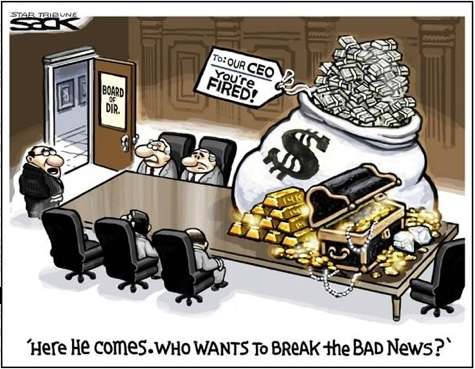

Finally… if a company wants its version of a stimulus check (what amounts to bailout funds from the taxpayer), they’ll need to cap executive pay, according to Obama’s executive compensation plan.

It looks like President Obama is taking steps to get us down the right course while we weather this recession. Capping executive pay for the time being makes total sense to me, since rumor has it that more companies will be begging for more funds, including those that have already previously received loans. These guys need to learn how to conserve!

I think that with the way the recession is shaping up, additional government handouts seem to be likely in the future, which is why we sorely need this pay cap. Unfortunately, earlier bailouts are not subject to this policy, so it remains to be seen if earlier bailout recipients will bother to conform to the new rules.

Consider this as a follow up to my post on how Wall Street jobs pay out big bonuses: from the New York Times, this just gets my goat:

Five of the biggest companies to get help — Citigroup, Bank of America and the American International Group, General Motors and Chrysler — were all facing acute problems. And top executives at those companies made far more than $500,000 in recent years.

Some defenders of executive pay are using the term “draconian” to describe this policy, as they continue to present the excuse that with pay caps, “key executives” will now just want to up and leave and go elsewhere where pay is better.

Hmmm…. okay, so I didn’t realize we were swimming in jobs out there that offered more than $500,000 in pay, all for the taking. I want to call out their bluff and say, “tough”! I’d love to see these executives *really* earn their pay — if they were so exceptional and worth the millions of dollars they were making, then they should be brilliant enough to be able to turn their ailing companies around without having to get help. Don’t you think?

Copyright © 2009 The Digerati Life. All Rights Reserved.

{ 14 comments… read them below or add one }

This executive salary cap is long overdue. In my opinion, they should have cut the salaries of the CEOs from companies asking for a handout long ago. But, they should have put some restrictions and limitations on what the TARP funds could be used for. They didn’t, so companies will do what they want…including $400,000 vacations for the same idiots that ran the company into the ground in the first place…(cough cough AIG cough cough).

I agree with you here. Make the execs earn their pay. Only in corporate America do we keep the ones responsible for our financial demise in control, and only in corporate America would we give them a raise for a job not-so-well done. Personally, I think it’s time for an overhaul of management altogether. Keep the salary caps, but get rid of these ego-bloated execs who aren’t concerned with anything other than keeping their salary and corner offices. Let’s get down to business, cut the fat, and tighten the belt. If these folks can’t deliver the basic requirements in their contract, then they’ve got to go. Plain and simple.

While it should go without saying that even a legitimate President’s “ordered” $500,000 pay cap is an unenforceable intrusion into the private sector, as if that weren’t enough, Obama LACKS EVEN OSTENSIBLE AUTHORITY to issue the order UNTIL HE OVERCOMES “RES IPSA LOQUITUR” BY SUPPLYING HIS LONG FORM BIRTH CERTIFICATE AND PROVING HIS ELIGIBILITY TO BE PRESIDENT UNDER ARTICLE 2 OF THE US CONSTITUTION.

My understanding is that there is no cap on stock they can receive, though it can’t be sold until the loans are repaid to the government. They are not limited to $500k per year unless they fail to turn the company around, incentive. The president pays less than $500k per year, is far more stressful and yet many people want that job. I don’t buy the argument that no one would want the job due to salary.

I am totally with you on an executive pay freeze. I also agree with Kristy above that regulations were needed on how TARP funds are used.

“Draconian,” huh? Yes, I suppose making ten times the income of the average American while doing one-tenth of the work is pretty draconian *rolls eyes*

One interesting note is that the transparency of executive pay seems to have caused it to skyrocket like this. If CEO A knows that CEO B is making more than him, then he has a legitimate reason to go to his board and say, “Hey, I should be paid more!” And it’s a neverending cycle.

Oh, and let’s not forget that corporations are some of the biggest tax dodgers out there, setting up offices places like Aruba and the Isle of Man to avoid paying taxes.

The banking industry is seriously out of control… and as much as I like Obama, I’m uncertain how much he can do about it, especially when he’s got people like Geithner on his cabinet, who has the best interests of the banking industry in mind…

I think that CEO salary caps are going to have an unintended consequence of only getting people who can’t make more than $500k. 🙂 Not to be cynical but if I had the skills to helps these banks recover, wouldn’t I rather become a consultant to the bank than the bank CEO?

Oh, that being said, I think these caps are necessary; I don’t want to be subsidizing a bank CEO’s salary. 🙂

I’d love to see Vikram Pandit get a million dollar job at another company.

Manshu,

Yes, I read this ditty about Vikram Pandit. From the Wikipedia:

Citigroup really wanted this guy very badly, but now they’re begging for TARP money. My point here is that they could’ve probably gotten anyone at the helm for so much less and still wind up in the same sinking boat they’re in right now — needing bailouts. Gah!

Hah, I definitely agree. Capping salaries at half a million a year for a company that is essentially asking for a handout from the government is more than justified.

If they have a problem with it…well then I guess they didn’t REALLY need the money.

Thinking about it now I actually got the image of giving a dollar bill to a homeless person on the street that is asking for change and then getting the dollar thrown back at with the bum yelling at me, “I only take twenties!” Random…haha

Yeah, I never really agreed with the whole bailout thing in the first place. These companies are messed up. They should pay for their errors. But I guess it’s better than going into a depression =/

I usually agree with your positions, but this time we are on opposite sides of the argument. I think that salary caps are counter productive to tax payer interests. I actually wrote a post on this subject as well, taking the opposite position

I would have agreed with policies banning golden parachutes, eliminating dividends and a range of other policies, but a salary cap is completely counter productive for reasons I explain at length in my post.

I can’t help but think about my dad’s company when I was growing up. He owned a small business and when his company was struggling, he took pay cuts and invested the money in the company to keep it afloat. There were years when he didn’t receive any pay. There were also years when the company did really well and he took home a lot of pay. Shouldn’t CEOs pay be performance based as well? Yeah they have incentives to make money, but the base compensation should be reduced if they don’t perform well. I don’t know if I agree with a cap, but something has to be done when the company isn’t performing.

“Citigroup, Bank of America and the American International Group, General Motors and Chrysler were all facing acute problems …”

While you could argue that Citigroup, GM and Chrysler’s bad decisions caused their problems, do you understand that the government is largely responsible for Bank of America’s problems? Before Bank of America was strong armed BY THE GOVERNMENT to compete the Merrill Lynch deal, Bank of America had been considered one of the stronger banks. Paulson essentially told Bank of America’s CEO that it was his patriotic duty to buy Merrill (and spend billions on a company with essentially negative net worth) leaving Lewis no choice. Sure he could’ve refused, but the fed could’ve made his life pretty difficult. So according to you it’s fine if the government first forces a CEO of a company that is doing OK to buy an insolvent company than cap the CEO’s pay after his company starts experiencing problems because of this decision?

That’s the first of many steps that are necessary. When executives do well, they get large bonuses. They clearly failed in this case so the opposite is warranted until they turn the companies around.