Our stock portfolio is languishing; how is yours doing?

I haven’t discussed our portfolio for some time now — the last time I reported on it was many many months ago, and I’ve got an excuse. I was simply not excited about letting you all know how much money we’ve lost since my last formal portfolio report.

The thing is, this investment climate has been cruel to most investors. But the opportunity to do another formal portfolio check up arose when my fellow Money Writers decided to do a group writing exercise that involved revealing our recent investment returns — something like a “misery loves company” kind of sharing 😉 . If you’re curious, our group writing project yielded the following writeups from my blogging colleagues:

- Mid Year Investment Portfolio Checkup 2008 @ Million Dollar Journey

- The Money Writers Portfolio Project: An Inside Look at My Portfolio and Performance This Year @ Gen X Finance

- Investment Performance Update: Bleeding Money! @ Money Smart Life

- I Share My Asset Allocation (as do 7 other Money Writers) @ Lazy Man and Money

- What are My Investments and How are They Doing So Far? @ The Sun’s Financial Diary

- Mid Year Investment Portfolio Update @ My Dollar Plan

- Mid Year Investment Portfolio Checkup @ Brip Blap

As for me, I spent a good part of this weekend evaluating our investments and coming to terms with the devastation I expected to see. It was unnerving alright, and made more awful by the fact that we had been heavily drawing down from our cash savings to cover our lack of work income over the last couple of years.

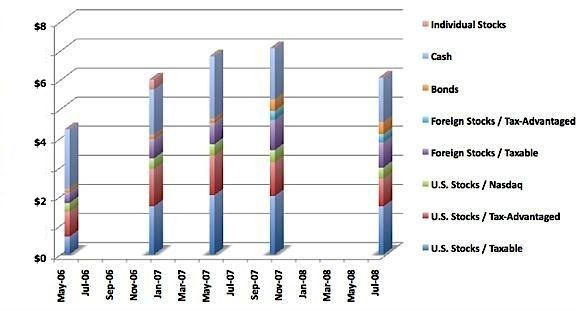

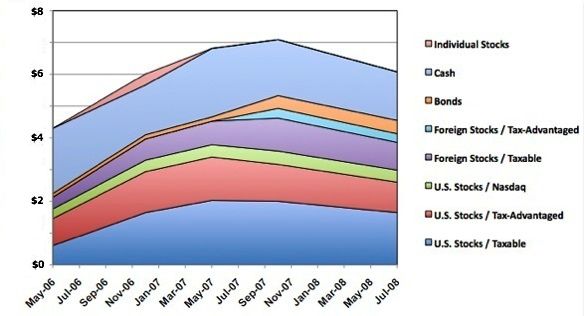

Here are some details of our investment portfolio. I measured its performance over the last 2 to 3 years and plotted the results:

Historical Investment Performance: Bar Chart

Historical Investment Performance: Area Graph

You may have noticed that I’ve altered the scale on the axis that shows the portfolio dollar values, but you get the idea. Also, the only thing that made us any money over the last year was our bond sector, and even so, it was a marginal increase. Everything else was down around 14% from our last check up (its high point), which I performed in October of last year. It’s not a huge surprise either, since late last year, the market was doing fairly well. YTD, it’s fared much better and beat the S & P returns by being down 7.3% to the S & P’s -12%.

Certainly, the down market is mostly to blame, but we can also partially attribute our fairly large savings erosion to the continuous budget deficits we’ve been incurring due to our recent lifestyle changes.

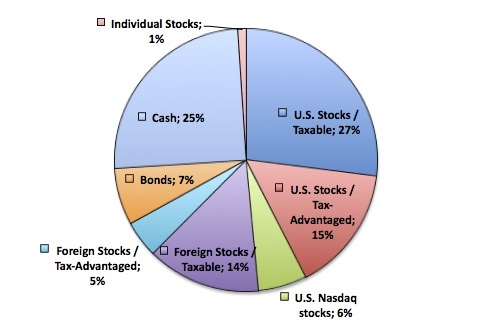

Here is what our asset allocation looks like right now:

Asset Allocation as of July 2008

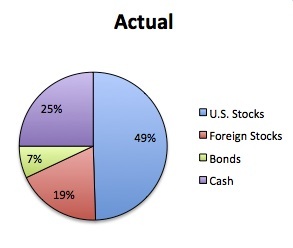

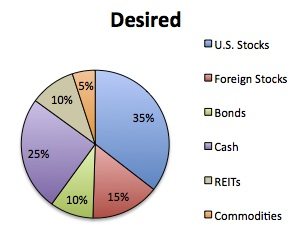

One look at this portfolio and you’ll see that it is heavily weighted towards stocks. This was a deliberate choice on our part, but after the research I’ve done recently on asset allocation models and how to further diversify by adding new asset classes, I thought to heed my advice and work on a plan to revamp our holdings. We’ll still be predominantly in stocks, but we’re planning to add REITs and commodities in the mix and hike up our bond position.

I mulled over our model for quite some time in order to recreate a reallocated model (on paper) that I believe will not trigger any taxable events. Note that when you reallocate or rebalance, you can do it several ways:

- #1 You can use regular account holdings, but this has tax consequences.

- #2 You can use tax-advantaged funds (such as retirement or 529 plans) to avoid tax hits.

- #3 You can add new money to investments to do the reallocation.

Well… because we’re actually currently living off of our meager business income and emergency fund savings, we don’t have ANY money to add to the market at this time. As I’ve mentioned, we’re sucking out money from existing savings in order to pay our day to day expenses so option 3 above is out of the question. Therefore, my best option was to see if we had enough money in our tax-advantaged accounts to be able to move around to achieve the new allocation. Thankfully, there was, but it took some effort to figure it all out.

Shown here is our actual portfolio as well as the target portfolio we’d like to have. Although I’d like to do the complete reallocation now, my spouse wants to delay buying the REITs because he strongly believes that REITs still have a ways to drop. But I see this target portfolio in place in the near future.

|

|

We suspect that the market will continue to struggle for sometime while the recession runs its course. Just our luck, we’ve been hit with a double whammy: a bad economic climate that’s doing a number on our investments while my spouse and I simultaneously try to get our business ventures off the ground.

Isn’t life grand?

This article is written as part of a group writing project offered by The Money Writers network.

Copyright © 2008 The Digerati Life. All Rights Reserved.

{ 18 comments… read them below or add one }

Your wall street portfolio is down 14%? How long do you think it will take for you to make back your loss? 5 years? 10 years? It ain’t gonna be months, that’s for sure.

Let’s say 5 years……..5 years to get back to where you were before. Doesn’t make much sense does it? People are led to believe that they will make more money in the long run if they invest in Wall Street rather than a FDIC bank or CD’s or safe bonds.

Wall Street always craps out every 5-7 years or so. The secret is to get in, make a profit and then get OUT! and invest the profit in a secure investment. But people never do that because they want to make MORE.

Betcha when you get your portfolio back to where it was, you are going to stay in it hoping to make more. Wrong. Make back your loss (if you ever can) and then pull your money out and make sense of it all someplace else.

In order to make money in Wall Street, someone else has to lose it. Not a very nice concept, now, is it?

You’d be better off buying a house than a REIT. Yes, I said ‘house’. You buy when things are down, hold onto them and then sell when they go up. No one is buying a house right now so it is the perfect time for you to buy. In 10-15 years I guarantee you that home will be worth more than any silly investment in Wall Street.

Just my 2 cent opinion based on 30+ years of experience.

Boomie,

Actually, our investment portfolio is down 14% from its high in October 2007. It is actually down 7.3% YTD.

It’s actually better than the S & P year to date which is down 12%, but still it’s not where I’d like it to be. Also, it includes the withdrawals we’ve been making to our funds to cover our expenses (deficits) over the last 2 years as we jump start our business projects. My spouse and I don’t work the corporate life anymore and so we’re relying quite a bit on our cash funds to cover us.

You’ll probably notice that our cash position is quite high compared to most investors in the financial blogosphere — it’s 25%!

I’ll be posting the Money Writers’ portfolios shortly and you’ll see where we all stand.

Boomie,

With respect to the market timing references you’ve provided, I have a different point of view.

I’ve personally been investing in the market around 20 years now and have never made profits in the way you describe.

I’ve been passively investing using asset allocation methods and have done very well by staying in the market through the ups and downs. Our losses are short term but in the long term, we’ve enjoyed pretty good success by riding the long term market trends of the stock market.

If we’d been jumping in and out of the market, who knows how good things would be overall? I am willing to bet that I wouldn’t be as happy as I am now (in general) over our total returns over the last 20 years.

I don’t really believe I’m an expert at timing and wholeheartedly believe that if I tried it, I’ll be much more distressed and disappointed with the results. I’ve tried holding individual stocks in the past and even tried shorting positions. All were sad failures that caused me great frustration. It just showed me that I am not “built” to do timing and will most likely be no good at it long term. (I’m no good with playing the casinos either…).

I figured, if I’m no good at timing, how else can I participate in the markets? I determined the best way to do so was with diversified long term investing.

Okay, now you’re saying that it’ll take us 5 years to make up our money. I don’t believe that. The markets go up and down as they please and rallies have been just as powerful as slides. Also, we anticipate new money coming in in the future so that would mean buying positions at lower prices so that as the investment climate improves, we can take advantage of the tides turning.

It is disappointing to see your investments decrease in value. But for retirement savings for those that are not retiring for a decade or more the decline is actually good news (if you assume it is a temporary measure). If the stock market is not reflecting some systemic decrease (that the entire stock market has been harmed in some way that was unknown last year and now means the market 10-40 years from now will be lower) then it is just a matter of you being able to buy more than you would if prices didn’t decline.

It isn’t fun to watch your investments decline, but it can often be to your benefit. Not as much as it would be if you were “smart” (either noone is smart enough or like 5 people in the entire world are so…) enough to sell before the decline and then buy back in. But if you are that smart/lucky… with your investments you really are either amazingly rich now or will be soon, so what the market does doesn’t matter to you.

Like you, blog author, I’m self employed. Since I don’t have steady income (paycheck) coming in, I need to rely on my investments/savings to get me through the rough spots.

My scenario may not work for everyone. But it’s worked for me. I keep 90% of my money in investments that pay guaranteed returns. When things get slow for me, I have my piled up interest returns that I can withdraw without touching the principal.

I bought a house in a wealthy location in 1985 the last time the housing market tanked. I sold it 16 years later when the housing market was almost at the peak. I had accumulated enough equity that when I sold the house, I bought another one without a mortgage with enough capital left over to keep drawing out interest, monthly if need be.

As a lark, I only put 10% of my money in the stock market, most of which is in international and emerging markets. Supposed to be good, right? Wrong. I just keep losing money with that lousy 10% stock market investment.

Listen, I was wiped out in the crash of 1987 and the dot com disaster of 2001. Wall Street is just a bunch of unregulated idiots, as per my opinion. Pres. Bush called them drunkards the other day.

I’m debt free, have no payments to worry about and basically just work part time as a self-employed person just to earn enough to pay my daily living expenses. I haven’t met anyone yet (proof worthy) who can make the same claims as I through investing in Wall St.

I wouldn’t say this downturn has been a breeze for me, but it sure is a heck of lot better than what I felt back in 1987 or 2001!!!!!! And just because Wall Street bounced back before doesn’t mean it will bounce back again. Wall St has just gotten too crooked for my taste. I can only imagine what they’ve got schemed up for next time. And oh! yes indeedie, there will be a next time.

Boomie the reason no one is buying house in the us at the moment is 2 fold — first no finance, 2nd no one knows where the bottom of the market is, it could another 2 years away and no one wants to catch a falling knife.

@ SVB,

Although all bear markets are painful, it is particularly so when one is withdrawing, as we both are. While the order of yearly returns doesn’t matter during the saving phase, it makes a big difference during the withdrawal phase, i.e. withdrawing in the first few years when the market is going down can be a big negative impact to retirement savings:-(

By the way, although I am not an accountant, it seems including your withdrawals for expenses in your return calculation seems over conservative for estimating one’s returns. For example, if you withdrew 4%, then the investments are only down 3.3% YTD, not 7.3% Agree it’s important to know that your account went down 7.3%, but only 4% was due to investment losses, which is pretty good.

Finally, I’ve been taking advantage of an opportunity in the 2008-2010 tax code. For married filing joint returns with taxable income under $65,100 (after adjustments, exemptions and itemized/standard deduction, the tax rate on long term capital gains and qualified dividends is ZERO percent. If you search “zero percent” on my blog, I have a couple articles on how I’m using this tax benefit.

Here’s hoping all our portfolios are high in the back half of 2008 🙂

The only sure way to know when the real estate market has hit bottom is when the prices start going UP. By then, it will be too late.

From what I have gathered from the new housing bill Congress just passed, starting in October ’08, first time home buyers get a $7500 tax credit. Lenders will be lining up to loan money to credit worthy buyers because the loans will be guaranteed by the govt.

If you purchase a home to live in it (not flip or whatever) stay in it for a few years (10) and never refinance (live within your means) you’ll be ahead of the game next time Wall St. craps out.

SVB,

As a fellow 20+ year investor who has weathered the storms of 1987 and 2001, I recommend you consider Dollar Cost Averaging as a way to soften the blow and set up for the enxt cycle.

It doesn’t sound like you are swimming n money right now, but it’s definitely the right time to increase your investment contributions. I wrote a solid post on this, if you are interested.

Boomie,

I respect your lifestyle and your 30+ years of invesment experience. But, I don’t recommend market timing for most investors. They are way more likely to get hurt by timing then to benefit from it. People who track this, such as The Hulbert Financial Digest, show that no Timer has been right consistently.

Bret

Boomie. I agree that since real estate is down now might not be a bad time. But in your first post you said

“In order to make money in Wall Street, someone else has to lose it. Not a very nice concept, now, is it?”

This isnt really true. If the market goes up no one has to lose money in order for people to make money. And historically the stock market goes up.

And while personally I have made most of my money in real estate I know a lot of people that have done extremely well in the stock market.

Man, I thought the same thing when I was down 20%. If only we could go back to those times. It’s gonna be a while before I see the portfolio level I was at before this mess.

There are not many people and businesses not hit by this but especially start-ups. I think it all went wrong with securitization in the banking markets over last few years and along with an over boom in the housing, plus demand and supply forces at working overtime – add these problems plus the media hard at work like never before! This all leads to lack of confidence in the economy.

This economy has been hurting my business.

Try not to think negative. This is the right time to apply your “winning power”. Business wise, a negative economy is a positive in the offing. Cheer up nothing can beat positive thinking.

Wow, amazing to read some of these “old” pre-crash posts…. when we thought July 2008 was a “downturn” and a “recession” – it was already a recession, of course, but who knew what was just around the corner…. we “knew” something was coming with all the problems that were already easy to see, but it’s still amazing to think about. Extrapolate from where we are now in April 2009, just after the nice bear market rally…. is it going to get worse again?

MoneyEnergy,

That’s the beauty of blogs, we’re able to see how things transpire over time. It’s an ongoing diary of our finances. I love looking back at my old posts to see both the progress we’ve made and the challenges we’ve met and have resolved (or attempted to resolve). It puts a lot of things in perspective, and the whole process is not just cathartic, but also educational.

Can you imagine? As you said, sitting on July 2008, we didn’t realize then that the worst was yet to come, although we had a feeling something was up and about to happen. To answer your question about whether it will “get worse again” — I believe the answer is “yes”. There will most likely be a restest of bear market lows before any progress will be made back into bull territory. So let’s all sit tight!

This a great post, rough times call for changes in strategy!

@MT4,

I agree with you. And that is why I’m looking at real estate and business as ways to hedge our assets. In the past, I focused quite a bit on equity investing. These days, I am turning to other forms of investing, including investing in my own business! So far, it seems to be helping…. but I would love the stock market to recover. Who knows how long before it does.