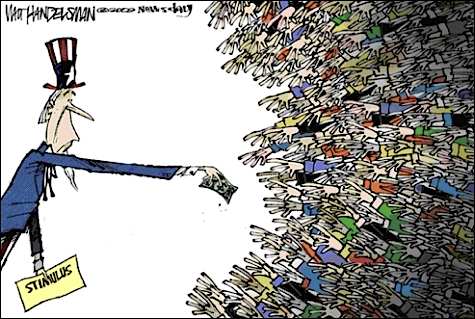

With the stimulus package details finalized, President Obama proudly announced the fastest tax break in history, which will begin to reach the middle class’ pockets after April 1. You’ll get the full impact of the tax reduction if you make less than $150,000 a year as a couple, according to the new IRS tax rates.

Consequently, over the next year, our wallets will be carrying around an extra $35 a month to use as we please. The purpose of the bill approved on February 13 is to motivate consumers to spend a little more to boost the flagging economy. How well will this work and what is one to do with the extra money?

What Should I Do With My Stimulus Tax Credit?

Although we’re not getting a stimulus check, we are receiving a tax credit, and the big question of course is whether we’re inclined to spend it. Though economists may want me to spend the money, this is not necessarily what I’m planning to do.

If everybody rushed to the mall to spend $35 every month, the economy would certainly enjoy some kind of revival. But how big? Multiply this amount by 138 million tax payers and you get close to $55 billion dollars forked over to businesses over the next year. Our GDP (Gross National Product) or the total amount of everything produced in the country stands at $14 trillion (2008); so is $55 billion enough to get us back on our feet? Of course not. The rest has to come from what we export (11% of GDP) and what we normally consume. But since most of the world is suffering a recession, they also stop importing as much from us. In other words we are going through a vicious circle with seemingly no end in sight.

Should I Spend Or Save My Tax Break? Taking Care of Me First

Unfortunately, as is the case in every economic crisis, most people will become selfish, and look out for their families first. Human nature has it that given the choice between feeding our neighbor and feeding our family, you can guess what the great majority of people will do. It would certainly be awesome if we could do both! I therefore predict that a lot of people will be hanging on to the extra bucks with a tight grip.

I also don’t think that this puny tax break of $800 per family over the next year will make much of a difference to the global economy. My tendency, for example, is to add this “windfall” to my savings in secure investments. For those carrying debt or who own a house, it would be financially wise to add it to your mortgage payments or emergency fund by banking it in a high yield savings account.

Should we rethink the tenets of responsible personal finance and how it applies to us, because our economy is tanking? If we spend our tax credit, it will be for the “greater good” of our overall economy, while if we save the extra bucks, the stimulus tax break won’t be as effective. But with all the ridiculous behavior we’ve seen going on in Washington, Wall Street and trickling down into Main Street, spending to save the economy just because someone else expects us to do so should be the last things in our minds.

How we use our tax credit depends on our specific circumstances and financial situation; it’ll depend on how we decide to use the money to look out for #1.

Stimulus Package Tax Deductions For A New Car, But What About Medical Bills?

The tax relief bill also includes a tax deduction for new car buyers (who make less than $250,000 as a couple). That’s good, but how many people want to increase their total debt in these trying times? Still, it’s great news for consumers — this kind of provision is here to reward big ticket spending.

Understandably, the stimulus package details can only accommodate so many provisions. But as a senior citizen, I want to put in a word for the older generations, and one thing that the stimulus bill (or any government bill or budget for that matter) fails to address properly is the enormous cost of medical bills, especially for older Americans.

If your total medical payments do not exceed 7.5% of your adjusted gross income, you can’t deduct anything. So if somebody has bills for $4,100 and makes $55,000 a year, he or she cannot deduct a dime, a serious injustice that hurts thousands of Americans. Care to posit why the stimulus bill avoided addressing our health care issues?

How Much Do You Plan To Spend?

We look upon what President Obama has done and despite all the gaps we may see in this stimulus plan, this package was a lot of work and is ultimately the result of much compromise. This program is a big balancing act that aims to make the biggest impact on as many people and parts of the economy as possible. It would be interesting to see if the people positively affected by the stimulus bill will uphold their end of the “bargain” and decide to spend in the way that they’re expected to do.

How are you planning to use your tax credit?

Copyright © 2009 The Digerati Life. All Rights Reserved.

{ 22 comments… read them below or add one }

As a single earner, I make too much to qualify – even though I’m only middle class for Los Angeles. They never take location into account, they treat america as this homogenous nation. If we get married this year (I’m pushing the idea of marrying for the health insurance on my other half) then we would qualify for the full amount, no marriage penalty here. I cut my spending to the bare minimum a few years ago to get out of debt, the only place to go is up. I’d probably spend anything extra in my paycheck. As long as I’m making my already ambitious savings goals, I don’t see the need to save more. But alas I’m not receiving this credit, yet another way it’s not going where it’s most needed.

I’ll be handing mine to the State of California when I renew my car registration this summer and whenever I buy something and when I file next year’s state taxes.

I’ll be putting it towards either my 401(k) or my travel fund. If it goes towards the 401(k), I’ll never spend any of the extra, but if it goes into the travel fund, then I may spend a little here and there. Just depends. I want to see what it works out to be before I make a concrete decision on what to do.

The amount is so small per paycheck that most people will forget about it as an extra – in a couple of months or os and end up spending it.

This tax break won’t save the economy, but it’ll make life a little easier for some.

As for why health care is missing from the bill, I’ll answer your question with a question. Does the entire Democratic platform have to be in the fiscal stimulus package?

Christine,

Yes, very good points. Not everything can certainly be in the stimulus bill. And I knew that a solid point such as yours would be made about health care.

Our health care issues are a whole ‘nother animal and we’ve been struggling with this concern for a while. I don’t believe that the stimulus bill should necessarily be the platform used to resolve it either. Stimulus is for spending…. Universal health care or other avenues of resolution regarding our health care system — for some other bill/budget.

If everyone saved their stimulus, that would gum up the market works and exacerbate the impact of the recession on non-capitalized small business in the same way the spike in savings Japan experienced in the 1990’s amidst a recession lengthened the lean times for all. Investing the stimulus money in some innovative enterprise would be the best use of the money for society; paying down consumer debt would be second best for society, and would also be a sure thing for the individual. Paying debt has a similar personal wealth effect as savings, but doesn’t have the “slam the brakes” effect on the market as everybody socking the cash away in a bank account. Consumer debt is about the only thing differentiating the current day U.S. economy from 1990’s Japan – http://www.newsy.com/videos/japan_s_lessons_for_u_s_economy/

I’ll think of it as the raise that I didn’t get this year because my company is tanking. I’ll use it to pay off my debts.

Either debt repayment or a gym membership (no really, I’ll use it. I just don’t have room for weights in my shared 600 sq ft apartment) I’d only do the gym because I was going to do it anyway though.

@Travis – Lol. That’s awesome. 🙂

We’ll put our extra tax credit dollars into needed home repairs and improvements. My wife really wants some remodeling done and we do have a couple things that definitely need fixing. I’m rationalizing spending money on the home as an investment which I think is fairly true. Remodeling the kitchen for example will improve the value of the home so it is an investment plus its got an added side benefit of actually stimulating the local economy some.

Jim

I am getting a raise this year (none last year) so I will bank my raise and spend the ‘stimulus’ dollars:

New expense – dishwasher detergent. I am thrilled to have this new expense because my landlord installed a dishwasher!!

The rest will be spent at various local watering holes on food and beer, as I expect to be picking up the tab more often for my friends who are artists, DJ’s and/or self-employed.

To be completely honest, I probably won’t even notice an extra $35ish dollars in my account. I would definitely be more inclined to spend a windfall stimulus check. I will most likely save this money.

Amazing the difference in getting a check for $300 vs. $600 over the course of 12 months, huh? I think everyone should spend it like crazy!

How am I planning to use my tax credit? Oh, mostly to help pay off the credit card debt I racked up last year. That’s what I’m using my normal tax return for, anyway.

I think those making lower incomes will see the most of $35. They will use it for thngs needed times are tough and real wages for the working people in USA have been falling for quite some time. I for one will either save it or spend it depending on my needs/wants.

As usual, the ordinary consumer has spoken with wisdom borne out of years of experience and toils. Whether it’s used for the gym, getting soap for the laundry, buying essential food, or buying a couple of beers at the local waterhole, everybody agrees that the stimulus is looking paltry and won’t save the economy. In a way, we have just carried out an informal survey of the middle class, information that government honchos would do well to read and learn from it.

I think it is great that we will be getting a tax break, even IF it is such a seemingling insignificant amount of money. Throughout the course of the year that money will add up. As for me and my $14 a paycheck, I’ll either be saving it or applying it towards my car loan. Any little bit helps and I for one will take the money without any complaints.

I personally am saving it. Remember…since it’s a tax CREDIT, this means we may have to pay it back come April 15, 2010. At last by saving it, I’ll earn a little interest.

How is $35 going to make a difference for anyone….They can Keep IT!

It is hard to look at his as incentive for some people. $35 a month or $420 a year won’t rack in the interest, but the ma and pa shops around will find the useful, Wal-Mart maybe not.

I would recommend that anyone that is in debt use it to at least make the minimal payment on their credit cards and keep afloat a bit longer.

the cost of living went up way higher than the $35 a month I get. My grocery bill went up more than that a month with the prices all going up and the gas to get to the grocery store. So I’m still struggling.

Are we as tax payers going to have to pay this back? Some people say yes, so do we? Want to fix the economy ? Give the tax payers 1 million dollars each. The government spends BILLIONS anyway.