Allow us to share some investing strategies that can help you make smarter stock market timing decisions. You won’t be holding on to a stock or investment forever, so it’s still good to be prepared with a decent exit strategy which can utilize this particular tactic.

When people invest and trade, a useful tactic is to use what’s called a stop loss order. Let me introduce that idea here in some detail. I know what you’re thinking –- surely there’s a mistake in the title, because a stop order is a trader’s tool rather than an investor’s friend. In this article, I hope to dispel a few myths about stop orders, but first let me remind you of what a stop order is.

What is a Stop Order?

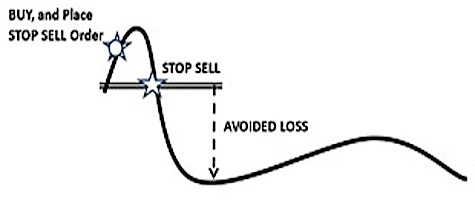

Many people regard a stop order as a mechanism for “stopping a loss” — hence the more common terminology of “stop-loss order”. It is a standing order that you place with your broker to automatically sell you out of a newly-established stock position if the price goes the wrong way, like this:

This makes perfect sense to traders who (in some cases) suffer no dealing fees on the original purchase and subsequent sale, and who can re-establish their stopped-out positions quickly if the price goes even lower.

For investors, this use of stop orders can be problematic. You pay a dealing fee to establish your original position, you pay another dealing fee when you stop out, and you lose out on the difference between your original purchase price and the lower level at which you placed your stop order. To add insult to injury: as soon as you have stopped out, you may find that the price rebounds upwards rather than continuing to fall –- so you need not have stopped out at all. You panic-buy in order to re-establish your position at a now-unfavorable price, with a new stop order (of course), and the whole sorry cycle begins again.

Not Just for Stopping Losses

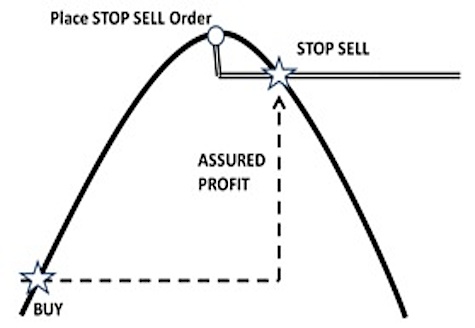

Now let’s consider an alternative scenario, in which your expert stock pick has already doubled in value; lucky you! Do you crystallize your profit by selling out prematurely before watching the one-that-got-away go on to become a ten-bagger? Or do you hold on blindly, to see –- on your return from that extended vacation –– that your profit has evaporated away… and worse?

So I put it to you that stop orders are more useful to investors as a mechanism for “locking in profits” rather than for “stopping losses”, as shown here:

You can take that vacation with some confidence that you have not sold out too soon, but that the broker will sell you out (for a profit) if your stock runs into trouble when you’re not watching.

There Are No Guarantees With Stock Trading

Nothing is life is guaranteed, unless your stock broker affords you the luxury of a “guaranteed stop order”. If the price of your stock “gaps down” on some overnight adverse news, you might find yourself stopping out at a less favorable price than the level at which you placed your stop order. This is unfortunate, but in my experience it’s usually better to escape with at least some of your profit intact than to hold on for none at all –- at least until you get a chance to look into what just happened.

How To Use Stop Loss Orders To Lock In A Profit

So where do you place the stop order? This is the $64,000 question, possibly literally, and there is no one-size-fits-all answer. Traders would place very tight stop orders initially, just below their purchase price, so as to stop out for the smallest possible loss.

As an investor, you’re looking to lock in some profit without crystallizing that profit too soon; and (ideally) you really don’t want to get stopped out at all. A stop order placed at 20% below the current price might give your stock sufficient wriggle room while securing 60% of your 100% paper profit. And don’t forget to adjust your stop order by trailing it upwards when your 100% paper profit rises to become a 150% paper profit.

Copyright © 2011 The Digerati Life. All Rights Reserved.

{ 0 comments… add one now }