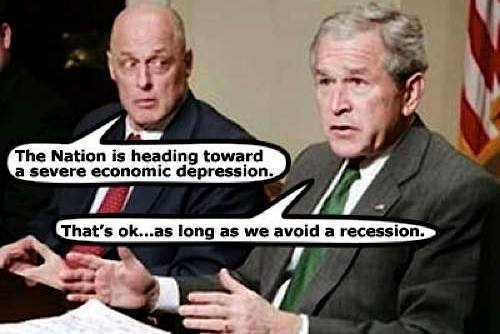

Who’s to blame for the worst economic crisis since the Great Depression?

Warning… long rant ahead.

Have you heard the latest bad joke around? It’s the one on how we’re socializing our financial markets by making the taxpayers bail out all our financial institutions. As someone put it, “this is a form of wealth distribution alright, the government robbing from the poor to give to the rich….”.

So when will this nightmare of a crisis end? Sure we’re shoring up our failing banks and institutions right now, and even possibly certain vital industries that are the heart and pulse of our nation. But, I also see the flip-side, which is the fact that we (and our kids, and maybe even our grandkids) will be paying off for this till kingdom come, with the whole thing financed by our debt to foreign interests (e.g. Chinese).

This soap opera can’t be without its sorry cast of characters.

Capitalism Gone Awry

I wonder: how naive have I been? I am big on capitalism and believe wholeheartedly in rewarding anyone for the work they’ve done and value they’ve produced. I’ve always been of the mind that, if a CEO does well by his company and makes me happy as a stockholder, I have no qualms in approving a commensurate pay package for the geezer.

I’ve always been a proponent of self-regulation and a laissez faire economy, but this very thing has led to the disasters we’re seeing today. Now with the government sweeping in to save “the big guys” from themselves and their gross mistakes, I see that apparently, self-accountability is optional in this free market. Very interesting what this blog has to say:

Now consider: finance is a necessary function, but is represents a tax, a drain on the productive economy, just as defense and lawyers do. It is ironic that free market fundamentalists have so vociferously argued for unfettered markets, without understanding (or perhaps understanding all too well) that the house always wins.

The whole crisis has caused a very large swing from one extreme to another, the moving pendulum leaving behind much collateral damage: credit’s gone from very loose to extremely tight overnight.

Some people who had access to a lot of credit will correctly have a lot less, and that on dearer terms. But there are also perfectly worthwhile businesses and individuals who are also caught in the meat grinder of indiscriminate reduction of loan balances. Times are bad, and any efforts to extract more revenues from customers, even if it is blood from a turnip, or worse, even if it puts a viable business under, is warranted.

Silly me to have been so gullible, as I now stand confused about what should be done and how the economy should be run. It doesn’t help that I keep reading stuff like this to feed my migraines and sour stomach bouts.

How This Economic Crisis Is Breaking Financial Rules

What stance do I take now, as a die-hard pro-business supporter? I had placed my faith in the “powers that be” and didn’t think I’d ever see these levels of corruption, unchecked greed and blatant mismanagement in a first world country on this grand a scale (yes, I say this as someone who’s no stranger to the machinations of the third world, where corrupt ineptitude is rampant). This stuff happens, sure enough, but it happens in another world, and under the covers.

But there’s no hiding the ugly anymore. All I can see now is just how the ruling class has done a number on the working masses. And for the millions of people who followed the financial rule book throughout their lives to meet a horrible end to their futures because of the incompetent, morally degenerate few — well, I can say I’m beyond disappointed, and have crossed the line to feeling outrage and disgust.

Yes, this crisis is breaking all sorts of rules, including those I’d consider as long-standing successful personal financial tenets. Responsible approaches to personal finance don’t have a chance against a crisis of tsunamic proportions:

So let’s see — doing the right thing by scrimping, saving, investing, diversifying, doing proper asset allocation, avoiding market timing, indexing, and hedging against inflation through equities, even doing your job well will no longer guarantee you a splendid, worry-free financial future. Not when a “once in a century financial event” can just come by and rob you off the stuff you worked so hard for; not when someone “up there” can change the rules for you, just like that.

I didn’t necessarily see it coming, but some of my readers here have: I see just how observant readers have been, as they’ve shared their insights on the causes and consequences of the subprime mortgage financial crisis, the pros and cons of financial bailouts, and the relevance of market timing during a stock market bear and the current investment climate.

The Economic Crisis Calls For Faith: Do You Have Any To Spare?

Perhaps I’ve placed far too much faith in the integrity of our political and business leaders and trends in modern history to believe that our financial system was strong enough (and people were smart and honest enough) to absorb any shakeups, shocks and imbalances that happen. I still have hope, but recent events continually call to question my position in this matter.

Not long ago, I had asked: who’s to blame for the subprime mortgage mess? I said then that everyone here had a hand in this (from the mortgage lenders to the developers to the Fed to ignorant homeowners), but in reality, I’m now seeing where the bulk of that blame should go. It should be clear by now who should bear the brunt of your harsh judgment: follow the money.

Sure we (as the little people) can’t really do much about this (except whine, rant and call the villains out), but with more discussion, we can spread awareness of these ridiculous affairs. What I got out of this is that there’s little out there we can count on and few people we can trust when it comes to our finances. A sobering thought. Do you think there are really any lessons and takeaways here for the future? Do we even have much of a future the way it’s been mortgaged?

I welcome your thoughts on this matter. Fire away!

Copyright © 2008 The Digerati Life. All Rights Reserved.

{ 26 comments… read them below or add one }

Great rant – I loved it!

I’m from rural Oregon, and as such, I’m not exactly big on labor unions or protesting against big business. But I’m also a psychologist, one that cares deeply about the human condition, and I’m of the opinion that we all drove together straight into this. Without getting into too much detail about the specifics of how much regulation is too much regulation, we have to make a cultural shift to valuing work. And I don’t just mean “let’s all say we like what people do”, but I mean a conscious shift away from a system of sticks and carrots. Motivation has to be about more than just monetary fines and rewards.

Our society has come to view money as the ultimate proxy for motivation. Companies are bad? Fine them. Companies are good? Encourage them with tax breaks. This assumes that the only way to affect change in a company is through economic incentive, and it assures that they will consider the bottom line and only the bottom line.

So they do the math. Chance of getting cost x penalty of getting caught against Chance of reward x total reward. If the math works out right, they go for it.

We have to move away from the math. I read each and every piece of user feedback that Thrive receives, and when we get positive notes, I forward them on to the team. I know when they go out because I send them, and I know when people get them because of the way the mood changes in the room. Knowing that you are doing something worthwhile is the ultimate motivation, and money cannot substitute.

All by way of saying, in response to this rant: the next time you get good service, say thank you. Tell it to your bank, to your waiter, to any company large or small that improves your life at the right price, in the right way. That won’t fix the economy, but it will help more than most people think.

@Matt,

Thanks for your very constructive ideas! There indeed needs to be ways for us to feel motivated about our work beyond the typical things that drive us to do stuff (money, recognition), and yes, small things and adjustments may make a difference. But human nature is also such that we fall victim to our base emotions eventually (or for some others, it’s just inherent in them to be ambitious and driven for particular reasons like money and power). Society is built on the collective tendencies of human beings and their behavior, so it may be pretty idealistic to think that something other than “sticks and carrots” will make the difference long term.

But yes, I agree that small things can be done to make things more pleasant on a daily level.

In high school, I learned that economy generally moves in a 50-year-cycle from bust to boom to bust or boom to bust to boom. This bust may be a little late, but here it is. It seems like the big financial disasters are usually preceded by idiots at the top answering to greed rather than common sense. So, really the only lessons we can take from this are: people never learn, history repeats itself, and pray you were born in the right part of the cycle.

Very reasonable rant except that it unfortunately reaches a conclusion common to so many other rants like it. Don’t blame those who borrowed and spent the money (us). We – who have become obsessed with our credit scores while ignoring our negative net worth – are victims. Sorry, but we allowed this to happen to us. What is sadly true is that those of us who actually lived within our means are being dragged down with the rest of them.

@Aryn,

You’re right, we never learn, do we! It’s always the same thing — greed and fear ruining the economy for us every several years. Given this predictability, we can probably set ourselves up to be more defensive going forward. Perhaps?

@Mr. Tough Money Love,

I totally agree. In fact, I wrote several posts that discuss the role of the general populace in this financial mess. But many of those who got into this mess were led to it or got into it without their eyes open.

I didn’t say we are absolved of the blame here. I’m saying that the bulk of the blame lies upon those who did it for sheer greed and their own gain, fully knowing they were taking a risk and placing a bet — the so-called financial experts we have out there.

The general populace may be blamed for going along with the con, but they’re not the experts here. Many of these people trusted those who told them to sign on the dotted line or who encouraged them to fork over their savings.

And given how things are today, it seems that we can be victims even without doing anything, right? As taxpayers, we were never asked to sign on any dotted line to fork out money to guys in private jets. As retirees, we didn’t sign up for a future of working on menial jobs till we drop dead.

Whoa! That was a rant and a half 😉

I may sound weird but I am quite happy of what is going on. This is an opportunity in a lifetime!

Money is cheap to borrow, Stocks are cheap to buy and people are depressed so they don’t think about doing business.

Sure it is a rough time, but it is definitely a precious moment where we can stand up and make money out of it!

I have sympathy for those who feel they are losing out due to the acts and ommissions of others (including irresponsible and incompetent leaders) when they have acted responsbily in so far as their own finances are concerned. That said, economic ups and downs are a part of life and no amount of managing of the economy is going to change that. This is the third severe economic contractions I have experienced in my adult life and it would be naive to think it will be the last.

As The Financial Blogger points out, these economic contractions and the cheaper asset prices that accompany them should be viewed as opportunities – not just opportunities to acquire assets cheaply but opportunities to reaffirm the value of living well within our means, managing debt responsibly and saving for the future.

I agree with you most of way on this stream of thought, except for some of the socialist commentary. If we had some of these “so-called” socialist ideas that countries like Canada, France, and the UK have, we would not be in the shape we are in.

These three RED countries have regulations so that the banking and investment sectors can’t get away with the $hit that has gone on in Wall Street.

It’s not as easy to get a loan in Canada because you have to REALLY be good for it.

Oh yeah….and these 3 RED socialist countries are also guilty of having universal health care. Commies!

I love a good rant and this was a good one. A laugh is a good outlet too. Here’s a funny bailout song: http://www.youtube.com/watch?v=uZUXXSxZPhw. Enjoy!

Part of me agrees with you, and part of me doesn’t. I am ticked off as you are about the whole crisis, and there is plenty of blame to go around. However, I think the biggest blame is not being identified by anyone. It is the people who rate stocks/bonds and the analysts who recommend them. Here me out. The whole point of a company (morning star, moody’s) is to rate items to validate if they are a good, safe rating. If they are trusting the company that is pitching the product, then they are not rating them based on what is in there, just what BS is being provided to them. I know there are literally millions of items out there to rate, but, they have been totally remiss and asleep at the wheel for the last decade or so. How can a company like Lehman Brothers have an A+ rating, and then tank faster than Lindsey Lohan does a shot of vodka. It means the rating people got it wrong. That is great .. they are allowed to screw up, but not on every rating they do !!!

This is the biggest reason why we have so much problems. You have “Independent Ratings Firms” who are in bed with the people delivering the crappy products, and brokerage firms who are buying the bad debt because it is 5 star triple A rated, and it is not even worth the paper it was written on. Yes, they should have done more research before taking a massive dive into an industry. However they need to look at the companies that they are paying millions of dollar to be independent raters of funds.

I think the free market works, when people have recourse on those that don’t do their jobs. Fire a CEO who is crap, fire some VPs, fire a rating firm, sue the pants off of them. I mean this is what it will come down to.

This is just excellent, SVB. I think you’re really hit the nail on the head when you say that even if you follow the “rules,” you can still be screwed over in this crisis.

I’d argue, however, that this has been true for a while in this country – so many of us are just a job loss or illness away from financial disaster. There is no longer a safety net for the middle class in the U.S. (was there ever?), which is why the middle class in this country is failing, while the middle class in so-called “socialist” countries is thriving and growing.

I’m in the process of reviewing the book The Two-Income Trap, written in 2003, that talks, in fact, about middle-class insolvency – about doing everything right and still getting screwed over. If you’d like to follow along, you can start here.

I’ve seen some really hateful speech come out of this crisis, so I really appreciated your well thought-out (if saddened) analysis of the situation.

I think the government is to blame for this situation because they knew about all of the problems that were arising with these large banks and corporations. It is funny how everything is all happening at once.

Hi SVB,

I think you hit the nail on the head. “Follow the money” Citibank is a LARGE cause of this mess and yet they get over 300 billion promised to them! This is blatantly wrong. The public outcry should be larger but so few are educated on the real issues.

I think more people like yourself should speak up. I have already written a lot on this issue and I have more on the way, including some new stuff from guest bloggers. Unfortunately I dont have near the same amount of traffic as you and some of the more well known bloggers do.

Keep up the great work educating everyone!

Thanks,

Jeremy

p.s. Stumbled!

I’m glad you mentioned some of the blame must lay at the feet of the borrowers who ignored the realities of what they signed up for with, I don’t feel the mainstream media has the nerve to say it!

This is an interesting post. Thanks for sharing.

Since it has already happened, nothing much can be done by the victims. The most we can do now is to try to keep afloat and don’t make mistakes in future. Also, those at the top should really think how their actions would affect in the long-run..

There are two causes of this financial crisis:

1) The vast majority of financial participants believed that there was no risk in the mortgage area other than prepayment risk. That belief has turned out to be wrong.

2) Financial institutions were allowed to leverage themselves too much, both to the mortgage market in general and through unregulated derivative products.

A small group of people made these two mistakes, but virtually everyone benefited from them over the last several years. These two mistakes resulted in trillions of dollars in relatively easy money flowing into the consumer economy and allowed the US to grow from 2001-2007 despite a series of deflationary forces.

We can agree that people benefited disproportionately from these two errors. But we also see that people are harmed disproportionately by the unwinding of the leverage created by these two errors. I would argue that the people helped the most are being hurt the most.

In my opinion when a bank finances a house they should check the borrowers’ ability to repay their mortgages. This was not the case for many of the subprime mortgages. The whole snowball started rolling as the banks created so complicated packages out of these bad mortgages that not even the other banks not to mention the other investors were able to estimate the risks.

So the banks should not finance every house and the not every family should not live in a 10000 sq ft mansion. They both are to blame. It’s the greed from all sides that dirves us to these decisions.

You said it right.

The ruling class has done a serious number on us poor sods.

Like RDPD said in one of his books, only the rich end up being lawmakers, and no way they’ll make any laws that harm them. And if somehow they can get the Gomen to bail them out, well they’ll have plenty of company within the legislature.

Us poor sods? We are told that we can always choose a better guy come the next election, and the cycle repeats.

Why the people to blame are our legislators. The people who make US monetary polices and laws. The people that have been primarily trained as attorneys at our colleges and universities. 90 % of our law makers. They have gone from practicing law to theoretical fiscal policies that are suppose to manage the economy to a higher level of achievement.

Unfortunately, many do not have training in this area and are driven by political motives. As a group they flunk the test every time. They use the power of their office to defy natural economic forces for a multiple of motives. A case in point is to used the economic power of the US as economic sanctions to gain political power in another country (all the time). Another case in point is NAFTA (North American Free Trade Agreement-1990’s). Ship factories, companies and industries overseas for a multitude of political reasons (1990’s). Or how about shipping the steel industry to Japan (1980’s)? Or maybe the auto industry and technology to Asia (1980’s) ? Maybe selling the computer electronic and software industry to Japan and India? How about sharing high tech-accelerator technology to Europe? Manufacturing technology with China? How about high tech missile guidance system technology to China (1990’s)? Or nuclear power plant technology to Japan? The list is on, on and on. American Engineers and Scientists have watched these economic power houses go overseas for the past 40-50 years.

Wonder why the US is in economic distress? Every American idea, industry and technology has been sent overseas. Anything that is an industrial power house, gone. Along with employment and decent wages. Negotiated and managed away by attorneys and politicians with short sight. Americans are left with small business as our industrial power house. We can sell cookies on the internet and have our college trained attorneys and politician to thank.

Want to hear what the financial crisis sounds like when it’s set to some techno-polka music? Then check out this video that shows us some melodies derived from recent stock charts (the songs were arranged using Songsmith, the Microsoft Composition tool). It’s a little hard to describe but when you see it, it’s self-explanatory. Maybe it’ll elicit a mild chuckle out of you. If I’m lucky.

Hmmm… I think it could have worked better if they used more dramatic musical scores; those would have been more effective in emphasizing the market downtrends.

I’d also like to point you to my latest post over at Wise Bread entitled How The Economic Crisis Challenges Our Financial Beliefs. I asked the question “does this financial crisis affect your views on personal finance?” I wrote my thoughts on this because I’m beginning to notice just how insidious a recession we have (that the crisis has spawned): not only does it wreak havoc on our finances but also tests and challenges our long-held money beliefs and the way we think about our finances.

I like the Polka video by the way… it is nice to at least have some fun with all the bad news. You gotta be able to laugh at life, right?

i think the point is that in this charts music song they used this easy-listening sound as a contradiction to the serious money damage.

Re the polka music — okay, you got your chuckle! Who would think to do that?!

Yes you guys have a point! I guess what else can we do but try to take a humorous swipe at our troubles. But I still can’t help but cringe at how far some of those stocks have fallen!