 engaging submissions that kept me glued to my computer all weekend. I hope you enjoy these entries as tremendously as I have. And if you do, please don’t hesitate signing up to my RSS feed or subscribing to my email channel.

Struwwelpeter

See! his nails are never cut;

They are grim’d as black as soot;

And the sloven, I declare,

Never once has comb’d his hair.

Editor’s Picks

Sound Money Matters: Aryn isn’t keen about forgiving credit card debt. In fact, if Congress changes the accounting rules surrounding credit card debt, she’s going to be pretty crabby. Er…stabby.

Stumble Forward: Christopher Holdheide pointedly asks — is spreading your wealth around a terrible idea? He then provides an engrossing argument against wealth redistribution and discusses its effects on the economy and our money.

Alpha Consumer: Kimberly Palmer presents us with a series on how the financial crisis has affected us. She starts of with reflecting on her own personal situation and how this recession has helped her evaluate some priorities.

Empowering Mom: Wow, apparently being a work-at-home entrepreneur can induce a great deal of envy! Don’t let envious people get you down.

Stop Buying Crap: Goodness knows how much we need free entertainment these days! Who needs basic cable, music players, and video games when you have a PC and the net? Well Cap can give you more than a few leads on this!

Beyond Paycheck To Paycheck: Is the economy really in the toilet? Have you ever heard of using toilet paper as an economic indicator? These days, it seems that shoppers are now buying smaller-count packs of toilet paper by the end of the month, when their paychecks begin to run out….

Blueprint For Financial Prosperity: Oh yeah, Jim is up to another Devil’s Advocate post 🙂 . This time he’s saying that 401k’s and IRA’s are for suckers — primarily because of the restrictions imposed upon these retirement vehicles. There’s a lot of talk here too, about our tax system. Make sure you read the insightful comments on this article.

Amateur Asset Allocator: Kyle was freshly laid off a few days ago, so he definitely knows what he’s talking about when he comes up with 11 things to do immediately when you get the axe. Among them: get a girlfriend/boyfriend…. 🙂 !

The Frugal Duchess: Here are some great personal lessons that we can take from the Obama campaign and presidential election process.

When the children have been good,

They shall have the pretty things

Merry Christmas always brings.

Money Management

Hustler Money Blog: Glad to know there are still some really useful things out there that are still free, including these seven free online personal finance tools.

Good To Grow: Before you buy something, ask yourself, “Is it really better to pay more for this?”. Research shows that we actually derive more enjoyment from more expensive things, but is it really worth it?

Blogging Banks: Find out where to get better returns for your money while keeping your savings safe.

Canadian Personal Finance Opinions: Is it better to leave your money in your company’s pension plan than it is to take it out and invest it yourself?

Insight Writer: These are 11 little steps to help people get on the road to better money management. They’re helpful for anyone starting out and also serve as useful reminders for those already down the road to improving their finances.

Million Dollar Journey: FT happened to catch one of Oprah’s shows with Suze Orman as a guest. The topic of the show was about teaching kids the basics of money management.

Are You Going To Be This Way: BeThisWay evaluates her medical insurance requirements by starting with an analysis of her current plan.

Gen X Finance: How do you review your health insurance benefit options? Some things to compare include the deductibles, co-pay and co-insurance amounts.

Think Your Way To Wealth: If you devote 15 minutes of each day to review your finances, you may find that this exercise actually helps improve your financial situation.

No Credit Needed: Today is your day. Don’t wait until January 1st to make your resolutions and get your finances in order!

Prime Time Money: PT nicely covers the book “How To Be The Family CEO” by Kim Snider, in a well-written book review.

Lazy Man and Money: He’s got his eye on early retirement and checks out his personal income streams and cash flow to see how these fit into his financial picture. Do they address his goals for early retirement?

The Strump: All of us commit financial errors at one point or another. Here are some great lessons learned!

This is cruel Frederick.

Investing

Growing Money Blog: Day trading has worn out Smarty. He just realized that day trading is just not his game. I’ll add a corollary to this — day trading isn’t really my thing either; I doubt that it is, for most people.

Uncommon Cents: Ryan is aghast that some professor would question the preferential tax treatment that’s awarded to 401ks, 403bs and other similar retirement plans.

Dividend Growth Investor: There was a point when I almost bought Berkshire Hathaway. Maybe it’s something I should reconsider given the man at its helm and how dividend heavy it is.

Living Almost Large: Because of the looming recession, LAL is treading more cautiously and is thinking of putting a stop to her investing program.

The Financial Blogger: Now here is someone else advocating to withdraw your money from the stock market. But not for the reasons you may think!

Dividends4Life: With all the talk about the financial crisis, market melt-downs, Dow/S&P crashing, et. al., the one metric that really matters to each of us individually is the performance of our personal portfolio. So, how is your portfolio doing this year?

M Is For Money: Miss M discusses the tax consequences of stock losses.

Money Under 30: When does it make sense to invest in a Roth IRA vs a traditional IRA? Find out which retirement vehicle is right for you.

Harvesting Dollars: When his coworker proclaimed that he was going for early retirement at the age of 56, Todd couldn’t help but feel envious. Have you been hit by retirement envy before? If you love what you do, it’s less likely that you would.

Intelligent Speculator: Oil has been one of the more volatile assets in the past few months and at this point almost looks like a play on the global economy. But as the world economy’s prospects turn bleak, oil prices have devalued in a big way.

The Personal Financier: What holds for everything else also holds true with investing — two heads are usually better than one.

The Sun’s Financial Diary: I was shocked to see how badly Dodge and Cox funds were performing recently. Their performance ranking used to be tops in the mutual fund universe.

Quest For A Million: What are the prospects for future stock market returns? They’re likely to go lower, but there are things we can do about it.

Behavior Gap: There are some investing professionals who think they’re so smart. Losing $553 million in one day doesn’t seem like the smartest thing.

ABC’s of Investing: What is investment diversification? Find out with this short and simple explanation of what diversification is all about.

Mass Affluent: Heard about this rule that can limit your 401k contributions? High earners are subject to some 401k contribution limitations, based on a nondiscrimination rule.

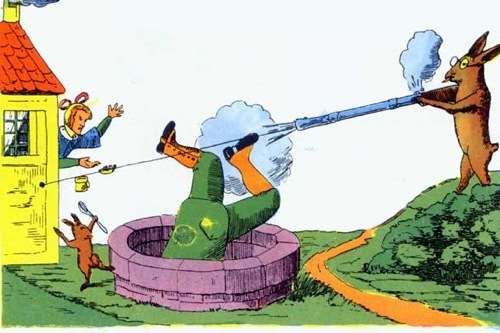

This is cruel Frederick getting his comeuppance.

Finance and The Economy

Five Cent Nickel: This is an open thread for readers to weigh in on how they’d spend another stimulus check if they were given the chance.

Insure Blog: Is it really worthwhile to save $100 but lose $3000? InsureBlog’s Bob Vineyard has the true story of an extreme sports enthusiast who made that choice.

Brip Blap: A lot of people are expecting a lot of things after the election — some negative, some positive. But some basic lessons about personal finance still ring true.

Money Smart Life: Sure, our economy isn’t doing too well right now, but we can still be successful. Let’s ask ourselves these eight questions to see where we stand financially.

MoneyNing: David thanks and honors his parents with a heartfelt post that shares what he’s learned about money and personal finance, thanks to their influence. 🙂

Saving To Invest: Don’t get ripped off when you try to get your car repaired. Andy relates his frustrations over a recent car service experience and shares some tips to avoid such issues.

Trees Full of Money: There is a saying among people who own or have owned pleasure boats. “The second happiest day in your life is the day you bought your boat. The happiest day in your life is the day you SELL it”.

Penny Jobs: Most people probably vote based on their stance on the economy and their financial well-being. But Curt strongly believes that we should vote based on our views on morality.

Pecuniarities: Penelope would love to support her local smaller shops but these merchants are charging more for the same items than do larger stores. What to do?

Online Savings Blog: Fred Siegmund shares his thoughts on why Alan Greenspan is wrong on economic regulation.

Tough Money Love: We all have advice we’d like to give the new President. What would yours be?

American Consumer News: Even our pets are feeling the effects of this recession. These are some constructive ways to help out those who are financially unable to care for their pets.

Smart Money Daily: Okay, the election party is over and Obama is the new great hope for America. But should our own personal success hinge on who won this time around?

The hunter and his prey, seeing a reversal of roles.

Frugality and Saving

Frugal Dad: While we’re frugal with our own money, shouldn’t we work just as hard to conserve other people’s money? Some thoughts on being frugal at home and at work.

Budgets Are Sexy: J Money shares his #1 tip for saving money. You’ll never guess what it is!

Christian PF: Gas prices are down. In some places it’s going for 50% off! How are gas prices where you are?

Free From Broke: FFB shares six positive effects that eating out less has had on his family. I love how he reminds us of that saying “A family that eats together, stays together”.

Passive Family Income: Here are four free holiday gift ideas that one family is taking advantage of to save money during this upcoming holiday season.

Fiscal Zen: More timely tips here for saving money during the holiday season.

Money Beagle: It’s nice to know that some city governments are actually helping their residents to save money.

Studenomics: Being a new grad, you may be tempted to enjoy the money you earn the moment it lands in your bank account. But here are some justifications for saving this money instead.

Steadfast Finances: Here are 10 ways to prove that frugal living is really green living in disguise.

Cash Money Life: You can get some really good deals with Priceline, especially if you use the “Name Your Own Price” feature.

Finance and Fat: Eden has outlined his plan for saying goodbye to cable TV.

Destroy Debt: Here’s a great set of resources that should help you save money on your Christmas shopping expeditions.

Dollar Frugal: Brooke tells us about her search for nice, cheap running shoes and sports apparel.

The great tall tailor always comes

To little boys that suck their thumbs.

Real Estate

Funny About Money: Are you looking to buy a home in foreclosure? Well here’s a heads up: foreclosed homes are actually attracting bidding wars!

Free Money Finance: A few pointers here from someone who almost bought a home recently.

Four Pillars: This post presents an interesting debate between real estate and dividend stocks. Mr. Cheap makes the case that investing in real estate is superior to investing in dividend stocks.

The Happy Rock: Check out these common sense rules to prevent you from making home buying mistakes.

See the naughty restless child

Growing still more rude and wild.

Till his chair falls over quite.

Philip screams with all his might.

Debt and Credit

Ask Mr. Credit Card Blog: I found this entry quite intriguing and somewhat poetic… sanity and greed are personified and are aiming to teach us something.

Tight Fisted Miser: More and more of us are getting our identities stolen, and this is but one more personal anecdote about this societal scourge. The irony here is that having poor credit helped out TFM’s situation somewhat!

The Credit Toolbox: Here’s an informative discussion on how to repair bad credit by ordering a secured credit card.

The Smarter Wallet: We’re facing a new age of tighter credit, loan limits and credit card defaults. What does the future hold for us consumers?

Discover Debt Freedom: What are some ways to avoid incurring credit card late fees? Some great suggestions here.

Taking Charge: Tyler Metzger reports on a crime involving the theft of D.C. passport applications for the purpose of committing identity theft and credit card fraud.

Accumulating Money: Clint compares credit cards to debit cards.

Look at little Johnny there,

Little Johnny Head-In-Air!

Career and Taxes

Mighty Bargain Hunter: Your #1 priority in a recession is to keep the money coming in. That is, work on keeping your job and building up other sources of income.

Money and Such: Lay-offs are coming across corporate America, but contrary to popular belief, lay-offs are often not random. This article explains what you can do to avoid the axe and how to keep your job in this ailing economy.

American Small Business News: If you run a home based business, here are some great tips to help you balance your work and life activities.

Greener Pastures: In June of 2007 Warren Buffett torpedoed the US tax system for its flagrant favoritism of the filthy rich.

My Dollar Plan: Madison performs some tax-related Q & A by responding to questions from readers.

Crackerjack Greenback: This article talks about some of the great wisdom in Benjamin Franklin’s “The Way to Wealth” and focuses on the taxes we pay besides those to the government.

Not The Jet Set: Mr. NTJS just survived a layoff and remains gainfully employed, but his experience has inspired some valuable pointers for getting your finances ready for anything.

Other

One Caveman’s Financial Journey: The Caveman likens the issues of our physical health with that of our financial health.

Saving Advice: We live in a constant state of denial that bad things can happen to us. We think we have plenty of time to make up that will, to handle our business affairs, or draw up that living will and power of attorney. We figure there’s no way we’re going to die tomorrow so we keep putting the “shoulds” off until “someday.”

My Wealth Builder: What do you think of jobs that offer you perks that exceed the pay?

Realm of Prosperity: Pretty interesting profiles of get rich quick schemes and pitfalls that can derail the financial growth of young adults (or anyone for that matter!).

Thank you to all who participated in this event — it was a great ride! See you sometime next year when I try this gig again… 😉 .

Now before I go, I’ll leave you with one last thing — if you’re interested in seeing the full text rendition of Struwwelpeter, you only have to click this link.

Copyright © 2008 The Digerati Life. All Rights Reserved.

{ 43 comments… read them below or add one }

Woohoo, thanks for the inclusion!

Stumbled and dugg!

Wow, thanks Simon! I appreciate the votes! 🙂 I also loved your article; thanks so much for joining this edition.

Cute theme and thank you for including my post!

Penelope

Thanks for the inclusion! Beautiful layout this week!

Thanks for putting this together, SVB! Interesting theme. Made me look, for sure.

Thanks so much for including my post in this week’s carnival!

I shudder to think of the poems we recited as children and how they have warped our minds! But somehow we have overcome. Thanks for the line up.

Thanks for including my article, and thanks for hosting. This is a huge carnival, and I know a lot of work goes into it. What a provocative storyline, too.

Great theme. Thanks for including my article.

Very cool!

Thanks for hosting, and for including our post.

Thanks for the inclusion! Very interesting theme! 🙂

Lots of fun! Thanks for hosting. 🙂

What an interesting theme! I suppose, for its time, it’s no weirder than In the Night Kitchen, which stirred up quite a controversy when it first appeared. I remember reading Grimm’s fairy tales as a child…and for a time thinking the word “grim” was supposed to be spelled with two m’s. 😀

Thanks so much for including Funny’s blurt about real estate in this excellent carnival!

Thanks for hosting and including my article on Warren Buffett!

That’s a huge list.

I will take some time to go through it.

Thanks,

Ren

Suck your thumb and it gets cut off?!? That’s pretty extreme. This carnival woke me up this Monday morning! Thanks for hosting and great job! (Dugg and Stumbled too!)

Thanks for hosting the carnival!

Thanks for hosting SVB! This is definitely a huge list 🙂

Great carnival theme. Thanks for including my post.

Really enjoyed this Carnival — thanks for including my post! Now my reading material is set for a couple days as I work through these articles.

Thanks for including me! I love the graphics, and I love Edward Gorey. I shall have to go looking for this book.

This is great stuff. Hats off to your artist, in addition to your posts every day. You guys are the best. Thanks!

thanks for this huge list! i am going to need a whole week to read it all!

Glad you guys can all stop by! It was a long list for sure as is the case in every carnival in finance. I actually noticed a lot of new blogs too. I found many of the articles quite thought-provoking — so much great content! Keep it up, pf blogosphere.

Thanks very much for hosting today!

Great theme – thanks for hosting!

Thanks for hosting and including one of my articles! As one of the “newbies” it’s a wonderful opportunity to put our blogs out there.

Great job with the carnival, unique and very creative! Thanks for including my article.

Crazy theme!

congrats on this great edition!

I check in daily – love the post – love Der Struwwelpeter!!. I have a copy from when I was a kid. I used it on my kid, to try to get him to stop sucking his thumb….didn’t work. I actually think more kids today need these types of lessons. Harsh lessons are good for us all. Too bad the government doesn’t feel the same regarding those who go astray with their finances!

@Chris,

I find Der Struwwelpeter just so unusual and entrancing in its weirdness.

For those with a strong stomach/disposition, there’s a pretty disturbing video of the Little-Suck-A-Thumb boy that’s been animated by a fan of this book. If you google “Struwwelpeter”, you’ll find that video.

I came across it and it was the creepiest video I’ve seen in a while, even though it was only 5 minutes long, was portrayed as a bunch of animated, old-fashioned line drawings true to the original art illustrations on the book, and you already knew what was going to happen.

The voice overs, sound effects, graphic visuals and utter bizarreness of it all caused a friend of mine to say that it was the most disturbing thing he’s seen in a while.

I’d link to it here, but I’m afraid I’d be flogged for posting something so extreme over here. At least, IMO.

Thanks for hosting and selecting my article!

Great job hosting. Thanks for including my post!!!

very unique and creative. I agree with you.

This huge list is really great! Thanks a lot for publishing it. It will cost me a week for checking all the links in this list, but it’s worth it. 😉

Some Struwwelpeter Bailout Rhymes Posted at my blog! 🙂

Great list, thanks for sharing.

I would agree. This list is extremely great! And I also love the theme, it is so entertaining and cute. Thank you for sharing. 🙂

If you want to collect riches it is usually a sensible conclusion to begin a savings or investing course of action as early in life as feasible. But don’t fear if you have not begun saving your money until later on in life. Through hard work, that is reading up on the best investment vehicles for your money you can slowly but surely increase your wealth so that it amounts to a huge sum by the time you hope to retire. Inspect all of the applicable asset classes from stocks to real estate as investments for your money. A wisely diversified portfolio of investments in various asset classes will make your money grow throughout the years.

-Christian Sokolowski

Thanks for this blog post; I like the simple layout of your blog and I will be sure to bookmark.

Just came across this blog, and I love it! The artwork in this post is awesome. I’ll be sure to bookmark your blog.

Just came across this list. Thanks for putting this together.

For those who are new to the concept, a blog carnival is an online event hosted by a particular site which covers a particular theme and which receives, through submissions, articles for review and eventual listing. It is an opportunity to submit quality articles and posts on the given subject and to learn something as well.

If you’re curious about blog carnivals, you can check out blogcarnival.com to get started!